- Home

- »

- Food Safety & Processing

- »

-

Liquid Packaging Cartons Market Size, Industry Report, 2033GVR Report cover

![Liquid Packaging Cartons Market Size, Share & Trends Report]()

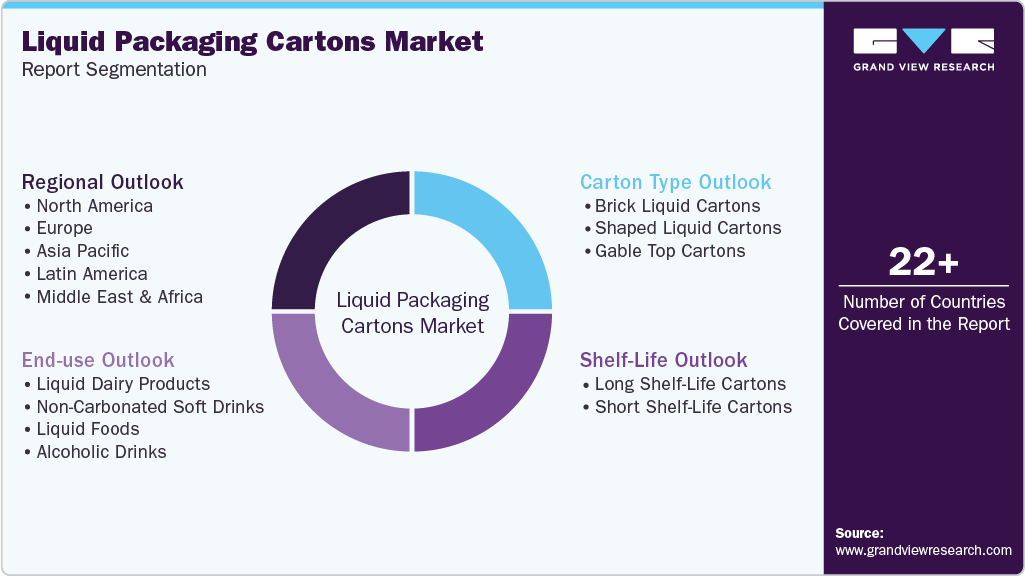

Liquid Packaging Cartons Market (2025 - 2033) Size, Share & Trends Analysis Report By Carton Type (Brick Liquid Cartons, Shaped Liquid Cartons, Gable Top Cartons), By Shelf-Life (Long Shelf-Life Cartons, Short Shelf-Life Cartons), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-682-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Packaging Cartons Market Summary

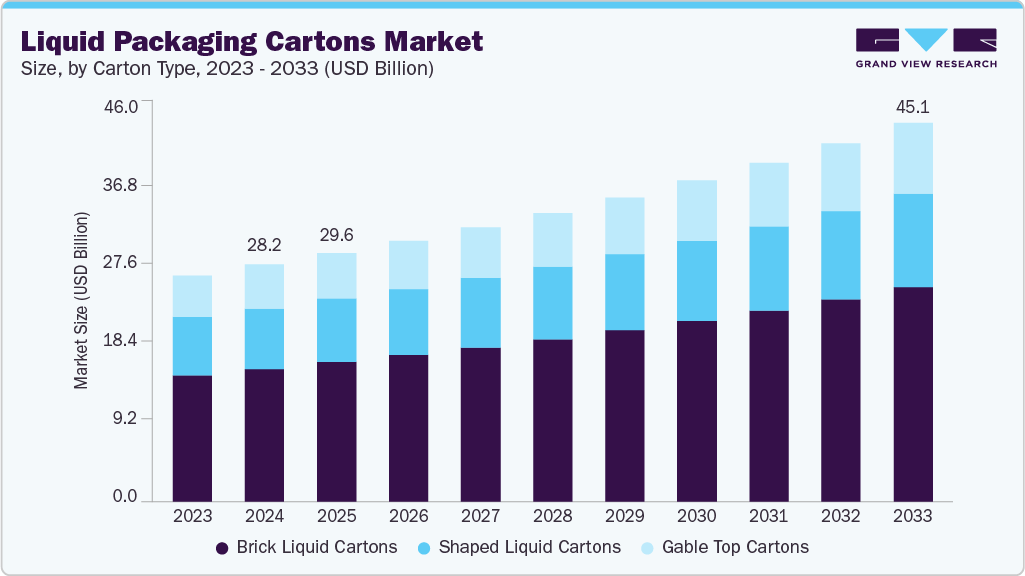

The global liquid packaging cartons market size was estimated at USD 28.17 billion in 2024 and is projected to reach USD 45.11 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market is driven by the rising demand for sustainable and eco-friendly packaging solutions and the growing consumption of packaged beverages such as milk, juices, and plant-based drinks.

