- Home

- »

- Advanced Interior Materials

- »

-

Magnetic Separation In Mining Market, Industry Report, 2033GVR Report cover

![Magnetic Separation In Mining Market Size, Share & Trends Report]()

Magnetic Separation In Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Iron Ore & Magnetite Beneficiation, Base Metals, Coal Processing, Industrial Minerals), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-800-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Magnetic Separation In Mining Market Summary

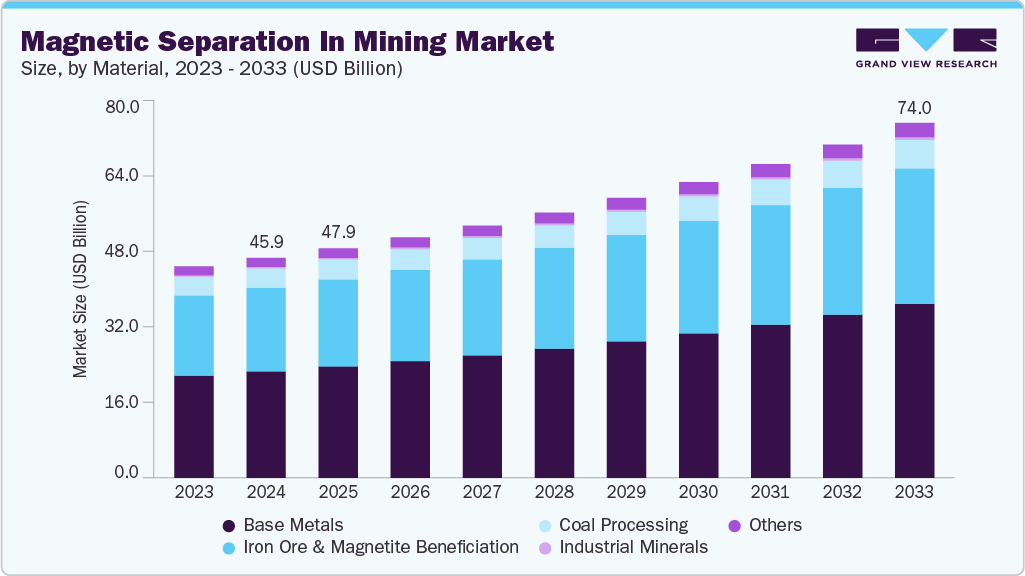

The global magnetic separation in mining market size was estimated at USD 45.89 billion in 2024 and is projected to reach USD 74.01 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The industry involves technologies and equipment used to separate magnetic minerals from non-magnetic materials to enhance ore purity and recovery efficiency.

Key Market Trends & Insights

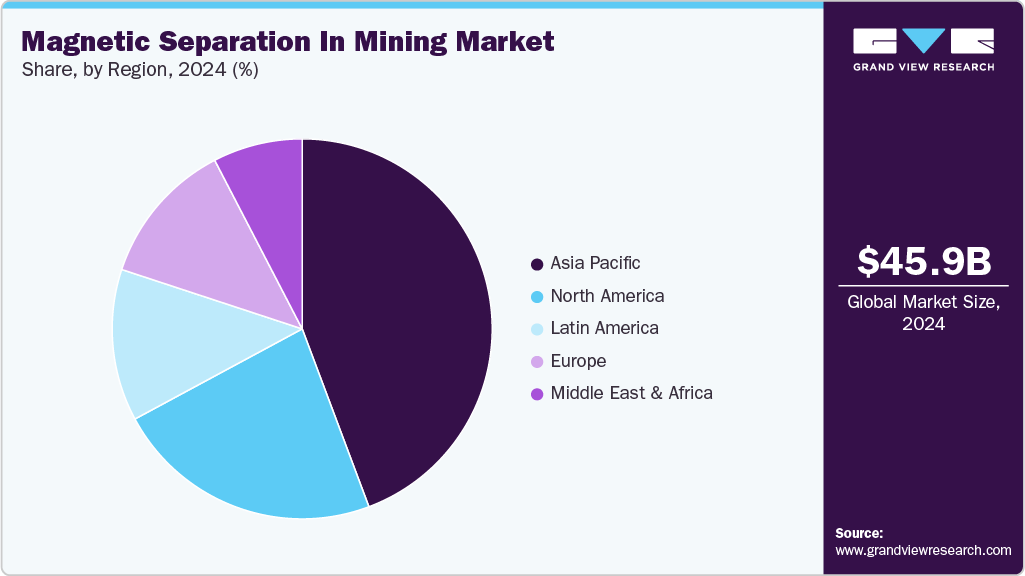

- Asia Pacific dominated the magnetic separation in mining market with the largest revenue share of 44.2%.

