- Home

- »

- Next Generation Technologies

- »

-

Near-eye Display Market Size & Share, Industry Report 2033GVR Report cover

![Near-eye Display Market Size, Share & Trends Report]()

Near-eye Display Market (2025 - 2033) Size, Share & Trends Analysis Report By Display Technology (MicroLED, DLP & Laser Beam Scanning), By Device Type (VR Headsets, AR Glasses, MR Devices, Smart Helmets & Eyewear), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-652-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Near-eye Display Market Summary

The global near-eye display market size was estimated at USD 2,864.3 million in 2024 and is projected to reach USD 18,920.7 million by 2033, growing at a CAGR of 23.5% from 2025 to 2033. The growth is anticipated to be significantly accelerated by the growing need for advanced display technology, such as AR and VR, with increased resolution and brightness for a more realistic experience of the object.

Key Market Trends & Insights

- North America dominated the global near-eye display market with the largest revenue share of 39.6% in 2024.

- The near-eye display market in the U.S. led the North America market and held the largest revenue share in 2024.

- By display technology, the OLED/Micro-OLED segment led the market, holding the largest revenue share of 34.4% in 2024.

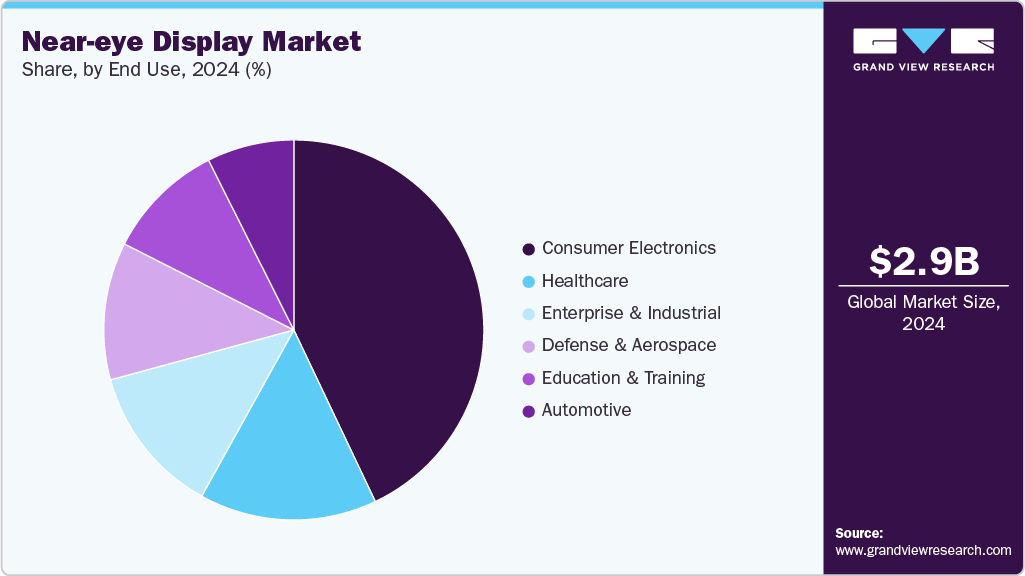

- By end use, the consumer electronics segment held the dominant position in the market and accounted for the leading revenue share of 42.9% in 2024.

- By device type, the VR headsets segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,864.3 Million

- 2033 Projected Market Size: USD 18,920.7 Million

- CAGR (2025-2033): 23.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The industry is primarily driven by the growing need for advanced technologies, mainly in the display field, to improve user experiences of viewing the object as in real-world, especially in augmented reality (AR) and virtual reality (VR). Advancements in the AR/VR displays are crucial in sectors where high-resolution display and interactive potential are majorly required such as gaming, education, healthcare, automotive, and defense.Furthermore, innovations in the progress of display technologies such as OLED, microLED, and OLED-on-Silicon (OLEDoS) have made it possible for high-resolution images and videos, slim, lightweight, and energy-saving panels needed for head-mounted displays; these factors are boosting the near-eye display market expansion. Other factors for the market growth are significant investments made by tech companies, which offer and operate by focusing on next-generation near-eye displays for both consumer and enterprise use to enhance their field of view. The market is also growing due to the increasing industrial use cases, rapid innovation, and strategic collaborations among major industry players.

