- Home

- »

- Electronic & Electrical

- »

-

North America Retail Vending Machine Market Report, 2030GVR Report cover

![North America Retail Vending Machine Market Size, Share & Trends Report]()

North America Retail Vending Machine Market Size, Share & Trends Analysis Report By Machine Type (Food Vending Machines, Beverage Vending Machines), By Channel, By Payment Method, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-094-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The North America retail vending machine market size was valued at USD 15.21 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. The most popular unattended commerce channel is the vending machine. However, several consumers would prefer more self-serve options, such as kiosks and cashier-less stores. Unattended retail channels are a new channel through which retailers can boost their sales and reach a wider customer base. These options offer customers a wide range of payment options and provide a seamless, fast, and convenient shopping experience. According to data published by PYMNTS in February 2020, approximately 14.4 million consumers in the U.S. currently shop at unattended retail locations. In addition, 48.6 million are willing to shop at such locations.

Unattended retail channels provide a wide range of products and services. A few examples are vehicle-based services such as air pumps and parking, laundry services, and kiosks that sell clothing or computers and electronics. Food and beverages are the most common products purchased at unattended retail channels, according to the data published by PYMNTS. Several consumers prefer to shop through unattended retail channels such as vending machines.

According to the data published by PYMNTS in February 2020, which includes findings from a survey of 2,325 U.S. consumers about their experience with unattended retail channels, most consumers prefer unattended options since they are faster. 49.4% say they use these options because they are quicker than employee checkout, and 34.7% say they use them because the lines are shorter. On the other hand, 33% of the respondents said they prefer shopping at unattended retail establishments since they can explore and make purchases without having to engage with salespeople.

Unattended retail channels like vending machines gained more traction since the COVID-19 pandemic. Consumers prefer the contactless nature of vending machine transactions, which reduces the need for physical contact with others. Vending machines can be regularly sanitized and maintained, providing a perceived sense of safety and hygiene during the purchase process. Moreover, vending machines are essentially automated shops wherein products are loaded into a machine and are generally available 24/7.

Some of the commonly sold products via vending machines are beverages, cans, bottles, snacks, salads, candies & confectionaries, tobacco products, and tickets. The growing adoption of vending machines is mainly attributed to the quick and convenient experience they provide. Vending machines are generally placed in areas with high foot traffic, both indoors and outdoors. Since they are easy to operate, they are ideal for use in offices, commercial and public spaces. Such factors are driving the growth of the North America food vending machine and beverage vending machine market.

Technological advancements in vending machines, including interactive display systems, voice recognition, and big data integration, have made them easier and more convenient to use, which is expected to have a positive impact on product demand. Vending machines play a significant role in reducing labor costs. Furthermore, they help generate higher revenue pockets by increasing impulse purchases at airports and train and bus stations.

Rapid technological advancements have led to the incorporation of a wireless system to manage remote vending machines. Reflex information can be used to handle vending machine information requests, responses, and liability information, which increases efficiency and reduces enterprise human management expenses. This increases service efficiency, further driving the market growth.

Vending machine facial recognition technology contains a motion sensor that detects incoming customers and a camera that can identify the individual. The device then presents a customized menu depending on the customer’s past purchases and discourages them from purchasing restricted items such as cigarettes if they are underage.

Another technology included in intelligent vending machines is self-inventory management, which helps keep track of inventory. These devices can gather and use information to make the right inventory decisions. For example, the machine will know to stop ordering ice cream when the temperature drops, saving the product inventory and reducing waste and additional expenditures.

Interactive screens installed within vending machines allow owners to access the Internet of Things. These machines are installed at gas stations or bathrooms as operators can make revenue weekly or monthly from advertising streams. The Internet of Things (IoT) technology advances digital payments by enabling cashless transactions and delivering products and services without human contact.