- The U.S. magnetic separation in mining industry is experiencing strong growth, driven by the expansion of domestic mining and mineral processing operations.

- By material, the base metals accounted for the largest revenue share of 48.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 45.89 Billion

- 2033 Projected Market Size: USD 74.01 Billion

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

The market is expanding rapidly, driven by the global surge in demand for essential minerals and metals that power modern technologies and infrastructure. As industries transition toward clean energy systems, electric vehicles, and urban development, the need for minerals such as magnetite, hematite, and rare earth elements has intensified. Magnetic separation innovations are projected to increase mineral extraction efficiency by 30% by 2025, underscoring the growing importance of this technology for mining companies facing declining ore grades and rising cost pressures.Magnetic separation enhances recovery rates and ensures consistent feedstock quality for downstream processes, including steelmaking, battery materials, and catalyst production. Traditional separators had a limited ability to recover fine or weakly magnetic minerals, but modern systems, such as high-gradient and superconducting magnetic separators, have transformed performance standards. These advanced systems capture ultra-fine particles and effectively separate valuable minerals from complex or low-grade ores that were once considered uneconomical. This advancement extends mine life, enhances resource recovery, and minimizes waste generation. As mining operations encounter deeper and more challenging ore bodies, the ability to extract valuable materials with precision and minimal loss has made magnetic separation one of the most indispensable tools in modern mineral processing.

Automation and digitalization are transforming the operation of magnetic separation systems within mining facilities. The integration of real-time sensors, AI-based control algorithms, and data-driven monitoring systems enables operators to dynamically adjust magnetic field strength, feed rate, and moisture control, thereby maintaining optimal separation efficiency. These technologies not only improve throughput but also reduce operational downtime through the use of predictive maintenance. Automated control frameworks help optimize plant performance, reduce energy consumption, and minimize human error. The digital transformation of mining operations, with magnetic separation at its core, is enabling companies to achieve higher productivity, consistent product quality, and improved cost management.

Sustainability has also become a crucial growth factor influencing the adoption of magnetic separation. Unlike flotation or chemical-based methods, magnetic separation is a cleaner and more resource-efficient process that uses less water and energy. This characteristic makes it an attractive choice for mining firms seeking to reduce their environmental footprint and meet global sustainability targets. Moreover, it enables recovery of valuable minerals from mine tailings, slag, and industrial waste streams, turning potential environmental liabilities into economic opportunities. The technology’s contribution to resource recycling and reduced carbon intensity aligns with global goals for greener and more responsible mining practices.

Ongoing research and development are shaping the next wave of innovation in magnetic separation. Companies and research institutes are investing in the development of nanomaterials and hybrid magnetic-fluid systems that can achieve higher precision and adaptability. Modular designs are being created for remote and small-scale mining operations, allowing flexibility in installation and use. Future systems are expected to integrate magnetic separation with complementary techniques such as gravity and sensor-based sorting to handle a broader range of mineral types.

Drivers, Opportunities & Restraints

The primary drivers of magnetic separation in the mining market include the growing demand for efficient mineral beneficiation and the increasing emphasis on sustainable mining operations. Magnetic separation helps improve ore grade by efficiently removing impurities, thereby reducing energy and water consumption during processing. Rising environmental awareness and stricter regulations have further encouraged mining operators to adopt magnetic separation as a cleaner alternative to chemical-intensive processing methods.

Opportunities in the market are emerging from the rising demand for rare earth elements and the integration of automation and artificial intelligence in mineral processing systems. As the electric vehicle, renewable energy, and advanced electronics industries grow, the demand for rare earth and specialty metals is increasing rapidly. This trend is creating strong prospects for magnetic separation equipment used in processing these complex ores. Additionally, the adoption of smart monitoring and automated control technologies in magnetic separators enhances accuracy, reduces downtime, and optimizes throughput, presenting new commercial opportunities for equipment manufacturers and service providers.

Despite these positive trends, the market faces certain restraints that may limit growth. High capital investment required for advanced magnetic separation systems remains a barrier, particularly for small and mid-sized mining operations. Maintenance and calibration of high-intensity magnetic equipment can also increase operational costs. Moreover, the effectiveness of magnetic separation is restricted to minerals with magnetic properties, reducing its application scope for non-magnetic ores. Limited awareness in underdeveloped mining regions regarding modern beneficiation techniques further challenges market penetration.

