- Home

- »

- Advanced Interior Materials

- »

-

Coated Textiles Market Size & Share, Industry Report 2030GVR Report cover

![Coated Textiles Market Size, Share & Trends Report]()

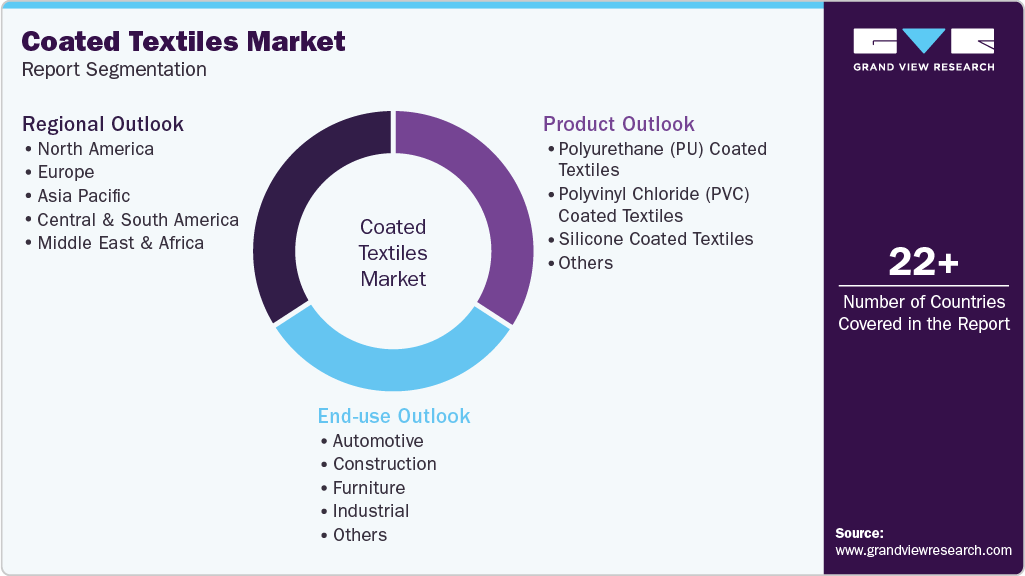

Coated Textiles Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polyurethane Coated Textiles, Polyvinyl Chloride Coated Textiles, Silicone Coated Textiles), By End-use (Automotive, Construction, Furniture, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-602-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Coated Textiles Market Summary

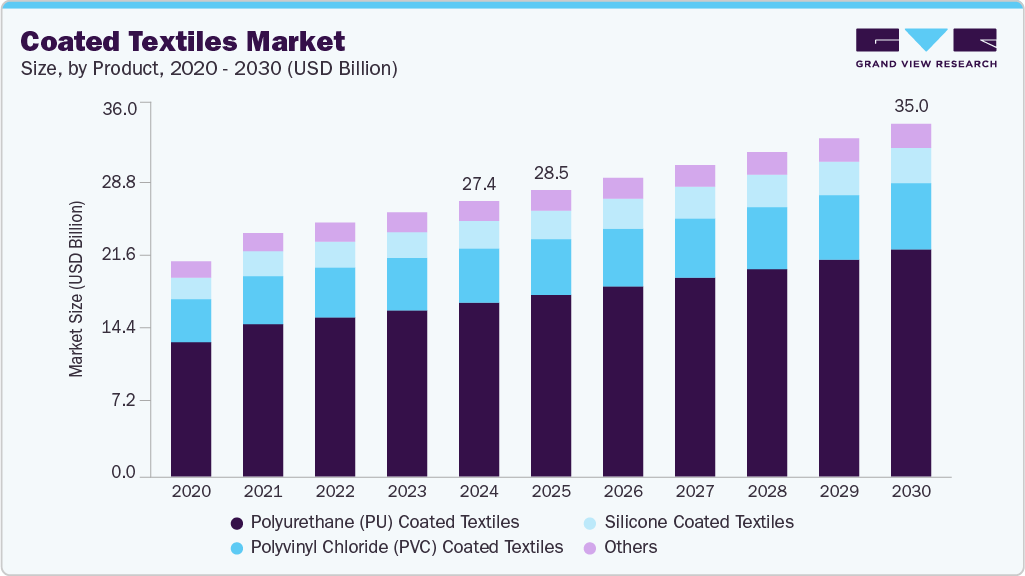

The global coated textiles market size was estimated at USD 27.36 billion in 2024 and is projected to reach USD 35.02 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030, due to rising demand across various industries such as automotive, construction, healthcare, and protective clothing.

