- Home

- »

- Biotechnology

- »

-

Protein Chip Market Size & Share, Industry Report, 2033GVR Report cover

![Protein Chip Market Size, Share & Trends Report]()

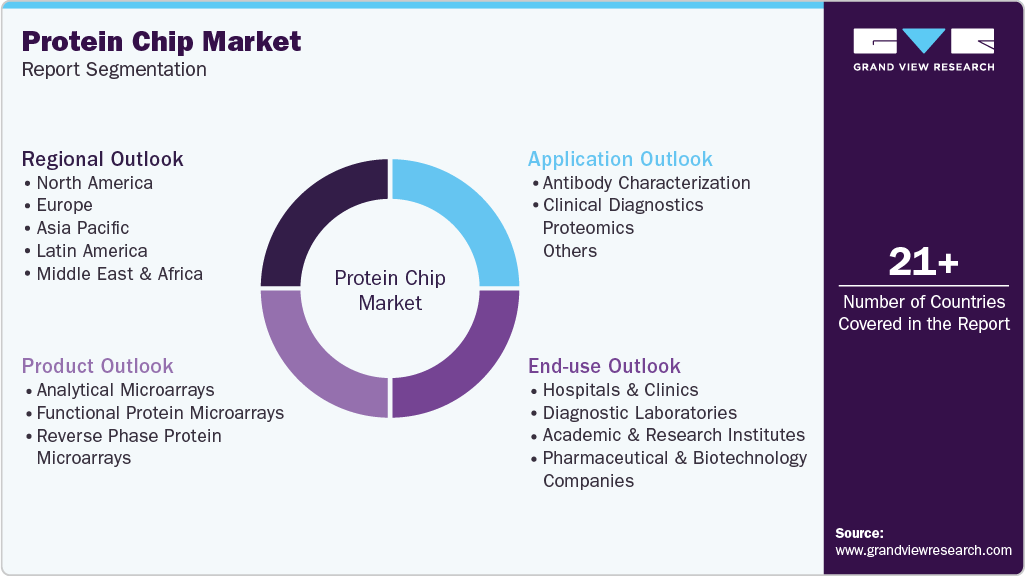

Protein Chip Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Analytical Microarrays, Reverse Phase Protein Microarrays), By Application (Antibody Characterization, Clinical Diagnostics), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-260-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Chip Market Summary