Modern vending machines can scan a rapid response (QR) code using a pre-installed mobile application to start and authorize a digital payment through an IoT gateway inside the vending machine. This creates a link between the user and the vendors’ financial entities, enabling users to select and order products from the web-based virtual vending machine. After a successful payment transaction, the vending machine's shelves are unlocked, and the ordered items are dispensed. With connected devices, data, and servicing, owners and operators can obtain real-time data about sales, stocking, and repairs, reducing operational and repair costs.

Machine Type Insights

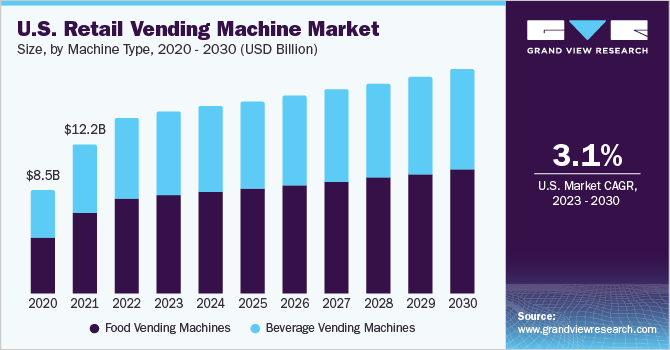

Food vending machines accounted for a share of 57.1% in 2022. Food vending machines have two distinct audiences in retail outlets. First, there are the customers that visit the store. A vending machine near an entrance could help increase foot traffic and leverage impulse purchases from customers who visit the store. The employee base is the second target audience. Retail employees often receive one or two ten-minute breaks every shift and a short break for meals.

With little to no time to visit a restaurant during their breaks, employees usually opt for vending machines that provide cost-effective food options before returning to work. Changing lifestyles, busy schedules, and the rising demand for convenience have driven the need for quick, accessible food options. Food vending machines offer a convenient solution, providing a wide range of choices 24/7. Furthermore, integrating advanced technologies like touchscreen interfaces, cashless payment systems, and real-time data analytics enhances user experience and operational efficiency.

Beverage vending machines is expected to grow at a CAGR of 2.8% over the forecast period. Beverage vending machines provide a range of options, including coffee, tea, or cocoa, as well as energy drinks, diet soda, lemonade, vitamin water, flavored drinks, and water bottles.

Beverage vending machines are immensely popular in hotels for guests who prefer a beverage or a small snack instead of a full meal. Vending machines are often placed in the lobby of a hotel to generate continuous revenue. The growing trend in the adoption of beverage vending machines due to their convenience and assistance in decreasing the time spent on purchasing a few items is expected to drive the vending machine market’s growth.

Channel Insights

The business and industry segment accounted for a share of 37.2% in 2022. Vending machines are installed at workplaces and industries to offer employees a convenient, affordable, and quick way of buying food, drinks, and other supplies they may need. This ensures employees can easily access items required during their daily work routine without leaving the premises or relying on external sources.

Retail businesses, such as clothing stores or electronics shops, may utilize retail vending machines as extensions of their physical stores. These machines allow customers to browse and purchase products even when the main store is closed or during peak shopping periods. Consumers can pay for such items with cash or cards or through mobile apps and e-wallets.

Healthcare is expected to grow at a CAGR of 3.7% over the forecast period. Retail vending machines have several practical applications in the healthcare industry, particularly in providing convenient access to food and beverages. Retail vending machines in healthcare facilities, such as hospitals, clinics, or nursing homes, offer a quick and accessible solution for healthcare professionals to access food and beverages during their demanding shifts.

These machines are placed in common areas or break rooms, ensuring easy access to food and beverages for healthcare staff. These retail vending machines are also available to visitors, patients, and their families, providing convenient options for snacks, drinks, and refreshments within the facility. This is especially useful for visitors who may spend extended periods in waiting areas or during visiting hours, allowing them to access refreshments without leaving the premises.

