- Home

- »

- Advanced Interior Materials

- »

-

Indium Mining Market Size & Share, Industry Report, 2033GVR Report cover

![Indium Mining Market Size, Share & Trends Report]()

Indium Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Flat Panel Displays, Solders, PV Cells, Thermal Interface Materials), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-4-68040-800-7

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Indium Mining Market Summary

The global indium mining market size was estimated at USD 245.3 million in 2024 and is projected to reach USD 415.4 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. Growth is driven by the rising demand for indium in advanced electronics, particularly in the production of indium tin oxide (ITO), which is used in flat-panel displays, touchscreens, and photovoltaic cells.

Key Market Trends & Insights

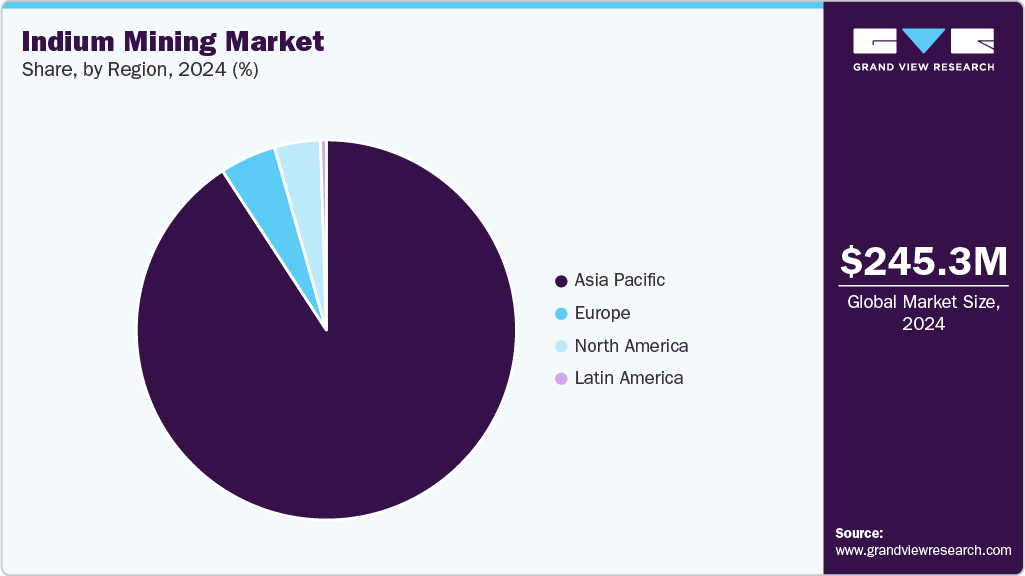

- Asia Pacific dominated the indium mining market with a revenue share of 90.7% in 2024.

- The Canada indium mining industry holds significant potential in the regional market.

- By application, the flat panel displays dominated the market with a revenue share of over 57.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 245.3 Million

- 2033 Projected Market Size: USD 415.4 Million

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest market in 2024

The expansion of renewable energy projects further supports the market, where indium is a critical material for thin-film solar panels. The indium mining market increasingly focuses on sustainability through improved resource efficiency and recycling initiatives. Given the limited primary sources of indium, producers emphasize the recovery of indium from secondary materials, such as electronic waste, LCD panels, and zinc smelting byproducts. This circular approach reduces dependence on mining and minimizes environmental degradation and carbon emissions associated with the extraction process. Governments and companies are also adopting stricter environmental standards and responsible sourcing practices to ensure long-term supply security while mitigating the ecological footprint of mining operations.

Technological advancements are reshaping the indium mining landscape by enhancing extraction efficiency and recovery rates. Innovations in hydrometallurgical and solvent extraction techniques enable more selective and cost-effective recovery of indium from complex ores and residues. Automation, data analytics, and real-time process monitoring are being increasingly integrated into mining operations to enhance precision and minimize waste. Additionally, advancements in recycling technologies are extending the material’s lifecycle, allowing indium to be efficiently recovered from end-of-life electronic products, further strengthening supply resilience and supporting global demand growth across electronics and renewable energy sectors.

Drivers, Opportunities & Restraints

Robust demand for electronics, telecommunications, and renewable energy drives the indium mining market. ITO, a crucial material used in touchscreens, flat-panel displays, and photovoltaic cells, is a key area of consumption. The expansion of 5G infrastructure, LED lighting, and advanced semiconductor production is further fueling demand. In February 2025, China implemented export controls on several critical minerals, including indium, to strengthen its strategic resource management, highlighting the metal’s growing importance in clean energy and high-tech applications. This combination of rising demand and restricted supply drives global market growth.

