- Home

- »

- Catalysts & Enzymes

- »

-

Industrial Enzymes Market Size, Share, Industry Report 2033GVR Report cover

![Industrial Enzymes Market Size, Share & Trends Report]()

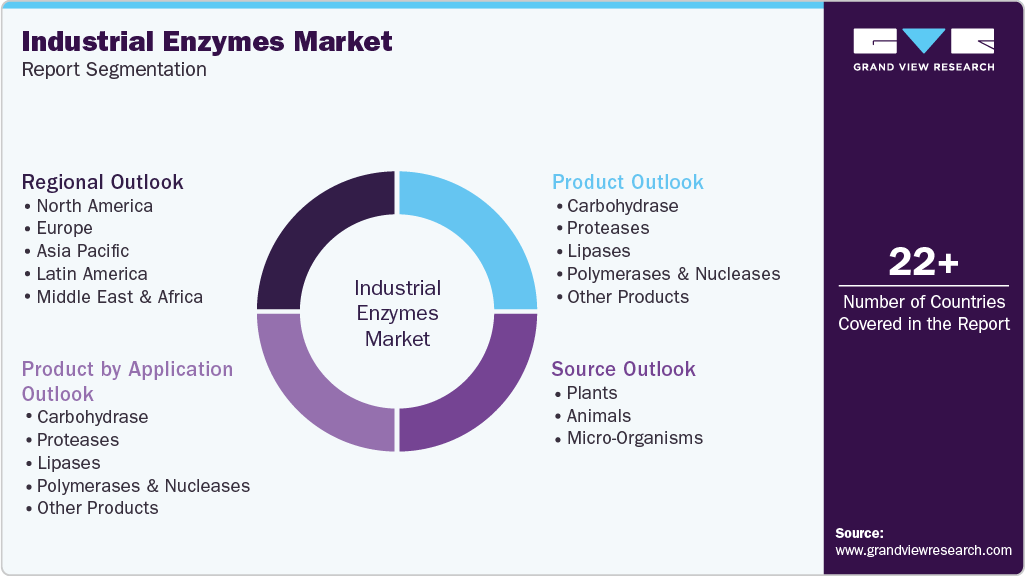

Industrial Enzymes Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Carbohydrase, Proteases, Lipases, Polymerases & Nucleases), By Source (Plants, Animals, Micro-Organisms), By Product by Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-844-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Enzymes Market Summary