Key Market Trends & Insights

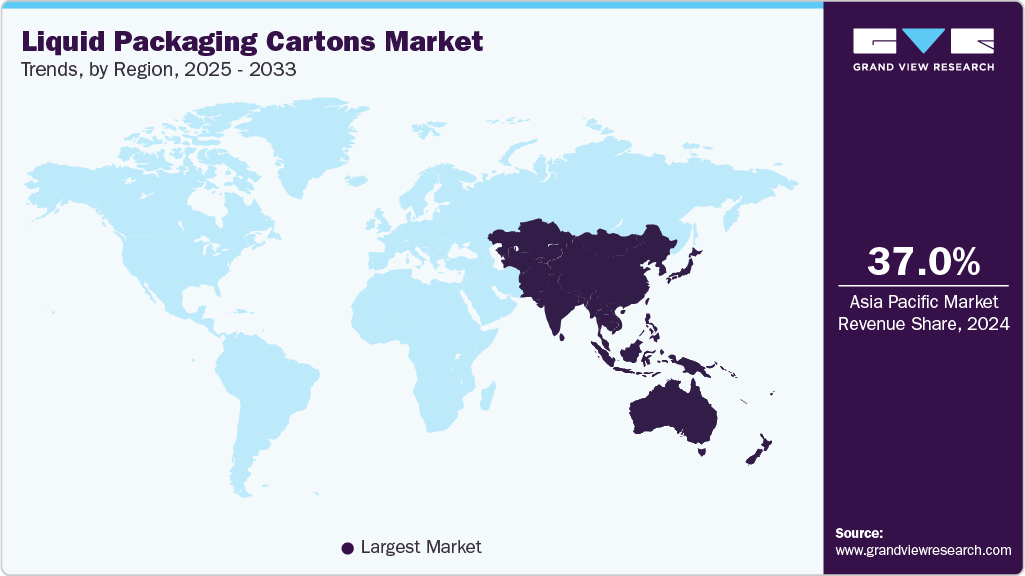

- Asia Pacific dominated the liquid packaging cartons market with the largest revenue share of over 37.0% in 2024.

- The liquid packaging cartons market in China is expected to grow at a substantial CAGR of 6.1% from 2025 to 2033.

- By carton type, the brick liquid cartons segment recorded the largest market revenue share of over 56.0% in 2024.

- By shelf life, the long shelf-life cartons segment recorded the largest market revenue share of over 68.0% in 2024.

