- Home

- »

- Biotechnology

- »

-

DNases, Ligases, And RNA Polymerases Market Report, 2030GVR Report cover

![DNases, Ligases, And RNA Polymerases Market Size, Share & Trends Report]()

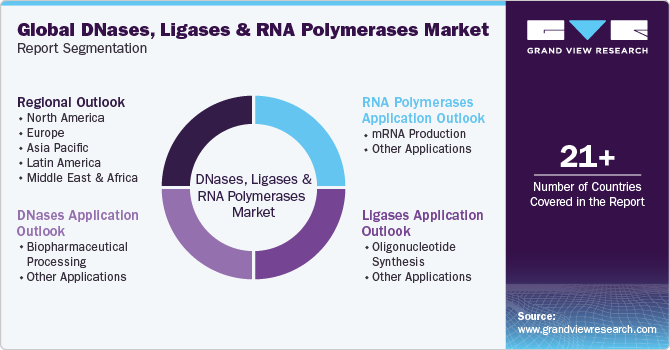

DNases, Ligases, And RNA Polymerases Market Size, Share & Trends Analysis Report By Application (DNases-Biopharmaceutical Processing, Ligases- ligonucleotide Synthesis), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-982-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global DNases, ligases, and RNA polymerases market size was estimated at USD 801.9 million in 2023 and is projected to grow at a CAGR of 10.63% from 2024 to 2030. The market is witnessing growth due to the growing academic and industrial interest in mRNA technology, advancements in biotechnology and molecular biology, and increasing demand for gene therapy. Recently, RNA centers have been established at numerous institutions to promote the therapeutic application of RNA, particularly In Vitro Transcribed (IVT) mRNA. The COVID-19 pandemic has had a significant impact on the DNases, ligases, and RNA global market, with a notable positive effect seen in the development of mRNA-based vaccines.

The rapid development and successful deployment of mRNA vaccines, such as those developed by Pfizer-BioNTech and Moderna, have highlighted the potential of mRNA technology in vaccine development. This success has increased interest and investment in mRNA-based therapeutics and vaccines, driving demand for the enzymes used in their production. The mRNA technology used in these vaccines has paved the way for the development of new vaccines and therapies for other infectious diseases and even cancer. This has created new opportunities for companies in the market to expand their product offerings and enter new markets. Moreover, testing of mRNA treatment is also being done to encourage the development of new blood vessels. For instance, AstraZeneca and Moderna are working together on a myocardial ischemia therapy using mRNA.

In addition, Arcturus Therapeutics is also testing mRNA treatments for cardiovascular diseases. Thus, many major pharmaceutical firms have started working on mRNA technology, including Novartis, Alexion, AstraZeneca, Pfizer, Sanofi Pasteur, and Shire. In addition, the players are receiving funds for mRNA research to develop therapeutics for various chronic and infectious diseases. For instance, in March 2022, Nutcracker Therapeutics, Inc. raised USD 167 million in funding to advance its pipeline of mRNA medicines for cancer. The advancements in biotechnology and molecular biology field continually expand enzyme applications and drive demand in various research, diagnostic, & therapeutic settings. For example, the emergence of CRISPR-Cas9 gene editing technology has fueled the demand for ligases essential for joining DNA fragments during editing.

The use of gene editing techniques for treating genetic illnesses has significantly increased in recent years, which has led to several improvements in the genomics field. For instance, in December 2023, there were two successful FDA approvals for genome editing in the clinical setting. The FDA approved the first two cell-based gene therapies, Casgevy and Lyfgenia, for treating sickle cell disease (SCD) in patients aged 12 years & older. In addition, breakthroughs in molecular diagnostics, such as the development of rapid & sensitive nucleic acid amplification tests, have driven the demand for DNases, ligases, and RNA Polymerases. These enzymes are integral to diagnostic assays for pathogen detection, genetic screening, and personalized medicine.

Moreover, advancements in synthetic biology have led to the creation of novel enzyme variants with enhanced properties, such as improved specificity, stability, and activity. These engineered enzymes are increasingly used in biotechnological applications, including metabolic engineering, biocatalysis, and biopharmaceutical production. Furthermore, increasing demand for gene therapy is a significant factor driving market growth. The use of gene editing techniques for treating genetic illnesses has significantly increased in recent years, which has led to several improvements in the genomics field. Researchers are working to make gene therapy available at clinics. Although very few patients have so far received effective gene therapy treatments, it holds high potential to revolutionize disease treatment regimens by targeting the genes responsible for disease pathogenesis.