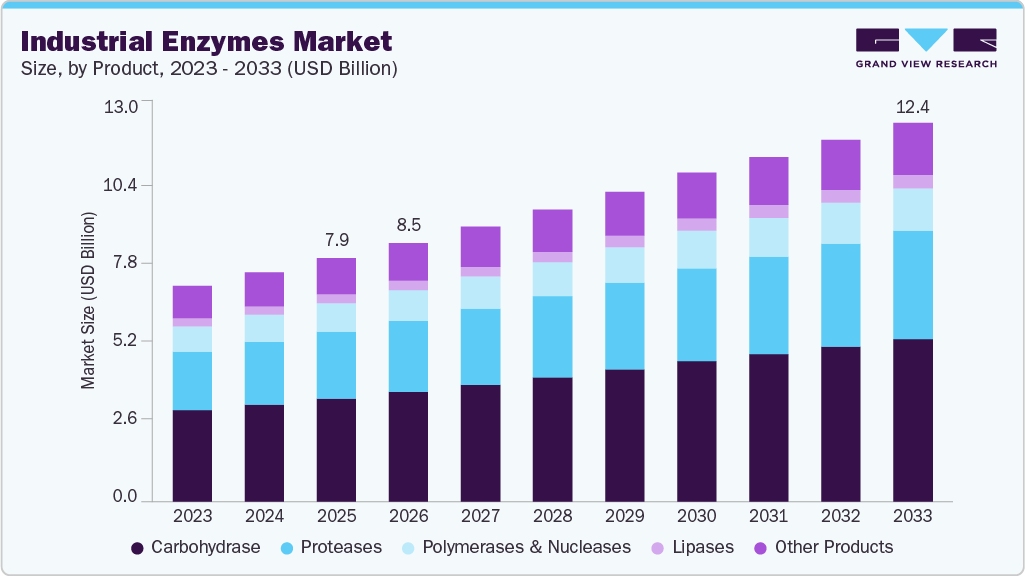

The global industrial enzymes market size was estimated at USD 7,997.6 million in 2025 and is projected to reach USD 12,434.3 million by 2033, growing at a CAGR of 5.6% from 2026 to 2033. Industrial enzymes are experiencing rapid expansion because industries increasingly recognize their capacity to enhance efficiency and reduce environmental impact through precise biological reactions.

Key Market Trends & Insights

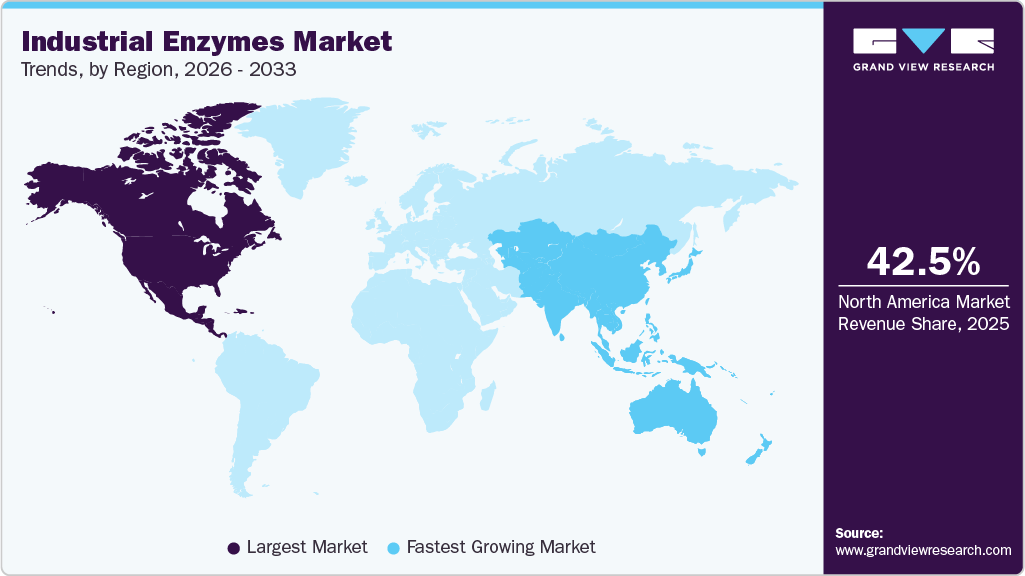

- North America industrial enzymes industry dominated the global market and accounted for the largest revenue share of 42.5% in 2025

- Asia Pacific is expected to grow fastest with a CAGR of 6.1% from 2026 to 2033.

- The proteases product segment is expected to grow fastest with a CAGR of 6.1% from 2026 to 2033.

