- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Asia Pacific Prebiotics Market Size Report, 2020-2028GVR Report cover

![Asia Pacific Prebiotics Market Size, Share & Trends Report]()

Asia Pacific Prebiotics Market Size, Share & Trends Analysis Report By Source (Roots, Fruits & Vegetables, Cereals & Grains), By Product, By Form, By Functionality, By Application, By Region, And Segment Forecasts, 2020 - 2028

- Report ID: GVR-4-68039-601-1

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

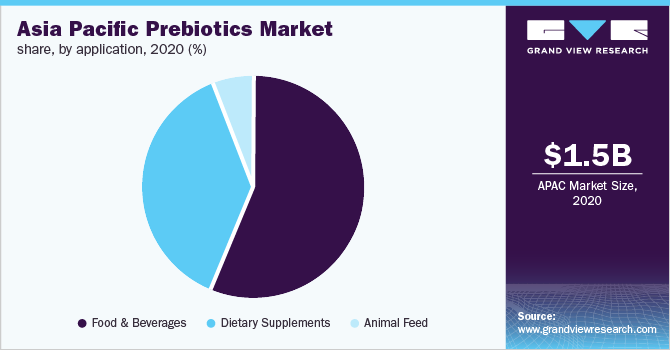

Asia Pacific prebiotics market size was valued at USD 1.5 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 15.6% from 2020 to 2028. The increasing gut problems coupled with the rise in demand for preventative healthcare products in countries such as India, China, and Japan is expected to result in increased demand for prebiotics products. A large number of people suffer from digestive problems such as cramps, pain, bloating, and constipation. Moreover, certain conditions such as Gastroesophageal Reflux Disease (GERD), diverticulitis, and Irritable Bowel Syndrome (IBS) have been growing in recent years. This rising prevalence of digestive diseases has generated the demand for fiber or prebiotic-rich food and beverage products.

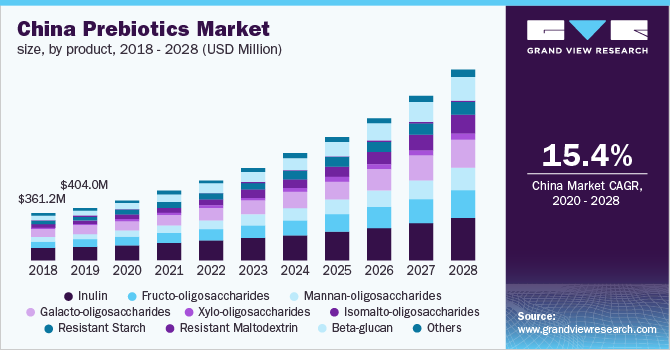

The demand for inulin in China is expected to witness steady growth on account of ease of incorporation in the food & beverage industry. Inulin is used in dairy product formulations such as yogurts, cheese, and ice creams. Dairy industry growth is expected to be a key driver for the inulin market over the next few years. The technological progress in the field of functional ingredients involves heavy spending on research & development. The research & development costs can be in the form of clinical trials or research on ingredients that adhere to the food regulations in countries.

Although such factors are beneficial for well-established market players, small- and medium-sized companies find it challenging to invest heavily in R&D activities as such costs would have a bearing on the final price of functional ingredients thus posing a challenge for the market. The outbreak of animal diseases in the past has had a negative impact on the animal feed industry, thereby resulting in reduced demand for animal feed ingredients such as prebiotics. For instance, the outbreak of H5N1 bird flu severely disrupted the entire poultry industry in India and led to a significant decline in the consumption of poultry in the country.

The importance of nutritional and fortified food products rose due to the COVID-19 outbreak; thus, food manufacturers are likely to incorporate ingredients such as prebiotics into their products to increase their nutritional value in order to attract consumers. Consumers have been consuming products with functional ingredients as part of preventive health, in turn benefiting the probiotics market as well.

