- Home

- »

- Pharmaceuticals

- »

-

North America OTC Health Products Market, Report, 2030GVR Report cover

![North America OTC Health Products Market Size, Share & Trends Report]()

North America OTC Health Products Market Size, Share & Trends Analysis By Application (Digestive Health, Women’s Health), By Form (Liquid, Gummies), By Product, By Demography, By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-951-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The North America OTC health products market size was estimated at USD 74.83 billion in 2024 and is projected to grow at a CAGR of 6.15% from 2025 to 2030. The growth of the market can be attributed to several factors. Increasing consumer awareness and willingness to spend on nutritional supplements are significant drivers. The rising geriatric population and the prevalence of lifestyle diseases, such as obesity and diabetes, also contribute to market expansion. In addition, an increase in disposable income and the growing number of distribution channels enhance product accessibility, further supporting market growth.

The increasing consumer awareness regarding health and wellness has driven interest in nutritional supplements and preventive healthcare measures. This trend reflects a shift toward proactive health management, where individuals focus on disease prevention rather than solely relying on treatment. Preventive healthcare practices include regular check-ups, vaccinations, and lifestyle changes such as diet and exercise. Key drivers include self-management of minor ailments, rising awareness of chronic diseases, public health initiatives, and access to information. Consumers are turning to supplements to support overall health and fill dietary gaps, contributing to market growth. This shift underscores the importance of preventive measures in healthcare.

The aging U.S. population significantly impacts the market, with demand surging due to the increased need for self-care, chronic condition management, and affordable healthcare solutions. According to the Population Reference Bureau (PRB), as of January 2024, the number of Americans aged 65 and older is expected to grow from 58 million in 2022 to 82 million by 2050, representing 23% of the total population. This demographic shift, coupled with rising racial diversity and positive trends in education, workforce participation, and poverty reduction, underlines the expanding market for OTC products. However, challenges such as stalled life expectancy, obesity, and increased caregiving demands continue to shape the healthcare landscape.

Proposed policy changes by HHS to include certain OTC preventive services under insurance coverage could significantly reshape the OTC market landscape. The Department of Health and Human Services (HHS) issued a Request for Information (RFI) in October 2023, seeking input on applying the Affordable Care Act's preventive services mandate to OTC products. This move could make certain OTC preventive services, such as progestin-only contraception and smoking cessation aids, free for consumers with private insurance. The RFI aims to explore ways to improve accessibility, especially for marginalized communities, by easing barriers to preventive services. The proposed changes are expected to boost demand for OTC preventive products, encouraging market expansion and innovation. Increased accessibility may enhance health equity and prompt insurers to collaborate with pharmacies, transforming the OTC market landscape.

Product Insights

The dietary supplement and weight loss products segment dominated the market and accounted for the largest revenue share of 33.71% in 2024, driven by increasing consumer awareness of health and wellness. Rising obesity rates and a growing focus on preventive measures have propelled demand for weight management solutions. Popular products include meal replacements, fat burners, and appetite suppressants, catering to diverse consumer preferences. In addition, the aging population and a shift towards natural ingredients have fueled growth in dietary supplements, such as vitamins, minerals, and herbal products. The segment's robust growth is further supported by effective marketing strategies and expanding distribution channels across retail and online platforms.

CBD nutraceuticals have emerged as the fastest-growing segment in the North America market, driven by increasing consumer interest in natural wellness solutions. The legalization of hemp-derived CBD has led to a surge in product offerings, including oils, capsules, and edibles, targeting various health concerns like anxiety, pain, and inflammation. Growing awareness of the potential benefits of CBD, combined with favorable regulatory changes, has spurred demand among consumers seeking alternative therapies. Innovative marketing strategies and expanding retail distribution channels are further propelling the growth of this dynamic segment in the health products landscape.

Application Insights

The sports formulation segment dominated the market and accounted for the largest revenue share of 22.24% in 2024, fueled by the growing popularity of fitness and wellness among consumers. Products such as protein powders, energy drinks, and recovery supplements cater to athletes and fitness enthusiasts seeking to enhance performance and support recovery. The increasing trend of active lifestyles, combined with the rise of professional sports and fitness influencers, has driven demand for these formulations. Innovative product development, including plant-based options and scientifically-backed ingredients, further solidifies the sports formulation segment's strong position in the competitive OTC landscape.

The immune defense is expected to grow lucratively during the forecast period, driven by heightened consumer awareness of health and wellness, particularly post-pandemic. Products such as vitamins C and D, zinc supplements, and herbal remedies like echinacea have gained popularity as consumers seek to enhance their immune systems. The rise in preventive healthcare and self-medication trends has led to increased sales in this segment. In addition, effective marketing and educational campaigns by manufacturers have contributed to consumer confidence and demand, solidifying immune defense as a dominant force in the OTC health landscape.

Form Insights

The capsules and tablets segment dominated the market and accounted for the largest revenue share of 37.79% in 2024 due to their convenience and ease of use. These formulations are popular among consumers seeking quick, accurate dosages of vitamins, minerals, and other supplements. The versatility of capsules and tablets allows for a wide range of applications, from dietary supplements to pain relief and cold medications. In addition, advancements in manufacturing processes have enhanced the quality and efficacy of these products. The segment's strong performance is further supported by robust marketing strategies and increased consumer trust in established brands.

