- Home

- »

- Advanced Interior Materials

- »

-

Pipe Fittings Market Size And Share, Industry Report, 2030GVR Report cover

![Pipe Fittings Market Size, Share & Trends Report]()

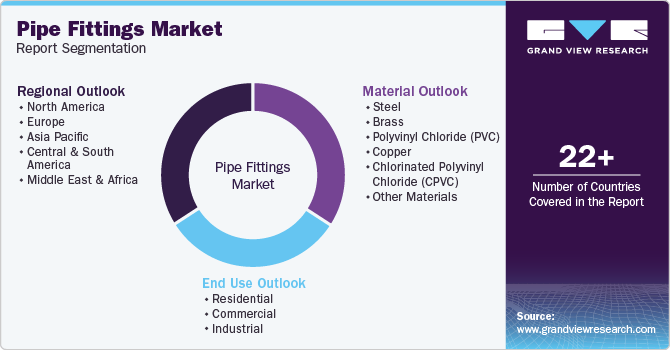

Pipe Fittings Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Steel, Brass, Polyvinyl Chloride, Copper, Chlorinated Polyvinyl Chloride), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-515-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pipe Fittings Market Summary

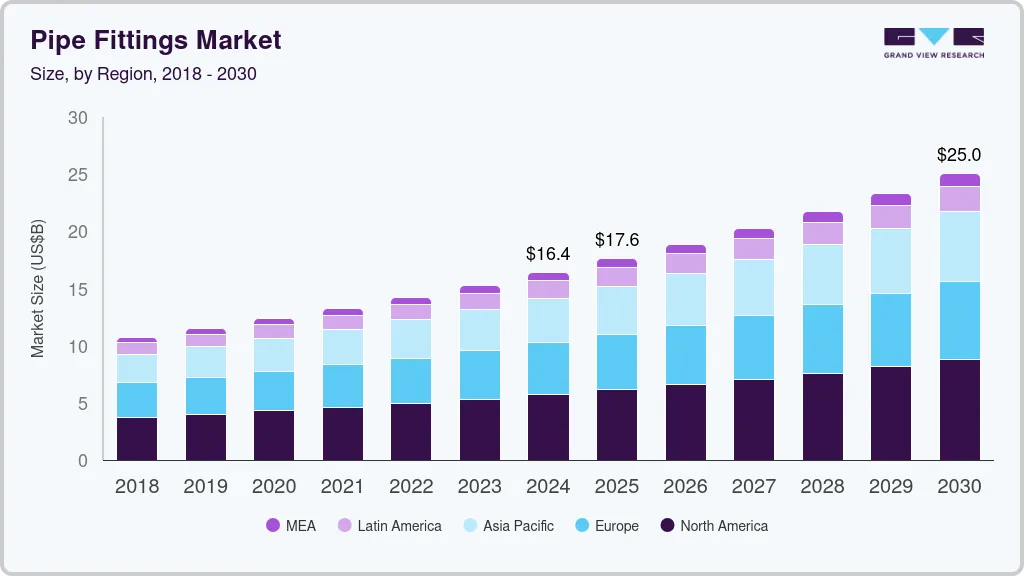

The global pipe fittings market size was estimated at USD 16,394.9 million in 2024 and is projected to reach USD 25,021.2 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The growth of the industry can be attributed to the crucial role they play in various industries, including construction, oil & gas, water treatment, manufacturing, and infrastructure development.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, steel accounted for a revenue of USD 6,626.5 million in 2024.

- Other Materials is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 16,394.9 Million

- 2030 Projected Market Size: USD 25,021.2 Million

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

The market is driven by rising urbanization, increasing infrastructure investments, and growing demand for efficient water management systems worldwide.

Additionally, advancements in material science, such as the development of corrosion-resistant polymers and composite materials, are enhancing the durability and efficiency of modern pipe fittings, making them an integral part of sustainable construction and industrial applications.

One of the primary drivers of the industry is the rising demand for water and wastewater management systems. With growing concerns over water scarcity and sanitation, governments across the world are investing in water distribution, drainage, and sewage treatment projects, thereby fueling the demand for durable and efficient pipe fittings. Additionally, the expansion of the oil & gas and chemical processing industries requires high-strength and corrosion-resistant fittings, further boosting market growth. Rapid urbanization and industrialization in emerging economies, particularly in Asia-Pacific and the Middle East, are also contributing to the increasing demand for pipe fittings in residential, commercial, and industrial infrastructure projects.