Product Insights

The inulin segment dominated the market and accounted for the largest revenue share of 26.25% in 2020. The rising demand for nutraceuticals as a result of growing health awareness is expected to fuel the demand for inulin as a functional ingredient. Inulin plays an important role in enhancing the activity of selected beneficial bacteria, which inhibits the growth of certain pathogenic bacteria and improves colon health.

The demand for FOS (Fructooligosaccharides) is projected to witness high growth on account of its growing utilization in the food and beverage, animal feed, dietary supplement, and pharmaceutical industries. The product is known to stimulate the growth of lactobacilli and bifidobacteria in the human gut and produces short-chain fatty acids.

In food and beverage applications, GOS (Galacto-oligosaccharides) is utilized for preventing allergies in infants and treating stomach disorders such as constipation and gastritis. Therefore, rising concerns regarding chronic diseases tied with a rise in the aging population have led to an increased demand for dietary supplements in the country, driving the galacto-oligosaccharides market.

The beta-glucan industry is likely to further grow on account of increasing awareness among manufacturers for using multiple sources, harvesting, processing, and extraction methods. The manufacturers use innovative patented technologies in a bid to improve the market share and increase overall sales.

Source Insights

The roots segment dominated the market and accounted for the largest revenue share of 54.7% in 2020. The segment is expected to witness a significant CAGR of 15.0% over the forecast period. Prebiotics obtained from roots and tubers such as manioc, salep, arrowroot, artichokes, taro, yam, chicory roots, and sweet potatoes in the human nutrition segment improve colonic integrity. Additionally, it also enhances immune function, reduces the duration and incidence of intestinal infections, and improves digestion and elimination processes in the gut.

Fruits and vegetables-based prebiotics help in regulating lower blood sugar levels and forestall a swift increase in blood insulin levels, which in turn, is linked with the risks of diabetes and obesity. Moreover, health benefits associated with consumption of the fruits & vegetables, such as cancer prevention, and cognitive improvement, and, are anticipated to boost the overall market growth. Some of the key prebiotics obtained from whole grains including wheat, rye, and barley, cereals, such as rice, maize, and wheat bran are beta-glucan, inulin, and resistant maltodextrin. The growing importance of beta-glucan as an immunity booster in the nutraceutical and pharmaceutical industries is projected to drive market growth.

The other sources of prebiotic ingredients are yeast, lentils, legumes such as lupin and chickpea, and nuts & seeds such as peanut, almond, cashew, and pecan, to name a few. Legumes are a good source of prebiotics and dietary fibers, which not only promote colonic bifidobacteria growth but also contribute to the overall colon health in the human body.

Application Insights

The food and beverage segment dominated the market and accounted for the largest revenue share of 56.5% in 2020. Rising awareness among consumers regarding a healthy and nutritious diet and growing demand for energy drinks and high-fiber foods are likely to fuel the demand for prebiotic ingredients such as Galacto-oligosaccharide (GOS). The rising food industry, on account of the growing population and changing lifestyle of consumers, is likely to drive the market over the coming years. The dietary supplements application segment is likely to accelerate owing to the rising demand for prebiotics-based digestive health products and the growing preventative healthcare industry.

The segment growth is principally driven by the rising disposable income and increasing awareness among consumers regarding the health benefits of dietary supplements. In the animal feed sector, regular consumption of prebiotics by broiler chickens aid in maintaining their gut health and inhibits the transmission of pathogens present in the food chain. Enzymes present in plant prebiotics help in the gut morphology of broilers by facilitating the digestion of fibrous food, including grains and soybean meal. Prebiotics in animal feed & pet food applications help the decrease risk of infectious diseases as well as promote the metabolic system of animals against fungi, viruses, and parasites. They also enhance livestock health and metabolism.

Form Insights

The liquid segment dominated the market and accounted for the largest revenue share of 54.6% in 2020. The segment is expected to witness a revenue-based CAGR of 15.4% over the forecast period. The rising demand for naturally derived functional ingredients, as a result of rising consumer awareness regarding a balanced and fiber-rich diet, is likely to propel the demand for liquid prebiotics. Besides, the low cost of the liquid, as compared to powder/crystal form, is projected to attract more buyers, thus promoting the expansion of the liquid-based prebiotics segment.

