- Home

- »

- Power Generation & Storage

- »

-

Micro Battery Market Size And Share, Industry Report, 2030GVR Report cover

![Micro Battery Market Size, Share & Trends Report]()

Micro Battery Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Alkaline, Silver Oxide, Lithium), By Type (Thin Film Batteries, Printed Batteries, Solid-state Chip Batteries, Button Batteries), By Capacity, By Battery Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-262-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro Battery Market Summary

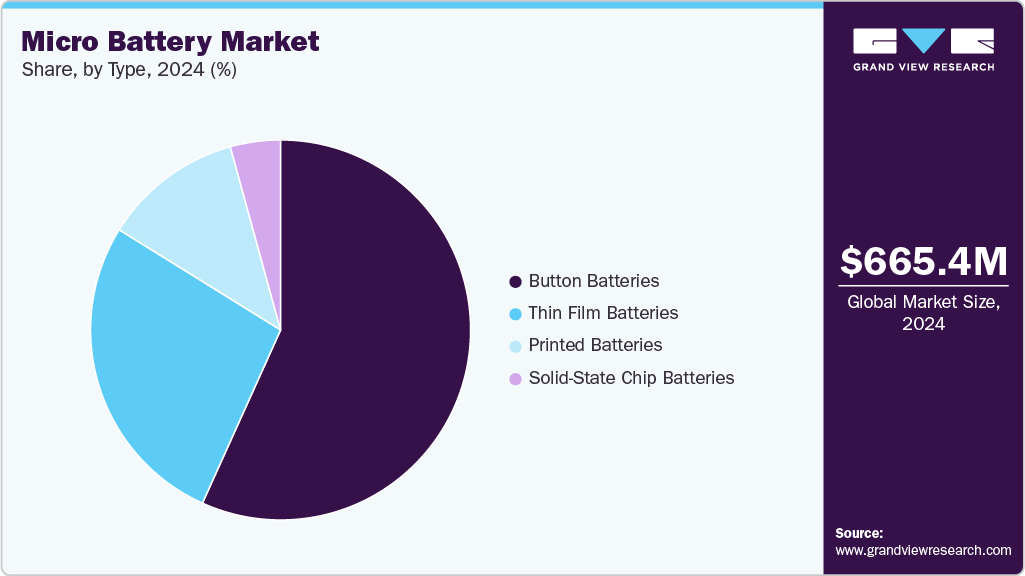

The global micro battery market size was estimated at USD 665.4 million in 2024 and is projected to reach USD 2,310.6 million by 2030, growing at a CAGR of 23.3% from 2025 to 2030. The micro battery market is driven by the need for compact, efficient power materials in applications such as wearable devices, medical equipment, IoT sensors, and portable electronics.

