- Home

- »

- IT Services & Applications

- »

-

Clustering Software Market Size, Industry Report, 2030GVR Report cover

![Clustering Software Market Size, Share & Trends Report]()

Clustering Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Self-Service Clustering, Managed Clustering, Hybrid Clustering), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-568-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clustering Software Market Size & Trends

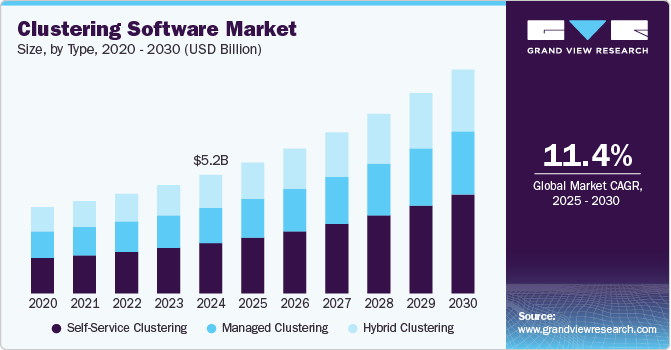

The global clustering software market size was estimated at USD 5.19 billion in 2024 and is anticipated to grow at a CAGR of 11.4% from 2025 to 2030. The increasing volume of data generated across industries is a major driver fueling the clustering software market. Organizations produce massive amounts of structured and unstructured data daily with the proliferation of connected devices, IoT networks, social media platforms, and e-commerce activities. Managing and extracting insights from this vast data is becoming more complex and crucial for business success. Clustering software helps businesses to group large datasets into meaningful categories, enabling better analysis, decision-making, and strategy formulation.

As companies strive to leverage big data to gain competitive advantages, the need for sophisticated clustering solutions that can automatically detect patterns, segment markets, and optimize operations is rapidly increasing, thus propelling the market forward. The expanding applications of clustering software in cybersecurity also act as a critical growth driver. As cyber threats become more sophisticated, traditional security systems often do not detect anomalies or advanced persistent threats (APTs). Clustering techniques allow cybersecurity teams to identify unusual patterns, segment malicious activities, and prioritize threats based on severity without explicit human labeling. With the growing incidence of data breaches, ransomware attacks, and other cybercrimes, organizations across the globe are investing heavily in security solutions that leverage clustering algorithms to enhance threat detection and response capabilities. This focus on proactive and intelligent cybersecurity measures creates robust opportunities for clustering software vendors.

Moreover, the emergence of cloud-based clustering solutions simplifies access and scalability, thus driving broader market adoption. Traditional on-premises clustering software often requires significant upfront investment in hardware and skilled IT staff. In contrast, cloud-based clustering platforms offer scalability, flexibility, and cost-effectiveness, allowing businesses of all sizes to benefit from advanced clustering capabilities without the burden of maintaining complex infrastructure. As more enterprises embrace digital transformation and shift toward cloud-native architectures, the demand for easy-to-deploy, subscription-based clustering solutions is rising sharply. Cloud deployment models also facilitate real-time data processing and collaboration across geographically dispersed teams, making clustering software even more attractive to modern organizations.

Furthermore, the proliferation of smart cities and IoT devices is driving the growth of the clustering software market. Smart city initiatives, which rely heavily on real-time data from IoT sensors, require sophisticated analytics tools to process and make sense of vast and diverse data streams. Clustering software is key in organizing data collected from smart traffic systems, energy grids, waste management solutions, and public safety systems. It enables urban planners and administrators to identify trends, optimize services, and proactively respond to issues. With governments worldwide increasingly investing in smart infrastructure, the use of clustering software to manage, analyze, and derive insights from IoT ecosystems is set to expand significantly.

Type Insights

The self-service clustering segment accounted for the largest market share of over 42.0% in 2024 in the clustering software market. Integrating self-service clustering tools with broader enterprise software ecosystems is driving market growth. Modern businesses often utilize a range of platforms, from customer relationship management (CRM) systems and enterprise resource planning (ERP) solutions to marketing automation and business intelligence (BI) tools. Integrating self-service clustering solutions with these platforms enables users to cluster data directly within their existing workflows, enhancing efficiency and user adoption. Integration capabilities also allow for richer, multi-dimensional insights by combining datasets from multiple sources. As businesses seek more interconnected and interoperable systems, the demand for self-service clustering software that complements and extends the value of existing enterprise tools is expanding significantly.