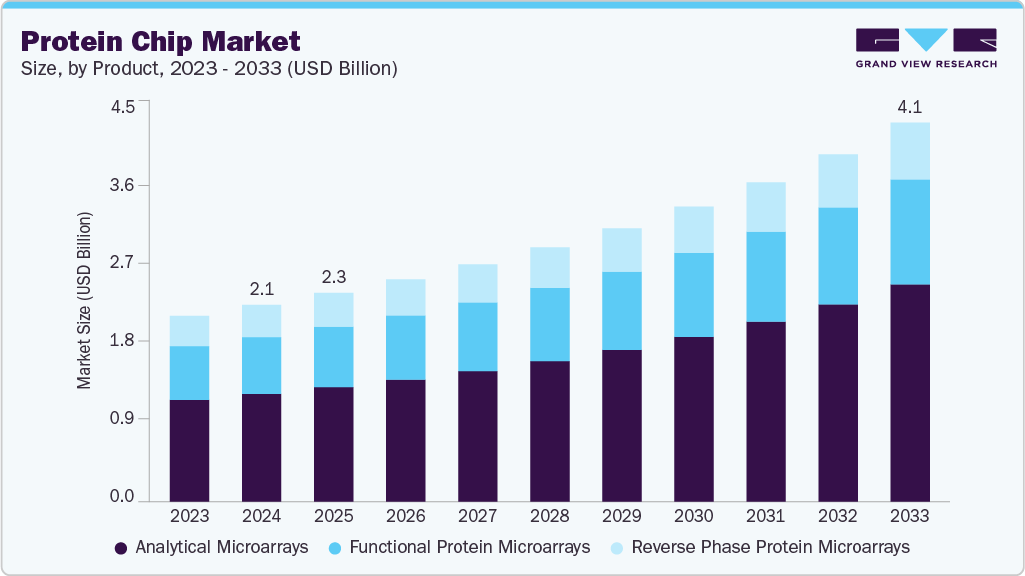

The global protein chip market size was estimated at USD 2.15 billion in 2024 and is projected to reach USD 4.14 billion by 2033, growing at a CAGR of 7.74% from 2025 to 2033, owing to the growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, increasing diagnostic applications, and ongoing technological advancements. Moreover, the growing investment in proteomics research & technology development is anticipated to fuel the market growth over the forecast period.

Key Market Trends & Insights

- The North America protein chip market held the largest share of 40.15% of the global market in 2024.

- The protein chip industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the analytical microarrays segment held the highest market share of 54.81% in 2024.

- By application, the antibody characterization segment led the market with the largest revenue share of 56.88% in 2024.

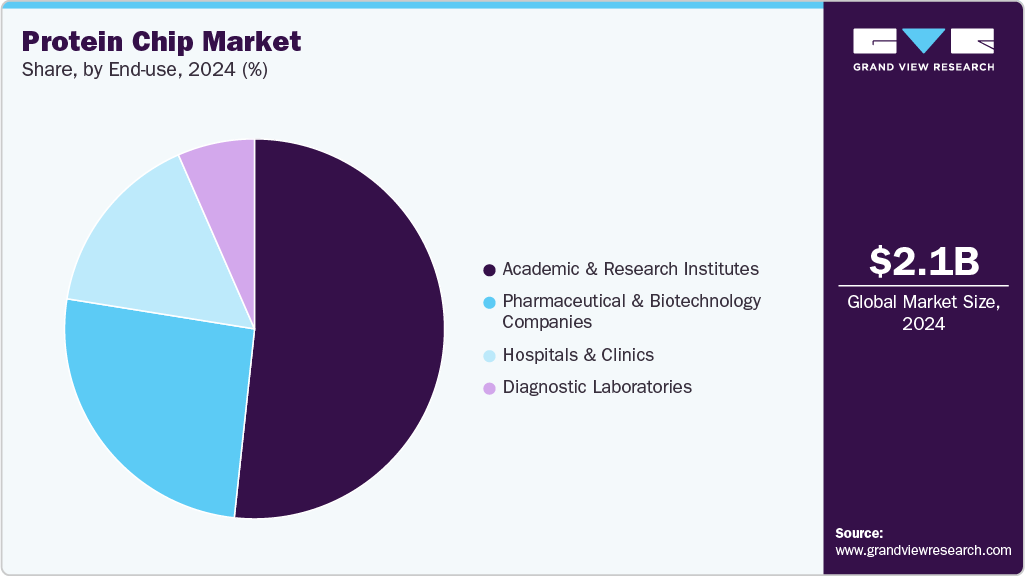

- By end-use, the academic & research institutes segment led the market with the largest revenue share of 51.71% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.15 Billion

- 2033 Projected Market Size: USD 4.14 Billion

- CAGR (2025-2033): 7.74%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Biomarker DiscoveryOne of the main factors driving the market expansion for protein chips is the discovery of biomarkers. Protein chips provide comprehensive insights into protein expression, post-translational modifications, and protein-protein interactions while facilitating high-throughput screening and the identification of disease-specific biomarkers. Because of these capabilities, they are essential for comprehending disease mechanisms at the molecular level. The need for trustworthy biomarkers to support early disease detection, patient stratification, and treatment monitoring has increased due to the increased emphasis on precision and personalized medicine on a global scale. Pharmaceutical and biotechnology companies and academic research institutions increasingly implement protein chip technologies to speed up biomarker validation and reduce discovery timelines.

Major protein microarray platforms for biomarker discovery in autoimmune diseases.