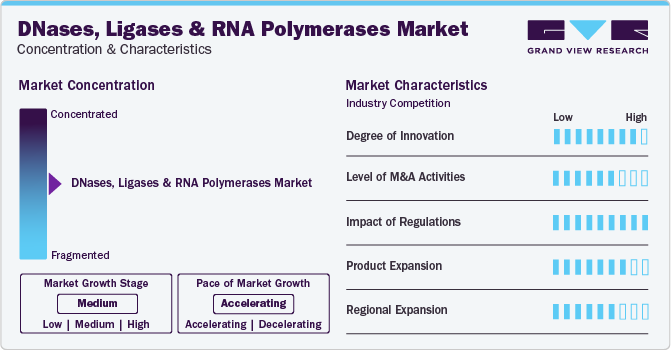

Market Concentration & Characteristics

The industry observes a high level of innovation. The increased research and development activities in the field of epigenetics, and cell and gene therapy propels the market growth. Many industry players and researchers are engaged in developing new enzymes. For instance, in May 2023, researchers at the University of California, Irvine, created a DNA enzyme, known as DNAzyme that can differentiate between two RNA strands inside a cell.

The market is also characterized by a moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. For instance, in May 2022, QIAGEN N.V. announced the signing of agreements to acquire a 96% majority ownership stake in BLIRT S.A., a leading manufacturer of recombinant enzymes for the life science industry located in Gdansk, Poland.

Regulations in the market provide a framework for the safety and quality of products but they also present challenges for industry players. The market is characterized by a high impact of regulations although the impact varies depending on the nature and stringency of regulations across geographical conditions. Furthermore, ethical and legal constraints may lead to further complexities in formulation and adherence to regulations leading to significant market challenges.

Many industry players are focusing on expanding their product and service portfolio. They are launching novel products and amplifying their current product portfolio. For instance, in May 2023, QIAGEN N.V. announced the availability of its high-quality enzymes as individual products, providing researchers and industrial customers with the flexibility to customize their assays and workflows.

The industry is currently witnessing a moderate level of regional expansion, with growth prospects driven by an expanding customer base for DNases, ligases, and RNA polymerases. The increasing interest of developed and developing countries in cell and gene therapeutics is expected to propel market growth.

DNases Application Insights

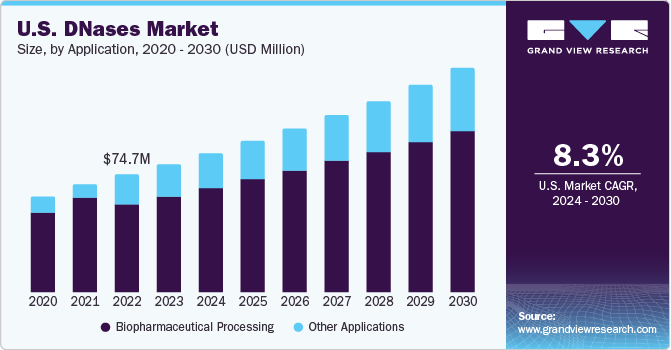

The biopharmaceutical processing segment accounted for the largest revenue share of 78.43% in 2023. The Biopharmaceutical manufacturing field employs and explores biological organisms & their products for therapeutic applications. Enzyme-assisted processes are commonly used in the downstream processing of highly valuable biopharmaceuticals. These processes include adding a particular amount of purified DNase enzyme preparation to a product-containing stream at a specific stage. However, the biopharmaceutical industry has yet to improve its purification processes to lower the potential risks associated with harmful biological & immunological responses caused by residual impurities originating from culture media & host cells.

To achieve sustainable and cost-effective production in the industry, it is essential to adopt new & improved biocatalysts, bioprocesses, and product recovery methods that are affordable and environmentally friendly. The other applications segment is expected to grow at the fastest CAGR from 2024 to 2030. Other applications comprise possible treatment of cystic fibrosis, COPD, & asthma; prediction of common diseases; and forensic applications. Moreover, DNases can also be used as biomarkers, along with their use in forensic applications. In addition, continuous R&D activities carried out by leading academic institutes further offer lucrative opportunities in the review period.

