- Home

- »

- Next Generation Technologies

- »

-

Industrial Software Market Size, Share, Growth Report, 2030GVR Report cover

![Industrial Software Market Size, Share & Trends Report]()

Industrial Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Manufacturing Execution System (MES), SCADA), By End-use (Process, Discrete), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-425-1

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Software Market Summary

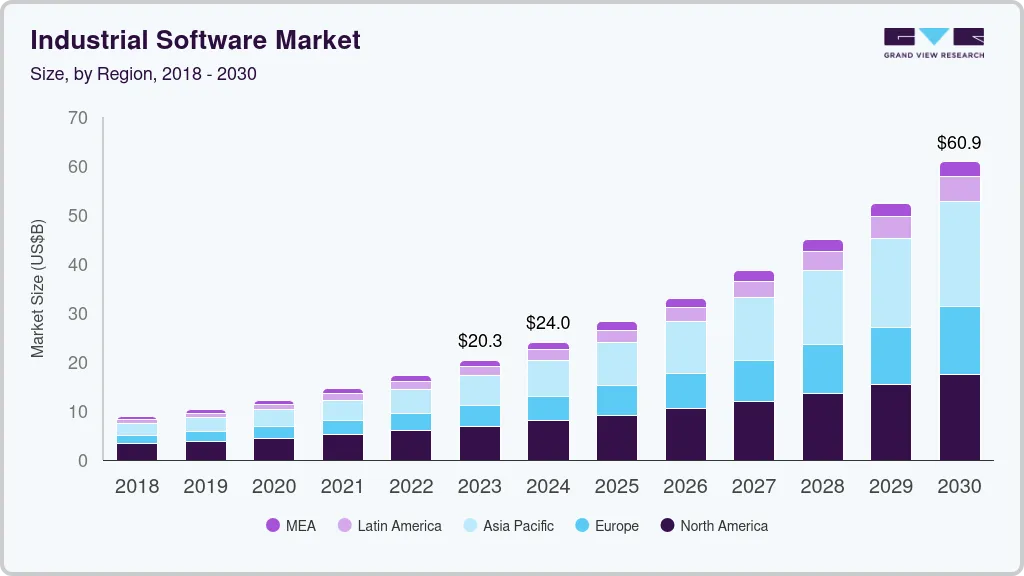

The global industrial software market size was estimated at USD 20.35 billion in 2023 and is projected to reach USD 60.91 billion by 2030, growing at a CAGR of 16.8% from 2024 to 2030. The increasing adoption of automation and digital transformation across industries is a major contributor as companies seek to enhance efficiency, reduce operational costs, and improve product quality.

Key Market Trends & Insights

- North America dominated with a revenue share of 33.96% in 2023.

- The industrial software market in the U.S. is expected to grow significantly from 2024 to 2030.

- By end-use, the process segment accounted for the largest market revenue share in 2023.

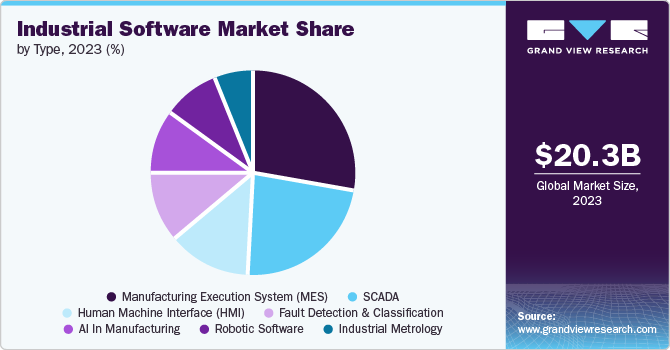

- By type, the Manufacturing Execution System (MES) segment led the market in 2023, accounting for a 28.22% global revenue share.

Market Size & Forecast

- 2023 Market Size: USD 20.35 Billion

- 2030 Projected Market Size: USD 60.91 Billion

- CAGR (2024-2030): 16.8%

- North America: Largest market in 2023

The rise of Industry 4.0 technologies, such as the Industrial Internet of Things (IIoT), artificial intelligence, and machine learning, also propels demand for advanced software solutions that can analyze data, optimize processes, and predict maintenance needs. Furthermore, the rapid expansion of cloud computing and the shift towards Software-as-a-Service (SaaS) models are also making industrial software more accessible to a broader range of businesses, including small and medium-sized enterprises.