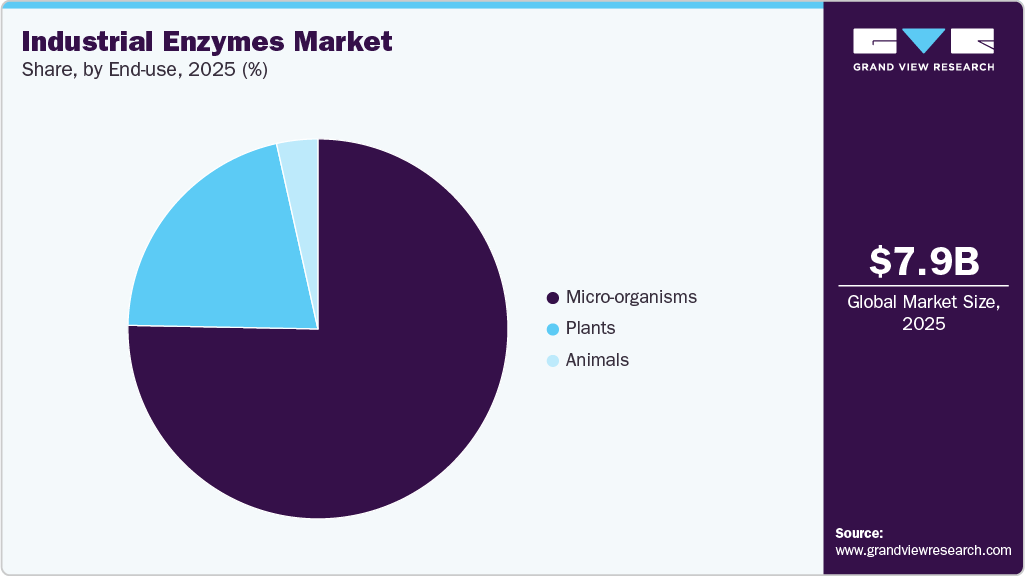

- The micro-organisms source segment dominated the market and accounted for the largest revenue share of 75.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7,997.6 Million

- 2033 Projected Market Size: USD 12,434.3 Million

- CAGR (2026-2033): 5.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Growth reflects rising demand for sustainable processing, expanding food production, cleaner manufacturing, and new applications emerging across sectors. This transformation reshapes how products are developed and delivered.The market has expanded significantly in recent years as businesses seek more efficient and cost effective methods to handle complex chemical processes. Enzymes sourced from microbes, plants, and animals serve diverse purposes from breaking down starches in food creation to improving detergent performance. Scientific improvements in fermentation and production methods have enabled manufacturers to produce enzymes at larger scales with more consistent quality. This has encouraged adoption by sectors beyond traditional food and beverage applications. At the same time, regulatory emphasis on minimizing chemical waste has encouraged companies to explore enzyme based solutions. Customers prefer processes that lower energy demands and yield higher purity outcomes. These preferences contribute to sustained interest in enzyme utilization across multiple sectors where performance and sustainability intersect.

Growth in the market for industrial enzymes also reflects emerging uses in fields such as biofuels, pharmaceuticals, paper processing, and animal nutrition. Enzyme blends tailored for specific reactions support customized solutions for complex production challenges. As researchers identify new biochemical pathways and refine enzyme specificity, companies can unlock novel uses that were previously impractical. For example, enzymes that facilitate biofuel conversion can improve output while reducing feedstock waste. In pharmaceuticals, enzymes enable delicate synthesis steps that are difficult with chemical catalysts alone. Industry leaders invest in research collaborations with academic and private laboratories to push the boundaries of enzyme applications. Customer demand for cleaner and more efficient processing continues to prompt exploration of innovative enzymatic approaches.