One of the challenges of powder/crystal-based prebiotics is the high price of the ingredient and difficulty in removing huge amounts of water from a liquid solution, which is naturally overcome by liquid-based protein ingredients. Liquid prebiotics have a promising dietary fiber profile and high-water solubility, which make them especially suitable for manufacturing pharmaceutical formulations. The powder/crystal-based prebiotics are used in the processing of nutritional dairy products, snacks, cereals, and infant foods.

Moreover, the growing demand for powdered prebiotic ingredients to manufacture nutritional supplement products such as ready-to-drink (RTD) and bars, which increase immune function, help maintain a healthy weight, and lower inflammation in the body, are anticipated to further enhance the overall market growth in the coming years. Rapid incorporation of crystalized/powdered prebiotics in various pet food products on account of easy availability, taste refining characteristics, and economical nature is anticipated to spur market demand for powder/crystal-based prebiotics over the next few years.

Functionality Insights

The gut health segment dominated the market and accounted for the largest revenue share of 46.7% in 2020. The human digestive system relies on a wide range of dietary fibers in order to function optimally. The consumption of prebiotics assists in the removal of waste and ensures normal digestion by nourishing the mucosal tissue lining the digestive tract. Thus, the demand for prebiotics is projected to witness a high growth on account of their ability to advance gut health and combat disorders. Supplements are mainly consumed to ensure the intake of nutritional constituents that are important for the human body.

Rising occurrences of cardiovascular diseases due to the inactive and slow lifestyle, mainly among individuals within the age group of 30 to 40 years, and shifting dietary patterns are likely to drive the demand for prebiotic-based nutritional supplements in the market over the coming years. Dietary supplements rich in prebiotic fibers are known to boost and maintain the energy levels in the human body. Furthermore, consumption of prebiotic ingredients in any form assists in rapid fat/calorie burning, reduced absorption of fats, and reduced appetite, which aids in reducing the consumption of calories and maintaining the overall body weight.

The demand for prebiotics in the anti-cancer segment is likely to grow as consuming prebiotics-based dietary supplements is known to reduce the risk of prostate and colon cancer. Moreover, cancer patients are increasingly turning to dietary supplements to ease nausea and strengthen their immune systems from chemotherapy.

Regional Insights

China accounted for the largest revenue share of 29.84% in the prebiotics market in 2020. The market is expected to witness steady growth over the next few years on account of the rising consumption of high fiber food & beverages products. Moreover, increasing incidences of various diseases due to an unhealthy lifestyle is likely to encourage the consumers in the country to turn towards health supplements. Such factors are likely to impede the market penetration of prebiotics in China in the coming years.

Consumers in the Philippines are increasingly becoming more concerned regarding their health as compared to wealth, while a majority of consumers are suffering from intestinal and digestive issues such as irritable bowel syndrome (IBS). The remaining population is also attempting to combat age-related diseases while avoiding medical treatments with side effects.

India is likely to witness a huge demand for prebiotics over the coming years due to the increasing demand for nutraceutical and functional foods. The growth of the nutraceutical industry in India can be attributed to the aging population and increasing cases of people suffering from diseases related to unhealthy lifestyles, which is leading to an increasing number of people opting for healthier food products.

The rising demand for functional foods tied with growing health consciousness among the people in Japan is likely to spur the growth of the prebiotics market in the country over the next few years. Furthermore, the rising prevalence of several health disorders such as diabetes, gastrointestinal troubles, obesity, and others are shifting consumer preference towards intake of products with high health benefits thus, driving the demand for prebiotics over the coming years.