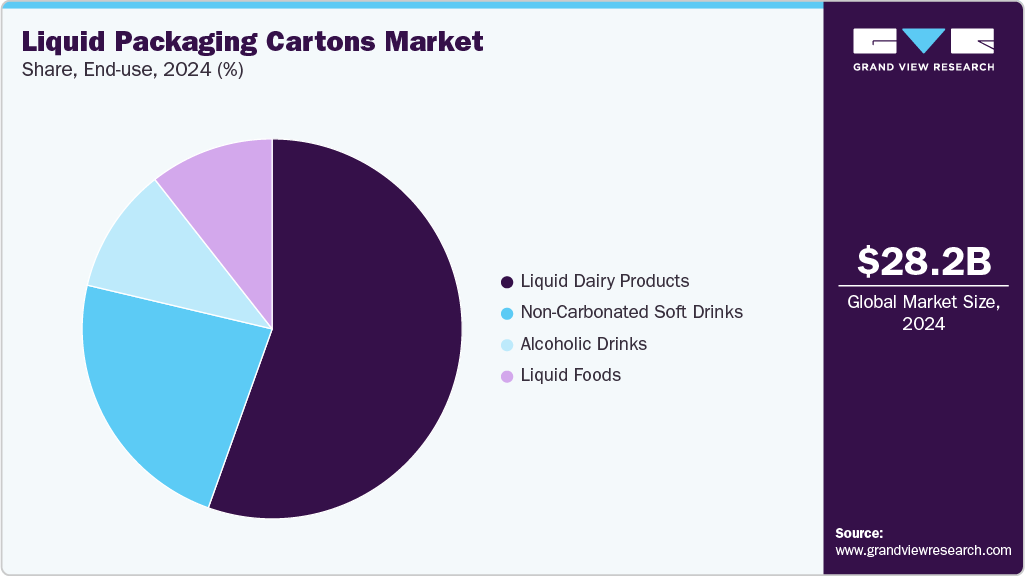

- By end-use, the liquid dairy products segment recorded the largest market share of over 55.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.17 Billion

- 2033 Projected Market Size: USD 45.11 Billion

- CAGR (2025-2033): 5.4%

- Asia Pacific: Largest market in 2024

Technological advancements in aseptic packaging and increased urbanization further boost market growth. Consumers and regulatory bodies alike are pushing for a reduction in plastic usage, prompting manufacturers to adopt renewable and recyclable materials. Liquid cartons, often made from paperboard with thin layers of polyethylene and aluminum for barrier protection, are perceived as an eco-friendlier alternative to plastic bottles and pouches. For instance, companies such as Tetra Pak have introduced plant-based cartons with reduced carbon footprints, meeting consumer demand for green packaging. This sustainability appeal is a key factor propelling market growth, especially in regions such as Europe, where environmental consciousness is high.

The growing consumption of ready-to-drink (RTD) beverages, dairy products, and non-carbonated drinks. As lifestyles become busier, consumers increasingly prefer portable, lightweight, and easy-to-store packaging formats. Liquid cartons are ideal for products like milk, fruit juices, iced tea, and functional beverages, offering convenience without compromising on shelf stability. For example, brands such as Tropicana and Minute Maid utilize aseptic carton packaging for their juice lines, ensuring long shelf life without refrigeration. The growth of the health and wellness trend is also fueling demand for nutrient-rich beverages, further boosting the use of liquid cartons.

The expansion of organized retail and e-commerce platforms has also played a pivotal role in boosting the liquid packaging cartons market. With the growing penetration of supermarkets, hypermarkets, and online grocery channels, there's increased visibility and accessibility of packaged beverages. Liquid cartons, being stackable and lightweight, are cost-effective to transport and display. This is especially beneficial in emerging economies such as India, Brazil, and Indonesia, where modern trade channels are expanding rapidly. The ability to print high-quality graphics on cartons also enhances shelf appeal, making them a preferred choice for brand differentiation and marketing.

Technological advancements in aseptic packaging and filling machinery are further accelerating the adoption of liquid cartons. Modern filling machines can handle high-speed production while ensuring sterile conditions, extending product shelf life without preservatives. Innovations such as screw caps, reclosable spouts, and paper-based barrier coatings enhance functionality and recyclability. Companies such as SIG and Elopak are investing in new packaging formats and materials to meet evolving industry standards. These innovations not only improve product safety and quality but also align with circular economy goals, reinforcing the market’s growth trajectory.

