- Home

- »

- Communications Infrastructure

- »

-

Wireless Router Market Size & Share, Industry Report, 2033GVR Report cover

![Wireless Router Market Size, Share & Trends Report]()

Wireless Router Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Single Band, Dual Band, Tri Band), By Bandwidth (Below 300 Mbps, 300 Mbps To 1000 Mbps (1 Gbps), Above 1000 Mbps), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-629-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wireless Router Market Summary

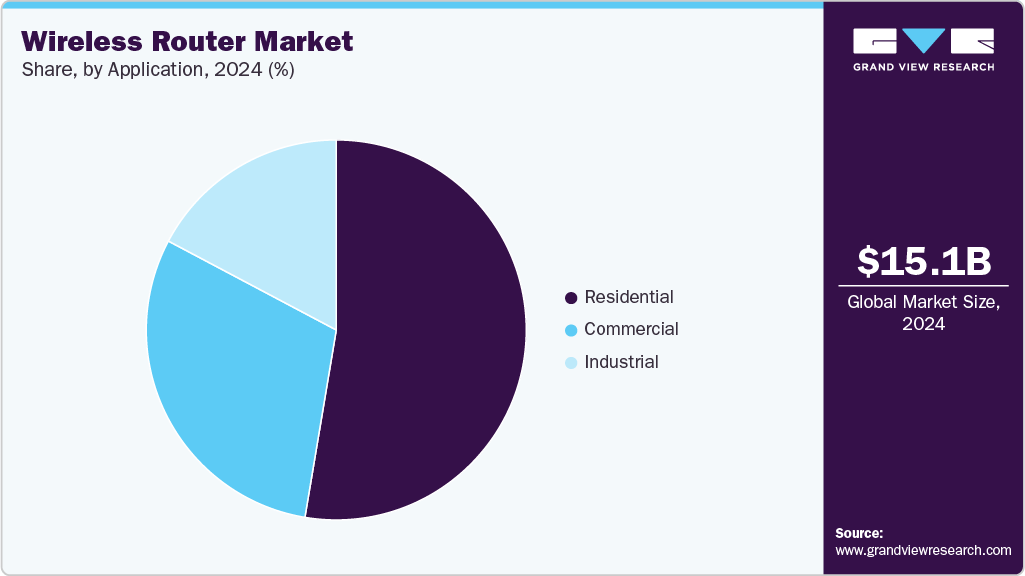

The global wireless router market size was estimated at USD 15.15 billion in 2024 and is projected to reach USD 38.10 billion in 2033, growing at a CAGR of 11.3% from 2025 to 2033. The market is experiencing significant growth, driven primarily by the rising demand for high-speed internet connectivity.

