- Home

- »

- Plastics, Polymers & Resins

- »

-

Barrier Films For Pharmaceutical Packaging Market Report 2030GVR Report cover

![Barrier Films For Pharmaceutical Packaging Market Size, Share & Trends Report]()

Barrier Films For Pharmaceutical Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Polyethylene (PE), Polyethylene Terephthalate (PET)), By Product Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-555-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Barrier Films For Pharmaceutical Packaging Market Summary

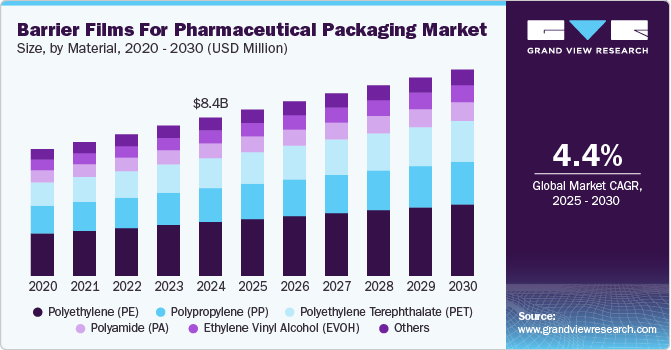

The global barrier films for pharmaceutical packaging market size was valued at USD 8.39 billion in 2024 and is expected to reach USD 10.94 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The barrier films for the pharmaceutical packaging market is driven by increasing demand for extended shelf life and protection against moisture, oxygen, and light.

Key Market Trends & Insights

- APAC dominated the global market and accounted for the largest revenue share of over 41.0% in 2024.

- By material, the polyethylene (PE) material segment recorded the largest revenue share of over 34.0% in 2024.

- By product, the multilayer films segment recorded the largest market revenue share of over 46.0% in 2024.

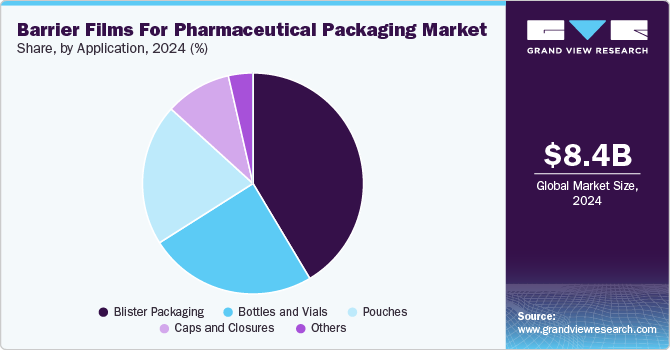

- By application, the blister packaging segment recorded the largest market share of over 41.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.39 Billion

- 2030 Projected Market Size: USD 10.94 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

Additionally, the rising prevalence of chronic diseases and growing regulatory emphasis on product safety boost market growth.The barrier films for pharmaceutical packaging market are primarily driven by increased demand for drug safety and extended shelf life. For example, drugs such as effervescent tablets, biologics, and antibiotics are highly sensitive to moisture and require packaging materials with superior barrier properties to ensure their potency and efficacy over time. The growing focus on patient safety and compliance with stringent quality standards has pushed pharmaceutical companies to adopt advanced packaging solutions like high-barrier films.

The growth in biologics and specialty pharmaceuticals is also contributing to market growth. It requires enhanced protection due to their complex compositions. These products are more sensitive to environmental conditions compared to traditional small-molecule drugs. As a result, pharmaceutical companies are increasingly using high-performance barrier films such as polyvinylidene chloride (PVDC), cyclic olefin polymers (COP), and aluminum foil laminates. For example, barrier films used in blister packaging for biologics help maintain drug stability and reduce the risk of contamination, ensuring that the medication remains safe and effective until it reaches the patient.

Regulatory compliance and sustainability trends are also shaping the market. Regulatory bodies such as the U.S. FDA and EMA mandate strict guidelines for pharmaceutical packaging, including barrier performance, material safety, and compatibility with the drug product. At the same time, there is a growing push toward eco-friendly and recyclable materials. This has led to innovation in developing multi-layer barrier films that balance high protection with recyclability.

Moreover, the global rise in pharmaceutical manufacturing and contract packaging services is amplifying demand for barrier films. The COVID-19 pandemic accelerated investments in pharmaceutical production and cold chain logistics, especially for vaccines and temperature-sensitive drugs. This has led to increased usage of barrier films in secondary and tertiary packaging formats such as pouches, sachets, and overwraps. Moreover, with the outsourcing of packaging operations to contract manufacturing organizations (CMOs), there is a greater emphasis on standardized, high-performance packaging materials that can be used across diverse drug portfolios and regional regulatory requirements.

Material Insights

The polyethylene (PE) material segment recorded the largest revenue share of over 34.0% in 2024. PE is widely used in pharmaceutical packaging due to its excellent moisture barrier properties, flexibility, and low cost. It is typically used as a sealant layer in multi-layer barrier films. PE, especially low-density polyethylene (LDPE), is valued for its transparency, softness, and heat-sealing capabilities, which make it suitable for packaging tablets, capsules, and medical devices.