Key Market Trends & Insights

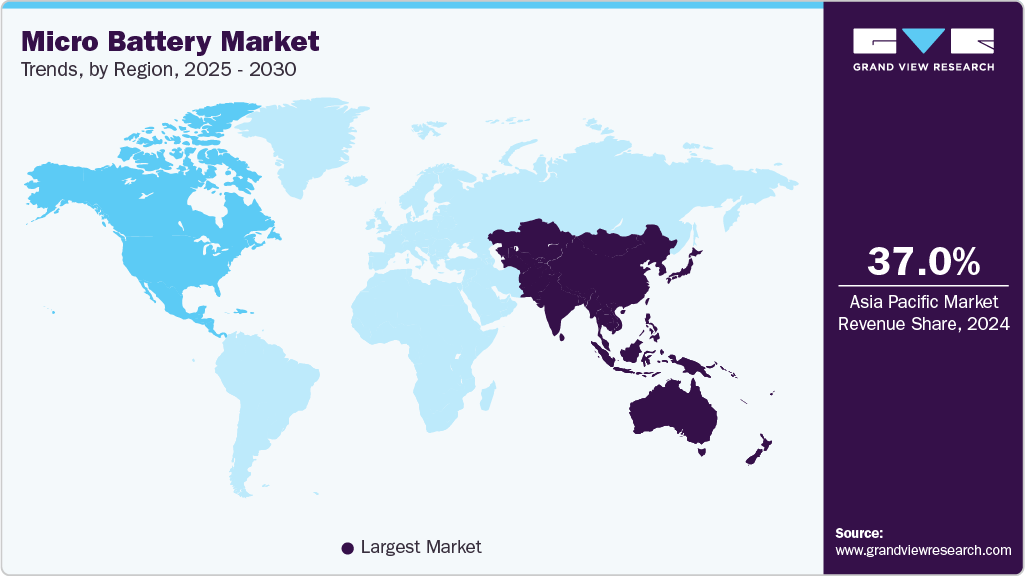

- Asia Pacific micro battery market held the largest revenue share of 37.0% in 2024.

- China micro battery market held the largest share within Asia Pacific in 2024.

- By material, the lithium segment held the largest revenue share of 51.1% in 2024.

- By capacity, the micro batteries in the 10 mAh to 100 mAh range segment held the largest share in 2024.

- By battery type, the primary micro batteries held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 665.4 Million

- 2030 Projected Market Size: USD 2,310.6 Million

- CAGR (2025-2030): 23.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The market is flourishing due to trends, miniaturized devices, and the demand for reliable power sources. Consumer electronics like smartphones, smartwatches, and hearing aids are constantly shrinking in size. This necessitates smaller power sources that pack a punch, making micro batteries perfectly suited for these applications.The increasing demand for compact and portable electronic devices is a major factor fueling the growth of the global micro battery industry. Rising popularity of smartwatches, fitness bands, hearing aids, and other wearable technologies, is increasing the need for small, lightweight batteries to deliver reliable and long-lasting power. Micro batteries, known for their high energy density and space-efficient design, are ideal for such next-generation gadgets. The healthcare sector is also expected to play a significant role as the demand for advanced medical devices, such as implantable monitors and drug delivery systems, continues to rise, further boosting the need for miniaturized power solutions.

The rapid expansion of the Internet of Things (IoT), which is transforming industries ranging from home automation and manufacturing to smart cities and agriculture, is another key factor positively impacting the market growth. As the number of connected devices increases, the demand for compact, energy-efficient, and maintenance-free batteries is also expected to surge. Micro batteries, particularly those based on thin-film and solid-state technologies, are well-suited to power these devices due to their durability and performance in tight spaces. In addition, ongoing investments in R&D and advancements in battery technology are helping reduce production costs, improve efficiency, and unlock new applications, accelerating the global market’s growth trajectory.

Environmental concerns are driving a shift toward eco-friendly batteries. The market is expected to witness a rise in rechargeable options and research on biodegradable materials. In addition, efficient manufacturing processes that minimize waste are expected to become increasingly important for manufacturers. Advancements in battery technology hold immense potential for the market. Areas of focus include solid-state chip batteries with higher energy density and printed batteries that can be integrated directly into devices for a streamlined design. These innovations promise longer battery life and more efficient power delivery for micro-powered electronics.