Key Market Trends & Insights

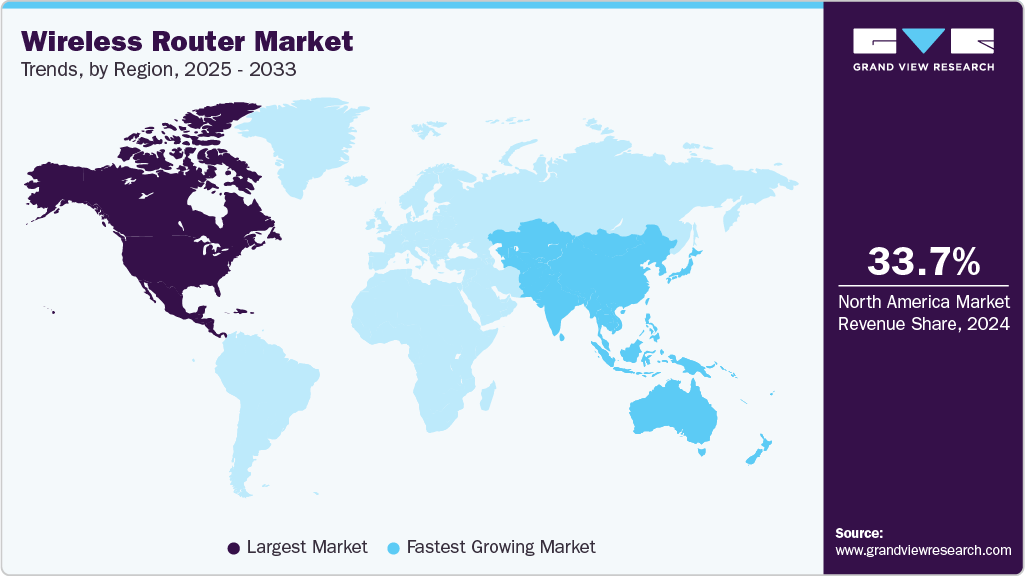

- North America dominated the wireless router industry with the largest revenue share of 33.74% in 2024.

- The wireless router market in the U.S. is the largest in North America.

- By type, the dual band segment held the largest revenue share of 43.43% in 2024.

- By bandwidth, the 300 Mbps to 1000 Mbps (1 Gbps) segment held the largest revenue share of 45.12% in 2024.

- By application, the residential segment held the largest life science market revenue share of 52.64% in 2024

Market Size & Forecast

- 2024 Market Size: USD 15.15 Billion

- 2033 Projected Market Size: USD 38.10 Billion

- CAGR (2025-2033): 11.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With the increasing popularity of bandwidth-intensive applications such as 4K/8K video streaming, cloud gaming, and video conferencing, consumers and businesses alike require routers that can deliver faster speeds and lower latency.Another key driver is the rapid growth of smart homes and IoT devices, which rely on stable and efficient Wi-Fi connections. The proliferation of smart speakers, security cameras, thermostats, and other connected devices has increased the need for routers that can manage multiple connections simultaneously without performance degradation. This has led to a surge in demand for Wi-Fi 6 and Wi-Fi 6E routers, which offer improved bandwidth, reduced congestion, and better power efficiency compared to older Wi-Fi 5 models. Furthermore, the upcoming Wi-Fi 7 standard is expected to revolutionize the market with even faster speeds and enhanced reliability, particularly for applications like augmented reality (AR), virtual reality (VR), and real-time cloud computing.

The shift to remote and hybrid work models has also played a crucial role in boosting the wireless router market. With more employees working from home, there is a growing need for reliable home networking solutions that can support video calls, large file transfers, and seamless connectivity across multiple devices. Mesh Wi-Fi systems have gained popularity as they eliminate dead zones in larger homes, ensuring consistent coverage. Enterprises, too, are investing in high-performance routers to support SD-WAN, VoIP, and other business-critical applications. Security concerns are another factor influencing purchasing decisions, with consumers and businesses opting for routers equipped with advanced features like built-in VPNs, AI-based threat detection, and parental controls.

The wireless router market is undergoing a transformative phase, driven by cutting-edge technological advancements that are redefining connectivity standards. One of the most significant developments is the emergence of Wi-Fi 7 (802.11be), which promises to revolutionize wireless networking with unprecedented speeds of up to 46 Gbps and ultra-low latency. This next-generation standard introduces innovative features such as 320 MHz channel bandwidth and Multi-Link Operation (MLO), enabling devices to simultaneously transmit data across multiple frequency bands for more stable and efficient connections. Early adopters, particularly in the gaming and enterprise sectors, are already leveraging Wi-Fi 7 routers, such as the ASUS ROG Rapture GT-BE98 and TP-Link Archer BE800, to support bandwidth-intensive applications like 8K streaming, virtual reality, and real-time cloud computing. These routers are not just faster but also smarter, capable of dynamically allocating bandwidth to prioritize critical tasks.

