- Home

- »

- Plastics, Polymers & Resins

- »

-

Biodegradable Electronics Polymers Market Report, 2033GVR Report cover

![Biodegradable Electronics Polymers Market Size, Share & Trends Report]()

Biodegradable Electronics Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Polymer (Polylactic Acid (PLA), Polycaprolactone (PCL)), By Application (Flexible Electronics, Printed Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-785-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biodegradable Electronics Polymers Market Summary

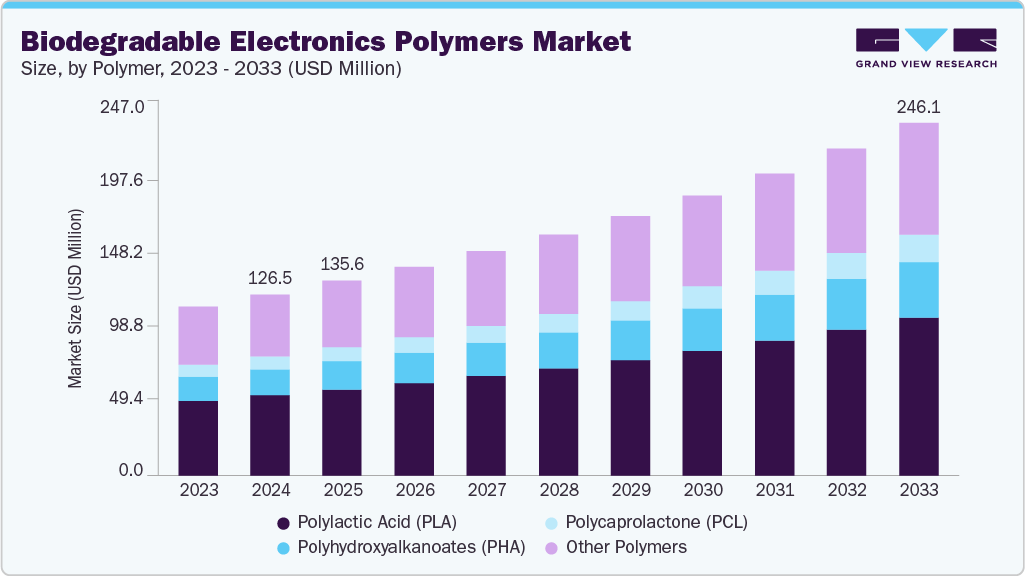

The global biodegradable electronics polymers market size was estimated at USD 126.47 million in 2024 and is projected to reach USD 246.14 million by 2033, growing at a CAGR of 7.7% from 2025 to 2033. The market for biodegradable electronics polymers is projected to experience significant growth in the coming ten years, fueled by rising environmental issues and strict worldwide regulations focused on minimizing electronic waste.