The other factor driving the market is the growing adoption of near-eye display technology in professional and industrial sectors other than entertainment. In healthcare, near-eye displays are being used for remote surgeries and medical training, and in the automotive industry, AR-based displays support technician training, remote diagnostics, and quality control, thus saving time and resources by improving efficiency and minimizing errors. The growing innovation in near-eye display technology is highly in demand due to various advancements such as enhancing display quality, reducing latency, and expanding viewing angles for the user.

Display Technology Insights

The OLED/Micro-OLED segment led the market in 2024, accounting for over 34.4% of global revenue due to this segment is important for the advancements in the near-eye display market as they have unique properties such as self-emissive which helps to eliminate the need for backlight for the view which results in good colors and their contrast ratios which significantly improves the quality of vision for the viewer by enhancing the density of pixel by surpassing the particular value of 2000-3000 PPI, this displays provides the ultra-high resolution in compact sizes, pixel-free display near-eye experiences with low power usage, making them best for the wearables technology of AR/VR, where battery efficiency are better.

The MicroLED segment is expected to grow at the highest CAGR during the forecast period due to its unique high brightness and black levels features, which provide great contrast of rich color and visibility, even in sunny environment, durability, longer operational life, and resistance to screen burn-in, which makes it best for using in AR applications of wearables for long-term use. MicroLEDs are built with smaller and light weight batteries due to which they consume less power for long-term wear users. Additionally, innovations like unidirectional light emission help minimize optical exchange and improve 3D effects, further enhancing the performance of the device display.

Device Type Insights

The VR headsets segment accounted for the largest market revenue share in 2024, due to the advanced technologies and innovations in the VR headsets such as eye motion tracking, gesture recognition, tracking motion, spatial audio, and voice control,AI integration and 3D visualization, all of which greatly enhance immersion, interactivity, system precision and lower operational costs. VR is available to a larger audience in the world due to the advancements and improvements in the hardware and software of VR. This segment is also growing due to the widespread adoption of smartphones across the world. Moreover, the increasing adoption of VR headsets across sectors such as education, healthcare, manufacturing, and automation for tasks like training, remote support, and better and cost saving product development is boosting demand.

The AR glasses segment is expected to grow at the highest CAGR over the forecast period, driven by the increasing demand for hands-free experience, boosting efficiency, and remote training. Compact and standalone AR glasses enhance usability due to the advances in micro-displays, waveguide optics, sensors, and on-device AI, thus increasing their demand. The integration of AI and IoT also widens the functionality, reduces latency, errors and the increased usage of 5G networks improves connectivity, enabling real-time AR interactions for the user. Additionally, growing consumer interest in wearable technology for gaming, fitness, and productivity is accelerating both innovation and adoption in this segment of near-eye display market.

End Use Insights

The consumer electronics segment accounted for the largest revenue share in 2024, driven by the growing demand for hands-free entertainment, especially in gaming. Popular VR headsets like the Meta Quest and PlayStation VR2 are mainly used in the market due to their engaging, interactive experiences that keep consumers interested and invested. The advancements in lightweight, compact, and power-efficient display technologies are enabling the development of more comfortable and stylish AR glasses and VR headsets for everyday use in gaming, organizations, and entertainment. Furthermore, the increasing technology of AI, motion, and eye-tracking power enhances personalization and user interaction, making near-eye displays more attractive to consumers who are looking for seamless, interactive digital experiences with realistic views.

The automotive segment is anticipated to grow at the highest CAGR during the forecast period, driven by the adoption of advanced near-field projection and augmented reality (AR) head-up displays (HUDs) that enhance both driver safety and convenience while driving the vehicle by providing the important information while driving such as navigation, vehicle performance, and safety alerts, displayed directly on the dashboard or windshield, helping drivers to stay focused on the road and minimizing distractions, this helps to reduce accidents and any major incidents. The integration of advanced optics, sensors, and AI-powered interfaces is transforming the in-car experience, making vehicles more intelligent, interactive, and aligned with consumer expectations for connected driving environments.