Despite strong growth prospects, the pipe fittings market faces several restraints, including fluctuating raw material prices and supply chain disruptions. Steel, copper, and brass, which are widely used in manufacturing high-performance fittings, are subject to volatile pricing due to geopolitical tensions, trade policies, and fluctuating demand. Additionally, the installation and maintenance costs associated with metal pipe fittings can be high, limiting their adoption in cost-sensitive markets. Environmental concerns related to plastic pipe fittings, such as PVC and CPVC, also pose a challenge, as governments and regulatory bodies impose restrictions on the usage of non-recyclable plastic materials.

Furthermore, the presence of stringent regulatory frameworks and compliance requirements also poses a challenge to the industry. In industries such as oil & gas, pharmaceuticals, and food processing, pipe fittings must adhere to strict safety, pressure, and material compatibility standards, making it challenging for manufacturers to balance cost, performance, and regulatory compliance.

However, the market presents significant opportunities, particularly in the development of eco-friendly and advanced material-based fittings. The growing demand for sustainable and energy-efficient piping solutions has led to increased research and development in composite materials, PEX (cross-linked polyethylene), and smart pipe fittings with built-in leak detection and monitoring capabilities.

Moreover, the rising adoption of green building initiatives and smart cities is expected to drive the demand for high-performance and long-lasting pipe-fitting solutions, particularly in the commercial and residential sectors. Innovations in 3D printing and automation in pipe manufacturing also open new avenues for the market, enabling cost-effective production with enhanced design flexibility.

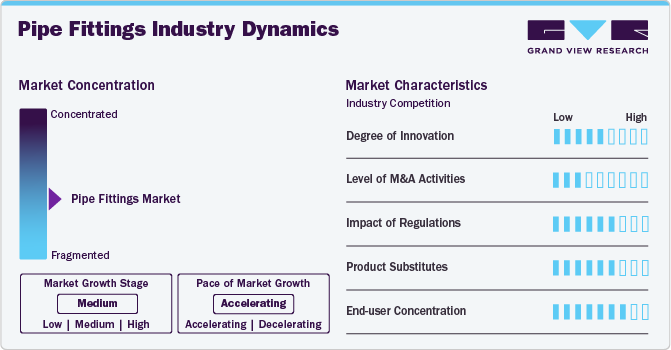

Market Concentration & Characteristics

Market growth stage is high, and the pace of the market growth is accelerating. The market is fragmented, with the presence of global and regional players focusing on product innovation, material advancements, and strategic expansions to strengthen their market position. Key manufacturers are investing in sustainable and high-performance materials, such as composites, corrosion-resistant alloys, and smart pipe fittings with IoT-based leak detection.

Mergers, acquisitions, and partnerships are also key strategies being adopted to expand market reach and enhance production capabilities. Going forward, industry players are expected to focus on automation in manufacturing, customized solutions for industries, and the integration of eco-friendly materials to align with sustainability trends and regulatory requirements.

The industry is subject to stringent regulations and industry standards across various end-use sectors, including water supply, oil & gas, chemical processing, and construction. Standards such as ISO (International Organization for Standardization), ASTM (American Society for Testing and Materials), and ANSI (American National Standards Institute) dictate specifications for pressure handling, material composition, and safety requirements.

Material Insights

Steel dominated the market with a revenue share of 37.7% in 2024 due to its strength, durability, and high-pressure resistance. Pipe fittings made from steel are widely used in oil & gas, water treatment, power plants, and heavy industries where extreme temperatures and pressure conditions require robust materials. Carbon steel and stainless steel fittings are particularly popular for their corrosion resistance and longevity, making them ideal for applications in chemical processing and energy production.

Additionally, advancements in galvanized and coated steel fittings have further improved their lifespan, making them suitable for both underground and above-ground installations. Furthermore, their ability to withstand harsh environmental conditions and heavy loads makes them irreplaceable in key industries. With increasing investments in infrastructure, pipelines, and industrial expansion, the demand for steel pipe fittings is expected to remain strong over the forecast period.

Polyvinyl Chloride (PVC) pipe fittings are among the most widely used in residential, commercial, and municipal applications, on account of their lightweight, low cost, and resistance to corrosion and chemical exposure. These fittings are particularly popular in water supply, irrigation, drainage, and sewer systems, where their non-reactive nature ensures safe water transportation without contamination. PVC’s ability to withstand moisture, acids, and salts makes it an excellent choice for underground and outdoor piping systems.