The integration of industrial software, such as Supervisory Control and Data Acquisition (SCADA), robotic software, and Manufacturing Execution System (MES), with Product Lifecycle Management (PLM) and Enterprise Resource Planning (ERP) solutions offers significant growth opportunities for the market. This convergence enables seamless data flow and synchronization across various business processes, enhancing operational efficiency and decision-making. Integrating MES with ERP allows companies to gain real-time visibility into production operations, inventory management, and financials, leading to optimized resource utilization and cost savings.

In addition, linking MES with PLM improves the management of product development cycles, ensuring that manufacturing processes align with design specifications and quality standards. This comprehensive approach enhances production accuracy and speed while fostering innovation by providing a complete view of the product lifecycle from inception to delivery. As businesses increasingly seek integrated systems to boost agility and competitiveness, the demand for advanced industrial software solutions that support such integration is expected to grow, driving market expansion and innovation.

End-use Insights

The process segment accounted for the largest market revenue share in 2023.The process industries, including oil and gas, chemicals, pharmaceuticals, and food and beverages, require precise control and monitoring of complex operations, making industrial software essential for maintaining efficiency, safety, and regulatory compliance. The increasing adoption of automation, digitalization, and advanced analytics in these industries has significantly boosted the demand for specialized software solutions to optimize production processes, minimize downtime, and enhance product quality. Moreover, the need to manage and analyze vast amounts of data generated by process operations has further driven the adoption of industrial software in this segment.

The discrete segment is anticipated to exhibit the highest CAGR over the forecast period, driven by the increasing adoption of automation and advanced manufacturing technologies in industries such as automotive, aerospace, electronics, and machinery. These industries are characterized by producing distinct items or components, requiring precise control and flexibility in manufacturing processes. The rise of smart manufacturing and Industry 4.0 practices is pushing companies in the discrete sector to implement advanced industrial software solutions that enhance production efficiency, reduce lead times, and improve product quality. Furthermore, the growing demand for mass customization and the need for efficient supply chain management is fueling the adoption of software tools that enable real-time monitoring, analytics, and optimization of discrete manufacturing operations.

Type Insights

The Manufacturing Execution System (MES) segment led the market in 2023, accounting for a 28.22% global revenue share. MES solutions offer control, real-time monitoring, and optimization of manufacturing processes, greatly enhancing production quality, efficiency, and compliance with industry standards. As industries increasingly embrace smart manufacturing and Industry 4.0 practices, the demand for MES is rising. These systems enable seamless integration with essential enterprise systems like PLM and ERP, creating a more responsive and agile manufacturing environment. Furthermore, MES delivers valuable insights through data analytics, empowering manufacturers to minimize downtime, make informed decisions, and enhance overall operational performance.

The Human Machine Interface (HMI) segment is predicted to foresee significant growth in the coming years. The increasing adoption of automation and smart manufacturing practices across various industries is a primary driver, as HMIs play a crucial role in enabling seamless interaction between operators and machines. The rising demand for intuitive and user-friendly interfaces that enhance operational efficiency and reduce human error is fueling growth in this segment. In addition, integrating advanced technologies such as touchscreens, gesture controls, and voice recognition in HMIs elevates user experience, making them more effective and accessible.

Regional Insights

North America dominated with a revenue share of 33.96% in 2023. The region's strong presence in advanced manufacturing industries, including aerospace, automotive, and electronics, has fueled the demand for industrial software solutions that enhance operational efficiency and competitiveness. North America is also a hub for technological innovation, with significant investments in digital transformation, automation, and Industry 4.0 practices. The region's well-established infrastructure, combined with the presence of leading software providers and technology companies, has further supported the widespread adoption of industrial software. Moreover, the emphasis on sustainability and energy efficiency in manufacturing processes has driven the integration of advanced software solutions that monitor and optimize resource use.

U.S. Industrial Software Market Trends

The industrial software market in the U.S. is expected to grow significantly from 2024 to 2030. The U.S. is also at the forefront of adopting Industry 4.0 technologies, including automation, IoT, and AI, which require robust software platforms for seamless integration and operation. Moreover, major technology companies and industrial software providers in the U.S. have accelerated the development and deployment of cutting-edge solutions.