Regional Insights

North America near-eye display industry dominated the with a revenue share of over 39.6% in 2024, driven by the strong innovation system that demands the ongoing improvements in display resolution, brightness, and reduced latency and errors, thus, time-saving, key factors for delivering immersive extended reality (XR) experiences as North America is the central hub for the development of near-eye display technology. Many companies in this region are focused on micro display technologies and benefit from strategic investments in research labs and pilot initiatives by automotive OEMs and major companies.

U.S. Near-eye Display Market Trends

The near-eye display market in the U.S. is driven by the significant government investments and initiatives focused at defense modernization and digital transformation, rising both market growth and technological innovation in sectors such as healthcare, defense, automotive, and industry, where these displays are used for essential applications like remote surgery, simulation-based training, mission planning, and product prototyping. Additionally, the ongoing advances in display miniaturization and optics, particularly required in areas such as the treatment in retinal projection and laser scanning, are the other factors driving the market.

Europe Near-eye Display Market Trends

The near-eye display market in Europe is witnessing steady growth over the forecast period, due to Europe’s strong focus on technological innovation and sustainability drives the creation of energy-efficient, lightweight, and user-friendly near-eye display devices that follow strict rules and regulations imposed by my government to meet the requirements and align with consumer expectations. The region supports regular improvements in display resolution, field of view, and overall user comfort.

Asia Pacific Near-eye Display Market Trends

The near-eye display market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period led by China, India, South Korea, and Japan, where strong government initiatives are increasing the demand of transformation in the digital field in sectors such as healthcare, defense, and education, increasing the adoption of XR technologies and near-eye displays for uses such as virtual training, remote collaboration, and medical surgeries. This is further supported by a well-developed supply chain and active investments from established firms and startups in the region such as new product launches, and partnerships among major players based in the area, including Sony (Japan), BOE Technology (China), and Himax Technologies (Taiwan). These initiatives enhance the region’s innovation landscape and global market in the near-eye display technology and market.

Key Near-eye Display Companies Insights

Key players operating in the near-eye display market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Near-eye Display Companies:

The following are the leading companies in the near-eye display market. These companies collectively hold the largest market share and dictate industry trends.

- Sony Corporation

- Seiko Epson Corporation

- BOE Technology Group Co., Ltd.

- SeeYA Technology

- eMagin

- KOPIN Corporation

- MICROOLED Technologies

- Himax Technologies, Inc.

- HOLOEYE Photonics AG

- Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

Recent Developments

-

In May 2025, Himax Technologies, with its subsidiary Liqxtal Technology, introduced the Liqxtal Pro-Eye, the world’s first patented vision care display, at Medical Taiwan 2025. This display utilizes electrically tunable liquid crystal technology to present virtual images at an optimal viewing distance, helping to alleviate eye strain and mitigate vision problems such as presbyopia and the progression of myopia. The Pro-Eye represents a major step forward in vision health, providing greater visual comfort for seniors, children, and individuals who have long screen times.

-

In November 2024, HOLOEYE Photonics AG partnered with the Fraunhofer Institute for Photonic Microsystems (IPMS) and created a new compact LCOS (liquid crystal-on-silicon) microdisplay that features faster refresh rates and smaller pixels, developed with the improved CMOS backplane design. This cutting-edge display offers better control of light, making it well-suited for technologies like AR/VR, biological imaging, and quantum computing.

-

In September 2024, Sony Semiconductor Solutions Corporation (SSS) launched its unique OLED Microdisplay known as ECX350F, a 0.44-inch Full HD, offering unique features as the smallest pixel size at 5.1 µm in the industry and has brightness levels up to 10,000 cd/m². Developed to be used in augmented reality (AR) wearables, supports compact and lightweight devices with high-resolution and brightness for clear, rich color visuals.

