- Home

- »

- Plastics, Polymers & Resins

- »

-

Pigment Dispersion Market Size, Share, Growth Report, 2030GVR Report cover

![Pigment Dispersion Market Size, Share & Trend Report]()

Pigment Dispersion Market (2024 - 2030) Size, Share & Trend Analysis Report By Product (Inorganic Pigment, Organic Pigment), By Application (Plastics, Inks, Coatings), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-177-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pigment Dispersion Market Summary

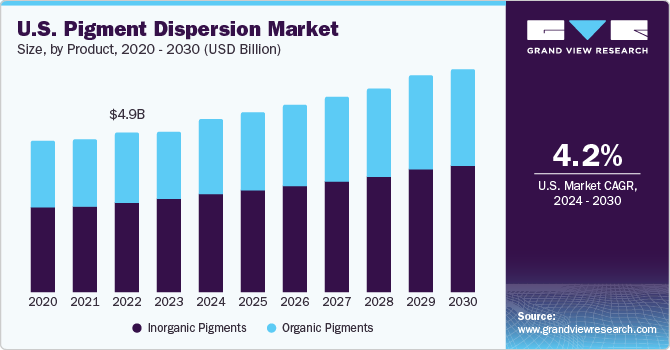

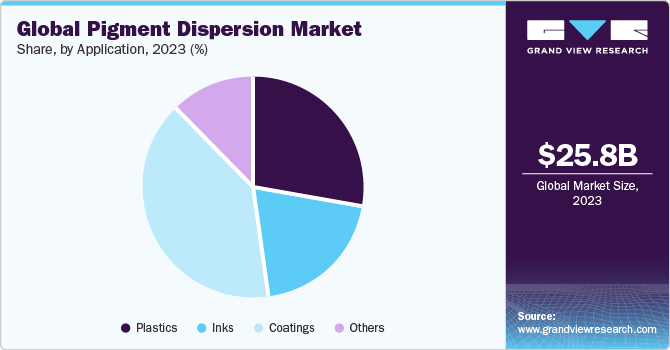

The global pigment dispersion market size was estimated at USD 25.8 billion in 2023 and is projected to reach USD 34.7 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. The steady growth in the packaging industry, in terms of both food and non-food packaging and printing of labels, is expected to drive demand for pigment dispersions during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a revenue share of more than 37.9% in 2023.

- China emerged as a major contributor to the market in Asia Pacific and is projected to lead the region over the upcoming years.

- Germany contributed maximum share in Europe pigment dispersion industry.

- Based on application, the coatings segment led the market and accounted for a revenue share of more than 30.3% in 2023.

- Based on product, the inorganic segment led the market and accounted for a revenue share of more than 57.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 25.8 billion

- 2030 Projected Market Size: USD 34.7 billion

- CAGR (2024-2030): 4.3%

- Asia Pacific: Largest market in 2023

Changing consumer buying behavior associated with attractive packaging colors is expected to drive demand for pigment dispersions over the forecast period. With the increasing use of plastics, papers, and paperboards for packaging applications, pigments find growth opportunities in the packaging industry. Polyethylene terephthalate (PET), polypropylene (PP), and polystyrene (PS) are the most preferred polymers in single-service food packaging segment. Factors such as the increasing use of plastic and paper & paperboard materials and use of various colorants to make attractive packaging are expected to drive overall pigments demand.

Organic pigments are an alternative to some of toxic inorganic pigments. However, organic pigments are more expensive and some pigments that exhibit superior properties are limited. Manufacturers are investing in research & development activities to replace metals in manufacture of red and yellow synthetic pigments to produce environment-friendly synthetic pigments.

Titanium dioxide is the most widely used inorganic pigment on account of its non-toxic content, chemical stability, and versatile properties for use in plastic and paper & paperboard food packaging. Zinc oxide is a synthetically produced pigment and is considered to have a lesser toxic effect on humans. Currently, titanium dioxide, iron oxide, and zinc oxide account for the maximum share of global pigment demand for plastic and paper & paperboard food packaging applications.

Application Insights

Based on application, the coatings segment led the market and accounted for a revenue share of more than 30.3% in 2023. The growing building & construction industry on account of infrastructure development in many economies such as the U.S., China, India, and Saudi Arabia, among others is expected to drive demand for coatings during the forecast period, thus boosting growth of the market in coming years. With growing demand for green building construction, organic pigments used in coatings are also anticipated to witness a considerable increase in demand.

The pigment dispersion has widely substituted dyes in printing ink applications as the former provides better coloring to printing ink, thereby offering intended results to printing ink manufacturers. Inks that are made from dyes are composed of a colorant that is completely dissolved in a carrier fluid, whereas pigment dispersion-based printing inks consist of fine solid particles that get suspended in a carrier liquid. These inks employ both organic and inorganic pigment dispersions; however, the percentage use of the latter is comparatively high owing to its low price and better dispersion capabilities.