The hybrid clustering segment is anticipated to grow at a CAGR of 11.2% during the forecast period. The rise of hybrid cloud adoption across industries is driving the segment growth. Enterprises increasingly adopt hybrid cloud strategies to balance cost efficiency, performance optimization, and regulatory compliance. Hybrid clustering software plays a critical role in this setup by ensuring organizations can run clustering analyses on data regardless of where it resides, whether in public cloud platforms, private clouds, or traditional data centers. This capability helps companies avoid data silos and ensures comprehensive insights without needing to consolidate all data into a single environment first. As hybrid cloud becomes the new normal for IT infrastructure, hybrid clustering solutions are witnessing heightened demand.

Deployment Insights

The on-premise segment accounted for the largest market in 2024 in the clustering software market. The growing emphasis on data security and privacy is a major driver fueling the demand for the on-premise segment in the clustering software market. Organizations dealing with highly sensitive information, such as financial institutions, healthcare providers, and government agencies, often prefer on-premise solutions to retain complete control over their data. With increasing incidents of cyberattacks and growing concerns around cloud vulnerabilities, many businesses are cautious about storing critical datasets off-site. On-premise clustering software ensures that sensitive information remains within the organization’s secure network, minimizing risks related to data breaches, unauthorized access, and compliance violations. This strong need for enhanced security measures continues to drive investments in on-premise clustering solutions.

The cloud segment is anticipated to register the highest growth rate during the forecast period. The growing adoption of remote and distributed work models is driving market adoption. With the widespread shift toward hybrid and remote working arrangements, organizations increasingly need centralized systems that are accessible from multiple locations without performance degradation. Cloud-based clustering software supports this need by allowing teams to collaborate and access clustered computing resources from anywhere, enhancing operational efficiency and business continuity.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024 in the clustering software industry. The rising focus on digital transformation initiatives within large enterprises is driving the adoption of clustering software among large enterprises. As companies modernize their operations with cloud migration, advanced analytics, AI, and IoT integrations, there is a growing need for scalable, resilient, and high-performing IT infrastructures. Clustering software supports this transformation by facilitating distributed application deployment, enabling high processing power, and reducing latency. It also ensures that mission-critical services remain operational during peak loads or maintenance periods, making it an indispensable tool for enterprises aiming to stay competitive in an increasingly digital economy.

The small and medium enterprises (SMEs) segment is expected to register the highest CAGR from 2025 to 2030. SMEs' growing reliance on digital platforms and online services is a significant driver for the adoption of clustering software among small and medium enterprises (SMEs). Uninterrupted service delivery has become critical as more SMEs expand their digital presence through e-commerce platforms, cloud applications, and remote collaboration tools. Clustering software provides high availability and load balancing, ensuring that applications remain operational even during hardware failures or maintenance activities. This capability is crucial for SMEs to maintain customer trust, optimize user experiences, and compete effectively in digital marketplaces, where even minor service disruptions can result in lost revenue and damaged reputations.

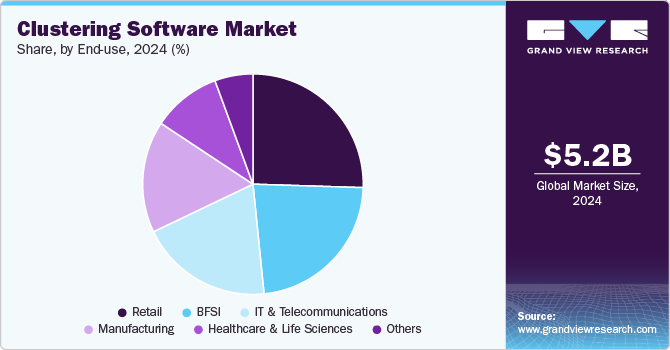

End Use Insights

The retail segment accounted for the largest market share in 2024 in the clustering software market. The surge in e-commerce and mobile commerce activities has created a pressing need for scalable IT infrastructures in retail. During major sales events like Black Friday or festive seasons, e-commerce platforms experience sudden spikes in traffic, which can overwhelm traditional IT systems. Clustering software helps retailers manage such traffic surges effectively by dynamically allocating resources and ensuring that websites and applications remain responsive under heavy loads. This scalability protects retailers from potential revenue losses due to system crashes and enhances their reputation for reliability and customer service excellence.