However, PVC has some limitations, including lower pressure and temperature resistance compared to metal fittings, making it unsuitable for high-temperature industrial applications. Additionally, concerns over environmental sustainability and plastic waste management have led to stricter regulations on PVC usage in certain regions.

End-use Insights

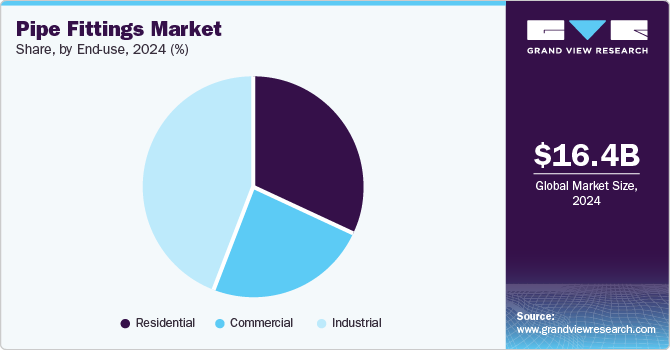

Based on end use, this market is segmented into residential, commercial, and industrial. Industrial accounted for the largest revenue share of 43.8% in 2024, driven by product use in oil & gas, chemical processing, power plants, food & beverage, pharmaceuticals, and manufacturing industries.

Pipe fittings in industrial applications must withstand high pressures, extreme temperatures, and exposure to aggressive chemicals, making steel, brass, and composite materials the preferred choice. Industries such as oil & gas and power generation require high-strength, corrosion-resistant metal fittings, whereas chemical and food processing plants rely on specialized non-reactive materials such as CPVC, polypropylene (PP), and polyethylene (PE) to ensure safety and compliance with industry regulations.

The residential sector is a key driver of the pipe fittings market, primarily due to urbanization, population growth, and increasing housing construction projects. Pipe fittings play a crucial role in plumbing, water supply, drainage, and HVAC systems in both newly constructed and renovated homes. The rising adoption of modern plumbing materials, such as PVC, CPVC, and PEX, has transformed the residential market, as these materials offer affordability, corrosion resistance, and ease of installation compared to traditional metal fittings.

Additionally, government initiatives promoting affordable housing and smart city developments in countries such as India, China, and the United States are further boosting demand for high-quality and durable pipe fittings in the residential segment.

Regional Insights

North America pipe fittings market was the largest regional segment in 2024, valued at USD 5.70 billion. This is driven by the region’s robust construction, oil & gas, and industrial sectors. The increasing demand for modernized infrastructure, water management systems, and industrial applications fuels the need for pipe fittings across various materials, including steel, PVC, and CPVC. The rise in residential and commercial construction projects, coupled with strict government regulations on water quality and pipeline safety, has further boosted the adoption of advanced pipe fitting solutions in the region.

U.S. Pipe Fittings Market Trends

The pipe fittings market in the U.S. is primarily driven by its extensive infrastructure, industrial base, and booming construction sector. The country’s aging water supply networks and increasing investments in municipal water and sewage treatment plants are key drivers for the demand for pipe fittings. In addition, the growth of residential and commercial real estate projects, driven by urbanization and population growth, has led to a rising need for efficient plumbing solutions.

Asia Pacific Pipe Fittings Market Trends

The pipe fittings market in Asia Pacific is witnessing rapid growth, driven by urbanization, infrastructure development, and industrial expansion. Countries like China, India, and Japan are leading the demand for residential, commercial, and industrial piping solutions. The increasing investments in smart cities, water treatment plants, and energy-efficient construction are fueling the market, with PVC and CPVC fittings gaining significant traction due to their cost-effectiveness and chemical resistance.

China pipe fittings market in Asia Pacific is driven by its booming construction, manufacturing, and energy sectors. The country’s rapid urbanization and industrialization have created enormous demand for plumbing, water distribution, and gas pipeline systems, with pipe fittings being an essential component in these infrastructures.

Europe Pipe Fittings Market Trends

The pipe fittings market in Europe is driven by strong demand in construction, water management, and industrial applications. The region’s emphasis on sustainable infrastructure development has led to increased adoption of eco-friendly materials such as PVC, CPVC, and composite pipe fittings. Additionally, strict EU regulations regarding water safety, sanitation, and energy efficiency are pushing manufacturers to develop more durable and environmentally friendly solutions.