Europe Industrial Software Market Trends

The industrial software market in Europe is expected to witness significant growth over the forecast period. The region's focus on energy efficiency and environmental regulations also propels the demand for industrial software that optimizes resource use and reduces emissions. Furthermore, government initiatives supporting innovation and digitalization, along with the presence of leading manufacturing and technology firms, are key factors driving robust growth in the European market.

Asia Pacific Industrial Software Market Trends

The industrial software market in Asia Pacific is anticipated to register rapid growth over the forecast period, driven by rapid industrialization, increasing adoption of automation, and the expansion of manufacturing sectors in countries like China, India, and Southeast Asia. The region's growing emphasis on smart manufacturing and Industry 4.0 technologies fuels the demand for advanced industrial software. In addition, the rise of e-commerce, electronics, and automotive industries in Asia Pacific, along with supportive government policies promoting digital transformation and innovation, further accelerates market growth.

Key Industrial Software Company Insights

Key industrial software companies, including ABB, Rockwell Automation, and Emerson Electric Co., are expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in May 2024, Forterro, a provider of highly specialized software products and services, announced the launch of Fortee in the UK. This entry-level, cloud-based ERP solution is tailored to meet the needs of industrial startups and SME discrete manufacturers. Fortee is built upon 15 years of expertise in cloud ERP, incorporating extensive learning and insights gained over the years.

Key Industrial Software Companies:

The following are the leading companies in the industrial software market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Rockwell Automation

- Emerson Electric Co.

- General Electric Company

- Honeywell International, Inc.

- SAP SE

- OMRON Corporation

- Hexagon AB

- Siemens

- Oracle

Recent Developments

-

In May 2024, Accenture announced the acquisition of Teamexpat, a specialist in embedded software for complex high-tech systems and products. Teamexpat is particularly known for its expertise in software testing, development, and integration for lithography systems utilized in the semiconductor industry. These systems employ ultraviolet light to project intricate patterns onto semiconductor materials, which is crucial for defining microchip performance.

-

In January 2024, ABB announced its agreement to acquire a majority stake in the software service provider Meshmind. This acquisition aims to enhance ABB's research and development capabilities in AI, Industrial IoT, and machine vision. By integrating Meshmind's engineering talent, AI expertise, and software knowledge, ABB will establish a new global R&D hub. This move is intended to accelerate the development of innovative automation solutions within ABB's Machine Automation division (B&R).

-

In December 2022, Schneider Electric, a prominent player in digital transformation for energy management and automation, unveiled the latest version of EcoStruxure Automation Expert. This update enhances the world’s first software-centric universal automation system, offering advanced automation capabilities to industries such as consumer-packaged goods, logistics, and water and wastewater operations. With EcoStruxure Automation Expert, these sectors gain next-generation automation features and unparalleled operational flexibility.

Industrial Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.01 billion

Revenue forecast in 2030

USD 60.91 billion

Growth rate

CAGR of 16.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ABB; Rockwell Automation; Emerson Electric Co.; General Electric Company; Honeywell International, Inc.; SAP SE; OMRON Corporation; Hexagon AB; Siemens; Oracle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global industrial software market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing Execution System (MES)

-

SCADA

-

Human Machine Interface (HMI)

-

AI in Manufacturing

-

Robotic Software

-

Fault Detection & Classification

-

Industrial Metrology

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Process

-

Oil & Gas

-

Chemicals

-

Pulp & Paper

-

Pharmaceuticals

-

Mining & Metals

-

Energy & Power

-

Others

-

-

Discrete

-

Automotive

-

Semiconductor & Electronics

-

Aerospace & Defense

-

Heavy Manufacturing

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global industrial software market size was estimated at USD 20.35 billion in 2023 and is expected to reach USD 24.01 billion in 2024.

b. The global industrial software market is expected to grow at a compound annual growth rate of 16.8% from 2024 to 2030 to reach USD 60.91 billion by 2030.

b. North America dominated the industrial software market with a share of 34.0% in 2023. The region's strong presence in advanced manufacturing industries, including aerospace, automotive, and electronics, has fueled the demand for industrial software solutions that enhance operational efficiency and competitiveness.

b. Some key players operating in the industrial software market include ABB, Rockwell Automation, Emerson Electric Co., General Electric Company, Honeywell International, Inc., SAP SE, OMRON Corporation, Hexagon AB, Siemens, and Oracle.

b. Key factors driving the industrial software market growth include the shift towards digitalization and automation in manufacturing and industrial processes, and the implementation of Industry 4.0 technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.