Material Insights

Base metals held the revenue share of 48.4% in 2024. The base metals segment is witnessing strong growth due to rising global demand for copper, nickel, zinc, and other essential industrial metals. The expansion of electric vehicles, renewable energy infrastructure, and electronics manufacturing has significantly increased the consumption of these metals, creating pressure to maximize recovery from existing ore sources. Magnetic separation is playing a critical role in improving the beneficiation efficiency of base metal ores by separating magnetic and non-magnetic minerals with higher precision.

The growth of the iron ore and magnetite beneficiation segment is being driven by the rising global demand for high-grade iron ore used in steelmaking. As steel production expands across developing economies such as India, China, and Brazil, mining companies are increasingly adopting advanced magnetic separation technologies to improve ore purity and recovery rates. For example, Xinhai’s Magnetite Separation Production Line demonstrates how modern processing systems enhance the efficiency of magnetite beneficiation. The depletion of easily accessible high-grade deposits has further encouraged miners to focus on beneficiation processes that can efficiently extract iron content from low-grade ores, thereby reducing waste and enhancing the overall yield of operations.

Regional Insights

Asia Pacific accounted for the largest market revenue share of 44.2% in 2024. The Asia Pacific magnetic separation in mining industry is experiencing strong growth, driven by the rising demand for iron ore beneficiation in China, India, and Australia. As ore grades continue to decline, miners are relying on magnetic separation systems to upgrade material quality for steelmaking efficiently. The region’s dominance in iron ore production and consumption is reinforcing this demand, as steel manufacturers seek consistent high-grade feedstock for expanding infrastructure and construction activities. The region accounted for more than 70% of global iron ore production in 2024, with Australia producing around 930 million tons, China producing nearly 250 million tons, and India contributing close to 250 million tons. This growing emphasis on beneficiation is directly boosting the adoption of advanced magnetic separation technologies.

North America Magnetic Separation In Mining Market Trends

The magnetic separation in mining industry in North America is expanding steadily, driven by the growing focus on mineral beneficiation and the modernization of mining operations in the U.S. and Canada. As ore grades decline and demand for high-purity feedstock increases, miners are investing in advanced magnetic separation systems to improve recovery efficiency and reduce waste. The technology is particularly vital in the processing of iron ore, taconite, and other magnetically susceptible minerals used in the steel and construction industries. Infrastructure development and renewed domestic mining initiatives are reinforcing this demand across the region.

U.S. Magnetic Separation In Mining Market Trends

The U.S. magnetic separation in mining industryis experiencing strong growth, driven by the expansion of domestic mining and mineral processing operations. As the country focuses on reducing reliance on imported raw materials, especially from Asia, there is a growing need for efficient beneficiation systems that can improve ore quality and recovery rates. With electric vehicle sales in the U.S. reaching an all-time high of 438,487 units in Q3 2025 and overall production projected to rise sharply throughout the decade, demand for neodymium, praseodymium, and other magnet materials is intensifying. Increasing infrastructure spending and the revival of U.S. steel production are also boosting demand for upgraded feedstock, further supporting market growth.

Europe Magnetic Separation In Mining Market Trends

The magnetic separation in mining industry in Europe is expanding as the region intensifies efforts to strengthen domestic mineral processing and recycling capacities. The European Union’s focus on securing critical raw materials and reducing dependence on imports from outside the region has encouraged investment in beneficiation and recovery infrastructure.

Middle East & Africa Magnetic Separation In Mining Market Trends

The magnetic separation in mining industry in the Middle East and Africa is gaining momentum as mining activities expand across key mineral-producing countries, including Saudi Arabia, South Africa, Morocco, and Egypt. Governments are investing heavily in mineral beneficiation projects to enhance value addition before export, resulting in the integration of magnetic separation technologies in new processing plants. The growing emphasis on resource diversification and industrial development under national programs such as Saudi Vision 2030 and South Africa’s Mining Charter is driving demand for advanced beneficiation equipment.

Latin America Magnetic Separation In Mining Market Trends

The Latin America magnetic separation in mining industryis expanding steadily, driven by the region’s vast mineral wealth and growing emphasis on enhancing beneficiation efficiency. Countries such as Brazil, Chile, and Peru are investing in advanced ore processing systems to enhance recovery rates and export value. Iron ore and copper producers are integrating magnetic separation into their concentrator circuits to boost product purity and reduce waste. As mining companies strive to maximize output from existing deposits and minimize processing costs, the demand for high-performance magnetic separators is increasing across the region.

