- Home

- »

- Consumer F&B

- »

-

Longevity And Anti-aging Brain Health Supplements Market Report 2030GVR Report cover

![Longevity And Anti-aging Brain Health Supplements Market Size, Share & Trends Report]()

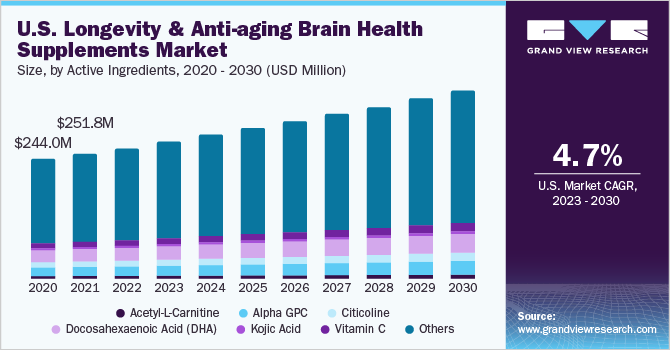

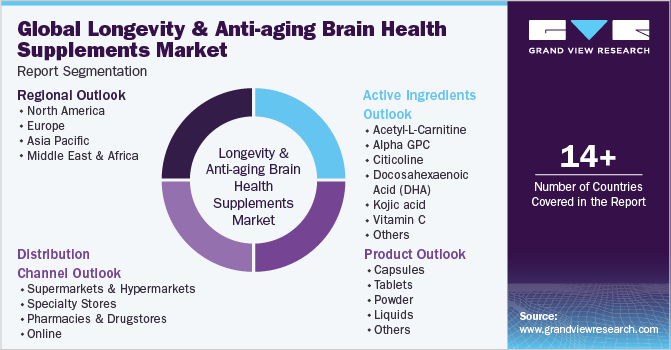

Longevity And Anti-aging Brain Health Supplements Market Size, Share & Trends Analysis Report By Active Ingredients (Citicoline, DHA), By Distribution Channel (Specialty Stores, Online), By Product, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-130-4

- Number of Report Pages: 113

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

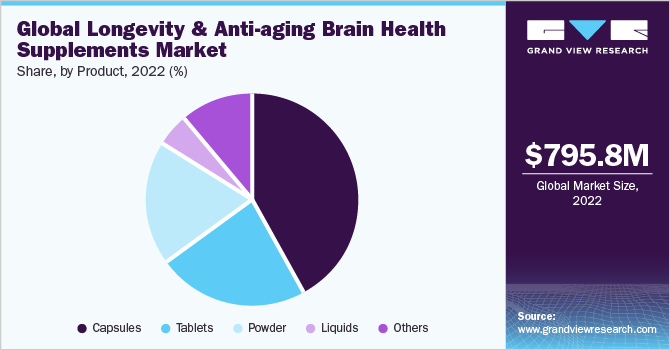

The global longevity and anti-aging brain health supplements market size was estimated at USD 795.8 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The global market is anticipated to witness significant growth in the next few years on account of the rising number of self-directed consumers, growing product awareness among millennials, and rapid modernization in this field. In addition, rising cost-effectiveness and accessibility to these products are expected to boost the market growth. Rising demand for multi-efficacy drugs that work as energy boosters, antidepressants, brain enhancers, and anxiety resistance is expected to drive R&D activity in this market.

Moreover, increasing demand within the sports industry to improve brain efficacy is expected to generate growth opportunities for the global market. People associated with academic and professional arenas are expected to contribute to the product demand over the next few years. In addition, these products are likely to gain high acceptance among people suffering from various brain ailments, such as depression, dementia, anxiety, and insomnia. According to an article published by the World Health Organization (WHO) in September 2021, approximately 280 million people of all ages suffer from depression at a global level. In the U.S., anxiety disorder is one of the most common mental illnesses among people.

As per an article published by the Anxiety & Depression Association of America in October 2022, approximately 19.1% of the adult population, which is 40 million people, in the U.S. suffered from anxiety. Increasing awareness about mental illnesses is expected to widen the scope of application for longevity & anti-aging brain health supplements in the near future. According to a study published by the National Center for Biotechnology Information, factors, such as continuous stress, lack of sleep, fast-paced lifestyle, and long working hours are expected to affect the quality of life, which, in turn, is anticipated to drive the product demand in the country. Over the past few years, there has been a shift in consumer preference toward herbal health supplements containing caffeine, matcha tea, spinach, beets, Brahmi, arctic root, turmeric, ginseng, and pine bark.

According to the American Council on Exercise (ACE), as of 2020, 50% of consumers in the U.S. prefer purchasing products containing natural ingredients. With an increase in consumer demand for herbal brain health supplements, producers are developing products created from a blend of chemical substances as well as herbs. For instance, in May 2022, Novos Labs, a New York-based health and nutrition supplier and retailer, launched NOVOS Core. A 'multivitamin' for longevity, with 12 ingredients formulated to slow down different signs of aging and promote cognition. It contains ingredients, such as Rhodiola rosea (salidroside), magnesium malate, ginger, and vitamin C.