The healthcare & life sciences segment is anticipated to register the highest CAGR of 12.9% during the forecast period. The increasing trend toward telemedicine and remote healthcare services drives the need for robust IT infrastructure in the healthcare and life sciences sectors. With more patients seeking virtual consultations and remote monitoring, healthcare providers require a reliable and scalable IT framework to support these services. Clustering software enables healthcare organizations to offer uninterrupted virtual care by ensuring that telemedicine platforms, patient portals, and remote monitoring systems remain operational under varying loads. This reliability is essential for maintaining patient satisfaction and trust in the healthcare system, especially as the industry embraces digital health solutions.

Regional Insights

North America held the major share of over 34.0% of the clustering software industry in 2024. The rise of edge computing in North America drives demand for clustering software. As more devices and applications move toward decentralized processing, edge computing becomes a key part of the digital infrastructure. Clustering software enables the efficient management of edge computing environments by ensuring that data is processed and stored at multiple points of presence while maintaining high availability and low latency. This is particularly important for manufacturing, transportation, and healthcare industries, where real-time data processing is essential for operational efficiency. As North American industries continue to adopt edge computing technologies, clustering software will play a vital role in ensuring these systems operate smoothly and reliably.

U.S. Clustering Software Market Trends

The U.S. clustering software market is projected to grow during the forecast period. The growth of microservices architecture in software development is fueling the demand for clustering software in the U.S. Microservices architecture breaks down applications into smaller, independent services that can be developed, deployed, and scaled individually. This architecture requires a highly available and scalable infrastructure to manage the numerous services and ensure they can communicate effectively. Clustering software is essential in microservice environments because it allows orchestrating and managing multiple services running across distributed systems. As organizations continue to adopt microservices to improve the agility and scalability of their applications, clustering software will be increasingly relied upon to ensure smooth operation and high availability.

Europe Clustering Software Market Trends

The clustering software market in Europe is expected to grow at a CAGR of 10.9% from 2025 to 2030. Rising demand for high-performance computing (HPC) is contributing to the growth of the clustering software market in Europe. HPC systems, which are used for complex simulations, scientific research, financial modeling, and artificial intelligence, require high computational power and the ability to process large datasets quickly. Clustering software is an integral part of HPC systems, as it allows for the efficient distribution of tasks across multiple processors and servers, enabling faster data processing and enhanced computational capabilities. As Europe continues to invest in research and development, particularly in fields such as climate modeling, healthcare research, and advanced manufacturing, the need for HPC solutions will continue to drive the adoption of clustering software.

The clustering software market in the UK is expected to grow significantly during the forecast period. The rapid adoption of IoT technologies in the UK is also fueling the growth of the clustering software market. The proliferation of Internet of Things (IoT) devices in sectors such as smart cities, agriculture, healthcare, and transportation is generating large volumes of data that need to be processed, analyzed, and acted upon in real-time. Clustering software is crucial in handling the enormous data load from IoT devices by distributing tasks across multiple computing systems and ensuring high availability. As the IoT ecosystem expands in the UK, with growing interest in connected devices, smart infrastructure, and automation, clustering solutions are becoming essential for managing the complexities of these networks and ensuring reliable data processing.