One significant restraint in the wireless router market is the high cost of next-generation routers, particularly those supporting Wi-Fi 6E and Wi-Fi 7 standards. While these advanced routers offer substantial improvements in speed, latency, and multi-device performance, their premium pricing creates a barrier to widespread adoption, especially among budget-conscious consumers and small businesses. Furthermore, the lack of widespread infrastructure to fully utilize Wi-Fi 6E/7 capabilities in certain areas reduces the perceived value of these high-end routers, creating a mismatch between their technological potential and real-world applicability for some users.

Type Insights

The dual band segment led the market and accounted for 43.43% share of the global revenue in 2024. Dual-band routers, operating on 2.4 GHz and 5 GHz frequencies, cater to diverse needs, offering broader coverage via 2.4 GHz and faster speeds through 5 GHz. Their cost-effectiveness makes them accessible to budget-conscious consumers while still supporting essential tasks like HD streaming, online gaming, and smart home devices. Additionally, their plug-and-play simplicity and strong ISP partnerships further drive adoption.

The tri band segment is expected to witness the fastest growth of 12.4% over the forecast period. This surge is fueled by escalating demand for high-performance, low-latency connectivity in bandwidth-intensive environments. Unlike dual-band routers, tri-band models add a dedicated 5 GHz or 6 GHz (Wi-Fi 6E) band, drastically reducing congestion in homes with 50+ connected devices, common in smart homes, 4K/8K streaming households, and competitive gaming setups.

Bandwidth Insights

The 300 Mbps to 1000 Mbps (1 Gbps) segment led the market and accounted for 45.12% share of the global revenue in 2024. This dominance is primarily attributed to the rising demand for mid-to-high-range internet speeds across both residential and small-to-medium enterprise (SME) sectors. Consumers are increasingly engaging in data-intensive activities such as 4K/8K video streaming, online gaming, virtual meetings, and cloud-based workflows, which require stable and high-speed internet connections.

The above 1000 Mbps (1 Gbps) segment is expected to witness significant growth over the forecast period, driven by the accelerating adoption of ultra-high-speed internet services and next-generation applications that demand exceptional bandwidth and low latency. This segment, which includes routers capable of supporting multi-gigabit speeds (e.g., 2.5 Gbps, 5 Gbps, and even 10 Gbps), is rapidly gaining traction across both advanced residential markets and enterprise environments.

Application Insights

The residential segment led the market and accounted for more than 52% of the global revenue in 2024. This dominance is primarily driven by the increasing number of internet-connected households and the surge in demand for reliable, high-speed Wi-Fi to support modern digital lifestyles. Post-pandemic lifestyle shifts such as remote work, online education, telehealth consultations, and home entertainment streaming have led to a substantial increase in home internet usage. Households are now operating multiple devices simultaneously, including laptops, smartphones, smart TVs, gaming consoles, and IoT devices like smart thermostats, cameras, and voice assistants.

The industrial segment is expected to witness the fastest growth of 13.6% over the forecast period. This rapid expansion is fueled by the increasing integration of wireless connectivity in industrial environments to support Industry 4.0 initiatives, smart manufacturing, and real-time data exchange across operational systems. Industrial facilities, including factories, warehouses, oil & gas sites, power plants, and transportation hubs, are undergoing a digital transformation that depends on robust and secure wireless networking infrastructure. Wireless routers with advanced capabilities such as ruggedized design, wide temperature tolerance, redundant connectivity options (Ethernet, 4G/5G, Wi-Fi), and remote management are in growing demand.

Regional Insights

The North America wireless router market led the global market and accounted for 33.74% of the global revenue in 2024. The region’s early adoption of advanced wireless technologies, such as Wi-Fi 6, Wi-Fi 6E, and mesh networking systems, has played a pivotal role in accelerating router upgrades. Consumers are increasingly investing in routers that support multi-gigabit speeds, lower latency, and better device management. These technologies have gained significant popularity among tech-savvy households and small businesses looking for seamless and uninterrupted connectivity. Additionally, government initiatives such as the FCC's Rural Digital Opportunity Fund (RDOF) and various broadband expansion programs in Canada are contributing to router demand by extending high-speed internet access to underserved rural and remote areas.