Ligases Application Insights

The other applications segment held the largest revenue share of 55.84% in 2023. Ligases have diverse applications in molecular biology and biotechnology, including in vitro gene manipulation, analyzing protein-protein interactions, DNA sequencing, and catalyzing the formation of phosphodiester bonds in DNA & RNA molecules. The DNA ligase from T4 bacteriophage is popular and widely used in molecular biology. The oligonucleotide synthesis segment is expected to grow at a moderate CAGR over the forecast period.

Synthetic oligonucleotides have been used in several applications, such as diagnosing infectious & genetic diseases, disease treatment, and new drug discovery. Numerous methods for oligo assembly have been established, which depend on a DNA polymerase enzyme. Enzymes offer the aid of selectivity, sustainability, and cost reduction in pharmaceutical synthesis. Moreover, wide product offerings are expected to drive market growth. For instance, Almac developed a wide range of biocatalytic services and products to help manage the challenges in biocatalytic oligonucleotide synthesis.

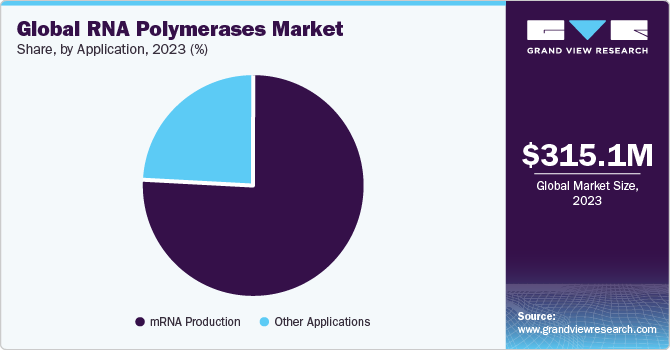

RNA Polymerases Application Insights

The mRNA production segment observed a lucrative growth and with the highest revenue share of 75.79% in 2023. mRNA developers are making continuous efforts to develop & commercialize therapies faster and manufacture reliable products to meet market demand. The year 2020 was a breakout year for mRNA technology platforms, with the unveiling and extensive use of mRNA vaccines for coronavirus. The COVID-19 pandemic offered lucrative opportunities for RNA polymerase applications.

The others segment is anticipated to grow significantly over the forecast period. RNA polymerase is a vital enzyme involved in transcription, cDNA synthesis, and antisense RNA and double-stranded RNA synthesis. It is primarily responsible for transcribing DNA into RNA. This enzyme is crucial for gene expression and regulation in all living organisms.

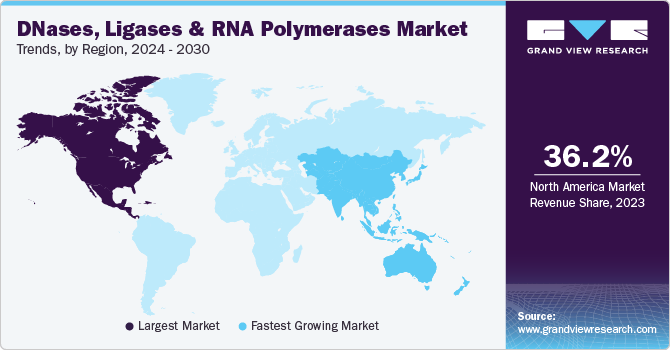

Regional Insights

The North America DNases, ligases, and RNA polymerases market dominated the global industry and accounted for a share of 36.22%in 2023 owing to the high level of innovation and investment in research & development (R&D) in the field. Moreover, the presence of a structured environment for the usage and approvals of mRNA-based therapeutics & vaccines, local presence of key companies, such as Thermo Fisher Scientific, New England Biolabs, and Maravai LifeSciences, and a comprehensive informatics network within the country are boosting market growth.

U.S. DNases, Ligases, And RNA Polymerases Market Trends

The DNases, ligases, and RNA polymerases market in the U.S. is expected to witness significant growth in future. A large number of market players in the U.S. are engaged in the continuous development of advanced products for research. The presence of innovators and major market players has resulted in higher product penetration in the country. For instance, in August 2022, New England Biolabs introduced a novel Faustovirus Capping Enzyme for enzymatic capping of mRNA to support mRNA therapeutic manufacturing requirements.Furthermore, some companies are engaging in strategic collaborations and partnerships to expand their product offerings, enhance technological capabilities, and access new markets.