Market Concentration & Characteristics

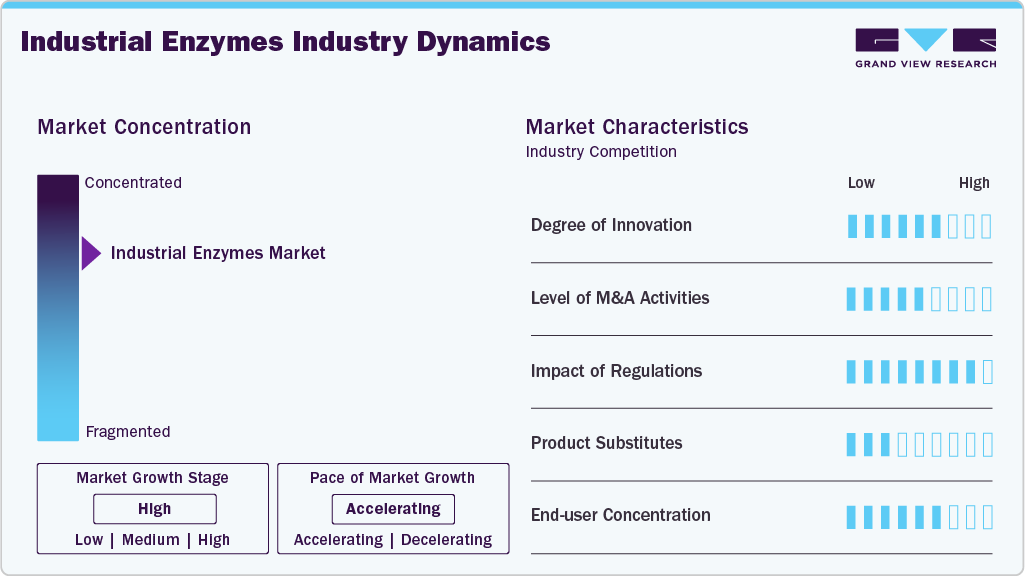

The industrial enzymes industry shows a moderately concentrated structure shaped by a mix of established producers and specialized manufacturers. Leading companies benefit from strong research capabilities, proprietary enzyme formulations, and long standing relationships with end use industries. At the same time, smaller players contribute innovation by focusing on niche applications and customized enzyme solutions, creating a competitive yet collaborative environment.

Market characteristics are defined by high technical expertise, continuous research efforts, and strict quality requirements. Product differentiation is driven by enzyme efficiency, stability, and application specific performance rather than price alone. The market also reflects close interaction between suppliers and customers, as enzymes often need to be tailored to specific production processes. This results in long development cycles and strong customer retention once solutions are implemented.

Product Insights

The carbohydrate product segment dominated the market and accounted for the largest revenue share of 42.4% in 2025. The carbohydrase segment held the largest share due to its extensive use across food and beverage, animal feed, and bioethanol production processes. These enzymes support efficient breakdown of starches and complex carbohydrates, improving yield and process consistency. Their broad applicability, stable performance under industrial conditions, and long-standing integration into large scale manufacturing workflows continue to sustain strong demand across multiple end use industries.

Proteases is expected to grow fastest with a CAGR of 6.1% from 2026 to 2033. The proteases segment is projected to expand rapidly as demand rises from detergents, pharmaceuticals, and protein processing industries. These enzymes enable effective protein breakdown at lower temperatures, improving efficiency and reducing processing intensity. Growing focus on high performance cleaning solutions, advanced pharmaceutical formulations, and improved feed digestibility supports wider adoption. Continuous development of specialized proteases further enhances their suitability for diverse industrial applications.

Product by Application Insights

The food & beverages application dominated in terms of market share across all product categories due to its consistent demand for enzymes in processing, preservation, and quality enhancement. Enzymes such as carbohydrases, proteases, and lipases are widely used to improve texture, flavor, shelf life, and production efficiency. Large scale consumption, continuous production cycles, and strict quality requirements sustain strong enzyme utilization within this application.

Nutraceuticals are expected to grow fastest over the forecast period, as increasing focus on health, wellness, and preventive nutrition drives demand for functional ingredients. Enzymes play an important role in improving bioavailability, digestion, and nutrient absorption in dietary supplements. Expanding consumer awareness and product innovation encourage manufacturers to incorporate specialized enzymes, supporting the rapid growth of this application across multiple product segments.

Source Insights

The micro-organisms source segment dominated the market and accounted for the largest revenue share of 75.3% in 2025 due to its strong suitability for industrial scale enzyme production. Microbial sources such as bacteria and fungi offer rapid growth, high productivity, and consistent performance under controlled fermentation conditions. These advantages enable cost effective manufacturing and precise customization, supporting widespread use across food processing, detergents, biofuels, and pharmaceutical industries.

The plant source segment is expected to grow fastest with a CAGR of 6.1% from 2026 to 2033 as demand increases for naturally derived enzyme solutions. Plant based enzymes are gaining traction in food, nutraceutical, and personal care applications where clean labeling and mild processing are important. Improvements in agricultural sourcing and extraction efficiency further enhance their commercial appeal, supporting accelerated adoption across selected end use industries.