Key Market Trends & Insights

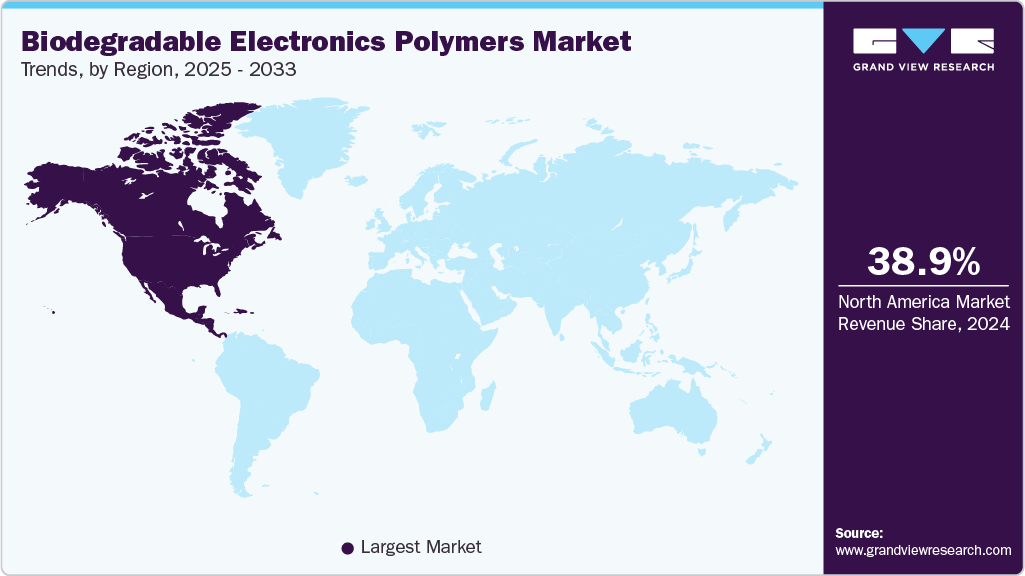

- North America dominated the global biodegradable electronics polymers industry with the largest revenue share of 38.99% in 2024.

- The biodegradable electronics polymers industry in Canada is expected to grow at the fastest CAGR of 7.9% from 2025 to 2033.

- By polymer, the polyhydroxyalkanoates (PHA) segment is expected to grow in revenue at a considerable CAGR of 8.8% from 2025 to 2033.

- By application, the flexible electronics segment is expected to grow at a considerable revenue CAGR of 8.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 126.47 Million

- 2033 Projected Market Size: USD 246.14 Million

- CAGR (2025-2033): 7.7%

- North America: Largest market in 2024

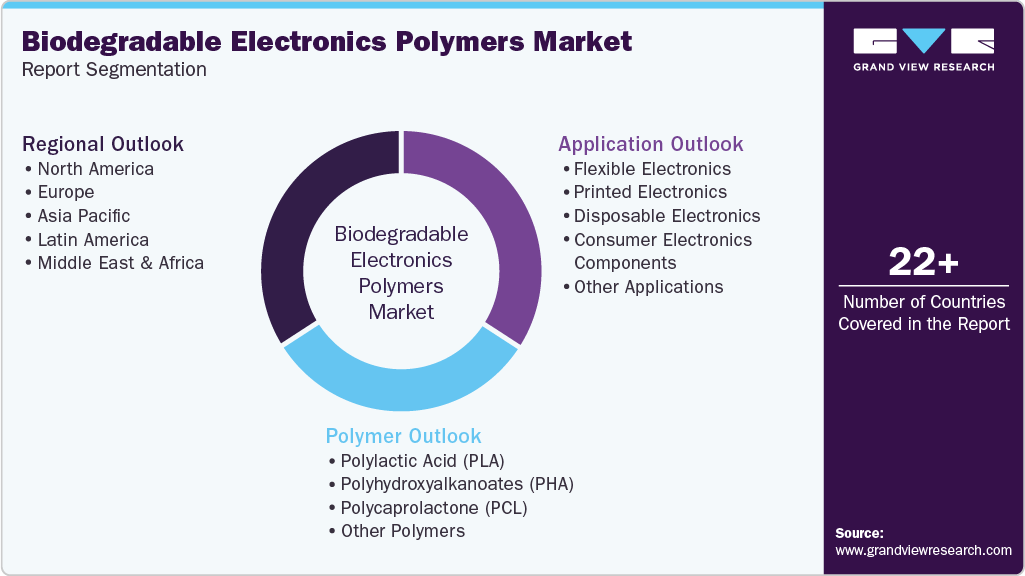

As manufacturers and OEMs transition to sustainable materials, the market is gaining momentum in the creation of transient, flexible, and environmentally friendly electronic components. The global biodegradable electronics polymers industry includes various materials aimed at replacing traditional non-degradable polymers in electronic applications, categorized by polymer. Key polymers consist of polylactic acid (PLA), polycaprolactone (PCL), polyhydroxyalkanoates (PHA), along with other biodegradable conductive polymers like polyaniline (PANI), polybutylene succinate (PBS), and polypyrrole (PPy). These materials are progressively utilized in flexible circuits, sensors, and transient devices where controlled degradation and environmental safety are essential.