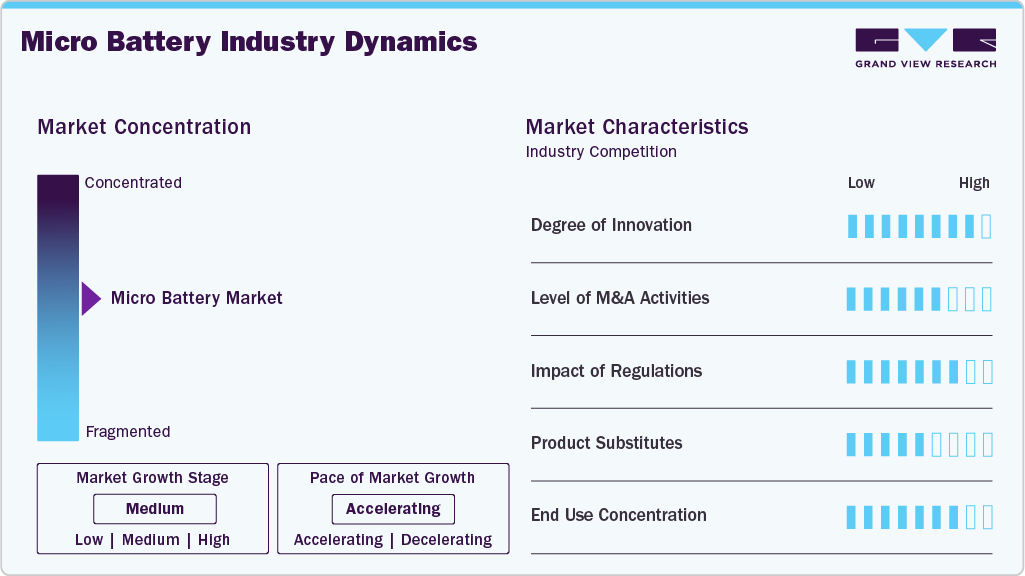

Market Concentration & Characteristics

The micro battery market growth is medium, and the pace of growth is accelerating. The market is characterized by a high degree of innovation, driven by the growing need for smaller, safer, and energy-dense battery solutions. Advancements in solid-state batteries, thin-film technologies, and printed batteries are at the forefront. Companies invest heavily in R&D to enhance performance, extend the lifecycle, and reduce battery size.

The global micro battery market is moderately concentrated, with several established players (like Panasonic, Murata, and Samsung SDI) competing alongside emerging startups and niche manufacturers. While large companies hold a significant market share due to scale and R&D capabilities, new players are gaining traction through innovations in solid-state and thin-film battery technologies. Mergers and acquisitions in the micro battery space are moderate, with large tech and electronics companies acquiring startups or forming partnerships to gain access to cutting-edge battery technologies. The participants are engaged in strategies, including expansion of portfolios, accessing advanced IP, and accelerating time-to-market for innovative products.

The threat of substitutes is moderate, as micro batteries serve a specific function that other power materials like supercapacitors or traditional batteries cannot fulfill in size, weight, and energy density. While alternative energy solutions like energy harvesting or micro fuel cells exist, they are not yet viable replacements on a large scale for micro battery applications. The regulatory impact on the market is moderate. While not overly restrictive, regulations related to battery safety, disposal, recycling, and toxic material handling (like lithium content) influence production and design. In regions like Europe and North America, compliance with RoHS, REACH, and environmental directives shapes product development. Safety standards are especially critical in medical and consumer applications. The end-user concentration in the market is high, with a majority of demand coming from a few sectors, including consumer electronics, medical devices, and IoT applications. These segments dominate due to their stringent size and performance requirements, making micro batteries a critical component.

Material Insights

The lithium segment held the largest revenue share of 51.1% in 2024. Lithium micro batteries are widely used for their high energy density, long shelf life, and reliable performance across a broad range of temperature. They are commonly found in medical implants, wearables, and remote sensors, where compact size and extended operating life are essential. These batteries support both primary (non-rechargeable) and secondary (rechargeable) chemistries, with solid-state variants gaining popularity for enhanced safety. Their lightweight design and stable voltage output make them ideal for low-power, space-constrained devices.

The silver oxide micro batteries segment is expected to grow at the fastest CAGR of 26.1% over the forecast period. Silver oxide micro batteries, known for their stable discharge voltage and compact form factor, are particularly suitable for precision electronics like wristwatches, hearing aids, and small medical devices. While they offer lower energy density than their lithium counterparts, they provide excellent voltage stability and high reliability in low-drain applications. They are favored for their long shelf life and minimal leakage risk, especially in devices that require consistent and accurate power output over time.