The other forms segment is expected to grow lucratively during the forecast period. Other form segment include powder, spray, and drop, among others, driven by the increasing number of product launches in powder form, particularly within the sports nutrition category. Consumers are increasingly favoring convenient, easy-to-mix powder supplements that enhance performance and recovery. Innovations in flavors, formulations, and the introduction of plant-based options have attracted a broader audience. This trend, combined with the rising popularity of fitness and wellness, positions the powder form segment for significant growth in the North America OTC health products market.

Demography Insights

The adults segment dominated the market and accounted for the largest revenue share of 78.94% in 2024, primarily driven by the increasing health awareness among this demographic. As adults become more proactive about their health, they are turning to OTC products for preventive care and management of chronic conditions. Categories such as dietary supplements, pain relievers, and immune support products are particularly popular. In addition, the aging population is fueling demand for health products that address age-related concerns. Effective marketing strategies targeting adult consumers and their specific health needs further reinforce this segment’s dominance in the market.

The children segment is experiencing the fastest growth in the market, driven by heightened parental awareness of health and wellness for their children. Increased focus on preventive care, combined with the rise in pediatric health issues, has led to a surge in demand for OTC products tailored for children, including vitamins, cough and cold medications, and digestive aids. Innovative formulations, such as chewable tablets and flavored syrups, enhance palatability and compliance. In addition, targeted marketing campaigns and endorsements from healthcare professionals are further propelling growth in this segment, catering to the unique health needs of children

Distribution Insights

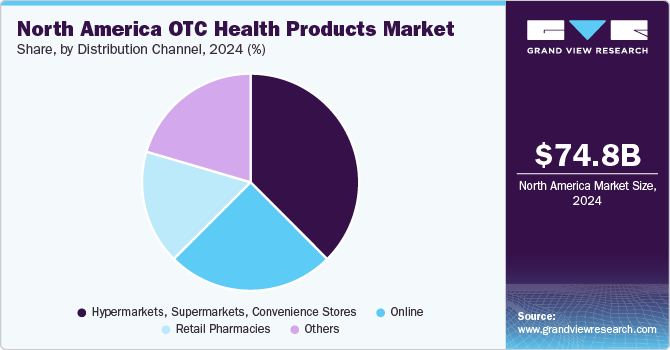

The hypermarkets, supermarkets, and convenience stores segment dominated the market and accounted for the largest revenue share of 37.53% in 2024 due to their extensive reach and consumer preference for one-stop shopping. These retail formats offer a wide range of OTC products, providing convenience and accessibility to consumers seeking health solutions. The attractive in-store displays and promotional offers further entice shoppers, encouraging impulse purchases. In addition, the rise of e-commerce has complemented traditional retail by allowing consumers to compare prices and products easily. The combination of physical and online presence positions this distribution channel as a leader in the OTC market.

The online segment is expected to exhibit the fastest growth during the forecast period in the North America OTC health products market, driven by the increasing adoption of e-commerce among consumers. The convenience of shopping from home, coupled with a wide variety of products and competitive pricing, has made online platforms increasingly popular. Moreover, the ongoing shift towards digital health solutions and telemedicine has encouraged consumers to purchase OTC products online. Enhanced user experiences, including personalized recommendations and fast delivery options, are further fueling this growth, making online shopping a preferred choice for many consumers seeking health products.

Country Insights

U.S. OTC Health Products Market Trends

The U.S. OTC health products market dominated and accounted for a 90.53% revenue share in 2024. The country boasts a well-established healthcare infrastructure and a high level of consumer awareness regarding health and wellness. An increasing emphasis on preventive care and self-medication has driven the demand for OTC products across various categories, including dietary supplements, pain relievers, and immune support. In addition, a diverse retail landscape encompassing pharmacies, supermarkets, and online platforms facilitates easy access to these products. Innovative marketing strategies and extensive distribution channels further strengthen the U.S. market position, making it a key player in the OTC sector.

Canada OTC Health Products Market Trends

Canada OTC health products market holds a significant position in the regional market, driven by a growing awareness of health and wellness among consumers. The increasing prevalence of chronic diseases and the shift towards preventive healthcare are propelling demand for OTC products such as dietary supplements, cold and flu medications, and pain relief options. Canadian consumers favor products that are backed by scientific research and have proven efficacy. In addition, the expansion of retail channels, including pharmacies, health food stores, and e-commerce platforms, enhances product accessibility. Regulatory support and a focus on health promotion further contribute to Canada’s strong market presence in the OTC sector.

Mexico OTC Health Products Market Trends

Mexico OTC health products market is a key player in the region, marked by steady growth driven by rising health consciousness among consumers. An increasing number of Mexicans are turning to OTC products for self-medication and preventive care, particularly in categories such as dietary supplements, pain relievers, and digestive health products. The expanding middle class and urbanization are also contributing factors as consumers seek accessible health solutions. Moreover, the growth of e-commerce and modern retail formats, including pharmacies and supermarkets, enhances product availability. Regulatory reforms supporting the OTC market further bolster Mexico's position in the region.