The increasing consumption of plastic in various end-use industries, including construction, automotive, medical devices, and electrical & electronics is expected to drive demand for pigment dispersion during the forecast period. Plastics are being used in construction applications such as floorings, high-performance safety windows, insulation materials, storage tanks, roofing, pipes, domes/skylights, cables, and doors. A moderate scope for growth is presented by such an evolving market.

Pigment dispersion is used in plastics, mostly with polyolefins, for plastic food packaging and other non-food packaging, in addition to building & construction products, coverings, gutters, sheets, films, and others. Pigment dispersions used in plastic applications involving direct exposure to sunlight are expected to protect it from ultraviolet (UV) radiations, as the radiations could affect pigment dispersion properties. In packaging, pigment dispersion helps in enhancing branding by improving visual design, which often attracts consumers.

Paper & paperboard coatings provide various features to the coated surface, for instance, better printability, better varnish hold out, and increased flexibility. In addition, paper & paperboards can be coated in various colors and can also be designed to have a high gloss finish. In addition, coated paperboards are strong, durable, and even water-resistant for specific applications.

Epoxy and polyurethane formulations are used in various floorings that require pigment dispersion to offer decorative and functional colors. Pigment dispersion is used in rubber applications for coloring rubber sheets, tire sidewalls, and surgery equipment in the medical industry.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of more than 37.9% in 2023. The high share is attributable to availability of raw materials in abundance and presence of low-cost labor, thus attracting manufacturers from various industries to set up their production facilities in the Asia Pacific to derive increased benefits. In South Korea, the coatings application segment is expected to contribute a maximum share of overall market growth during the forecast period.

China emerged as a major contributor to the market in Asia Pacific and is projected to lead the region over the upcoming years. The availability of raw materials and low cost labor along with the ease in supply chain facilities enables countries to export manufactured goods to other countries at competitive prices and safely. Increasing disposable income along with a change in behavior of a customer is projected to contribute to growth of market in various end-use industries such as automotive, construction, consumer goods, electrical & electronics, utility, packaging, food & beverages, and others such as paints & coatings, printing inks, and food & non-food packaging.

The growing infrastructure activities and increased spending from the government on public infrastructure development are anticipated to drive the South Korean market for pigment dispersion. In addition, macroeconomic factors such as low unemployment rate and high disposable income in South Korea are stipulated to propel the demand for pigment dispersions in packaging applications for various end-use industries, such as food & beverage and consumer goods.

Germany contributed maximum share in Europe pigment dispersion industry, in terms of both volume and revenue. Growing industrial facilities and supportive macroeconomic situations in several European countries are factors expected to boost the market growth for pigment dispersion in the region. Furthermore, the rapidly rising trend of green technology, which can be attributed to strict environmental regulations, is anticipated to favor growth of organic pigment dispersion in the region.

The demand for pigment dispersion in the U.S. is majorly driven by the increasing number of quick-serve restaurants (QSRs), which use pigment dispersion in food packaging and printing ink applications. The U.S. government has strict regulations for type of pigment dispersions to be used in food packaging, as many inorganic pigments become toxic after coming in contact with food products.

For instance, according to the FDA, materials that are permissible for use as food colorants are allowed to be used as coloring agents for food packaging and printing inks. However, pigments containing polynuclear aromatic hydrocarbons and benzopyrene, exceeding 0.5 parts per million and 5.0 parts per million, respectively, are prohibited from application in food packaging.

Market Dynamics

Increasing use of plastic and paperboard materials for food packaging has been a significant trend in the global food industry. In response, demand for pigments and pigment dispersions has also grown since these materials require various colorants to improve their visual appeal. Both plastic and paperboard materials offer several advantages in food packaging, including enhanced shelf life, improved food safety, and increased convenience. However, their widespread use has resulted in environmental concerns related to disposal of plastic waste.

The growing use of plastics in various applications, such as packaging, consumer goods, and construction, has led to an increase in demand for pigment dispersion. Versatility of plastics has expanded a range of applications for pigment dispersion. For example, color-stable pigments are used to produce colored plastic products such as toys, household items, and automotive parts. The use of pigment dispersion can enhance the performance of plastic products, such as UV stability, weather resistance, and flame resistance. Moreover, demand for innovative and high-quality plastic products is driving development of new pigment dispersion, resulting in increased opportunities for the market.

Product Insights

Based on product, the inorganic segment led the market and accounted for a revenue share of more than 57.3% in 2023. Inorganic pigment dispersion is derived from inorganic compounds such as chromates, sulfates, and metal oxides by various chemical formulations. Inorganic pigment dispersion is used in various applications, including plastics, paints & coatings, and printing inks, among others.

Inorganic pigment dispersion is generally lighter than organic pigment dispersion; however, in applications demanding higher durability, inorganic pigment dispersion is preferred over organic pigment dispersion. Unlike inorganic pigment dispersion, organic pigment dispersion may fade away when continuously exposed to sunlight.