Capacity Insights

Micro batteries in the 10 mAh to 100 mAh range held the largest revenue share in 2024, driven by their widespread use in medical devices, wearables, and smart consumer electronics. These batteries offer a strong balance between compact size and moderate power output, making them ideal for fitness trackers, hearing aids, continuous glucose monitors (CGMs), and smartwatches. Benefits including long operational life, stable discharge characteristics, compatibility with lithium-ion and silver oxide chemistries contribute to their dominance.

The segment of micro batteries with capacities above 100 mAh is expected to grow at the fastest CAGR over the forecast period, largely due to rising demand in IoT, industrial automation, and advanced wearable technologies that require longer battery life and more power. These batteries are increasingly being integrated into smart meters, GPS trackers, wireless industrial sensors, and connected health monitoring systems, where high energy output is crucial for uninterrupted functionality.

Battery Type Insights

Primary micro batteries held the largest revenue share in 2024. Their dominance is attributed to their widespread use in low-drain, long-life applications such as wristwatches, hearing aids, medical implants, remote controls, and smart cards. These batteries, especially those based on lithium and silver oxide chemistries, offer excellent shelf life, stable voltage, and minimal maintenance, making them ideal for devices where battery replacement is infrequent or impractical.

Secondary micro batteries are expected to grow at the fastest CAGR over the forecast period. This growth is fueled by the increasing use of wearables, wireless earbuds, smart sensors, and IoT-enabled devices, which require frequent power cycles and long-term reusability. With rising consumer preference for sustainable and cost-effective power solutions, manufacturers are investing heavily in rechargeable lithium-ion and solid-state technologies to improve cycle life, safety, and energy density.

Type Insights

The button batteries segment held the largest revenue share of the market in 2024, owing to their well-established use in hearing aids, wrist watches, medical implants, calculators, and remote controls. These compact, disc-shaped batteries are favored for their high reliability, long shelf life, and stable voltage output, particularly in low-drain applications. Their widespread adoption in consumer and medical sectors has created a mature and consistent demand. Key manufacturers continue to enhance the performance of button cells by optimizing silver oxide and lithium chemistries to improve capacity and safety. Moreover, the increasing elderly population and demand for compact medical devices, such as glucose monitors, are favoring the growth of this segment.

The thin-film batteries segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing demand for ultra-compact, flexible, and rechargeable power materials in wearables, medical patches, smart labels, and IoT devices. These batteries are incredibly thin, sometimes less than 1 mm, and can be integrated directly into flexible electronic systems, making them ideal for next-generation technologies. The rising interest in printed electronics, disposable medical sensors, and smart packaging is accelerating the adoption of thin-film batteries.

Regional Insights

The North America micro battery market is expected to grow at the fastest CAGR of 25.5% over the forecast period, driven by rapid advancements in healthcare technology, military electronics, and smart wearable ecosystems. The region's innovation-driven economy, early adoption of solid-state, and flexible battery technologies accelerate demand for advanced micro battery solutions.

U.S. Micro Battery Market Trends

The U.S. micro battery market held the largest revenue share in North America in 2024. Americans are embracing wearable technology at an increasing rate. Fitness trackers, smartwatches, and other wearables are becoming ubiquitous, creating a massive market for micro batteries. The need for reliable, long-lasting power sources to fuel these devices is a significant driver for the U.S. micro battery market.

Europe Micro Battery Market Trends

Europe is expected to grow in the coming years due to its emphasis on sustainable energy storage, medical innovation, and smart manufacturing. The Germany micro battery market held around 40.0% share in the European market in 2024 due to a confluence of factors specific to the German landscape and the broader European market. Germany is a leader in adopting Industry 4.0, a movement towards intelligent automation and digitalization of manufacturing processes. This translates into a growing demand for micro batteries to power these smart factories' vast network of sensors, trackers, and other connected devices.