The clustering software market in Germany is growing significantly during the forecast period. Germany's strong technological and industrial position further drives the clustering software market. The country has been at the forefront of the Industry 4.0 revolution, which includes adopting smart manufacturing, automation, and Internet of Things (IoT) technologies. As manufacturing plants become increasingly connected, the need for robust IT infrastructure to handle complex data tasks grows. Clustering software is essential for ensuring the efficient operation of these advanced manufacturing systems by balancing workloads, maintaining uptime, and enabling real-time data analysis. The automotive industry, which is a significant contributor to Germany's economy, relies on clustering solutions for everything from autonomous driving simulations to supply chain management, further boosting demand for clustering software.

Asia Pacific Clustering Software Market Trends

The demand for clustering software in the Asia Pacific is expected to grow at the fastest CAGR of 13.0% from 2025 to 2030. The increasing adoption of big data analytics in the Asia Pacific is a major factor contributing to the demand for clustering software. As businesses in APAC harness the power of big data to improve decision-making, marketing strategies, customer experiences, and operational efficiency, the need for data processing solutions grows. Clustering software plays a crucial role in managing and analyzing large volumes of data by distributing workloads across multiple servers or nodes, enabling faster and more accurate insights. Industries such as retail, manufacturing, finance, and telecommunications in the region are leveraging big data to optimize their operations, and clustering software is essential in enabling the large-scale data processing required for these applications.

The clustering software market in China is projected to grow during the forecast period. The expansion of the digital economy in China is also playing a significant role in the growth of software clustering. The country’s e-commerce giants, financial technology companies, and digital entertainment platforms generate enormous amounts of data that require powerful infrastructure. Clustering software ensures the scalability and reliability of these platforms, which is crucial as China’s digital economy continues to expand at an unprecedented pace. E-commerce platforms like Alibaba and JD.com and fintech companies like Ant Group rely on clustering software to support their data management needs, ensuring fast, uninterrupted services for millions of users.

The clustering software market in India is projected to grow during the forecast period. The emergence of data centers in India is also a significant factor driving the clustering software market. With the growing demand for cloud services, data storage, and data processing, India is witnessing a surge in data center infrastructure development. As more businesses in India move their operations to the cloud and rely on data centers to store and process information, the need for clustering software increases. Clustering software helps optimize data center operations by providing load balancing, resource allocation, and high availability. As data centers become more central to the Indian digital economy, clustering software ensures these facilities can handle large-scale operations and support the increasing demand for digital services.

Key Clustering Software Company Insights

Some of the key companies operating in the market Oracle Corporation, Google LLC, and SAP SE., among others, are leading participants in the clustering software market.

-

Oracle Corporation is a multinational technology company offering a comprehensive suite of enterprise software products, including databases, cloud services, and enterprise applications. Oracle Real Application Clusters (RAC) is a flagship clustering solution that enables multiple servers, or nodes, to run Oracle Database instances simultaneously while accessing a single shared database. This architecture provides high availability, scalability, and load balancing, ensuring that database services remain uninterrupted even in the event of hardware failures.

-

SAP SE is a global company specializing in enterprise resource planning (ERP) software, providing a comprehensive suite of business applications that help organizations streamline processes, improve efficiency, and drive digital transformation. SAP SE has integrated various clustering technologies into its software solutions, particularly within its SAP HANA platform and SAP Cloud Platform. SAP HANA is an in-memory data management system that supports real-time analytics and applications. To handle the massive scale of data processing required for modern enterprises, SAP HANA leverages clustering to enhance performance, ensure high availability, and provide fault tolerance.

Qubole Inc., RapidMiner Inc., and Splunk Inc. are some of the emerging market participants in the clustering software market.

-

Qubole Inc. is a cloud-native data platform company. At the core of Qubole’s offerings is the Qubole Data Service (QDS), an autonomous big data platform providing a unified environment for managing various compute clusters. QDS supports multiple open-source data processing engines, including Apache Spark, Hadoop, Presto, and Hive, allowing users to run queries and programs written in SQL, MapReduce, Pig, Scala, and Python.

-

RapidMiner Inc. is a data science platform provider. RapidMiner offers an open-source, extensible platform to facilitate data preparation, machine learning, and predictive analytics. RapidMiner provides robust clustering capabilities within its platform, allowing users to perform unsupervised learning to identify inherent patterns and groupings in data. The platform supports various clustering algorithms, including K-Means, X-Means, and hierarchical clustering, enabling users to choose the most appropriate method for their specific data and objectives.

