- Home

- »

- IT Services & Applications

- »

-

Extended Warranty Market Size And Share Report, 2030GVR Report cover

![Extended Warranty Market Size, Share, & Trends Report]()

Extended Warranty Market Size, Share, & Trends Analysis Report By Coverage (Standard Protection Plan, Accidental Protection Plan), By Distribution Channel, By Application, By End Use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-476-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Extended Warranty Market Size & Trends

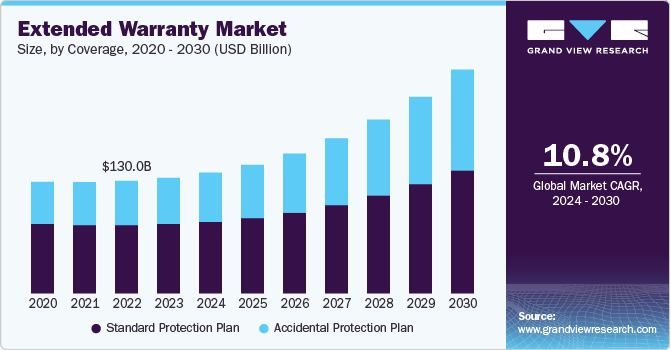

The global extended warranty market size was estimated at USD 133.6 billion in 2023 and is projected to grow at a CAGR of 10.8% from 2024 to 2030 owing to the surge in sales of consumer electronics and home appliances. With the increasing penetration of smartphones, laptops, smart home devices, and kitchen appliances globally, the demand for extended warranties has grown significantly. These products often represent a significant investment for consumers, who seek the reassurance of coverage beyond the standard manufacturer warranty, especially in the case of repairs or replacements. As electronic devices become more sophisticated and prone to technical malfunctions, customers are increasingly purchasing extended warranties for peace of mind.

There has been a significant rise in consumer awareness regarding the benefits of extended warranties. Manufacturers, retailers, and third-party providers have improved their marketing strategies to educate consumers about the financial protection offered by these plans. The proliferation of e-commerce platforms has also facilitated the easy bundling of extended warranty packages with products, further driving their adoption. As more consumers recognize the value of protecting their investments, extended warranty uptake has steadily increased.

The rise of online retail has supported the extended warranty market by creating more opportunities for providers to offer coverage directly to consumers. E-commerce platforms allow retailers to upsell extended warranties while purchasing of products, making it convenient for consumers to opt into these plans. Online comparison tools and platforms that specialize in extended warranty products have also gained popularity, enabling consumers to make more informed decisions about coverage options.

Companies are leveraging extended warranties as a tool for customer retention. Offering extended warranties creates an ongoing relationship between the customer and the product or brand, which can lead to increased customer loyalty. Many manufacturers and retailers bundle warranties with loyalty programs or offer perks to consumers who purchase extended coverage. This focus on retention is particularly important in highly competitive markets, where retaining customers can provide a strategic advantage.

Coverage Insights

The standard protection plan segment accounted for the largest market share, over 60% in 2023. The surge in sales of mid-range electronics, appliances, and other consumer goods is a major driver of the standard protection plan segment. While premium products often come with more comprehensive warranty offers, mid-range products are usually come with standard protection plans. Consumers who purchase these items are more likely to seek protection that covers potential repairs, but they may not require the extensive coverage offered by more premium options.

The accidental protection plan segment is anticipated to grow at a significant CAGR over the forecast period. The rapid growth of smartphones and wearable devices significantly contributes to the expansion of the accidental protection plan segment. Mobilephones, smartwatches, fitness trackers, and wireless earbuds are becoming integral to consumers' daily lives, but they are also prone to damage due to their constant usage and portability. These devices are frequently exposed to accidents such as falls, water exposure, and rough handling. Therefore, consumers are increasingly purchasing accidental protection plans to safeguard these valuable devices. The increasing adoption of wearable technology, in particular, has opened up new opportunities for accidental damage protection providers.