Payment Method Insights

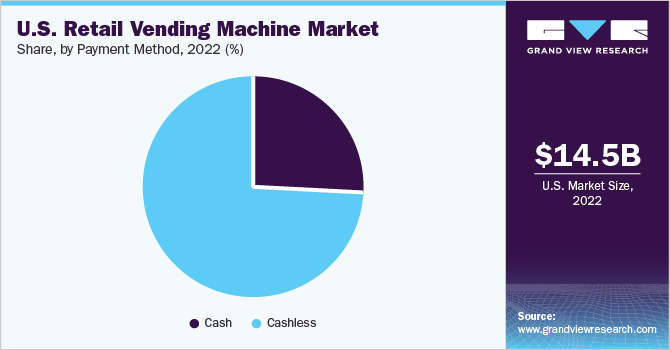

Payment through cash mode was valued at USD 3.94 billion in 2022. Cash payment through a retail vending machine refers to the ability to make a purchase using physical currency rather than electronic payment methods. Retail vending machines can be equipped with bill validators and coin acceptors that recognize and accept different denominations of cash. Clear instructions are prominently displayed on vending machines, guiding customers on the process of making a cash payment. Customers are instructed to insert bills or coins into designated slots, and the machine verifies the amount received before continuing with the transaction.

Cash payment allows individuals who prefer or rely on physical currency to make purchases. It caters to customers who may not have access to or feel comfortable with electronic payment methods, ensuring that everyone, especially the older generations, can participate in transactions. Cash is widely accepted and readily available, making it a convenient option for customers to make quick purchases without the need for credit or debit cards. It eliminates the need for electronic transactions, PINs, or card verification processes, simplifying the payment experience and ensuring everyone can access vending machines.

Payment through cashless method is expected to grow at a CAGR of 3.7% over the forecast period. Cashless payment through a retail vending machine refers to the ability to make a purchase using electronic payment methods instead of physical currency. Retail vending machines can be equipped with card readers that accept various types of payment cards, such as credit cards, debit cards, and prepaid cards. Customers can simply insert or tap their cards on the designated reader to initiate the transaction. Cashless payments deliver vending profits and increase customer satisfaction. Offering the option of cashless payment provides customers with the convenience and flexibility to make different kinds of purchases.

Country Insights

The U.S. retail vending machine market was valued at USD 14.48 billion in 2022. Retail vending machines stocked with a variety of snacks, beverages, and refreshments provide consumers with quick and accessible options to satisfy their hunger and thirst while on the move, whether during the day or night. This is especially beneficial when traditional dining establishments may be closed or limited in their offerings.

Consumers in the U.S. as well as travelers can rely on vending machines to provide sustenance during layovers, delays, or late-night travel. Some machines provide customization options, allowing travelers to choose specific ingredients or condiments to suit their preferences. They can opt for sandwiches, salads, snacks, hot and cold beverages, and even healthier alternatives. In hotels, vending machines offer guests access to food and drinks around the clock, even during odd hours when room service or the hotel restaurant may not be available.

The Canada retail vending machine market is anticipated to grow at a CAGR of 3.9% over the forecast period. Retail vending machines play a significant role in enhancing the consumer experience owing to their ease of use and the convenience they provide to individuals in obtaining food and beverage items, including snacks, soft drinks, coffee, iced tea, and sandwiches. With the growing popularity of cashless transactions, vending machines in the travel and leisure sector often accept various payment methods, such as credit and debit cards, mobile payment apps, or contactless options.

This allows for quick and convenient transactions, aligning with the preferences of modern travelers. Vending machines can help manage queues or alleviate congestion in busy travel areas. By offering self-service options, they reduce wait times and provide customers with a convenient option to make purchases, particularly during peak travel periods. Consumers can get snacks and beverages even during odd hours while checking into a hotel and when food service is unavailable. Therefore, the rise in tourism would propel the demand for retail vending machines during the forecast period.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In December 2022, Canteen, a leading vending services company, partnered with BLK & Bold, a coffee brand with a social mission, to launch a barista recipe book with a holiday theme. The book is not only designed to inspire coffee enthusiasts with delicious holiday recipes but also to support a charitable cause.