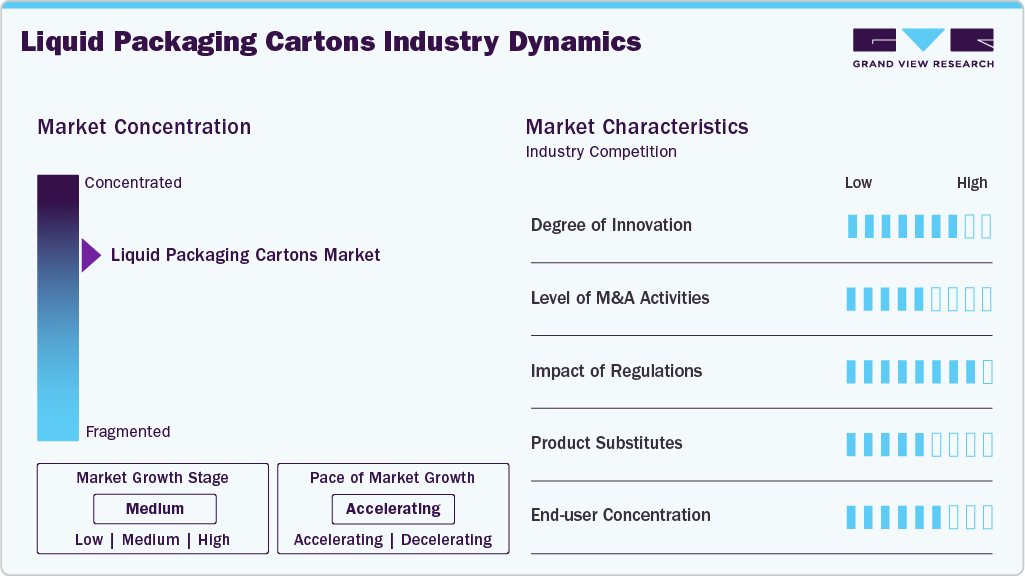

Market Concentration & Characteristics

The market experiences continuous innovation, particularly in sustainability and barrier technology. Companies are developing bio-based coatings, fully recyclable cartons, and advanced aseptic filling systems. For instance, Tetra Pak and Elopak are introducing plant-based polymers and paperboard alternatives to improve environmental performance.

Mergers and acquisitions are occurring as key players aim to strengthen their global reach and diversify product portfolios. Strategic partnerships between packaging converters, filling machine manufacturers, and beverage producers are also common. For instance, in August 2022, SIG acquired Evergreen Asia, Pactiv Evergreen’s chilled carton business, for USD 335.0 million, expanding its presence in China, Taiwan, and South Korea. The deal boosts SIG’s growth in Asia’s dairy market and strengthens its sustainable packaging offerings.

The market is highly regulated, especially in food and beverage applications, due to health and safety requirements. In addition, environmental regulations in the EU and North America are pushing companies to adopt recyclable and renewable materials. Compliance with FDA, EFSA, and other local food safety authorities is mandatory.

Carton Type Insights

The brick liquid cartons segment recorded the largest market revenue share of over 56.0% in 2024. Brick liquid cartons are rectangular or square-shaped cartons commonly used for long shelf-life products such as UHT milk, juices, and soups. These cartons are known for their space efficiency in transport and storage and are typically made from paperboard with barrier layers of plastic or aluminum to preserve the contents without refrigeration. Brick cartons are driven by the rising demand for aseptic packaging, particularly in developing countries where cold chain logistics are limited. Their compact design reduces logistic costs and maximizes shelf space, making them ideal for supermarkets and retail environments.

The gable top cartons segment is expected to grow at the fastest CAGR of 5.8% during the forecast period. Gable top cartons are characterized by their foldable top that forms a spout-like closure, making them easy to open and reseal. These cartons are widely used for chilled products such as fresh milk, juices, and liquid dairy alternatives. They are typically made from paperboard with a polyethylene coating for moisture resistance and are often found in refrigerated sections of retail outlets. The growth of the gable top carton segment is closely linked to the rising consumption of fresh, refrigerated beverages such as plant-based milks and cold-pressed juices.

Shelf-Life Insights

The long shelf-life cartons segment recorded the largest market revenue share of over 68.0% in 2024. Long shelf-life cartons, also known as aseptic cartons, are designed to preserve liquid products such as milk, juice, soups, and plant-based beverages for extended periods-typically 6 to 12 months-without refrigeration. These cartons are manufactured using multi-layer materials that include paperboard, aluminum foil, and polyethylene, which together provide excellent barrier properties against light, oxygen, and microorganisms. This packaging is widely used for products that need to be stored and transported over long distances without relying on cold chain infrastructure. The key driver for long shelf-life cartons is the growing demand for ambient storage solutions, particularly in emerging economies with limited access to refrigeration and cold chain logistics.

The short shelf-life cartons segment is expected to grow at the fastest CAGR of 5.9% during the forecast period. Short shelf-life cartons are mainly used for fresh liquid products that require refrigeration and are typically consumed within a few days to a few weeks after opening. These cartons are common in products like fresh milk, fresh juices, and other perishable dairy beverages. They are made primarily from paperboard and coated with plastic, offering basic protection against contamination while being cost-effective and recyclable. The demand for short shelf life cartons is largely driven by the increasing consumption of fresh and minimally processed beverages in urban markets.