Drivers, Opportunities & Restraints

The growth of the global market for biodegradable electronic polymers is fueled by heightened concerns for the environment and strict regulatory measures focused on reducing electronic waste. Governments and industry standards are promoting the use of sustainable materials in electronic components, especially in areas with robust e-waste management policies. In addition, the increasing need for flexible, disposable, and wearable electronics, such as medical devices and environmental sensors, is driving the demand for polymers that are both biodegradable and compatible with biological systems. Innovations in bio-based conductive polymers and eco-friendly manufacturing technologies are improving material performance, thus facilitating wider commercial adoption.

The market offers considerable opportunities in creating transient electronics, implantable medical devices, and environmentally friendly consumer electronics. The expansion of the Internet of Things (IoT) landscape is increasing the need for single-use or short-lifespan sensors that can safely break down after use. Partnerships between research organizations and electronics producers are accelerating the introduction of advanced biodegradable conductive polymers to the market. Furthermore, emerging markets in the Asia-Pacific region and Europe, bolstered by supportive sustainability policies and R&D incentives, present significant growth opportunities for businesses emphasizing material innovation and scalable manufacturing solutions.

Even with favorable growth potential, the market faces limitations due to elevated production expenses and a lack of extensive manufacturing capabilities. Biodegradable polymers generally show lower electrical conductivity, diminished mechanical stability, and are prone to environmental influences, which limit their use in high-performance or long-lasting electronic applications. In addition, the lack of standardized testing protocols for biodegradability and insufficient recycling infrastructure presents obstacles to widespread use. Overcoming these technical and economic hurdles is essential for boosting market presence and facilitating the sustainable, large-scale implementation of biodegradable electronic polymers.

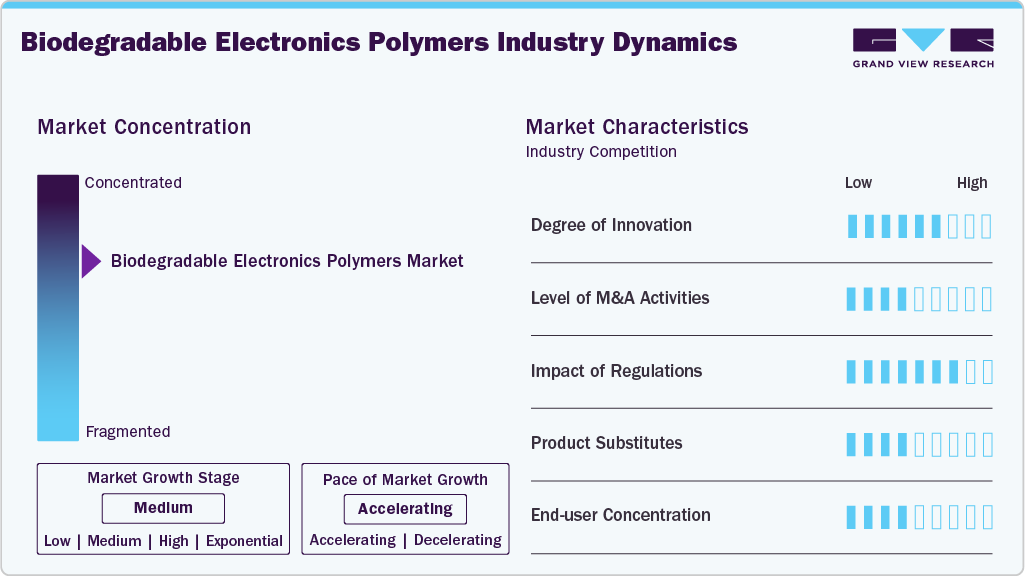

Market Concentration & Characteristics

The market growth stage is moderate, and at an accelerated rate of growth. The market shows slight fragmentation, with key players holding significant influence. Major companies such as BASF SE, NatureWorks LLC, Mitsubishi Chemical Corporation, and others, play a crucial role in shaping market trends. These leading firms often drive innovation, launching new products, technologies, and applications to meet changing industry needs.