Significant opportunities emerge from recycling and recovery initiatives to reduce dependence on primary indium mining. Companies like Indium Corporation have launched large-scale reclaim and recycling programs for indium, ITO targets, and indium alloys, allowing manufacturers to recover valuable materials from production waste and end-of-life electronics. Moreover, new hydrometallurgical and pyrometallurgical recovery methods developed in 2024 have demonstrated higher efficiency in extracting indium from e-waste and smelter residues. These advancements support economic goals, create cost-effective supply chains, and open profitable avenues for recyclers and refiners in Asia, Europe, and North America.

The market faces challenges due to its concentrated production base, dependency on by-products, and regulatory uncertainties. Since indium is primarily recovered as a by-product of zinc mining, its output remains tied to zinc production trends, limiting supply flexibility. The export controls introduced by China in early 2025 have heightened supply chain risks for downstream manufacturers, particularly in the electronics and solar industries. Additionally, the high cost of extracting indium from low-grade ores and the limited availability of standalone deposits restrict new entrants from expanding production. These factors contribute to market volatility, hindering consistent long-term growth.

Application Insights

The flat panel display segment dominated the global indium mining industry in 2024, accounting for the largest share of over 57.0% in 2024. ITO, derived from refined indium, is a critical material for manufacturing liquid crystal displays (LCDs), touchscreens, and light-emitting diode (LED) panels due to its exceptional transparency and electrical conductivity. The sustained growth in consumer electronics such as smartphones, tablets, televisions, and monitors has driven substantial demand for ITO coatings. Additionally, the post-pandemic surge in remote work and digital communication has accelerated the demand for display-based devices, further consolidating the segment's dominance.

Beyond consumer electronics, the adoption of indium-based coatings is increasing across industrial and automotive displays, augmented reality (AR) devices, and high-resolution medical imaging systems. Continuous innovation in display technologies, such as OLED and micro-LED, is expected to sustain demand for indium, as manufacturers strive for thinner, brighter, and more energy-efficient screens. Leading electronics producers in China, South Korea, and Japan have expanded their production capacities to meet the increasing global demand for displays, thereby ensuring steady indium consumption within the display manufacturing ecosystem.

While the flat panel display segment remains the key growth engine, other applications, including solders, photovoltaic (PV) cells, and thermal interface materials, contribute to overall market expansion. The use of indium in PV cells is rising with the increasing adoption of Copper Indium Gallium Selenide (CIGS) thin-film solar technologies, while indium-based solders are gaining traction in advanced semiconductor packaging and aerospace electronics. Indium’s superior thermal conductivity and ductility make it valuable for high-performance electronic assemblies. Growing investment in clean energy technologies and miniaturized electronic components is expected to expand their application scope further. As industries shift toward energy-efficient and high-reliability materials, indium’s versatility positions it as a key enabler across multiple next-generation technologies.

Regional Insights

Asia Pacific dominated the indium mining market with a revenue share of 90.7% in 2024. The indium mining industry in the Asia Pacific dominates the global market, accounting for the majority of production and consumption. Countries such as China, South Korea, and Japan are leading producers and consumers of indium, primarily driven by their extensive electronics and display manufacturing industries. China’s dominance in refining and export has solidified the region’s control over global supply. The ongoing expansion of semiconductor fabrication, solar PV manufacturing, and LED production across emerging economies, such as Uzbekistan, further boosts regional demand.

North America Indium Mining Market Trends

The indium mining industry in North America is experiencing steady growth driven by rising demand from the semiconductor, aerospace, and renewable energy sectors. The region’s strong electronics manufacturing base, particularly in the United States, continues to support the use of indium in solders, displays, and advanced optoelectronic components. Increasing investments in solar energy and electric vehicle (EV) technologies also create opportunities for indium-based thin-film solar cells. Furthermore, the government's emphasis on securing critical mineral supply chains has encouraged research into the recycling and secondary recovery of indium from electronic waste, aiming to reduce dependence on imports.

The Canada indium mining industry holds significant potential in the regional market, primarily as a by-product producer from its zinc and polymetallic mining operations. The country’s advanced mining infrastructure, stable regulatory environment, and focus on sustainable extraction methods position it as an emerging source of indium for North American industries. Recent exploration and development projects in British Columbia and Quebec aim to enhance the recovery efficiency of critical minerals, such as indium and gallium, from existing mines. Canada’s strategic push toward developing a domestic supply chain for clean technologies and critical materials is expected to strengthen its role in the global indium value chain.

Europe Indium Mining Market Trends

The indium mining industry in Europe is growing steadily, supported by increasing demand from renewable energy, automotive, and industrial electronics sectors. The region’s strong focus on sustainability and economic practices has encouraged investment in recycling and recovery of indium from end-of-life electronics and industrial residues. European Union policies aimed at securing critical raw materials encourage collaborations between mining companies and technology developers to enhance local supply capabilities.

Key Indium Mining Company Insights

Some of the key players operating in the market include Korea Zinc Co., Ltd., Dowa Holdings Co., Indium Corporation, and Others.