Distribution Channel Insights

The manufacturers segment accounted for the largest market share of nearly 45% in 2023. The rising cost of repairs and replacements is compelling consumers to seek additional protection beyond standard manufacturer warranties. As products become more complex and technologically advanced, the potential for malfunctions increases, prompting consumers to invest in extended warranties

The retailers segment is anticipated to grow at a significant CAGR over the forecast period. The integration of advanced technologies such as artificial intelligence (AI), machine learning, and data analytics has revolutionized how retailers market extended warranties. AI-powered tools allow retailers to provide personalized warranty offerings based on customer purchase history and preferences. By using predictive analytics, retailers can target potential buyers with extended warranty options at the optimal time, increasing conversion rates.

Application Insights

The consumer electronics segment accounted for the largest market share, over 33% in 2023. Many extended warranty providers now offer installment-based payment options or bundle warranty costs into device financing plans. This affordability and flexible payment structures make extended warranties more accessible to a broader range of consumers. For instance, instead of paying a large upfront sum, consumers can now include the warranty cost in their monthly device payments, reducing the immediate financial burden and increasing overall adoption.

The mobile devices and PCs segment is anticipated to grow at a significant CAGR over the forecast period. The shift toward remote and hybrid work environments, accelerated by the COVID-19 pandemic, has further fueled the need for extended warranties for PCs and mobile devices. As more people rely on personal devices for professional tasks, the assurance of uninterrupted functionality becomes critical. Extended warranties help reduce downtime by offering fast repair or replacement services for devices essential to remote work.

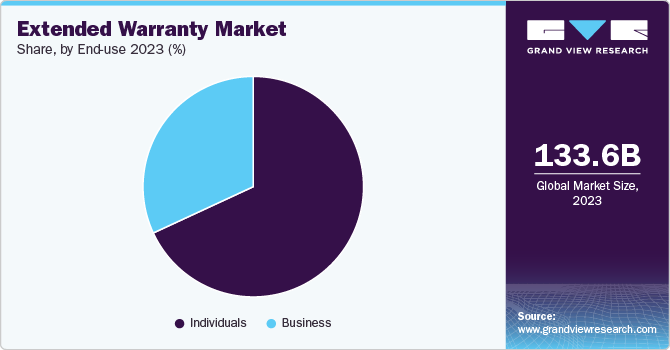

End Use Insights

The individuals segment accounted for the largest market share, over 68% in 2023. Extended warranty providers are increasingly offering flexible payment plans, allowing individual consumers to spread out the warranty cost over time. For example, warranties are often bundled with installment-based purchasing, which makes it easier for consumers to include warranty protection without a large upfront expense.

The business segment is anticipated to grow at a significant CAGR over the forecast period. The rise of cloud computing, data centers, and enterprise software has spurred significant investments in IT infrastructure, which businesses seek to protect through extended warranties. Servers, networking hardware, storage systems, and office devices are critical to business operations, and any downtime or malfunction can result in lost revenue or productivity. Extended warranties offer businesses to cover repair or replacement costs, helping them safeguard their IT investments.

Regional Insights

The extended warranty market in North America held a share of around 36% in 2023. The market in North America is characterized by high adoption rates across consumer electronics, automotive, and home appliances. Given the rising costs of repairs and replacements, consumers are increasingly seeking protection for high-value items such as smartphones, laptops, and vehicles. The surge in demand for expensive electronics and smart home devices has contributed to the popularity of extended warranties, as consumers aim to safeguard these purchases from potential damage or defects.

U.S. Extended Warranty Trends

The extended warranty market in the U.S. is expected to grow significantly from 2024 to 2030. Businesses, particularly SMEs, are major consumers of extended warranties in the U.S. The rising adoption of technology, machinery, and IT infrastructure by small businesses are driving the demand for extended warranties to protect these valuable assets. SMEs rely on extended warranties to manage maintenance costs and minimize operational downtime, particularly for essential equipment such as computers, office appliances, and business vehicles.

Europe Extended Warranty Trends

The extended warranty market in Europe is growing significantly at a CAGR of 10.0% from 2024 to 2030. The automotive extended warranty is a key segment in the region, driven by high vehicle ownership rates and rising vehicle repair costs. As cars become more sophisticated with integrated electronics, sensors, and automation, repair costs have surged, making extended warranties a popular choice among vehicle owners. Additionally, the increasing adoption of electric vehicles (EVs) has spurred demand for extended warranties that cover the unique components of EVs, such as batteries and electric motors.