Key Magnetic Separation In Mining Company Insights

Some of the key players operating in the market Bunting Magnetics Co., Dings Magnetic Group, and others.

-

Bunting Magnetics Co., headquartered in Newton, Kansas, is a global leader in magnetic technology solutions established in 1959. The company specializes in designing and manufacturing magnetic equipment for a wide range of industries, including mining, recycling, food processing, plastics, and pharmaceuticals. Its operations span North America, Europe, and Asia, supported by advanced research and development and production facilities. In the mining industry, Bunting Magnetics offers a comprehensive range of magnetic separation equipment specifically designed for processing ores and minerals. Its offerings include high-intensity magnetic separators, cross-belt and drum magnets, eddy current separators, and metal detectors used in removing ferrous and non-ferrous contaminants.

-

Dings Magnetic Group, founded in 1899 and based in Milwaukee, Wisconsin, is one of the oldest manufacturers of industrial magnetic equipment in the United States. The company has a long-standing reputation for engineering durable and high-performance magnetic solutions across various industries, including mining, aggregates, recycling, and bulk material handling. In the mining sector, Dings Magnetic Group offers a wide range of magnetic separation technologies designed to enhance material purity and process reliability. Its key products include overhead self-cleaning electromagnetic separators, drum separators, and suspended magnets, which effectively remove tramp iron and magnetic impurities from conveyed materials.

Key Magnetic Separation In Mining Companies:

The following are the leading companies in the magnetic separation in mining market. These companies collectively hold the largest market share and dictate industry trends.

- Bunting Magnetics Co.

- Dings Magnetic Group

- Eriez Manufacturing Co.

- Goudsmit Magnetics Group

- Kanetec Co., Ltd.

- LONGi Magnet Co., Ltd.

- Metso Outotec Corporation

- Multotec Pty Ltd.

- SLon Magnetic Separator Ltd.

- STEINERT GmbH

- Illumina, Inc.

Recent Development

- In October 2025, Sable Exploration and Mining entered into a supply agreement with Daemaneng Minerals to accelerate the production ramp-up at the Lapon plant. This agreement focuses on enhancing the beneficiation process, particularly by leveraging magnetic separation technology to upgrade the DMS-grade magnetite product efficiently. Daemaneng Minerals will take over operations, logistics, and sales, aiming to reach 5,000 tons of product within three months and scale up to 15,000 tons per month by April 2026.

Magnetic Separation In Mining Market Report Scope

Report Attribute

Details

Market definition

The market value represents the economic throughput associated with magnetic separation technology across global mining and mineral beneficiation operations.

Market size value in 2025

USD 47.87 billion

Revenue forecast in 2033

USD 74.01 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Sweden; Norway; Finland; Russia; China; India; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

Eriez Manufacturing Co.; Metso Outotec Corporation; STEINERT GmbH; Bunting Magnetics Co.; Goudsmit Magnetics Group; SLon Magnetic Separator Ltd.; LONGi Magnet Co., Ltd.; Kanetec Co., Ltd.; Multotec Pty Ltd.; Dings Magnetic Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Magnetic Separation In Mining Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global magnetic separation in mining market report on the basis of material and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Iron Ore & Magnetite Beneficiation

-

Base Metals

-

Coal Processing

-

Industrial Minerals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Finland

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global magnetic separation in mining market size was estimated at USD 45.89 billion in 2024 and is expected to reach USD 47.87 billion in 2025.

b. The global magnetic separation in mining market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 74.01 billion by 2033.

b. The base metals segment dominated the market with a revenue share of 48.3% in 2024.

b. Some of the key players of the global magnetic separation in mining market are Eriez Manufacturing Co., Metso Outotec Corporation, STEINERT GmbH, Bunting Magnetics Co., Goudsmit Magnetics Group, SLon Magnetic Separator Ltd., LONGi Magnet Co., Ltd., Kanetec Co., Ltd., Multotec Pty Ltd., Dings Magnetic Group, and others.

b. The key factor driving the growth of the global magnetic separation in mining market is the increasing demand for efficient mineral processing technologies that enhance ore purity, reduce waste generation, and improve recovery rates across iron ore, rare earth, and non-ferrous metal mining operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.