- Home

- »

- Food Additives & Nutricosmetics

- »

-

Europe, CIS & MENA Sorbitol Market Size Report, 2020-2027GVR Report cover

![Europe, CIS And Middle East & North Africa Sorbitol Market Size, Share & Trends Report]()

Europe, CIS And Middle East & North Africa Sorbitol Market Size, Share & Trends Analysis Report By Product, By Application, By End-use, By Downstream Opportunities, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-267-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Specialty & Chemicals

Report Overview

The Europe, CIS and Middle East and North Africa sorbitol market size was valued at USD 434.9 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2020 to 2027. Rising awareness regarding healthier diets amongst the consumers in key markets, such as Germany, France, Italy, and UAE, is expected to promote the consumption of dietary foods and beverages, thereby driving the sorbitol demand. The rising demand for low-calorie and sugar-free products on account of the increasing prevalence of diabetes and obesity is expected to propel the demand for sorbitol. High sorbitol demand for the manufacturing of products that tend to harden or dry, such as baked goods, confectionery, and chocolates, is likely to boost industry growth.

The shifting consumption trend toward fiber-based foods in developed countries, including Germany and France, on account of increasing awareness regarding nutritional enrichment, is expected to fuel the demand for fiber-rich products, thereby augmenting demand for sorbitol over the forecast period. The predominant consumption of bread as a staple food in Europe is expected to remain a favorable factor for industry growth in the coming years.

The packaged food industry has witnessed significant growth in the recent past on account of the changing eating habits of consumers. Long working hours, increasing young working population, and quick access to packed food available in a broad range of cuisines are the factors contributing to the changing consumer lifestyles. Thus, the use of the product as a preservative in the ready to cook packaged food products is expected to drive the market over the forecast period.

Furthermore, lack of time and increasing purchasing power of consumers are driving the demand for packaged food products. Companies such as ConAgra, Unilever, and McCain are focused on strengthening their presence in the market by ensuring easy availability of packaged food products in hypermarkets and retail stores. All the factors combined are expected to complement the market growth over the forecast period.

The market presence of other sugar alcohols and conventional sucrose syrups in the food and beverage, chemicals, pharma, personal care, and animal feed industries is expected to pose a credible threat to the market. Sugar syrup is expected to remain one of the most economical sweetening ingredients in the food and beverage and pharmaceutical industries owing to its easy availability and low prices as compared to other artificial sweeteners.

Furthermore, the growing demand for other polyols, including mannitol and xylitol, as a low-calorie ingredient in the nutrition sector on account of new product launches by companies, including DuPont, is expected to shrink the application of sorbitol over the next seven years.

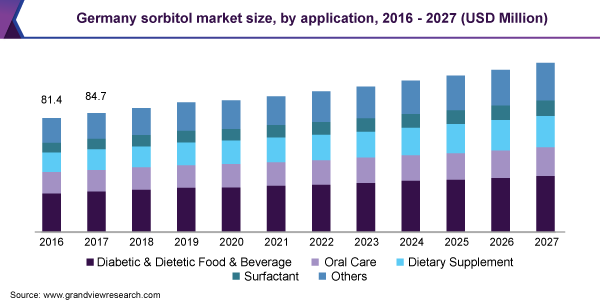

Application Insights

The diabetic and dietetic food and beverage application segment led the market and accounted for a 35.8% share of the overall revenue in 2019. The growing demand for artificial sweeteners, such as sorbitol, by the food and beverage manufacturers to produce baked foods, frozen products, confectionaries, and numerous cold drinks is expected to support industry growth. Furthermore, the European Union has approved the use of sorbitol as an additive and humectant in the food industry, which is likely to propel the market growth.

Changing dietary habits have led to a rising incidence of various ailments caused due to vitamin deficiency. Thus, the growing demand for dietary supplements is expected to drive the demand for the product from the ascorbic acid manufacturers. Additionally, there has been burgeoning demand for dietary supplements and immunity booster products after the outbreak of the COVID-19 pandemic.

The product finds application as foaming and wetting agents, emulsifiers, dispersants, and detergents. Escalating consumer preference for the use of bio-based products, particularly in Europe, is expected to drive the market for bio-surfactants, such as rhamnolipids and sorbitol. Additionally, stringent regulations aimed at reducing greenhouse gas emissions are expected to promote the growth of bio-based surfactants, which, in turn, will have a positive impact on market growth.

End-use Insights

The food segment led the market and accounted for 35.8% share of the overall revenue in 2019. The growth of the food and beverage industry directly influences the demand for sweeteners including sorbitol. The increasing adoption of various types of frozen foods, confectionery, and dairy products by end-consumers is expected to drive the market. Furthermore, the rising demand for low calorie non-alcoholic and dairy beverages is anticipated to augment the sorbitol demand.