Asia Pacific Extended Warranty Trends

Asia Pacific is growing significantly at a CAGR of 13.1% from 2024 to 2030. The extended warranty market in Asia-Pacific is becoming increasingly competitive, with numerous players entering the space, including traditional insurers, third-party warranty providers, and technology companies. This competition is driving innovation, leading to the development of more flexible and customized warranty products that cater to specific consumer needs. Providers are offering diverse plans that cover various scenarios, including accidental damage, technical support, and on-site repairs.

Key Extended Warranty Company Insights

Key players operating in the extended warranty market include Assurant, Inc., Asurion, American International Group, Inc., Endurance Warranty Services, LLC and AXA. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Extended Warranty Companies:

The following are the leading companies in the extended warranty market. These companies collectively hold the largest market share and dictate industry trends.

- American International Group, Inc.

- ASSURANT, INC

- Asurion

- AXA,

- CARCHEX, LLC

- Edel Assurance

- Endurance Warranty Services, LLC

- Liberty Mutual Insurance

- Likewize

- SquareTrade, Inc.

Recent Developments

-

In August 2024, Asurion partnered with Reach, a U.S.-based platform provider specializing in digital connectivity and mobile virtual network enabler (MVNE) solutions. This collaboration aims to offer seamless device protection and trade-in services to small and mid-sized regional operators. By integrating Asurion's services into Reach’s platform marketplace, the partnership provides operators with a valuable revenue stream. It enhances customer retention, streamlines the go-to-market process, and delivers a superior user experience.

-

In July 2024, Assurant, Inc. partnered with HEVI Corp., a U.S.-based manufacturer specializing in all-electric heavy construction equipment. This collaboration allows HEVI customers to acquire an Assurant Extended Service Contract (ESC), which offers protection for their equipment beyond the standard manufacturer’s warranty period.

-

In May 2023, Endurance Warranty Services, LLC expanded its range of auto protection offerings by introducing mechanical breakdown insurance (MBI) for residents of California. This new coverage provides California consumers with financial protection against expensive repairs resulting from unforeseen breakdowns or mechanical failures, ensuring they have the necessary support to safeguard their vehicles.

Extended Warranty Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 139.6 billion

Revenue forecast in 2030

USD 258.6 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Coverage, distribution channel, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa

Key companies profiled

American International Group Inc.; Asurion; AXA; CARCHEX, LLC; Edel Assurance; Endurance Warranty Services, LLC; Liberty Mutual Insurance; Likewize; SquareTrade, Inc.; ASSURANT, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extended Warranty Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global extended warranty market report based on coverage, distribution channel, application, end use, and region.

-

Coverage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Standard Protection Plan

-

Accidental Protection Plan

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturers

-

Retailers

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automobiles

-

Consumer Electronics

-

Home Appliances

-

Mobile Devices and PCs

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individuals

-

Business

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global extended warranty market size was estimated at USD 133.6 billion in 2023 and is expected to reach USD 139.6 billion in 2024.

b. The global extended warranty market is expected to grow at a compound annual growth rate of 10.8% from 2024 to 2030 to reach USD 258.6 billion by 2030.

b. The standard protection plan segment accounted for the largest market share of 60.1% in 2023. The surge in sales of mid-range electronics, appliances, and other consumer goods is a major driver of the standard protection plan segment.

b. Some key players operating in the extended warranty market include American International Group, Inc., Asurion, AXA, CARCHEX, LLC, Edel Assurance, Endurance Warranty Services, LLC, Liberty Mutual Insurance, Likewize, SquareTrade, Inc., ASSURANT, INC

b. With the increasing penetration of smartphones, laptops, smart home devices, and kitchen appliances globally, the demand for extended warranties has grown significantly. These products often represent a significant investment for consumers, who seek the reassurance of coverage beyond the standard manufacturer warranty, especially in the case of repairs or replacements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."