Europe DNases, Ligases, And RNA Polymerases Market Trends

The Europe DNases, ligases, and RNA polymerases market was identified as a lucrative regional market in the global industry. This is attributed to strong government support, advancements in research infrastructure, and technological growth in the fields of biotechnology and molecular biology.

The DNases, ligases, and RNA polymerases market in Germany is expected to have lucrative growth from 2024 to 2030. The healthcare system in Germany is considered strong & sufficiently financed, which is expected to increase the demand for advanced diagnostic and therapeutic technologies, including oligonucleotides & mRNA. This includes applications in cancer diagnostics, personalized medicine, and gene therapy. Moreover, Germany’s strong R&D landscape in these areas is expected to improve the adoption of innovative therapies. Furthermore, the German government is actively promoting the development of biotechnology and healthcare infrastructure. Initiatives, such as “Industrie 4.0” and R&D grants, empower domestic players and attract foreign investments, which is positively impacting the domestic market growth.

The UK DNases, ligases, and RNA polymerases market is highly dynamic and rapidly growing due to increasing research and approvals of mRNA-based vaccines in the country. In addition, collaborations between academic institutions and biotechnology companies enable the translation of basic research findings into practical applications. Academic researchers bring novel ideas & discoveries, while industry partners contribute resources for the development and commercialization of products.

The DNases, ligases, and RNA polymerases market in France is projected to have considerable growth from 2024 to 2030. The burden of cancer is significant in France, with it being the leading cause of death. Oligonucleotides are important in cancer diagnostics, including personalized medicine approaches, such as gene expression profiling & liquid biopsies. They also hold promise for developing novel anticancer therapies, such as RNA interference (RNAi) drugs. Moreover, cardiovascular diseases (CVDs) are another major health concern in France, and oligonucleotides are being investigated for their potential in diagnosing & treating conditions like atherosclerosis and heart failure.

Asia Pacific DNases, Ligases, And RNA Polymerases Market Trends

The Asia Pacific DNases, ligases, and RNA polymerases market is anticipated to witness the fastest CAGR of 13.61% from 2024 to 2030 in the DNases, ligases, and RNA polymerases market. The regional market is expected to be driven by the increasing demand for genome editing technologies and the rising prevalence of genetic disorders and diseases across several countries.

The DNases, ligases, and RNA polymerases market in Japan is expected to witness significant growth over the forecast period. Japan has a significant geriatric population and a high focus on personalized medicine. According to the World Economic Forum 2023, the geriatric population in Japan is rapidly rising, and over 10% of its citizens are aged 80 years or above. This is expected to improve the demand for oligonucleotide therapeutics, especially antisense and RNA Interference (RNAi) therapies, for treating cancer, CVDs, and neurological disorders. Moreover, the growing adoption of precision medicine and personalized healthcare in Japan is boosting the demand for these diagnostic applications.

The China DNases, ligases, and RNA polymerases market growing investments and favorable government initiatives in the biotechnology sector in China are expected to boost the DNases, ligases, and RNA polymerases market. Moreover, expansion plays a key role in this market. It involves investing in larger and more advanced synthesis facilities. This increased production capacity allows companies to meet the growing demand for oligonucleotides, whether for research, diagnostics, or therapeutic applications. For instance, in May 2023, GenScript Biotech Corp. expanded its primary manufacturing facility for oligonucleotide production in Jiangsu, China.

The DNases, ligases, and RNA polymerases market in India isexpected to have considerable growth in future. On account of the high birth rate, India has a high prevalence of genetic disorders due to various factors, such as consanguineous marriages and founder mutations. Oligonucleotides, DNA, & others are essential for prenatal screening, carrier testing, and genetic counseling for these disorders. They are also used for potential gene therapy applications. The Indian government is actively promoting the development of biotechnology and healthcare infrastructure. Furthermore, initiatives, such as “Make in India” and R&D grants empower domestic players and attract foreign investments, boosting the market.

Middle East & Africa DNases, Ligases, And RNA Polymerases Market Trends

The MEA DNases, ligases, and RNA polymerases market is projected to grow rapidly in the near future due to the rising prevalence of diseases and increasing awareness of gene therapy to combat these diseases.

The DNases, ligases, and RNA polymerases market in Saudi Arabia is projected to grow over the forecast period. The country has been investing in biotechnology and life sciences initiatives, including R&D, which is expected to drive the demand for DNases, ligases, and RNA polymerases in various applications, such as genomics, diagnostics, and therapeutics.Furthermore, high incidence of genetic diseases along with various government initiatives to combat them is projected to boost market growth.