The micro battery market in UK is anticipated to grow at a CAGR of around 24.0% in the coming years. This growth can be attributed to a rapid rise in the adoption of IoT technologies. Smart homes, connected factories, and intelligent infrastructure initiatives all rely on a network of sensors and devices powered by micro batteries. The need for reliable, long-lasting power sources in these applications is driving the demand for high-quality micro batteries within the UK.

The France micro battery market is expected to grow significantly over the forecast period. The French government actively supports research and development in key technological areas, including micro battery technology. This translates into funding for innovative projects exploring new materials, advanced chemistries, and improved manufacturing processes.

Asia Pacific Micro Battery Market Trends

Asia Pacific micro battery market held the largest revenue share of 37.0% in 2024, driven primarily by strong electronics manufacturing hubs in China, Japan, and South Korea. The region benefits from a high concentration of battery production facilities, consumer electronics companies, wearable tech adoption, and cost-effective labor and raw materials.

China micro battery market held the largest share within Asia Pacific in 2024, driven by its role as a global manufacturing powerhouse for consumer electronics, medical wearables, and low-cost smart devices. Government initiatives supporting digital health, smart factories, and export-oriented manufacturing further propel domestic demand.

The micro battery market in India is anticipated to grow rapidly over forecast period. India’s growing middle class and increasing disposable income are driving a significant rise in consumer electronics purchases. Smartphones, wearables, and other electronic devices all require micro batteries, creating a vast and rapidly expanding market.

The South Korea micro battery market is anticipated to register a CAGR of about 22.9% in the Asia Pacific region over the forecast period. South Korea possesses a robust manufacturing ecosystem perfectly suited for micro battery production. The presence of skilled labor, established supply chains, and advanced infrastructure allows companies to efficiently manufacture high-quality micro batteries at scale.

Key Micro Battery Company Insights

The market is moderately consolidated with the presence of a sizable number of small, medium, and large-sized companies. The micro battery industry is a dynamic landscape with established players in the battery space and innovative startups.

-

Murata is renowned for its high-performance silver oxide and lithium coin cell batteries used in medical devices, wearables, and industrial electronics. The company focuses heavily on miniaturization, energy density, and reliability and has formed strategic partnerships with healthcare firms to expand its footprint in the medical and biosensor sectors.

Key Micro Battery Companies:

The following are the leading companies in the micro battery market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Spark Technologies, Inc.

- Front Edge Technology, Inc.

- Enfucell SoftBattery

- Panasonic Corporation

- Molex

- TDK Corporation

- Shenzhen Grepow Battery Co., Ltd.

- VARTA AG

- Murata Manufacturing Co., Ltd.

- SAMSUNG SDI

Recent Developments

-

In January 2024, Betavolt unveiled a micro battery measuring 15x15x15 millimeters. While the power output is modest (100 microwatts at 3 volts), it caters to applications with minimal power needs.

-

In September 2022, Maxell launched the PSB401515H, a high-capacity solid-state micro battery. This technology offers advantages like increased durability and safety compared to traditional lithium-ion batteries.

Micro Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 812.1 million

Revenue forecast in 2030

USD 2,310.6 million

Growth rate

CAGR of 23.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, capacity, battery type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; India; South Korea; Australia

Key companies profiled

Blue Spark Technologies, Inc.; Front Edge Technology, Inc.; Enfucell SoftBattery; Panasonic Corporation; Molex; TDK Corporation; Shenzhen Grepow Battery Co., Ltd.; VARTA AG; Murata Manufacturing Co., Ltd.; SAMSUNG SDI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global micro battery market report based on material, type, capacity, battery type, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Alkaline

-

Silver Oxide

-

Lithium

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Thin Film Batteries

-

Printed Batteries

-

Solid-state Chip Batteries

-

Button Batteries

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 10 mAh

-

10 mAh to 100 mAh

-

Above 100 mAh

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.