Regional Insights

North America industrial enzymes industry dominated the global market and accounted for the largest revenue share of 42.5% in 2025 due to its well-established biotechnology infrastructure and early adoption of enzyme technologies across key industries such as food and beverage, detergents, and pharmaceuticals. Strong presence of major enzyme producers fuels innovation and commercial scale production. Furthermore, stringent environmental regulations and a strong focus on sustainability encourage manufacturers to replace traditional chemical processes with enzyme-based solutions. Demand for high-performance and customized enzymes in advanced applications continues to reinforce the region’s revenue share.

U.S. Industrial Enzymes Market Trends

U.S. holds 73.8% revenue share of the North America industrial enzymes market. The U.S. industrial enzymes industry benefits from a strong biotechnology ecosystem, significant R&D investment, and advanced manufacturing capabilities. High demand in food processing, pharmaceuticals, and specialty chemicals drives enzyme adoption. Regulatory emphasis on sustainability and reduction of chemical waste encourages enzyme-based processes. Well-established supply chains and collaboration between industry and research institutions help accelerate commercialization of tailored enzyme solutions, reinforcing the U.S. as a leading and innovative market.

Asia Pacific Industrial Enzymes Market Trends

Asia Pacific industrial enzymes industry is expected to grow fastest with a CAGR of 6.1% from 2026 to 2033. Asia Pacific’s rapid growth is driven by expanding industrial activity and increasing investments in bio-based manufacturing across emerging markets. Growth in food processing, animal nutrition, and biofuel sectors is stimulating demand for diverse enzyme solutions. Improving infrastructure and rising technical expertise support local enzyme production and adoption. In addition, growing awareness of eco-friendly processing and expanding consumer markets in the region are encouraging both global and domestic players to strengthen their presence, contributing to faster market growth.

China industrial enzymes industry is expanding rapidly due to robust growth in food processing, animal feed, textiles, and biofuel sectors. Government support for biotechnology and a shift toward higher value-added manufacturing encourage local enzyme production and adoption. Rising domestic demand for sustainable manufacturing and improvements in technical expertise contribute to increased uptake of enzyme solutions. Investments by both domestic and multinational players in production infrastructure also drive market expansion across varied applications.

Europe Industrial Enzymes Market Trends

Europe’s industrial enzymes industry is shaped by strict environmental policies and aggressive targets for reducing carbon emissions. Industries such as detergents, paper, and bioenergy increasingly turn to enzymes to meet regulatory requirements and improve energy efficiency. Consumer preference for green and biodegradable products further supports enzyme use. Strong biotechnology clusters in countries such as Germany and France foster innovation, enabling customized enzyme development and reinforcing Europe’s focus on sustainable industrial transformation.

Latin America Industrial Enzymes Market Trends

Latin America’s industrial enzymes industry growth is supported by expanding agriculture, food and beverage processing, and bioethanol production industries that increasingly require efficient and cost-effective processing solutions. Brazil’s strong biofuel sector and Argentina’s agro-processing base create demand for enzymes in fermentation and feed applications. Growing awareness of sustainable processing and the need to improve operational efficiencies encourages adoption of enzyme technologies. Local manufacturers and partnerships with global suppliers further enable regional market development.

Middle East & Africa Industrial Enzymes Market Trends

The Middle East & Africa industrial enzymes industry is gradually evolving as industries diversify away from traditional oil and gas toward food processing, water treatment, and industrial manufacturing. Growing investments in industrial infrastructure and efforts to improve efficiency in key sectors support enzyme adoption. Demand for cost-effective and environmentally friendly solutions aligns with economic diversification plans and sustainability goals. Strategic partnerships with international technology providers help accelerate enzyme integration in industrial processes across the region.

Key Industrial Enzymes Company Insights:

The two key dominant manufacturers in the market are Novozymes A/S and BASF SE.

-

Novozymes A/S is widely recognized for its strong focus on enzyme innovation and sustainable biological solutions. The company develops a broad range of industrial enzymes used across food processing, detergents, bioenergy, agriculture, and technical industries. Its strength lies in deep biological expertise, advanced strain development, and close integration of research with industrial application needs. Novozymes emphasizes environmentally responsible processes that help industries reduce resource consumption while maintaining high performance. Continuous investment in biotechnology and application-specific solutions allows the company to address evolving industrial requirements and expand enzyme use into new processing areas.