Near-eye Display Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,505.9 million

Revenue forecast in 2033

USD 18,920.7 million

Growth rate

CAGR of 23.5% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Display technology, device type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Sony Corporation; Seiko Epson Corporation; BOE Technology Group Co., Ltd.; SeeYA Technology; eMagin; KOPIN Corporation; MICROOLED Technologies; Himax Technologies, Inc.; HOLOEYE Photonics AG; Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Near-eye Display Market Report Segmentation

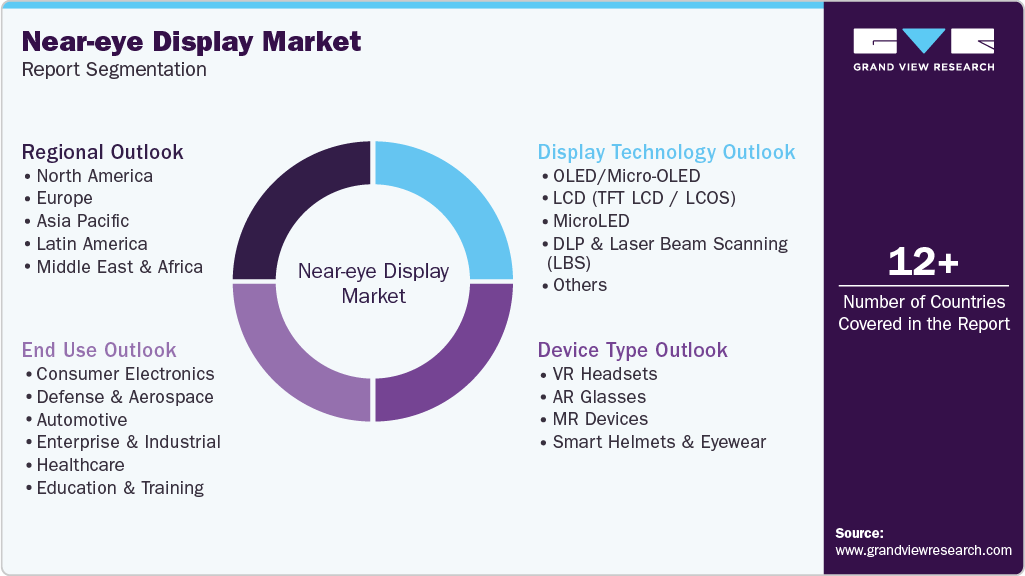

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global near-eye display market report based on display technology, device type, end use, and region:

-

Display Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

OLED/Micro-OLED

-

LCD (TFT LCD / LCOS)

-

MicroLED

-

DLP & Laser Beam Scanning (LBS)

-

Others

-

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

VR Headsets

-

AR Glasses

-

MR Devices

-

Smart Helmets & Eyewear

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Defense & Aerospace

-

Automotive

-

Enterprise & Industrial

-

Healthcare

-

Education & Training

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global near-eye display market size was estimated at USD 2,864.3 million in 2024 and is expected to reach USD 3,505.9 million in 2025.

b. The global near-eye display market is expected to grow at a compound annual growth rate of 23.5% from 2025 to 2033 to reach USD 18,920.7 million by 2033.

b. North America dominated the near-eye display market with a share of 39.6% in 2024. Driven by the strong innovation system that demands the ongoing improvements in display resolution, brightness, and reduced latency and errors, thus, time-saving.

b. Some key players operating in the near-eye display market include Sony Corporation; Seiko Epson Corporation; BOE Technology Group Co., Ltd.; SeeYA Technology; eMagin; KOPIN Corporation; MICROOLED Technologies; Himax Technologies, Inc.; HOLOEYE Photonics AG; Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

b. Key factors that are ddriving the near-eye display market is the growing adoption of near-eye display technology in professional and industrial sectors other than entertainment. In healthcare, near-eye displays are being used for remote surgeries and medical training, and in the automotive industry, AR-based displays support technician training, remote diagnostics, and quality control, thus, saving time and resources by improving efficiency and minimizing errors

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.