The market for biodegradable electronics polymers is very innovative, as firms are creating bio-derived conductive polymers, temporary materials, and adaptable composites intended for wearable and medical electronic applications. M&A activity is at a moderate level, with well-established companies collaborating with startups to leverage specialized polymers and speed up the commercialization process. Moreover, strict e-waste and sustainability laws in North America, Europe, and the Asia-Pacific region are propelling the use of biodegradable polymers. Regulatory backing promotes environmentally friendly product design and stimulates research and development in sustainable materials.

The market contends with competition from traditional non-biodegradable polymers, recycled plastics, and hybrid materials that deliver some sustainability advantages. Although these alternatives often achieve better mechanical and electrical properties at lower prices, they fall short of the necessary degradability and biocompatibility standards essential for transient electronics, implantable devices, or short-lifespan sensors. The end-user base is fairly varied, with significant demand originating from manufacturers of medical devices, developers of wearable technology, companies in the consumer electronics sector, and providers of environmental sensors. Applications in healthcare and the Internet of Things are becoming increasingly prominent as they depend on biodegradable materials, which guarantee a consistent and rising demand across various industries.

Polymer Insights

Polylactic Acid (PLA) dominated the market across the polymer segmentation in terms of revenue, accounting for a market share of 44.19% in 2024, and is forecasted to grow at a 7.1% CAGR from 2025 to 2033. The growth of the PLA-based electronics polymers segment is fueled by increasing regulatory pressures to minimize electronic waste, a rising demand for sustainable and bioresorbable devices, and continuous advancements in PLA composites that improve thermal stability and electrical performance. Its adaptability, along with its growing use in medical, consumer electronics, and IoT sectors, positions PLA as a crucial material in the shift toward sustainable electronics.

The Polyhydroxyalkanoates (PHA) segment is anticipated to grow at a substantial CAGR of 8.8% through the forecast period. The expansion of the market for PHA-based electronics polymers is fueled by increasing environmental regulations, a growing need for sustainable electronic components, and progress in PHA processing that enhances electrical performance and thermal stability. The distinctive blend of biodegradability and functional flexibility makes PHA the material of choice for specific electronic applications where sustainability and device safety are paramount.

Application Insights

Flexible electronics dominated the market across the application segmentation in terms of revenue, accounting for a market share of 36.63% in 2024, and is forecasted to grow at the fastest CAGR of 8.2% from 2025 to 2033. Flexible electronics are a major application area for biodegradable electronic polymers, including wearable gadgets, foldable screens, flexible sensors, and transient circuits. Biodegradable polymers like PLA and PHA are gaining traction in this field due to their suitability for printing and thin-film manufacturing methods. The expansion of wearable technology, health monitoring devices, and IoT-connected sensors is fueling the need for flexible, lightweight, and environmentally sustainable electronic materials, positioning biodegradable polymers as essential components for the next generation of flexible electronics.

The printed electronics segment is projected to grow at a substantial CAGR of 7.9% throughout the forecast period. Printed electronics represents a developing field for biodegradable electronic polymers, which involves creating circuits, sensors, and electronic components through additive printing methods on flexible materials. Utilizing biodegradable materials in printed electronics promotes the creation of lightweight, flexible, and environmentally responsible devices while helping to minimize electronic waste.

Regional Insights

North America biodegradable electronics polymers market held the largest revenue share of 38.99% in 2024 and is expected to grow at the fastest CAGR of 7.0% over the forecast period. The market for biodegradable electronics polymers in North America is experiencing consistent growth, fueled by strict e-waste regulations, heightened environmental awareness, and the increased use of sustainable materials in the manufacturing of electronics. The region boasts a strong presence of wearable technology, IoT devices, and medical electronics, which are progressively incorporating biodegradable polymers like PLA and PHA for temporary and flexible uses. The market is supported by advanced research and development facilities, favorable government initiatives, and the proactive adoption of green materials by original equipment manufacturers, positioning North America as a vital area for innovation and commercialization in biodegradable electronics polymers.