-

BASF SE plays a significant role in the industrial enzymes industry through its integrated chemical and biological capabilities. The company incorporates enzymes into a wide range of industrial processes, particularly in detergents, animal nutrition, and technical applications. BASF benefits from strong research infrastructure and the ability to combine enzyme technology with broader chemical solutions, creating optimized performance outcomes. Its global manufacturing footprint and emphasis on process efficiency support consistent product development. By aligning enzyme innovation with sustainability and performance goals, BASF continues to strengthen its position across multiple enzyme-driven industrial applications.

Key Industrial Enzymes Companies:

The following key companies have been profiled for this study on the industrial enzymes market.

- Novozymes A/S

- BASF SE

- International Flavors & Fragrances Inc. (IFF)

- DSM-Firmenich

- Associated British Foods plc

- Amano Enzyme Inc.

- Advanced Enzyme Technologies Limited

- Lesaffre Group

- Adisseo

- Novus International

Recent Developments

-

In October 2025, BASF and IFF announced a strategic collaboration to accelerate development of next-generation enzyme and polymer technologies, combining biotechnology and chemical expertise to deliver sustainable, high-performance solutions for cleaning, personal care, and industrial applications.

-

In March 2025, Novonesis launched Progress® Beyond and Progress® Go, expanding its protease portfolio with advanced solutions designed to deliver efficient protein stain removal across diverse wash temperatures, formulations, and rapid laundry cycles while supporting sustainable consumer washing preferences.

-

In March 2025, Kemin Industries acquired CJ Youtell Biotech, strengthening its global enzyme innovation capabilities by expanding fermentation assets and enzyme portfolios, enabling delivery of high-performance, sustainable enzyme solutions across multiple industries worldwide.

Industrial Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8,494.0 million

Revenue forecast in 2033

USD 12,434.3 million

Growth rate

CAGR of 5.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, product by application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

Novozymes A/S; BASF SE; International Flavors & Fragrances Inc. (IFF); DSM-Firmenich; Associated British Foods plc; Amano Enzyme Inc.; Advanced Enzyme Technologies Limited; Lesaffre Group; Adisseo; Novus International

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Enzymes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global industrial enzymes market report based on product, source, product by application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Carbohydrase

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Other Products

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Plants

-

Animals

-

Micro-Organisms

-

-

Product by Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Carbohydrase

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Proteases

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Lipases

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Polymerases & Nucleases

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Other Products

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial enzymes market size was estimated at USD 7,997.6 million in 2025 and is expected to reach USD 8,494.0 million in 2026.

b. The global industrial enzymes market is expected to grow at a compound annual growth rate of 5.6% from 2026 to 2033, reaching USD 12,434.3 million by 2033.

b. The carbohydrate product segment dominated the market and accounted for the largest revenue share of 42.4% in 2025. The carbohydrase segment held the largest share due to its extensive use across food and beverage, animal feed, and bioethanol production processes. These enzymes support efficient breakdown of starches and complex carbohydrates, improving yield and process consistency. Their broad applicability, stable performance under industrial conditions, and long-standing integration into large scale manufacturing workflows continue to sustain strong demand across multiple end use industries.

b. Some of the key players operating in the industrial enzymes Market include Novozymes A/S, BASF SE, International Flavors & Fragrances Inc. (IFF), DSM-Firmenich, Associated British Foods plc, Amano Enzyme Inc., Advanced Enzyme Technologies Limited, Lesaffre Group, Adisseo, Novus International.

b. Industrial enzymes are experiencing rapid expansion because industries increasingly recognize their capacity to enhance efficiency and reduce environmental impact through precise biological reactions. Growth reflects rising demand for sustainable processing, expanding food production, cleaner manufacturing, and new applications emerging across sectors. This transformation reshapes how products are developed and delivered.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.