-

Korea Zinc Co., Ltd., established in 1974 and headquartered in Seoul, is one of the world’s largest non-ferrous metal producers specializing in zinc, lead, and silver refining. The company recovers indium as a valuable by-product from its zinc smelting operations and supplies high-purity indium for use in electronics, displays, and photovoltaic applications. Korea Zinc’s advanced refining technologies and commitment to sustainable resource recovery make it a global leader in the indium supply chain.

-

Dowa Holdings Co., Ltd., founded in 1884 and based in Tokyo, is a diversified metals and environmental services company with operations spanning mining, smelting, recycling, and advanced materials. The company is a major refiner of indium, recovering it from smelter residues and electronic waste through proprietary hydrometallurgical processes. Dowa’s focus on resource recycling, coupled with continuous innovation in metal recovery technologies, strengthens its position as a sustainable supplier of indium for the global electronics and renewable energy industries.

-

Indium Corporation, established in 1934 and headquartered in Clinton, New York, is a globally recognized supplier of indium alloys and related materials for high-tech applications. The company produces refined indium metal and manufactures solders, thermal interface materials, and ITO targets for displays and semiconductors. Indium Corporation also operates recycling programs to reclaim indium from used materials, reinforcing its commitment to economic practices and supply chain resilience.

Key Indium Mining Companies:

The following are the leading companies in the indium mining market. These companies collectively hold the largest market share and dictate industry trends.

- China Tin Group (Yunnan Tin Company) Ltd.

- Dowa Holdings Co., Ltd.

- Guangxi Debang Technology Co., Ltd.

- Indium Corporation

- Korea Zinc Co., Ltd.

- Mitsui Mining & Smelting Co., Ltd.

- Teck Resources Limited

- Umicore NV

- Young Poong Corporation

- Zhuzhou Smelter Group Co., Ltd.

Recent Developments

-

Korea Zinc Co., Ltd., in February 2025, announced the completion of a significant upgrade to its Onsan refinery to enhance indium and rare metal recovery efficiency through advanced solvent extraction systems. The project is expected to increase indium output by 20% while reducing waste generation, supporting the company’s goal of achieving carbon-neutral refining operations by 2035.

-

Dowa Holdings Co., Ltd., in April 2025, launched a new recycling initiative in partnership with major Japanese electronics manufacturers to recover indium and gallium from discarded LCD panels and semiconductors. The program integrates high-efficiency hydrometallurgical processes and AI-based sorting systems to boost material recovery rates and reduce dependency on imported raw materials.

-

Indium Corporation, in January 2025, introduced its next-generation ultra-high-purity indium ingots designed for advanced display and semiconductor applications. The company also expanded its recycling facility in Utica, New York, to support closed-loop recovery of indium from ITO targets and solder materials, aligning with growing global demand for sustainable sourcing in the electronics industry.

Indium Mining Market Report Scope

Report Attribute

Details

Market Definition

Market size represents the total value of indium refined or produced at the refinery level.

Market size value in 2025

USD 257.3 million

Revenue forecast in 2033

USD 415.4 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America

Country scope

Canada; Belgium; France; Russia; China; Japan; South Korea; Uzbekistan; Peru

Key companies profiled

China Tin Group; Dowa Holdings Co., Ltd.; Guangxi Debang Technology Co., Ltd.; Indium Corporation; Korea Zinc Co., Ltd.; Mitsui Mining & Smelting Co., Ltd.; Teck Resources Limited; Umicore NV; Young Poong Corporation; Zhuzhou Smelter Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Indium Mining Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global indium mining market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flat Panel Displays

-

Solders

-

PV Cells

-

Thermal Interface Materials

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

Canada

-

-

Europe

-

Belgium

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Uzbekistan

-

-

Latin America

-

Peru

-

-

Frequently Asked Questions About This Report

b. The global indium mining market size was estimated at USD 245.3 million in 2024 and is expected to reach USD 257.3 million in 2025.

b. The global indium mining market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033, reaching USD 415.4 million by 2033.

b. By application, flat panel displays dominated the market, accounting for a revenue share of over 57.0% in 2024.

b. Some of the key vendors in the global indium mining market are China Tin Group, Dowa Holdings Co., Ltd., Guangxi Debang Technology Co., Ltd., Indium Corporation, Korea Zinc Co., Ltd., Mitsui Mining & Smelting Co., Ltd., Teck Resources Limited, Umicore NV, Young Poong Corporation, and Zhuzhou Smelter Group Co., Ltd.

b. The global indium mining market is driven by the rapidly growing demand from the electronics, renewable energy, and semiconductor industries. Indium is a critical material for producing indium tin oxide, essential for manufacturing flat-panel displays, touchscreens, and photovoltaic cells.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.