Key Market Trends & Insights

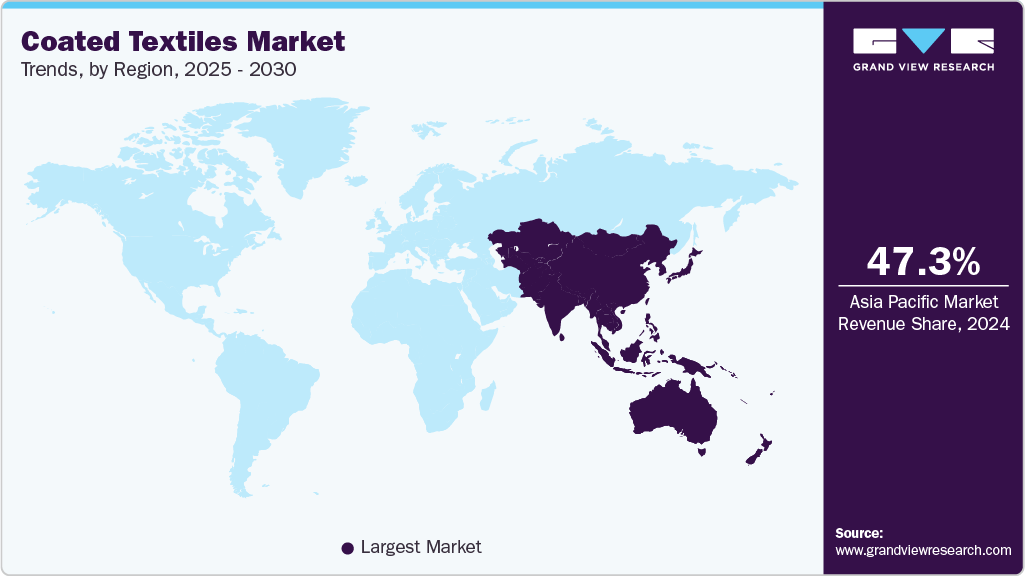

- The coated textiles market in Asia Pacific accounted for the largest revenue share of about 47.3 % in 2024.

- China coated textiles market plays a central role in the Asia Pacific market, accounting for a significant share of global coated textile output.

- By product, the polyurethane (PU) coated textiles segment led the industry and accounted for the largest revenue share of 63.2% in 2024.

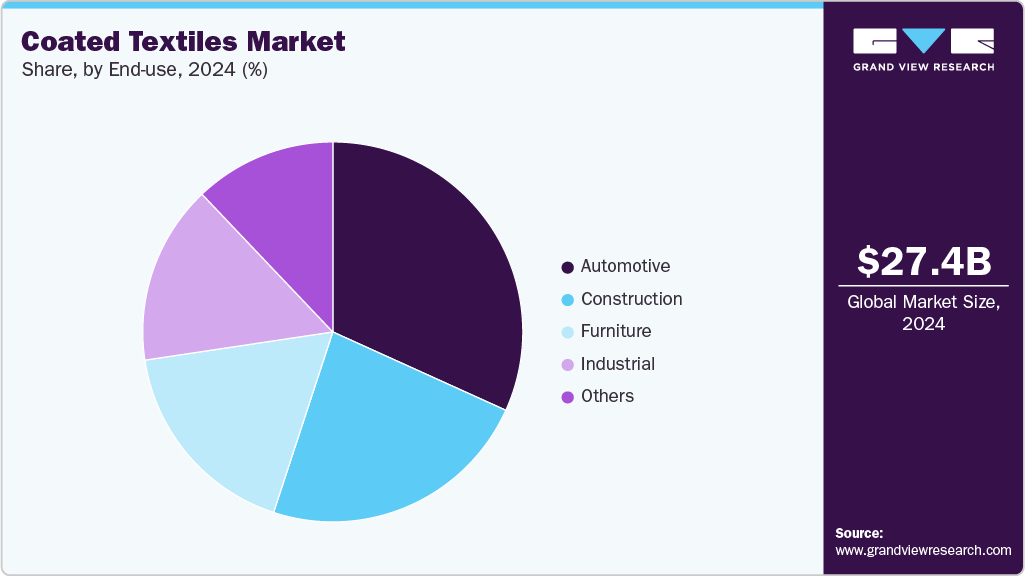

- By end-use, the automotive segment led the industry and accounted for the largest revenue share of 31.8% in 2024.