Key Companies & Market Share Insights

Players are further focusing on partnerships and expansion strategies to strengthen their foothold in the Asia Pacific prebiotics market. In January 2020, Meiji Seika Pharma Co., Ltd. announced that it had entered into a distribution, and partnership agreement for the epigenetic immunomodulator, HBI-8000, from HUYA Bioscience International, LLC. With this agreement, Meiji has the authority to sell HBI-8000 in Japan and to grow and has authority to market in seven licensed countries such as Indonesia, Malaysia, Philippines, Singapore, Vietnam, and Thailand. Some of the prominent players in the Asia Pacific prebiotics market include:

-

BAOLINGBAO BIOLOGY

-

Tata Chemical Ltd.

-

Quantum Hi-Tech (China) Biological Co., Ltd.

-

SAMYANG HOLDINGS CORPORATION

-

CJ CheilJedang Corp

-

Meiji Holdings Co., Ltd.

-

Fuji Nihon Seito Corporation

Asia Pacific Prebiotics Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.8 billion

Revenue forecast in 2028

USD 4.9 billion

Growth Rate

CAGR of 15.6% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million volumes in Kilotons and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, form, functionality, application, region

Regional scope

Asia Pacific

Country scope

China; India; Japan; Taiwan; Australia; Thailand; Malaysia; Indonesia; Philippines; Vietnam; Singapore; South Korea

Key companies profiled

BAOLINGBAO BIOLOGY; Tata Chemical Ltd.; Meiji Holdings Co., Ltd.; Quantum HI-Tech (China) Biological Ltd.; SAMYANG HOLDINGS CORPORATION; CJ CheilJedang Corp; Fuji Nihon Seito Corporation; Yakult Honsha Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the Asia Pacific prebiotics market report on the basis of product, source, form, functionality, application, and region:

-

Product Outlook (Volumes, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Inulin

-

Fructooligosaccharides (FOS)

-

Mannan- oligosaccharides (MOS)

-

Galacto-oligosaccharides (GOS)

-

Xylo-oligosaccharides (XOS)

-

Resistant maltodextrin

-

Isomalto-oligosaccharides

-

Resistant starch

-

Beta-glucans

-

Others

-

-

Source Outlook (Volumes, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Roots

-

Fruits & Vegetables

-

Cereal & Grains

-

Others

-

-

Form Outlook (Volumes, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Powder/crystal

-

Liquid

-

-

Functionality Outlook (Volumes, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Gut Health

-

Cardiovascular Health

-

Bone Health

-

Immunity

-

Weight Management

-

Others

-

-

Application Outlook (Volumes, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Food & Beverages

-

Dairy Products

-

Infant Foods

-

Cereals

-

Beverages

-

Meat Products

-

Others

-

-

Dietary Supplements

-

Food Supplements

-

Nutritional Supplements

-

Specialty Supplements

-

-

Animal Feed

-

Poultry

-

Swine

-

Cattle

-

Aquaculture

-

Pet Food

-

-

-

Regional Outlook (Volumes, Kilotons; Revenue, USD Million; 2017 - 2028)

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

Philippines

-

Vietnam

-

Singapore

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific prebiotic market size was estimated at USD 1.5 billion in 2020 and is expected to reach USD 1.8 billion in 2021.

b. The Asia Pacific prebiotics market is expected to grow at a compound annual growth rate of 15.6% from 2020 to 2028 to reach USD 4.93 billion by 2028.

b. Inulin segment dominated the Asia Pacific prebiotics market with a share of nearly 26.25 % in 2020 due to the ease in the incorporation of prebiotic ingredients in the food & beverage industry.

b. Some of the key players operating in the Asia Pacific prebiotic market include BAOLINGBAO BIOLOGY, Tata Chemical Ltd, Quantum Hi-Tech (China) Biological Co., Ltd., SAMYANG HOLDINGS CORPORATION, CJ CheilJedang Corp among others.

b. The key factors that are driving the Asia Pacific prebiotics market include the increasing concerns towards gut health, increasing focus towards preventive healthcare, and rising consumer spending on health and wellbeing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."