Germany pipe fittings market is driven by its strong industrial, construction, and manufacturing sectors. The country has a well-developed water management system, and investments in modernizing aging pipelines are creating significant demand for high-quality fittings. Germany’s stringent regulations on environmental protection and energy efficiency have encouraged the use of innovative, corrosion-resistant materials like CPVC and composites in piping solutions.

Central & South America Pipe Fittings Market Trends

The pipe fittings market in Central & South America is experiencing moderate growth, primarily driven by urbanization and improvements in water infrastructure. Countries such as Brazil are focusing on upgrading their plumbing and water distribution systems, leading to a higher demand for PVC and CPVC fittings.

Middle East & Africa Pipe Fittings Market Trends

The pipe fittings market in the Middle East & Africa is driven by oil & gas, construction, and water management projects. Countries such as Saudi Arabia, UAE, and South Africa are investing heavily in energy infrastructure, commercial real estate, and smart water management, creating a strong demand for steel and brass fittings.

Key Pipe Fittings Company Insights

Some of the key players operating in the market include Mueller Industries, Georg Fischer, Tata Steel, and Saint-Gobain.:

-

Mueller Industries is a leading manufacturer of pipe fittings, valves, and flow control products, specializing in copper, brass, aluminum, and plastic components. With a strong presence in HVAC, plumbing, refrigeration, and industrial applications, the company focuses on innovation, sustainability, and expanding its global footprint.

-

Tata Steel is a major player in the pipe and fittings industry, manufacturing steel-based piping solutions for construction, oil & gas, and industrial applications. With a strong focus on innovation and sustainability, the company is investing in corrosion-resistant, high-strength materials and advanced manufacturing technologies to meet growing infrastructure demands.

Metline Industries and Aliaxis are some of the emerging market participants in the pipe fittings market.

-

Metline Industries is a leading Indian manufacturer and supplier of pipe fittings, flanges, and piping components, serving industries such as oil & gas, petrochemicals, power plants, and construction. The company specializes in stainless steel, carbon steel, and alloy-based fittings, ensuring high-quality, durable solutions for global industrial markets.

-

Aliaxis is involved in plastic piping systems and fluid management solutions, providing PVC, CPVC, PEX, and PE-based pipe fittings for water supply, drainage, industrial, and residential applications. The company focuses on sustainability, digital solutions, and high-performance materials, driving innovation in smart water management and infrastructure projects worldwide.

Key Pipe Fittings Companies:

The following are the leading companies in the pipe fittings market. These companies collectively hold the largest market share and dictate industry trends.

- Mueller Industries

- Georg Fischer

- Tata Steel

- Saint-Gobain

- Aliaxis

- RPM International Inc.

- Eastman Chemical Company

- Popular Pipes Group of Companies.

- Merck KGaA

- Metline Industries

Recent Developments

In May 2024, Westlake Pipe & Fittings, a division of Westlake Corporation, announced plans to expand its manufacturing facility in Wichita Falls, Texas, with the addition of a 190,000-square-foot PVCO pipe plant. This expansion aims to enhance the company's product portfolio and production capacity by introducing molecular-oriented PVC (PVCO) pipes, known for their strength, durability, and efficiency in water conveyance. The investment reinforces Westlake’s commitment to innovation, sustainability, and customer-focused solutions while creating economic opportunities in the region.

Pipe Fittings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.59 billion

Revenue forecast in 2030

USD 25.02 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea

Key companies profiled

Mueller Industries, Georg Fischer, Tata Steel, Saint-Gobain, Aliaxis, RPM International Inc., Eastman Chemical Company, Popular Pipes Group of Companies., Merck KGaA, Metline Industries

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pipe Fittings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pipe fittings market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Brass

-

Polyvinyl Chloride (PVC)

-

Copper

-

Chlorinated Polyvinyl Chloride (CPVC)

-

Other Materials

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global pipe fittings market size was estimated at USD 16.39 billion in 2024 and is expected to reach USD 17.59 billion in 2025.

b. The global pipe fittings market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 25.02 billion by 2030.

b. Industrial accounted for the largest revenue share of 43.8% in 2024, driven by product use in oil & gas, chemical processing, power plants, food & beverage, pharmaceuticals, and manufacturing industries.

b. Key players operating in the market are Mueller Industries, Georg Fischer, Tata Steel, Saint-Gobain, Aliaxis,RPM International Inc., Eastman Chemical Company, Popular Pipes Group of Companies., Merck KGaA, and Metline Industries.

b. The key factors that are driving pipe fittings market include the rising urbanization, increasing infrastructure investments, and growing demand for efficient water management systems worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.