Market Size & Forecast

- 2024 Revenue: USD 27.36 Billion

- 2030 Projected Market Size: USD 35.02 Billion

- CAGR (2025-2030): 4.2%

- Asia-Pacific: Largest market in 2024

These textiles, which are coated with substances like rubber, PVC, or polyurethane, offer enhanced durability, water resistance, and resistance to UV and chemical exposure, making them ideal for outdoor and industrial applications. The growing focus on safety, hygiene, and comfort in both consumer and industrial segments is contributing to the increasing adoption of coated fabrics globally.

Several key drivers are propelling the demand for coated textiles. Rapid urbanization and infrastructure development fuel the use of coated textiles in roofing, architectural membranes, and transportation. In the automotive industry, coated textiles are increasingly used in airbags, seat covers, and interior materials due to their high-performance characteristics. Additionally, the rise in demand for personal protective equipment (PPE) in sectors such as healthcare, defense, and manufacturing, particularly after the COVID-19 pandemic, has led to an uptick in production and consumption of these materials.

Innovations in coated textiles are also accelerating market growth. Manufacturers are focusing on developing eco-friendly coatings such as water-based PU and bio-based polymers to address environmental concerns and comply with regulatory standards. Advancements in nanotechnology are enabling the production of coated textiles with enhanced breathability, antibacterial properties, and self-cleaning surfaces. Moreover, smart textiles integrated with sensors and conductive coatings are opening up new applications in sportswear, medical textiles, and wearable technology, further expanding the market potential.

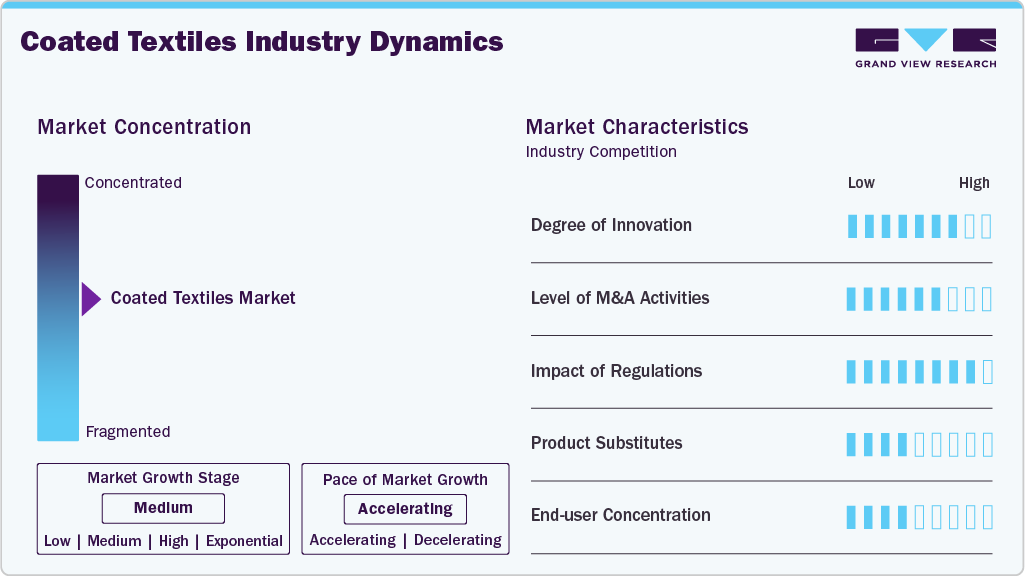

Market Concentration & Characteristics

The industry is moderately to highly concentrated, with a few dominant global players holding substantial market shares due to their advanced manufacturing capabilities, broad product portfolios, and strong distribution networks. Companies like Trelleborg AB, Saint-Gobain, Continental AG, and TenCate Protective Fabrics lead the market by consistently investing in R&D and expanding their geographical reach.