Polyethylene terephthalate (PET) is expected to grow at the fastest CAGR of 5.1% during the forecast period. PET is used in pharmaceutical packaging for its excellent strength, clarity, and barrier to gases and moisture. It is often used as a laminate layer over aluminum foils or other barrier materials in blister packs and sachets. The increasing demand for transparent, tamper-evident, and aesthetically appealing pharmaceutical packaging is fueling the use of PET.

Product Type Insights

The multilayer films segment recorded the largest market revenue share of over 46.0% in 2024 and is expected to grow at the fastest CAGR of 5.8% during the forecast period. Multilayer films consist of multiple polymer layers bonded together, each contributing a specific property such as moisture resistance, oxygen barrier, or mechanical strength. These films are widely used in pharmaceutical packaging to protect sensitive drugs from environmental degradation. Multilayer films are driven by the rising demand for high-barrier packaging in the pharmaceutical industry, especially for biologics and moisture-sensitive drugs.

Laminated films segment is primarily driven by the increasing demand for flexible, durable, and aesthetically appealing packaging solutions in the pharmaceutical industry. Laminated films are formed by bonding two or more film layers using adhesives or heat, offering combined benefits of the individual layers. These films are known for their excellent mechanical strength, printability, and high barrier capabilities, and are commonly used for sachets, pouches, and blister packs.

Application Insights

The blister packaging segment recorded the largest market share of over 41.0% in 2024 and is projected to grow at the fastest CAGR of 4.8% during the forecast period. The demand for blister packaging is primarily driven by its ability to offer unit-dose protection, reduce contamination risks, and improve patient compliance. Additionally, the increasing trend toward self-medication and over-the-counter (OTC) drug sales, especially in developing regions, fuels growth. The rising geriatric population and the need for tamper-evident and child-resistant packaging also bolster demand for barrier films in this segment.

Pouches made from multi-layer barrier films are used for packaging powders, granules, or transdermal patches. They are flexible, lightweight, and offer excellent protection against oxygen, moisture, and light, making them suitable for pharmaceutical and medical device applications. The increasing demand for convenient, portable, and single-use packaging drives the adoption of barrier films in pouch applications.

Bottles and vials serve as primary containers for liquid, powder, and injectable drugs. Barrier films are used either as linings or secondary seals to enhance the container’s resistance to moisture, gas, and microbial contamination. These films ensure the stability of sensitive pharmaceutical formulations during storage and transportation. Growth in this segment is driven by the expanding biologics and injectable drugs market, which requires high-barrier packaging to maintain drug efficacy.

Region Insights

North America’s growth in the barrier films for pharmaceutical packaging market is due to its robust pharmaceutical industry infrastructure and stringent regulatory framework. The FDA's strict packaging requirements for drug stability, shelf life, and protection against moisture, oxygen, and contaminants have driven pharmaceutical companies to adopt high-performance barrier films. Major companies such as Johnson & Johnson, Pfizer, and Merck have established extensive manufacturing facilities across the region, creating consistent demand for advanced packaging solutions.

U.S. Barrier Films for Pharmaceutical Packaging Market Trends

The barrier films for pharmaceutical packaging market in the U.S. are primarily driven by the rapid growth of biologics, injectables, and personalized medicine in the country. In addition, the U.S. pharmaceutical supply chain's growing complexity, driven by cold chain logistics, online pharmacies, and decentralized clinical trials, has escalated the demand for high-performance packaging. Moreover, government support for domestic pharmaceutical manufacturing, such as initiatives under the Biomedical Advanced Research and Development Authority (BARDA) and the FDA’s Drug Supply Chain Security Act (DSCSA), continues to stimulate investment in packaging innovations.

Europe Barrier Films for Pharmaceutical Packaging Market Trends

Europe barrier films for pharmaceuticals packaging market has one of the largest and most well-established pharmaceutical markets globally, with countries such as Germany, Switzerland, and France being home to some of the world’s largest pharmaceutical companies. These companies require advanced packaging solutions to protect their products during transportation and storage, thus driving the market growth in the country.

Barrier films for pharmaceutical packaging market in Germany are primarily driven by its combination of pharmaceutical manufacturing expertise, stringent regulatory framework, robust innovation ecosystem, and export-oriented economy. The country consists of major global pharmaceutical companies, including Bayer, Boehringer Ingelheim, and Merck KGaA, all of which demand high-quality, protective packaging materials to ensure drug safety and compliance with regulatory standards.

Asia Pacific Barrier Films for Pharmaceutical Packaging Market Trends

APAC barrier films for pharmaceutical packaging market dominated the global market and accounted for the largest revenue share of over 41.0% in 2024 and is projected to grow at the fastest CAGR of 5.1% during the forecast period. The region hosts rapidly expanding pharmaceutical manufacturing hubs in countries such as India, China, and Singapore, which collectively produce a significant portion of the world's generic medications and active pharmaceutical ingredients. This manufacturing concentration naturally drives demand for high-quality packaging solutions, including specialized barrier films that protect sensitive medications from moisture, oxygen, and light degradation.