U.S. Wireless Router Market Trends

The rapid growth of smart homes in the U.S. is a major driver of the market growth. As consumers integrate more smart devices such as thermostats, doorbell cameras, voice assistants, and home security systems into their daily lives, there is a rising need for routers that can handle a high volume of simultaneous connections without performance degradation. This is pushing the adoption of routers that support the latest Wi-Fi standards like Wi-Fi 6 and Wi-Fi 6E, which are better suited for dense and device-rich environments.

Asia Pacific Wireless Router Market Trends

The Asia Pacific region is expected to register the fastest CAGR of 12.6% over the forecast period. Asia Pacific is witnessing accelerated urbanization, coupled with substantial investments in broadband infrastructure across both developed and emerging economies. Countries like China, India, Japan, and South Korea are expanding their fiber-optic and 5G networks at a fast pace, which is directly contributing to increased demand for high-speed wireless routers. Government-backed digital initiatives such as India's “Digital India” and China’s “New Infrastructure” plan is further supporting widespread internet access and connectivity, fueling the router market’s growth across residential and commercial sectors of these respective nations.

China wireless router market is growing due to the robust manufacturing capabilities and the presence of leading router manufacturers such as Huawei, TP-Link, and Xiaomi contribute to the competitive pricing and availability of wireless routers in the market. The ability to produce high-quality routers domestically allows for cost-effective solutions that cater to a wide range of consumers, from budget-conscious individuals to enterprises seeking advanced networking equipment.

Wireless router market in India is witnessing growth due to the Indian government's push for digital inclusion through initiatives like the National Broadband Mission (NBM) 2.0 aims to provide high-speed internet access to over 270,000 villages by 2030. This expansion of broadband infrastructure, particularly in underserved rural areas, is driving the demand for wireless routers as households and businesses seek reliable connectivity solutions.

Europe Wireless Router Market Trends

With the increasing number of connected devices, ensuring network security has become a top priority for consumers and businesses alike. European regulations, such as the General Data Protection Regulation (GDPR), have heightened awareness around data privacy and security. As a result, there is a growing demand for wireless routers that offer advanced security features, including built-in firewalls, VPN support, and automatic firmware updates, to protect against cyber threats.

Germany's wireless router market is characterized by a mix of global technology companies and specialized local players. Established brands like Cisco, Huawei, and Hewlett Packard Enterprise compete alongside local companies such as AVM GmbH, which holds a significant share of the German market. This competitive landscape drives continuous innovation and product development, ensuring that consumers have access to a wide range of high-quality wireless routers that meet their specific needs and preferences.

Key Wireless Router Company Insights

Some of the key players operating in the wireless router market include TP-Link Systems Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd., and ZTE. These companies are actively investing in research and development (R&D) to enhance their product offerings and expand their technological capabilities. They are integrating advanced technologies such as artificial intelligence (AI), machine learning, and blockchain into their wireless networking solutions to improve network management, enhance security, optimize data traffic, and enable smarter device connectivity. These innovations are driving improvements in real-time network monitoring, predictive maintenance, user experience, and overall router performance across residential, commercial, and industrial applications.

-

TP-Link Systems Inc. is a global provider of networking products and solutions, offering a broad range of wireless routers for both residential and commercial applications. Established in 1996 and based in Shenzhen, China, the company has become one of the leading manufacturers of Wi-Fi routers globally, known for producing reliable and cost-effective networking equipment. Its product lineup includes wireless routers, range extenders, mesh Wi-Fi systems, network switches, and smart home devices. TP-Link Systems Inc. actively integrates current wireless standards such as Wi-Fi 6 and Wi-Fi 6E to support higher data speeds, extended coverage, and improved connectivity across multiple devices.