U.S. Biodegradable Electronics Polymers Market Trends

The U.S. biodegradable electronics polymers industry stages a proactive approach to using biodegradable polymers in sectors like wearable electronics, IoT devices, and medical applications. Robust regulatory policies on electronic waste, along with a well-established research infrastructure and sustainability-driven efforts by original equipment manufacturers, are fostering the expansion of biodegradable electronic polymers in the nation.

Asia Pacific Biodegradable Electronics Polymers Market Trends

The market for biodegradable electronic polymers in the Asia-Pacific region is growing swiftly, driven by the emergence of electronics manufacturing centers, heightened environmental regulations, and a rising need for sustainable and wearable electronic products. Nations like China, Japan, and South Korea are committing resources to research and development as well as large-scale production of bio-based polymers such as PLA and PHA, establishing the area as a crucial contributor to the advancement of sustainable electronics.

Europe Biodegradable Electronics Polymers Market Trends

Europe biodegradable electronics polymers industry is at the forefront of regulating and implementing sustainability-focused biodegradable electronic polymers. Countries such as Germany, France, and the UK actively support green electronics, leading to a rise in the use of biodegradable polymers in applications such as flexible circuits, printed electronics, and transient devices. The region's commitment to circular economy principles and environmentally conscious innovation is consistently propelling market growth.

Key Biodegradable Electronics Polymers Company Insights

The biodegradable electronics polymers industry is moderately competitive, with several key global players dominating the landscape. Major companies include BASF SE, NatureWorks LLC, Mitsubishi Chemical Corporation, among others. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Biodegradable Electronics Polymers Companies:

The following are the leading companies in the biodegradable electronics polymers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- NatureWorks LLC

- Mitsubishi Chemical Corporation

- Novamont S.p.A.

- Total Corbion PLA

- Biodegradable Electronics Polymers

- Daicel ChemTech

- Polysciences, Inc.

- Lubrizol

- CD Bioparticles

Recent Developments

-

In July 2025, Balrampur Chini Mills Limited introduced its "Bioyug" PLA brand in India, with the goal of increasing the adoption of biodegradable polymers in multiple applications. The company intends to create downstream applications in Printed Electronics and other industries, with potential avenues in electronics, showcasing a strategic commitment to sustainable and versatile PLA-based solutions.

-

In March 2025, TotalEnergies Corbion and Benvic announced a strategic alliance aimed at creating low-carbon, PLA-based compounds for long-lasting applications, such as electric and electronic goods. The partnership is centered on utilizing sustainable polymer solutions to minimize the carbon emissions of electronic components while fulfilling the increasing need for environmentally friendly and high-performance materials in the electronics industry.

Biodegradable Electronics Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 135.63 million

Revenue forecast in 2033

USD 246.14 million

Growth rate

CAGR of 7.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD thousand/million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Polymer, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF SE; NatureWorks LLC; Mitsubishi Chemical Corporation; Novamont S.p.A.; Total Corbion PLA; Biodegradable Electronics Polymers; Daicel ChemTech; Polysciences, Inc.; Lubrizol; CD Bioparticles

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biodegradable Electronics Polymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biodegradable electronics polymers market report based on polymer, application, and region:

-

Polymer Outlook (Volume, Tons; Revenue, USD Thousand, 2021 - 2033)

-

Polylactic Acid (PLA)

-

Polyhydroxyalkanoates (PHA)

-

Polycaprolactone (PCL)

-

Other Polymers

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2021 - 2033)

-

Flexible Electronics

-

Printed Electronics

-

Disposable Electronics

-

Consumer Electronics Components

-

Other applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.