Low-calorie sweeteners are majorly used to deliver sweet flavor in formulating food and beverage products. In addition, rising health concerns over tooth decay, diabetes, and diarrhea and the increasing importance of low-calorie foods are expected to strengthen the demand for sugar alternatives, such as sorbitol.

Rapid population growth in the Middle East, coupled with the high demand for processed food products in the region, is expected to drive the demand for sorbitol. Increasing consumer knowledge regarding convenience foods and exotic cuisines with different tastes and flavors is expected to boost the penetration of sorbitol in various food types.

Downstream Opportunities Insights

Ethylene glycol led the market and accounted for 71.9% share of the overall revenue in 2019. It is primarily used in the production of polyethylene terephthalate (PET) plastic resin, which is widely used in the production of water bottles, beverage containers, and polyester fiber. Moreover, the product is rapidly emerging as an environmentally sustainable feedstock for the production of ethylene glycol, which is expected to drive its demand.

The growing awareness about the environmental impact caused due to the production of petroleum-based polymers is leading to rising demand for bio-based polymers. As a result, sorbitol is expected to witness significant demand from the ethylene glycol production industry.

Isosorbide is expected to witness significant gains on account of increased adoption as a biobased monomer building block in the production of polycarbonates, polyesters, polyurethanes, and epoxide resins. With the growing demand for sustainable polymers, many of the sorbitol manufacturers are forward integrating themselves in the production of isosorbide monomers.

For instance, in 2015, Roquette Frères announced the launch of its new isosorbide production unit at its site in Lestrem, Pas-de-Calais, France. The unit has a capacity of 20,000 tons per year isosorbide. The company has developed a patented isosorbide production process using sorbitol as a primary raw material. Marketed under the ‘POLYSORB’ brand name, these monomers are witnessing growing adoption in the production of various thermoplastics and curable resins, such as polyesters, polycarbonates, polyurethanes, and epoxy resins.

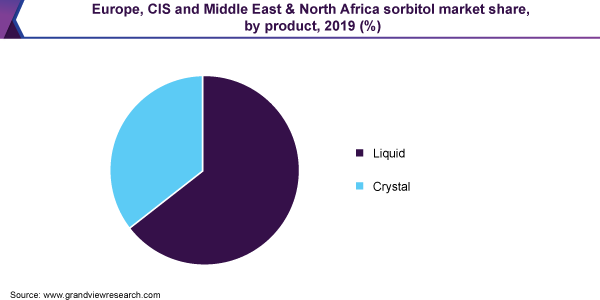

Product Insights

Liquid sorbitol led the market and accounted for 64.6% share of the overall revenue in 2019. Liquid sorbitol is used as a sugar substitute in the pharmaceutical and food and beverage industries. This product is also used as excipients for humectants in pastes and texturing agents. The rising demand for sugar substitutes in low-calorie food and beverages is expected to have a positive impact on segment growth.

Moreover, the low cost of liquid sorbitol as compared to its crystal counterpart is expected to attract buyers and have a positive impact on the segment growth. However, the market presence of substitutes, such as HIFS and HFC, is expected to remain a restraining factor for the liquid sorbitol segment.

Crystal sorbitol is majorly used as a food additive for the manufacturing of sugar-free products, including chewing gums, mint tablets, and other frozen aquatic products, including roasted fish fillet, frozen raw fish, shrimp ball, and dried squid thread. Rising demand for the aforementioned products is expected to promote the growth of crystal sorbitol over the next seven years.

Crystal sorbitol is also used as a plasticizer in the production of capsule outer shell and as a filler and excipient in the production of pharmaceutical tablets. Moreover, crystal sorbitol is used as a humectant in various cosmetic products, such as face cream and moisturizers, owing to its ability to retain moisture and resistance to bacteriological degradation. Thus, the growing demand for cosmetic products is anticipated to prove beneficial to future sorbitol demand.

Regional Insights

Europe held the largest revenue share of more than 80.0% in 2019. The region is anticipated to witness significant growth over the projected time on account of the growing consumer awareness regarding the consumption of nutrition-rich food and beverage items. Consumers in Europe are becoming increasingly aware of healthy lifestyles and are taking more responsibility to ensure the wellbeing of both their mental and physical health.

The growing technological innovation in the nutraceuticals sector offers new opportunities for the dietary supplements market in the European region. The Federation of European Nutrition Societies (FENS) funds and invests in various nutritional foods and nutria-cosmetics businesses, promoting the consumption of dietary supplements, which is expected to drive the demand for the sorbitol over the forecast period.