-

In July 2022, Dave & Buster's partnered with The Coca-Cola Company to introduce a micro market concept within a full-service restaurant environment. This collaboration was aimed to enhance the dining experience by offering a convenient and self-service market avenue.

-

In March 2022, Compass Group North America acquired the vending division of FreshBrew, a private-label coffee and tea producer. With this acquisition, Compass Group North America gained access to FreshBrew's vending division, which includes its vending machines, distribution networks, and customer base. This strategic move allowed Compass Group to expand its presence in the vending industry and offer a wider range of coffee, tea, and other beverage options to its clients.

Some prominent players in the North America retail vending machine market include:

- The Coca-Cola Company

-

PepsiCo

-

Canteen Vending Services

-

365 Retail Markets

-

USConnect

-

Compass Group

-

24 Seven Vending

-

Keurig Dr Pepper, Inc.

-

Unilever PLC

-

Nestlé S.A.

-

Royal Vendors, Inc.

-

Sodexo

North America Retail Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.78 billion

Revenue forecast in 2030

USD 19.48 billion

Growth rate

CAGR of 3.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine type, channel, payment method, country

Country scope

U.S.; Canada

Key companies profiled

The Coca-Cola Company; PepsiCo; Canteen Vending Services; 365 Retail Markets; USConnect; Compass Group; 24 Seven Vending; Keurig Dr Pepper, Inc.; Unilever PLC; Nestlé S.A.; Royal Vendors, Inc.; Sodexo

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Retail Vending Machine Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the North America retail vending machine market report based on machine type, channel, payment method, and country:

-

Machine Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Food Vending Machines

-

Refrigerated Food and Beverages

-

Non-Refrigerated Food and Beverages

-

-

Beverage Vending Machines

-

Cold Beverages

-

Hot Beverages

-

-

-

Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Business and Industry

-

Education

-

Colleges and Universities

-

K-12 Colleges

-

-

Entertainment Venues

-

Travel and Leisure

-

Hotels/ Lodging

-

Airports

-

-

Healthcare

-

Hospitals

-

Long-Term Care

-

Others

-

-

Retail

-

Retail Stores

-

Malls

-

Supermarkets

-

-

Others

-

Military Bases

-

Correctional Facilities

-

Gyms

-

Others

-

-

-

Payment Method Outlook (Revenue, USD Million, 2017 - 2030)

-

Cash

-

Cashless

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America retail vending machine market size was estimated at USD 15.21 billion in 2022 and is expected to reach USD 15,027.9 million in 2023.

b. The North America retail vending machine market is expected to grow at a compounded growth rate of 3.1% from 2023 to 2030 to reach USD 19.48 billion by 2030.

b. Food Vending Machines dominated the North America retail vending machine market with a share of 54.3% in 2022. This is attributed to two distinct audiences in retail outlets. First, there are the customers that visit the store. A vending machine near an entrance could help increase foot traffic and leverage impulse purchases from customers who visit the store. The employee base is the second target audience. Retail employees often receive one or two ten-minute breaks every shift and a short break for meals.

b. Some key players operating in North America retail vending machine market include The Coca-Cola Company, PepsiCo, Canteen Vending Services, 365 Retail Markets, USConnect, Compass Group, 24 Seven Vending, Keurig Dr Pepper, Inc., Unilever PLC, Nestlé S.A., Royal Vendors, Inc. , Sodexo

b. Key factors that are driving the market growth include, increasing demand for on-the-go snacks and beverages due to the hectic lifestyles of consumers is boosting product sales through vending machines. The growth of the vending machine market can also be attributed to the machines’ ability to deliver goods quickly, making it an extremely convenient option for consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."