The barrier films for pharmaceutical packaging market in China are primarily driven by its massive pharmaceutical manufacturing base has expanded dramatically in recent years, with domestic companies scaling up production while multinational corporations establish regional manufacturing hubs to serve Asian markets. The Chinese government's "Healthy China 2030" initiative has prioritized pharmaceutical innovation and quality improvements across the supply chain, directly benefiting packaging materials.

Key Barrier Films For Pharmaceutical Packaging Company Insights

The competitive environment of the barrier films for pharmaceutical packaging industry is characterized by intense rivalry among global and regional players striving to enhance product performance, regulatory compliance, and sustainability. Major companies dominate the market through continuous innovation in multilayer film technology, advanced materials such as PVDC and EVOH, and eco-friendly alternatives. The industry is highly influenced by stringent pharmaceutical packaging regulations, driving companies to invest in R&D and strategic partnerships to meet safety, shelf-life, and barrier property requirements. Additionally, emerging players are gaining traction by focusing on cost-effective solutions and sustainable materials, adding further competition to an already dynamic market.

-

In May 2024, TOPPAN Holdings Inc. and India-based TOPPAN Speciality Films (TSF) plan to launch Indian production of GL-SP, a BOPP-based barrier film designed for sustainable packaging. The film offers barrier performance comparable to vapor-deposited PET, providing excellent protection against oxygen and water vapor, making it ideal for packaging applications in sectors such as food, medical/pharmaceutical, and industrial materials.

-

In October 2023, Solvay launched Diofan Ultra736, a new ultra-high barrier polyvinylidene chloride (PVDC) coating solution designed for pharmaceutical blister films that offers superior water vapor barrier properties while enabling thinner coating structures, which significantly reduces the carbon footprint of the packaging. This aqueous, fluorine-free dispersion meets regulatory requirements for direct pharmaceutical contact and maintains excellent oxygen barrier, chemical resistance, transparency, and thermoformability, allowing for smaller pack sizes with higher pill density.

Key Barrier Films For Pharmaceutical Packaging Companies:

The following are the leading companies in the barrier films for pharmaceutical packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Klöckner Pentaplast

- Sealed Air

- Cosmo Films

- UFlex Limited

- Honeywell International Inc.

- TOPPAN Inc.

- ACG

- West Pharmaceutical Services, Inc.

- Tekni-Plex, Inc.

- Neelam Global Pvt. Ltd.

- Perlen Packaging

- WEIFU Films

- Dai Nippon Printing Co., Ltd.

- ALMA Packaging AG

- Vishakha Polyfab Pvt Ltd

Barrier Films For Pharmaceutical Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.83 billion

Revenue forecast in 2030

USD 10.94 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product type, application, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

Klöckner Pentaplast; Sealed Air; Cosmo Films; UFlex Limited; Honeywell International Inc.; TOPPAN Inc.; ACG; West Pharmaceutical Services, Inc.; Tekni-Plex, Inc.; Neelam Global Pvt. Ltd.; Perlen Packaging; WEIFU Films; Dai Nippon Printing Co., Ltd.; ALMA Packaging AG; Vishakha Polyfab Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barrier Films For Pharmaceuticals Packaging Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global barrier films for pharmaceutical packaging market report based on material, product type, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Ethylene Vinyl Alcohol (EVOH)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Single-layer Films

-

Multilayer Films

-

Coated Films

-

Laminated Films

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Blister Packaging

-

Bottles and Vials

-

Caps and Closures

-

Pouches

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global barrier films for pharmaceutical packaging market was estimated at around USD 8.39 billion in the year 2024 and is expected to reach around USD 8.83 billion in 2025.

b. The global barrier films for pharmaceutical packaging market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach around USD 10.94 billion by 2030.

b. Blister packaging dominated the application segment of the market in 2024 with a 41.0% value share due to its superior protection against moisture, oxygen, and contaminants. Its unit-dose format also enhances patient compliance and product safety.

b. The key players in the barrier films for pharmaceutical packaging market include Klöckner Pentaplast; Sealed Air; Cosmo Films; UFlex Limited; Honeywell International Inc.; TOPPAN Inc.; ACG; West Pharmaceutical Services, Inc.; Tekni-Plex, Inc.; Neelam Global Pvt. Ltd.; Perlen Packaging; WEIFU Films; Dai Nippon Printing Co., Ltd.; ALMA Packaging AG; Vishakha Polyfab Pvt Ltd.

b. Rising demand for extended shelf-life and protection against moisture, oxygen, and light is driving the growth of barrier films in pharmaceutical packaging. Additionally, increasing regulatory emphasis on safe and contamination-free drug delivery supports market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.