The CIS region is expected to emerge as the fastest-growing regional market for value-added food products in the years to come. Increasing income of the middle-class population has resulted in changes in the eating patterns, such as the consumption of more meat and poultry products. Increasing demand for ready meals and convenience products due to the rise in urban population is also expected to support the growth of the market.

Moreover, the steady growth of the generics market in the CIS region, coupled with demographic changes such as the increasing aging population and the rising burden of chronic diseases, is expected to aid the growth of the pharmaceutical industry. Increasing healthcare expenditure due to sedentary lifestyles and changing reforms is anticipated to contribute to the growth of the industry. The rising obese population in the region is also expected to have a major impact on the consumption of pharmaceuticals in the region, thereby driving the demand for pharmaceutical grade sorbitol.

Key Companies & Market Share Insights

The prominent market players have been benchmarked based on their distribution networks, product portfolios, innovation, operational capabilities, strategic developments, geographical reach, and the market presence of their brands.

Major market players are engaged in implementing various strategies, such as backward and forward integration, expansion of production capacities, and product portfolios. For instance, in 2015, Roquette Frères announced the launch of its new isosorbide production unit at its site in Lestrem, Pas-de-Calais, France. The unit has a capacity of 20,000 tons per year isosorbide. The company has developed a patented isosorbide production process using sorbitol as a primary raw material. Marketed under the ‘POLYSORB’ brand name, these monomers are witnessing growing adoption in the production of various thermoplastics and curable resins, such as polyesters, polycarbonates, polyurethanes, and epoxy resins. Some prominent players in the Europe, CIS and Middle East and North Africa sorbitol market include:

-

ADM

-

Cargill, Incorporated

-

Ingredion Incorporated

-

Roquette Frères

-

Associated British Foods plc

-

Merck KGaA

-

Tereos SCA

-

Sunar Misir

-

Mosselman s.a.

Europe, CIS and Middle East & North Africa Sorbitol Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 443.0 million

Revenue forecast in 2027

USD 568.4 million

Growth Rate

CAGR of 3.4% from 2020 to 2027

Market demand in 2020

475.8 kilotons

Volume forecast in 2027

619.4 kilotons

Growth Rate

CAGR of 3.6% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2020 to 2027

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, downstream opportunities, region

Regional scope

Europe; CIS; Middle East & North Africa

Country scope

Germany; U.K.; France; Spain; Italy; Turkey; RoEU; Russia; RoCIS; Saudi Arabia; UAE; Egypt; Morocco; RoMENA

Key companies profiled

ADM; Cargill, Incorporated; Ingredion Incorporated; Roquette Frères; Associated British Food Plc; Merck KGaA; Tereos; PT. Ecogreen Oleochemicals; Sunar Misir; Mosselman s.a.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented Europe, CIS and Middle East & North Africa sorbitol market report on the basis of product, application, end-use, downstream opportunities, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Liquid

-

Crystal

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Oral Care

-

Dietary Supplement

-

Diabetic & Dietetic Food & Beverage

-

Surfactant

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Personal Care

-

Food

-

Chemical

-

Pharmaceuticals

-

Others

-

-

Downstream Opportunities Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Ethylene Glycol

-

Propylene Glycol

-

Glycerol

-

Isosorbide

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Turkey

-

Rest of Europe

-

-

CIS

-

Russia

-

Rest of CIS

-

-

Middle East & North Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Morocco

-

Rest of MENA

-

-

Frequently Asked Questions About This Report

b. The Europe, CIS & MENA sorbitol market size was estimated at USD 434.9 million in 2019 and is expected to reach USD 443.0 million in 2020.

b. The Europe, CIS & MENA sorbitol market is expected to grow at a compound annual growth rate of 3.4% from 2020 to 2027 to reach USD 568.4 million by 2027.

b. Food & Beverage led the market and accounted for more than 35.8% of the global revenue share in 2019. The growth of the food & beverage industry directly influences the demand for sweeteners including sorbitol. The increasing adoption of various types of frozen foods, confectionery, and dairy products by end-consumers is expected to drive the market.

b. Some of the key players operating in the sorbitol market include ADM, Cargill, Incorporated, Ingredion Incorporated, Roquette Frères, Associated British Food Plc, Merck KGaA, Tereos, PT. Ecogreen Oleochemicals, Sunar Misir, Mosselman s.a.

b. The key factors that are driving the sorbitol market include rising awareness towards calorie reduction and healthier diets across consumers in key markets such as Germany, France, Italy, and UAE is expected to promote the consumption of dietary foods and beverages over the coming years, thereby also driving the growth of the sorbitol market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."