Key Clustering Software Companies:

The following are the leading companies in the clustering software market. These companies collectively hold the largest market share and dictate industry trends.

- Alteryx Inc.

- Amazon Web Services Inc.

- Google LLC

- IBM Corporation

- Informatica Corporation

- Micro Focus International plc

- Microsoft Corporation

- Oracle Corporation

- Qubole Inc.

- RapidMiner Inc.

- SAP SE

- SAS Institute Inc.

- Splunk Inc.

- Teradata Corporation

- Tibco Software Inc.

Recent Developments

-

In January 2025, Oracle and Google Cloud announced plans to expand with eight new regions alongside powerful enhancements to Oracle Database Google Cloud that will help customers strengthen database instances, reduce costs, and gain greater flexibility and resilience. Additionally, the single-node VM clusters for Oracle Exadata Database Service provide customers with increased flexibility in managing costs and infrastructure footprint. This allows them to leverage Oracle Exadata’s workload isolation, high performance, and simplified management. The new single-node clusters cater to use cases such as test and development environments and databases that don’t require RAC’s high availability features or licenses.

-

In November 2024, Nutanix, a hybrid multicloud computing company, expanded strategic collaboration with Amazon Web Services, Inc. (AWS) to expedite cloud migration and offer more options for customers managing workloads across both on-premises and cloud environments. This expanded collaboration allows customers to utilize Nutanix Cloud Clusters (NC2) on AWS, facilitating a seamless extension of their on-premises Nutanix infrastructure to AWS. As a result, organizations can run their applications in a consistent environment across both on-premises and AWS while gaining access to AWS services such as AWS Databases, Amazon S3, and advanced AI and ML services, along with AWS's security, scalability, and resiliency.

-

In September 2024, Oracle and Amazon Web Services (AWS) launched Oracle Database AWS. Oracle Database AWS provides customers access to the Oracle Exadata Database Service on AWS, which includes Oracle Autonomous Database on dedicated infrastructure and workloads utilizing Oracle Real Application Clusters. This enables businesses to consolidate their enterprise data and foster transformative innovation.

-

In November 2023, Amazon Web Services, Inc. (AWS) and NVIDIA announced a strategic partnership to deliver cutting-edge infrastructure, software, and services to drive generative artificial intelligence (AI) advancements. This collaboration combines NVIDIA’s multi-node systems with AWS technologies, including the Nitro System for improved virtualization and security, the Elastic Fabric Adapter interconnect, and UltraCluster scalability. These innovations are tailored to optimize the training of foundational models and the development of generative AI applications.

Clustering Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.72 billion

Revenue forecast in 2030

USD 9.80 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Informatica Corporation; Splunk Inc.; Oracle Corporation; Google LLC; SAP SE; SAS Institute Inc.; Micro Focus International plc; Alteryx Inc.; Tibco Software Inc.; RapidMiner Inc.; Amazon Web Services Inc.; Microsoft Corporation; IBM Corporation; Qubole Inc.; Teradata Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clustering Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clustering software market report based on type, deployment, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Self-Service Clustering

-

Managed Clustering

-

Hybrid Clustering

-

-

Deployment Outlook (Revenue, USD Million; 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million; 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Retail

-

BFSI

-

Healthcare & Life Sciences

-

Manufacturing

-

IT & Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global clustering software market size was estimated at USD 5.19 billion in 2024 and is expected to reach USD 5.72 million in 2025.

b. The global clustering software market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2030 to reach USD 9.80 billion by 2030.

b. North America held the major share of over 34.0% of the clustering software industry in 2024. The rise of edge computing in North America is driving demand for clustering software.

b. Some key players operating in the market include Accenture, Tata Communications Limited, IBM, Microsoft, Rackspace Technology, Infosys Limited, NTT DATA Group Corporation, Spark NZ, Cisco Systems, Inc., Locuz

b. The increasing volume of data generated across industries is a major driver fueling the clustering software market and the increasing volume of data generated across industries is a major driver fueling the clustering software market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.