Key North America OTC Health Products Company Insights

The competitive landscape of the market is characterized by the presence of key players and the continuous launch of innovative products. Major companies such as Johnson & Johnson, Pfizer, Bayer, and GlaxoSmithKline dominate the market, offering a wide range of OTC products across various categories, including dietary supplements, pain relief, and cold medications. These companies leverage extensive distribution networks, strong brand recognition, and aggressive marketing strategies to maintain their market share. The growing popularity of e-commerce has also led to increased competition from online retailers. Additionally, the emergence of smaller, specialized players in areas like CBD nutraceuticals and immune defense supplements is intensifying market competition.

Key North America OTC Health Products Companies:

- Herbalife Nutrition

- CV Sciences, Inc.

- Medical Marijuana Inc.

- Nature's Sunshine Products Inc.

- Johnson and Johnson Services, LLC

- GlaxoSmithKline Inc.

- Bayer AG

- American Health

- THE BOUNTIFUL COMPANY (Nestlé Health Science S.A.)

Recent Developments

-

In April 2024, Amneal Pharmaceuticals received FDA approval for its Over-the-counter Naloxone Hydrochloride Nasal Spray, a generic equivalent to NARCAN Nasal Spray, designed for emergency treatment of opioid overdoses. This 4 mg nasal spray aims to improve access to life-saving medication, particularly as the opioid crisis continues to escalate, with synthetic opioids like fentanyl contributing to a significant number of overdose fatalities. Amneal's product is now available for purchase without a prescription, helping to combat the public health emergency surrounding opioid misuse.

-

In August 2023, Walgreens announced that the OTC NARCAN Nasal Spray will be available in stores and online starting September 5, 2023, following FDA approval.

-

In June 2023, McKesson launched its new private brand, Foster & Thrive, offering over-the-counter (OTC) health and wellness products. The brand consolidates McKesson’s Health Mart and Sunmark products to meet the increasing demand for affordable and quality OTC solutions. Foster & Thrive features four product categories: Acute Care, Diagnostic Care, Everyday Care, and Preventative Care, addressing a wide range of health needs. The transition to the new brand will occur from July 2023 through October 2024. McKesson aims to support community pharmacists with reliable products that customers trust.

North America OTC Health Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 79.09 billion

Revenue forecast in 2030

USD 106.61 billion

Growth rate

CAGR of 6.15% from 2025 to 2030

Historical Range

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, form, demographics, distribution channel, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Herbalife Nutrition, CV Sciences, Inc.,

Medical Marijuana Inc., Nature's Sunshine Products Inc., Johnson and Johnson Services, LLC, GlaxoSmithKline Inc., Bayer AG, GlaxoSmithKline plc (GSK), American Health, THE BOUNTIFUL COMPANY (Nestlé Health Science S.A.)

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

North America OTC Health Products Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America OTC health products market on the basis of product, form, application, demographics, distribution channel, and country

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cough, Cold, and Flu Products

-

Liquid

-

Capsules/Tablets

-

Gummies

-

Others

-

-

Dietary Supplements and Weight Loss Products

-

Liquid

-

Capsules/Tablets

-

Gummies

-

Others

-

-

Sports Nutrition Products

-

Liquid

-

Capsules/Tablets

-

Gummies

-

Others

-

-

Probiotics

-

Liquid

-

Capsules/Tablets

-

Gummies

-

Others

-

-

CBD Nutraceutical Products

-

Liquid

-

Capsules/Tablets

-

Gummies

-

Others

-

-

-

Form Outlook (Revenue, USD Billion, 2018 - 2030)

-

Liquid

-

Capsules/Tablets

-

Gummies

-

Others

-

-

Demography Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children

-

Adults

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Digestive health

-

Women’s & Men’s Health

-

Weight Control

-

Joint health

-

Immune Defense

-

Sports Formulation

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail pharmacies

-

Online

-

Hypermarkets, supermarkets, convenience stores

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America OTC health products market size was valued at USD 74.83 billion in 2024 and is anticipated to reach USD 79.09 billion in 2025.

b. The North America OTC health products market is expected to witness a compound annual growth rate of 6.15% from 2025 to 2030 to reach USD 106.61 billion by 2030.

b. Based on product type, the dietary supplements segment accounted for a share of 33.71% in 2024 due to increasing consumer awareness and consumption of dietary supplements such as multivitamins, single vitamins, minerals, enzymes, amino acids, and conjugated linoleic acid.

b. Some of the key players in the North America OTC health products market are Herbalife Nutrition; CV Sciences, Inc.; Medical Marijuana Inc.; Nature's Sunshine Products Inc.; Johnson and Johnson Services, LLC; GlaxoSmithKline Inc.; Bayer AG; American Health; and THE BOUNTIFUL COMPANY (Nestlé Health Science S.A.) among others

b. The major factors driving North America OTC health products market growth are the rising geriatric and obese population base, increasing awareness and consumption of dietary supplements and sports nutrition, and increasing willingness to spend on health products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."