End-use Insights

The liquid dairy products segment recorded the largest market share of over 55.0% in 2024. Liquid dairy products such as milk, flavored milk, yogurt drinks, and cream are the dominant end-use category for liquid packaging cartons. These products are often packaged in aseptic or gable-top cartons, offering long shelf life without refrigeration and preserving nutritional content. Major brands such as Amul, Lactalis, and Nestlé rely heavily on carton packaging for ambient and chilled dairy distribution. The increasing demand for safe, shelf-stable dairy products in both developed and emerging economies drives this segment.

The alcoholic drinks segment is projected to grow at the fastest CAGR of 7.8% during the forecast period. Though relatively niche, this segment is gaining traction with products such as wine, cocktails, and traditional liquors being packaged in cartons, particularly in portable, single-serve formats. Some markets in Europe and Asia are exploring carton packaging for boxed wine and travel-friendly alcohol options. In addition, consumer interest in casual, on-the-go alcoholic beverages and premium boxed wine is supporting the segment’s expansion, especially in urban retail formats and duty-free sales.

Region Insights

Asia Pacific liquid packaging cartons market dominated the global market and accounted for the largest revenue share of over 37.0% in 2024 and is expected to grow at the fastest CAGR of 6.0% over the forecast period. This positive outlook is due to rapid urbanization, the growing middle class, and increasing demand for packaged beverages such as milk, juices, and dairy alternatives. Countries such as India and China are witnessing a surge in consumption due to rising health awareness and convenience trends. For instance, in India, companies such as Tetra Pak and SIG are expanding their production capacities to meet the demand for sustainable and shelf-stable packaging. In addition, government initiatives promoting food safety and environmental sustainability are accelerating the shift from plastic to carton-based packaging. The region’s e-commerce boom also supports the growth of liquid cartons, as online grocery platforms prefer lightweight, durable, and eco-friendly packaging solutions.

China liquid packaging cartons market is the largest and fastest-growing market, fueled by rising disposable incomes, urbanization, and government policies promoting food safety and sustainability. The dairy industry, led by companies such as Yili and Mengniu, heavily relies on aseptic cartons for UHT milk distribution across vast regions. E-commerce giants like Alibaba and JD.com also drive demand, as cartons are preferred for online grocery deliveries due to their lightweight and tamper-proof nature.

North America Liquid Packaging Cartons Market Trends

North America’s liquid packaging carton market is driven by high demand for plant-based beverages, organic dairy products, and ready-to-drink (RTD) beverages. The U.S. and Canada are leading due to consumer preference for sustainable packaging and stringent regulations on single-use plastics. For instance, Evergreen Packaging and Elopak provide aseptic cartons for brands such as Silk (plant-based milk) and Juicy Juice, catering to eco-conscious consumers. The region’s well-established retail infrastructure and cold chain logistics further support the adoption of liquid cartons for extended shelf-life products.

U.S. Liquid Packaging Cartons Market Trends

The U.S. dominates the North American liquid carton market, driven by the booming demand for alternative dairy products, functional beverages, and sustainable packaging solutions. Major brands such as The Coca-Cola Company (Fairlife milk) and Danone (Horizon Organic) use cartons to appeal to environmentally conscious consumers. The U.S. recycling infrastructure is improving, with initiatives such as the Carton Council promoting carton recycling programs. In addition, the rise of private-label products in retail chains such as Costco and Walmart has increased carton adoption due to cost efficiency and extended shelf life.

Europe Liquid Packaging Cartons Market Trends

Europe liquid packaging cartons market is driven by strict environmental regulations, high recycling rates, and consumer preference for sustainable packaging. The European Union’s Single-Use Plastics Directive (SUPD) has accelerated the shift toward paper-based cartons, particularly in countries such as Germany, France, and Sweden. Companies such as Tetra Pak and Stora Enso are investing in renewable and recyclable materials to meet circular economy goals. For example, in Sweden, Arla Foods uses plant-based cartons for its organic milk, emphasizing carbon-neutral packaging. The region’s well-developed waste management systems ensure high carton recycling rates (over 50% in many countries), reinforcing the sustainability appeal of liquid cartons. Additionally, the growing demand for lactose-free and functional beverages is boosting carton usage in the dairy and juice segments.