The UAE DNases, ligases, and RNA polymerases market will have a considerable growth over the forecast years due to the presence of a rapidly growing healthcare sector fueled by government investments, an increasing population, and rising disposable income. In addition, there is a growing awareness of the benefits of genetic testing in the UAE, especially for prenatal screening, cancer diagnosis, and personalized medicine. This awareness is fueling the demand for oligonucleotides, DNases, ligases, and RNA polymerases used in these tests.

Key DNases, Ligases, And RNA Polymerases Company Insights

Key players operating in the DNases, ligases, and RNA polymerases market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies, such as expansion activities and partnerships, play a key role in propelling market growth.

Key DNases, ligases, And RNA Polymerases Companies:

The following are the leading companies in the DNases, ligases, and RNA polymerases market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- Promega Corporation

- New England Biolabs

- RayBiotech, Inc.

- BioVision, Inc.

- ABclonal, Inc.

- QIAGEN N.V.

- Takara Bio, Inc.

- Abnova Corporation

- Calzyme

- ArcticZymes Technologies

- Worthington Biochemical Corporation

- MBL International

- MyBioSource

- BPS Bioscience Inc.

- Sino Biological

- Novus Biologicals

Recent Developments

-

In March 2024, Almac Group announced the completion of its two new purpose-built facilities at its headquarters in Craigavon, Northern Ireland. These new facilities are expected to boost the production of peptide APIs and commercial manufacturing and packaging of sachet drug product presentations

-

In January 2024, Almac Science, a subsidiary of Almac Group introduced an RNA Ligase (RNAL) enzyme kit, extending the company’s selectAZyme enzyme screening collection

-

In December 2023, ArcticZymes Technologies introduced a new product, the T7 RNA Polymerase, specifically tailored for molecular research and diagnostics, addressing the specific needs of customers in the molecular tools segment

-

In November 2023, New England Biolabs launched the NEBNext UltraExpress DNA and RNA library preparation kits for next-generation sequencing

-

In March 2023, the Centre for Process Innovation Limited, AstraZeneca, Novartis, and the University of Manchester collaborated to revolutionize oligonucleotide synthesis

DNases, Ligases, And RNA Polymerases Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 881.55 million

Revenue forecast in 2030

USD 1.62 billion

Growth rate

CAGR of 10.63% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

DNases application, ligases application, RNA polymerases application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Singapore; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Agilent Technologies, Inc.; Promega Corp.; New England Biolabs; RayBiotech, Inc.; BioVision, Inc.; ABclonal, Inc.; QIAGEN N.V.; Takara Bio, Inc.; Abnova Corp.; Calzyme; ArcticZymes Technologies; Worthington Biochemical Corp.; MBL International; MyBioSource; BPS Bioscience Inc.; Sino Biological; Novus Biologicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNases, Ligases, And RNA Polymerases Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNases, ligases, and RNA polymerases market report based on DNases application, ligases application, RNA polymerases application, and region:

-

DNases Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Processing

-

Other Applications

-

-

Ligases Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oligonucleotide Synthesis

-

Other Applications

-

-

RNA Polymerases Application Outlook (Revenue, USD Million, 2018 - 2030)

-

mRNA Production

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNases, ligases, RNA polymerases market size was estimated at USD 801.9 million in 2023 and is expected to reach USD 881.55 million in 2024.

b. The global DNases, ligases, RNA polymerases market is expected to grow at a compound annual growth rate of 10.63% from 2024 to 2030 to reach USD 1.62 billion by 2030.

b. North America dominated the DNases, ligases, RNA polymerases market with a share of 36.22% in 2023. This is attributable to the increased adoption of DNA enzymes that can be used for drug development, which are essential for different therapeutic regimes to treat chronic disorders and digestive diseases. Moreover, many novel mRNA-based vaccines are under various stages of development for various cancers.

b. Some key players operating in the DNases, ligases, RNA polymerases market include Merck KGaA/ Sigma Aldrich, Takara Bio, Calzyme, Thermo Fisher Scientific, New England Biolabs, RayBiotech, Agilent Technologies, BPS Bioscience Inc., Novus Biologicals, Sino Biological, Inc., MyBioSource and Abnova Corporation.

b. Key factors that are driving the market growth include growing academic and industrial interest in mRNA technology, advancements in biotechnology and molecular biology, and increasing demand for gene therapy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."