Active Ingredients Insights

The other active ingredients segment held the largest share of 70.8% in 2022. Other types of active ingredients include ginkgo biloba, Vitamin B, curcumin, and coenzyme Q10. Factors, such as rising cases of psychological distress and increased awareness about brain health are driving the demand for these ingredients. According to the U.S. Department of Health & Human Services, in 2020, 11.2% of adults aged above 18 years faced feelings of anxiety, worry, and nervousness. The use of ingredients, such as curcumin and ginkgo biloba, can help reduce age-related decline in brain function, owing to which they are increasingly used for brain health supplements.

The citicoline active ingredients segment is projected to grow at a CAGR of 8.2% from 2023 to 2030. Increasing awareness about the role of nutrition and bioactives in cognitive function, coupled with growing consumer interest in proactively improving health, is supporting the demand for supplements containing citicoline. The rising number of companies marketing citicoline as an important ingredient for brain health is supporting the growth of the segment. The use of citicoline in brain supplements helps in increasing ‘phosphatidylcholine,’ which is critical for brain function. Gamers and people associated with e-sports can benefit from the use of citicoline-based supplements.

Distribution Channel Insights

The supermarkets & hypermarkets segment dominated the global market in 2022 and accounted for the largest share of 38.5% of the overall revenue. Factors, such as a rise in disposable income coupled with a rise in bulk purchases in supermarkets & hypermarkets in driving the segment growth. Supermarkets and hypermarkets are the most popular form of distribution channels among consumers. The easy availability of several brands under one roof and product availability at a discounted rate are major factors driving interest in supermarkets and hypermarkets. In May 2022, Sydney-based Renovatio Bioscience expanded its supplement SKUs in Woolworths.

The company aims to launch its mental well-being and skin health supplements exclusively for the Woolworths supermarket chain. The online distribution channel segment is expected to register a CAGR of 7.7% from 2023 to 2030. Factors, such as a rise in internet penetration and consumer awareness about health supplements, are supporting the segment's growth. Manufacturers in the supplements industry are increasingly offering their products on company-owned portals and e-commerce websites to gain wide consumer traction. In addition, rapid digitalization is supporting the growth of online stores.

Product Insights

The capsule product segment accounted for the highest revenue share of 41.53% in 2022. The usage of capsules for the ingestion of supplements is rising. Factors, such as the ease of swallowing, as well as the tasteless and odorless nature of capsules, are driving product penetration. Capsules offer oil nutrient or fat-soluble delivery options that enclose dosage combinations. Furthermore, capsules offer more advantages over tablets, such as higher absorption rates, lesser irritation to the GI tract, and availability in various sizes based on dosage. Moreover, microencapsulation advancements in the supplement industry to control the release of active ingredients are acting as an opportunity for manufacturers to use capsule formats.

In May 2020, a UK-based wellness firm, Heights, announced a subscription-based service for the delivery of its omega-3 capsules. The capsule aims to improve brain health and includes ingredients, such as blueberry, DHA & EHA, vitamin C, folic acid, biotin, and vitamin D3. The other product segment is projected to grow at a CAGR of 8.4% from 2023 to 2030. Other product types include gummies and soft gels. Marketing initiatives undertaken by key players on various social media platforms have popularized gummies and are supporting the growth of this segment. In addition, soft gels are easier to swallow and can incorporate a variety of compounds in liquid, gel, or semi-solid formats, thereby boosting the segment growth.

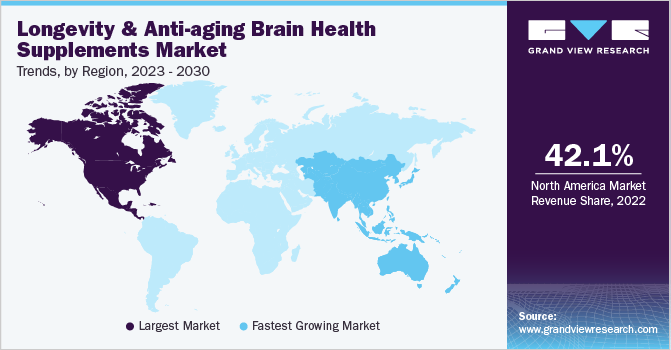

Regional Insights

North America dominated the market with a share of 42.10% in 2022. An increase in the use of products that improve cognitive health by consumers of various age groups is expected to fuel the market growth in this region. According to a survey conducted by the American Association of Retired Persons (AARP) on Brain Health and Dietary Supplements in June 2019, several Americans aged 50 years and older regularly consume brain health supplements owing to increasing concerns about their brain and cognitive health. These instances are expected to offer strong growth prospects to the regional market.

Furthermore, rising awareness regarding the consumption of these products in Mexico, on account of new product launches, is expected to drive the regional market growth. Online retailing is the most popular distribution method in the U.S., since it encourages dietary supplement sales via mobile and user-friendly websites, e-mails, paid marketing, affiliate marketing, and sponsored promotions via e-commerce websites. Online shopping is preferred by middle-aged and older individuals over in-store purchases. According to an article by Oberlo, there were 214.7 million online shoppers in the U.S. in 2022, with an average spending of USD 4,892 per person.