Key Liquid Packaging Cartons Company Insights

The competitive environment of the liquid packaging carton market is moderately consolidated, with a few major players dominating global market share while regional and niche manufacturers also maintain a significant presence. Major companies such as Tetra Pak, SIG, and Elopak compete intensely on innovation, sustainability, and cost-efficiency, particularly by offering lightweight, recyclable, and aseptic packaging solutions tailored for dairy, juice, and liquid food industries. These companies heavily invest in R&D and partnerships with beverage producers to maintain technological leadership and brand loyalty. Meanwhile, local players in Asia-Pacific and Latin America are increasingly entering the market with cost-competitive offerings, intensifying price competition, and encouraging broader innovation in packaging formats and materials.

Key Liquid Packaging Cartons Companies:

The following are the leading companies in the liquid packaging cartons market. These companies collectively hold the largest market share and dictate industry trends.

- Tetra Pak International S.A.

- SIG

- Elopak

- Mondi

- Nippon Paper Industries Co., Ltd.

- UFlex Limited

- IPI S.r.l.

- Greatview Aseptic Packaging Company Limited

- WestRock Company

- Heli Packaging Technology (Qingzhou) Co., Ltd

- Parksons Packaging Ltd.

Recent Developments

-

In July 2025, SIG launched the world’s first aseptic 1-liter carton pack that offers full barrier protection without an aluminum layer, reducing the carbon footprint by up to 61%. Made from over 80% paper and renewable materials, the sustainable packaging maintains up to 12 months of shelf life and works with existing filling lines. This innovation supports oxygen-sensitive products like juices and plant-based drinks and is now available globally following SIG’s new aseptic carton plant opening in India.

-

In July 2025, Greatview, a global supplier of aseptic carton packaging solutions, opened a new manufacturing facility in Perugia, Italy, through its major shareholder NewJF International. This strategic expansion aims to meet the increasing demand for high-quality, sustainable aseptic carton packaging specifically for liquid food products such as dairy in Europe. The new plant addresses the growing need for European-produced, environmentally conscious packaging, offering customers a reliable and competitive option while reinforcing Greatview’s commitment to sustainability and local sourcing.

Liquid Packaging Cartons Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.56 billion

Revenue forecast in 2033

USD 45.11 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Carton type, shelf-life, end-use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Tetra Pak International S.A.; SIG; Elopak; Mondi; Nippon Paper Industries Co., Ltd.; UFlex Limited; IPI S.r.l.; Greatview Aseptic Packaging Company Limited; WestRock Company; Heli Packaging Technology (Qingzhou) Co., Ltd.; Parksons Packaging Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Packaging Cartons Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global liquid packaging cartons market report based on carton type, shelf-life, enduse, and region:

-

Carton Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Brick Liquid Cartons

-

Shaped Liquid Cartons

-

Gable Top Cartons

-

-

Shelf-Life Outlook (Revenue, USD Million, 2021 - 2033)

-

Long Shelf-Life Cartons

-

Short Shelf-Life Cartons

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid Dairy Products

-

Non-Carbonated Soft Drinks

-

Liquid Foods

-

Alcoholic Drinks

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global liquid packaging cartons market was estimated at around USD 28.17 billion in the year 2024 and is expected to reach around USD 29.56 billion in 2025.

b. The global liquid packaging cartons market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach around USD 45.11 billion by 2033.

b. Liquid dairy products segment emerged as the dominating end use segment in the liquid packaging cartons market due to their high daily consumption and need for extended shelf life.

b. The key players in the liquid packaging cartons market include Tetra Pak International S.A.; SIG; Elopak; Mondi; Nippon Paper Industries Co., Ltd.; UFlex Limited; IPI S.r.l.; Greatview Aseptic Packaging Company Limited; WestRock Company; Heli Packaging Technology (Qingzhou) Co., Ltd.; and Parksons Packaging Ltd.

b. The liquid packaging cartons market is driven by the rising demand for sustainable and eco-friendly packaging solutions and the growing consumption of packaged beverages like milk, juices, and plant-based drinks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.