Calcium carbonate is a white powder and has three polymorphs, namely aragonite, calcite, and vaterite. It is also naturally available in limestone, chalk, seashells, and marble, and is generally available in various colors ranging from gray to yellow depending on the level of presence of impurities.

In addition, inorganic pigment dispersion is more economical than organic pigment dispersion and offers easier dispersion properties on various substrates owing to its smaller particle size as compared with organic pigment dispersion. Titanium dioxide and iron oxide are among the more popular types of inorganic pigment dispersion.

Organic pigments are composed of carbon chains and carbon rings and are transparent owing to their large particle size. The common types of organic pigments include azo pigments, phthalocyanine pigments, lake pigments, and quinacridone pigments. The color strength of organic pigments is much higher than inorganic pigments; however, high prices and poor dispersion capabilities are restraining the growth of the organic pigments segment. Organic pigments find application in printing inks, paints & coatings, rubber, and plastics.

Key Companies & Market Share Insights

The global market for pigment dispersion is fragmented in nature and major players are engaged in product development, strategic partnerships, mergers & acquisitions, and joint ventures to vertically integrate across the value chain, reducing operational costs to have more profit margins. For instance, in March 2019, BASF SE partnered with Landa Labs to introduce its second stir-in pigment eXpand! Blue (EH 6001), sold under the Colors & Effects brand. eXpand! Blue (EH 6001) is used in automotive coatings and outdoor coating applications.

In December 2018, Organic Dyes and Pigments acquired Premier Colors, Inc. to expand its business in Providence by catering to customers of latter. Premier Colors, Inc., located in South Carolina, U.S., is engaged in supply of pigment dispersions and specialty chemicals to paper, textile, paints & coatings, and leather end-use industries.

In February 2023, Vivify Specialty Ingredients acquired Reitech Corp., a manufacturer of pigment dispersions. Vivify is likely expand its product offerings and broaden its customer base in the specialty dispersions market.

Key Pigment Dispersion Companies:

- AArbor Colorants Corporation

- American Element

- Aralon Color GmbH

- BASF SE

- Clariant Ltd.

- Decorative Color & Chemical, Inc.

- Ferro Corporation

- Flint Group

- Heubach GmbH

- Kama Pigments

- Organic Dyes and Pigments

- Reitech Corporation

- Sun Chemical

- Trust Chem Co., Ltd.

- Sudarshan Chemical Industries Limited

- Pidilite Industries Ltd.

- Aum Farbenchem

- DyStar Singapore Pte. Ltd.

- Solvay

- Altana

- Achitex Minerva S.p.A.

- Heidelberger Druckmaschinen AG

- Avient

- Habich

- Synthesia, a.s.

Pigment Dispersion Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.96 billion

Revenue forecast in 2030

USD 34.7 billion

Growth rate

CAGR of 4.3 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Vietnam; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

AArbor Colorants Corporation; American Element; Aralon Color GmbH; BASF SE; Clariant Ltd.; Decorative Color & Chemical; Inc.; Ferro Corporation; Flint Group; Heubach GmbH; Kama Pigments; Organic Dyes and Pigments; Reitech Corporation; Sun Chemical; Trust Chem Co.; Ltd.; Sudarshan Chemical Industries Limited; Pidilite Industries Ltd.; Aum Farbenchem; DyStar Singapore Pte. Ltd.; Solvay; Altana; Achitex Minerva S.p.A.; Heidelberger Druckmaschinen AG; Avient; Habich; Synthesia, a.s.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pigment Dispersion Market Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pigment dispersion market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Inorganic Pigments

-

Calcium Carbonate

-

Titanium Dioxide

-

Iron Oxide

-

Carbon and Vegetable Black

-

Ultramarine Blue

-

Chrome Green

-

-

Organic Pigments

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Packaging

-

Plastic Food Packaging

-

Other Non-Food Packaging

-

-

Other Plastics

-

-

Inks

-

Coatings

-

Paper & Paper Board Coatings

-

Other Coatings

-

-

Others

-

Rubber

-

Silicone

-

LSR

-

HTV

-

RTV

-

-

EPDM

-

Polyurethane

-

Other Rubber

-

-

Epoxy

-

Adhesives

-

Sealants

-

Phthalate-Free PVC Masterbatch

-

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pigment dispersion market size was valued at USD 25.88 billion in 2023 and is expected to reach USD 26.96 billion in 2024.

b. The global pigment dispersion market size is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030 to reach USD 34.7 billion by 2030.

b. Asia Pacific dominated the market and accounted for more than 37% share of the global revenue in 2023.

b. Some of the key players operating in the pigment dispersion market include BASF SE, Clariant, Ferro Corporation, Pidilite Industries Ltd., PolyOne Corporation, Solvay SA, Sudarshan Chemical Industries Limited, and Sun Chemical.

b. Key factors driving the pigment dispersion market growth include increased consumer preference for brightly packaged food products and the growing use of plastic & paperboard materials for food packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.