Growing private-label supplement brands may benefit from internet buying as it is less expensive. Furthermore, when compared to other marketing tactics, it takes less time to reach a wider customer base. However, Asia Pacific is expected to grow at the fastest CAGR of 9.4% from 2023 to 2030 due to the growing awareness about brain health supplements with antiaging properties and overall health. Changing lifestyles, increasing disposable incomes, and rapid urbanization contribute to increased product adoption.

Anti-aging brain health supplements with dietary fiber generally contain fruits, vegetables, cereals, and grains, all of which are abundant in the region. The abundance of raw ingredients benefits producers of functional foods. In India, rising disposable income, hectic lives, increased product penetration, and greater awareness about overall health are all driving product demand. Gut health and growing obesity concerns are the primary consequences of mental health problems, given that they are intricately intertwined with immune function, which is a huge concern for Indian consumers. As a result, significant growth in demand for probiotics, prebiotics, and symbiotic-infused goods is anticipated in the future.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key market players are focusing on strategies, such as new product launches, partnerships, mergers & acquisitions, global expansions, and others. Some of the initiatives include:

-

In April 2020, NOW became a part of PETA's Beauty Without Bunnies initiative, allowing customers to easily identify that all NOW’s personal care items and essential oils are cruelty-free and have not been tested on animals

-

In November 2020, HVMN Inc. received funding of USD 5.5 million. The funds will be used to accelerate research and development of ketosis-related nutrition technologies and products

Some of the key players operating in the global longevity & anti-aging brain health supplements market include:

-

NOW Foods

-

Life Extension

-

NOVOS Labs

-

Purelife Biosciences Co., Ltd.

-

Alternascript

-

Natrol LLC

-

HVMN Inc.

-

Procera Health

-

RENUE BY SCIENCE, Inc.

-

Onnit Labs, Inc

-

Nootropics Depot

-

NAD Lab UK Ltd.

-

Quincy Bioscience

-

X115

-

Accelerated Intelligence Inc.

-

Natural Factors Nutritional Products Ltd,

-

Liquid Health, Inc.

-

VitaminExpress

Longevity And Anti-aging Brain Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 849.4 million

Revenue forecast in 2030

USD 1,350.6 million

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Active ingredients, product, distribution channel, region

Regional scope

North America; Europe; Middle Eastand Africa; Asia Pacific

Country scope

U.S.; UK; Germany; France; Italy; Spain; India

Key companies profiled

NOW Foods; Life Extension; NOVOS Labs; Purelife Biosciences Co., Ltd.; Alternascript; Natrol LLC; HVMN Inc.; Procera Health; RENUE BY SCIENCE, Inc.; Onnit Labs, Inc.; Nootropics Depot; NAD Lab UK Ltd.; Quincy Bioscience; X115; Accelerated Intelligence Inc.; Natural Factors Nutritional Products Ltd.; Liquid Health, Inc.; VitaminExpress

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Longevity And Anti-Aging Brain Health Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the longevity & anti-aging brain health supplements market report on the basis of active ingredients, products, distribution channel, and region:

-

Active Ingredients Outlook (Revenue, USD Million, 2017 - 2030)

-

Acetyl-L-Carnitine

-

Alpha GPC

-

Citicoline

-

Docosahexaenoic Acid (DHA)

-

Kojic acid

-

Vitamin C

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Capsules

-

Tablets

-

Powder

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Pharmacies & Drugstores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global longevity and anti-aging brain health supplements market size was estimated at USD 795.8 million in 2022 and is expected to reach USD 849.4 million in 2023.

b. The global longevity and anti-aging brain health supplements market is expected to grow at a compounded growth rate of 6.8% from 2023 to 2030 to reach USD 1,350.6 million by 2030.

b. In terms of revenue, Docosahexaenoic Acid (DHA) held a market share of 10.42% in 2022. The rise in innovation and marketing initiatives by manufacturers to promote brain health supplements containing omega-3 fatty acids is driving the growth of the segment. DHA (Docosahexaenoic acid) is an omega-3 fatty acid, which aims at improving brain function. For instance, U.S.-based Nordic Naturals offers the Ultimate Omega range for brain health and wellness. The supplement is sourced from sardines and anchovies.

b. Some key players operating in longevity and anti-aging brain health supplements market are NOW Foods, Life Extension, NOVOS Labs Purelife biosciences Co., Ltd, Alternascript, Natrol LLC, HVMN Inc., Procera Health, RENUE BY SCIENCE, Inc., Onnit Labs, Inc, Nootropics Depot, NAD Lab UK Ltd., Quincy Bioscience, X115, Accelerated Intelligence Inc., Natural Factors Nutritional Products Ltd, Liquid Health, Inc., VitaminExpress

b. Rising demand for multi-efficacy drugs that work as energy boosters, antidepressants, brain enhancers, and anxiety resistance is expected to drive R&D activity in this market. Moreover, increasing demand within the sports industry to improve brain efficacy is expected to generate growth opportunities for the global market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."