The industry also includes regional manufacturers that cater to niche demands and localized applications. Strategic partnerships, mergers, and acquisitions are common in this space, further consolidating market power among key players and creating high entry barriers for new entrants.

Despite their strong performance, coated textiles face competition from product substitutes such as laminates, composite materials, and advanced synthetic fabrics. For some applications, especially in lightweight packaging or disposable protective gear, nonwoven fabrics and polymer films may serve as cost-effective alternatives. Additionally, advancements in nanofibers and biodegradable materials are offering greener substitutes that appeal to environmentally conscious consumers and industries.

However, the superior mechanical strength, chemical resistance, and customizability of coated textiles often provide them with a competitive edge, limiting the impact of substitutes in high-performance applications.

Product Insights

The polyurethane (PU) coated textiles segment led the industry and accounted for the largest revenue share of 63.2% in 2024, due to their superior performance characteristics, including flexibility, breathability, abrasion resistance, and eco-friendliness compared to other coatings. PU-coated fabrics are widely used in automotive interiors, upholstery, sportswear, and medical textiles, where comfort and durability are critical. Their lightweight nature and compatibility with various fabrics like polyester, nylon, and cotton have made them a preferred choice across industries. Additionally, increasing consumer and regulatory pressure for sustainable and non-toxic materials has further boosted the adoption of PU coatings over traditional alternatives like PVC.

Polyvinyl Chloride (PVC) coated textiles are emerging as the fastest-growing segment, especially in construction, transportation, and signage sectors. PVC coatings offer excellent waterproofing, fire resistance, and durability, making them ideal for heavy-duty outdoor applications such as tarpaulins, tents, roofing membranes, and advertising banners. Their cost-effectiveness and ability to perform under extreme weather conditions are driving demand, particularly in emerging markets. Advances in formulation, such as phthalate-free and more flexible PVC options, are also helping the material overcome its environmental drawbacks, contributing to its rapid market growth.

End-use Insights

The automotive segment led the industry and accounted for the largest revenue share of 31.8% in 2024, due to the material's extensive use in vehicle interiors, seat covers, airbags, and convertible tops. Coated textiles, especially those with polyurethane and PVC coatings, provide essential features like durability, abrasion resistance, UV stability, and easy cleanability, making them ideal for automotive applications. As automakers prioritize lightweight materials to improve fuel efficiency and reduce emissions, coated textiles offer a strong alternative to heavier traditional materials. Additionally, the increasing demand for premium and customized interiors in both passenger and commercial vehicles continues to drive growth in this segment.

The construction segment is emerging as the fastest-growing application area for coated textiles, propelled by global infrastructure development and urbanization. These materials are being widely adopted in architectural membranes, roofing, scaffolding nets, and protective coverings due to their strength, weather resistance, and flexibility. The rise of smart buildings, green construction practices, and modular infrastructure has further increased the appeal of coated textiles, particularly those that are fire-retardant and energy efficient. With growing investments in commercial and residential construction, especially in Asia-Pacific and Middle Eastern regions, demand for coated textiles in this sector is rapidly expanding.

Regional Insights

North America coated textiles industry is driven by the high demand for advanced materials in the automotive, defense, and healthcare sectors. The region’s focus on innovation, safety standards, and durable consumer goods fuels the adoption of high-performance coated fabrics. Demand for customized, high-spec textiles is also growing. Additionally, stricter environmental regulations are encouraging shifts toward greener coatings.

U.S. Coated Textiles Market Trends

The coated textiles market in the U.S. leads the North American region, driven by its large automotive industry, military procurement, and strong infrastructure investment. There is an increasing use of coated textiles in protective clothing, home furnishings, and industrial applications. The U.S. also houses several key coated textile manufacturers with advanced R&D capabilities. Its emphasis on domestic production is driving technological investment.

Asia Pacific Coated Textiles Market Trends

The coated textiles market in Asia Pacific accounted for the largest revenue share of about 47.3 % in 2024, driven by rapid industrialization, a booming automotive sector, and expanding construction activities. Countries like China, India, and Japan are major contributors due to their large manufacturing bases and growing demand for protective clothing, technical textiles, and industrial fabrics. The region also benefits from cost-effective labor, abundant raw materials, and strong export capabilities, making it a global hub for coated textile production.