-

Established in 1984, Cisco Systems, Inc. is a multinational technology company headquartered in San Jose, California, specializing in networking hardware, software, and telecommunications equipment. The company’s portfolio encompasses a wide range of products, including routers, switches, security devices, and wireless networking equipment designed for large-scale enterprises, service providers, and data center environments. The company’s wireless router offerings focus primarily on enterprise-grade solutions that emphasize scalability, reliability, and advanced security features. The company also invests heavily in software integration and cloud-managed network services to enhance network visibility, control, and automation.

Key Wireless Router Companies:

The following are the leading companies in the wireless router market. These companies collectively hold the largest market share and dictate industry trends.

- TP-Link Systems Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- ZTE

- AVM Computersysteme Vertriebs GmbH

- NETGEAR

- ASUSTeK Computer Inc.

- D-Link Corporation

- RUCKUS Networks

- Shenzhen Tenda Technology Co.,Ltd.

Recent Developments

-

In January 2025, ASUSTeK Computer Inc. introduced a range of AI-integrated Wi-Fi 7 networking solutions at CES 2025, aimed at addressing connectivity requirements across gaming, travel, mobile, and outdoor use cases. The ROG Rapture GT-BE19000AI, positioned as the first AI-enabled gaming router with an integrated Neural Processing Unit (NPU), incorporates a tri-core architecture to enhance local processing, reduce network latency by up to 34%, and improve energy efficiency by 46%. Additionally, the company launched the RT-BE58 Go, a compact travel router supporting tri-mode connectivity, including 4G/5G tethering, WISP mode, and traditional routing, offering speeds up to 3600 Mbps with integrated security features and mesh networking support.

-

In July 2023, TP-Link Systems Inc. introduced its first Wi-Fi 7 router, the Archer BE900, marking a significant advancement in home networking technology. This quad-band router offers a combined wireless speed of up to 24.4 Gbps, achieved through a new 6 GHz band alongside dual 5 GHz and 2.4 GHz bands. The Archer BE900 is equipped with 12 internal antennas designed for optimal performance and minimal interference, ensuring robust coverage throughout the home.

Wireless Router Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.24 billion

Revenue forecast in 2033

USD 38.10 billion

Growth rate

CAGR of 11.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, bandwidth, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

TP-Link Systems Inc.; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; ZTE; AVM Computersysteme Vertriebs GmbH; NETGEAR; ASUSTeK Computer Inc.; D-Link Corporation; RUCKUS Networks; Shenzhen Tenda Technology Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wireless Router Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the wireless router market report based on type, bandwidth, application, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Band

-

Dual Band

-

Tri Band

-

-

Bandwidth Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 300 Mbps

-

300 Mbps to 1000 Mbps (1 Gbps)

-

Above 1000 Mbps

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wireless router market size was estimated at USD 15.15 billion in 2024 and is expected to reach USD 16.24 billion in 2025.

b. The global wireless router market size is expected to grow at a significant CAGR of 11.3% to reach USD 38.10 billion in 2033.

b. North America dominated the wireless router market with market share of 33.74% in 2024, driven by early broadband adoption, high consumer demand for advanced home networking, and strong enterprise requirements. Additionally, supportive regulatory frameworks and early access to unlicensed spectrum also accelerated innovation and deployment across the region.

b. Some of the players in the wireless router market are TP-Link Systems Inc.; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; ZTE; AVM Computersysteme Vertriebs GmbH; NETGEAR; ASUSTeK Computer Inc.; D-Link Corporation; RUCKUS Networks; Shenzhen Tenda Technology Co.,Ltd.

b. The key driving trends in the wireless router market include the rapid adoption of Wi-Fi 6 and Wi-Fi 6E technologies, which offer faster speeds and lower latency; the growing popularity of mesh networking systems for improved coverage in homes and offices; and increasing demand for secure, high-performance routers due to the rise in remote work and online learning.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.