China coated textiles market plays a central role in the Asia Pacific market, accounting for a significant share of global coated textile output. It has a robust textile manufacturing ecosystem and strong demand from domestic industries such as automotive, infrastructure, and healthcare. China is also emerging as a global leader in coated fabric exports. Its investment in smart textiles and sustainable manufacturing practices is accelerating.

Europe Coated Textiles Market Trends

The coated textiles market in Europe is known for its strong technical textile industry and stringent environmental regulations. The region is investing in sustainable coatings and high-performance applications, especially in automotive interiors, architecture, and industrial safety. EU initiatives supporting the circular economy and textile recycling are also impacting coated textile innovation. European consumers are demanding more bio-based and recyclable fabrics.

Germany coated textiles market is backed by its leadership in automotive manufacturing, engineering, and industrial machinery. German companies are at the forefront of innovation, developing advanced coated fabrics for precision-driven sectors like aerospace and medical textiles. Germany also serves as a key exporter of coated fabrics to the EU and beyond. Its sustainability-driven policies are encouraging greener product development.

Central & South America Coated Textiles Market Trends

The coated textiles market in Central & South America is developing with growing demand for coated textiles in construction, agriculture, and automotive applications. Countries like Brazil and Argentina are witnessing rising investments in infrastructure, which is boosting demand for durable and weather-resistant fabrics. However, supply chain constraints and reliance on imports limit growth. Efforts to boost local manufacturing are underway, especially in Brazil.

Middle East & Africa Coated Textiles Market Trends

The coated textiles market in the Middle East & Africa is an emerging market where infrastructure development, industrial expansion, and increasing urbanization are driving demand for coated textiles. The construction boom in the Gulf countries, along with growing use in oil & gas, transportation, and protective clothing, is supporting market growth. Hot climate and harsh conditions in the region also necessitate high-performance coated fabrics. Government infrastructure projects are expected to boost long-term demand.

Key Coated Textiles Companies Insights

Key players operating in the coated textiles market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Coated Textiles Companies:

The following are the leading companies in the coated textiles market. These companies collectively hold the largest market share and dictate industry trends.

- Trelleborg AB

- BASF SE

- Continental AG

- Saint-Gobain S.A.

- OMNOVA Solutions Inc.

- Serge Ferrari Group.

- Seaman Corporation.

- Sioen Industries NV

- SRF Limited

- Spradling International Inc.

Recent Developments

-

In September 2024, Freudenberg Performance Materials acquired major parts of the Heytex Group, including three production locations in Germany and China, to strengthen its position in the coated technical textiles market.

-

In March 2023, the Trelleborg Engineered Coated Fabrics manufacturing facility in Nottingham, England, received a patent for its Dartex Zoned Coatings. These coatings offer the ability to ‘zone’ different polyurethane coatings on support surface covers used in healthcare and medical applications, allowing a single fabric to perform multiple functions.

Coated Textiles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.51 billion

Revenue forecast in 2030

USD 35.02 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Trelleborg AB; BASF SE; Continental AG; Saint-Gobain S.A.; OMNOVA Solutions Inc.; Serge Ferrari Group; Seaman Corporation; Sioen Industries NV; SRF Limited; Spradling International Inc.

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coated Textiles Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coated textiles market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane (PU) Coated Textiles

-

Polyvinyl Chloride (PVC) Coated Textiles

-

Silicone Coated Textiles

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Furniture

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global coated textiles market size was estimated at USD 27.36 billion in 2024 and is expected to reach USD 28.51 billion in 2025.

b. The global coated textiles market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 35.02 billion by 2030.

b. The polyurethane (PU) coated textiles segment led the market and accounted for the largest revenue share, 63.2%, in 2024, due to their superior performance characteristics and broad application versatility.

b. Trelleborg AB, BASF SE, Continental AG, Saint-Gobain S.A., OMNOVA Solutions Inc., Serge Ferrari Group, Seaman Corporation, Sioen Industries NV, Spradling International Inc., and SRF Limited are prominent companies in the coated textiles market.

b. Key factors driving market demand include rising industrialization, growing automotive and construction sectors, increased demand for protective clothing, and advancements in eco-friendly coating technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.