Type

Product name

Protein content

Company / Laboratory

Major applications in AID biomarker discovery

Antigen array

ProtoArray Human Protein Microarray

9,483 unique full-length human proteins

Invitrogen

RA, IBD, type-1 diabetes, ankylosing spondylitis, primary Sjögren’s syndrome, ADEM, Meniere’s disease, neuromyelitis optica, myasthenia gravis, chronic renal disease, APS1, SLE, ulcerative colitis

HuProt Human Proteome Microarray

19,394 full-length human proteins

CDI Laboratories

SLE, MS, type-1 diabetes, PBC, dermatomyositis, Behçet disease

Immunome Protein Array

1,636 full-length human proteins involved in the immune response

Sengenics

SLE, RA

Recombinant human protein microarray (E. coli expressed proteins from 37,200 human fetal brain cDNA)

UNIspecified in this row (see next)

Protagen Diagnostics

MS, Behçet disease

UNIlarray

3,101 proteins or protein fragments from fetal brain cDNA

Protagen Diagnostics

MS

Recombinant human protein microarray (transmembrane / secreted proteins)

1,626 transmembrane & secreted proteins (selected in silico)

Grifinant laboratory

Autoimmune hepatitis, PBC

Nucleic Acid Programmable Protein Arrays (NAPPA)

2,500 in situ expressed proteins

BioDesign

Osteoarthritis, type-1 diabetes, ankylosing spondylitis, juvenile arthritis

Phage arrays

T7 phage display cDNA array biopanned by patient sera

Lin laboratory, D’Angelo laboratory

Celiac disease, sarcoidosis

HPA arrays

Various numbers of protein fragments from the Human Protein Atlas

Nilsson laboratory, Uhlen laboratory, etc.

MS, osteoarthritis, sarcoidosis, SLE

RepliTope peptide microarray

10,000 random-sequence 20-mer peptides

JPT Peptide Technologies

SLE

Antibody array

RayBiotech cytokine antibody arrays

Antibodies against various human cytokines

RayBiotech

SLE, pre-eclampsia, Crohn’s disease

Bead-based LUNARIS BioChip

Antibodies against several key inflammatory biomarkers

AYOXXA

Sjögren’s Syndrome

DotScan antibody microarray

82 mouse monoclonal antibodies against human CD antigens

Medsaic

SLE

Lectin array

Various lectin arrays

Lectins that bind glyco-biomarkers

Dang laboratory, Takeshita laboratory

IBD, RA

Source: Secondary Research, Grand View Research

Furthermore, the need for sophisticated proteomic tools has been heightened by the increasing incidence of complex and chronic diseases like cancer, heart disease, and autoimmune diseases. In addition to enabling multiplex analysis of thousands of proteins, protein chips offer a quicker and more economical alternative to conventional analytical methods like ELISA or Western blotting. Their accuracy and clinical relevance have increased due to their integration with data analytics and bioinformatics platforms.

Advancements in Proteomics

Proteomic advancements are emerging as a significant driver of the protein chip industry growth. Protein chips permit high-throughput platforms for simultaneously studying thousands of proteins, providing a powerful foundation for examining complex protein-protein interactions, post-translational modifications, and protein expression levels. As such, this technology has revolutionized proteomics research by providing a level of accuracy and effectiveness that was impossible with traditional methods for studying disease mechanisms and cellular processes. As functional proteomics continues to grow, protein chips are becoming essential tools in the academic and industrial laboratory.

The field of proteomics is developing rapidly, which continues to strengthen the need for protein chip technologies, allowing for more intricate protein profiling, instrumentation of drug target identification, and discoveries of disease-related biomarkers, especially in the fields of immunology, infectious disease, and oncology. Protein chips are expected to gain traction as the global scientific community embraces personalized medicine principles and understanding disease at a molecular level. Thus, protein chips will be the next wave of essential proteomics and life sciences research tools.

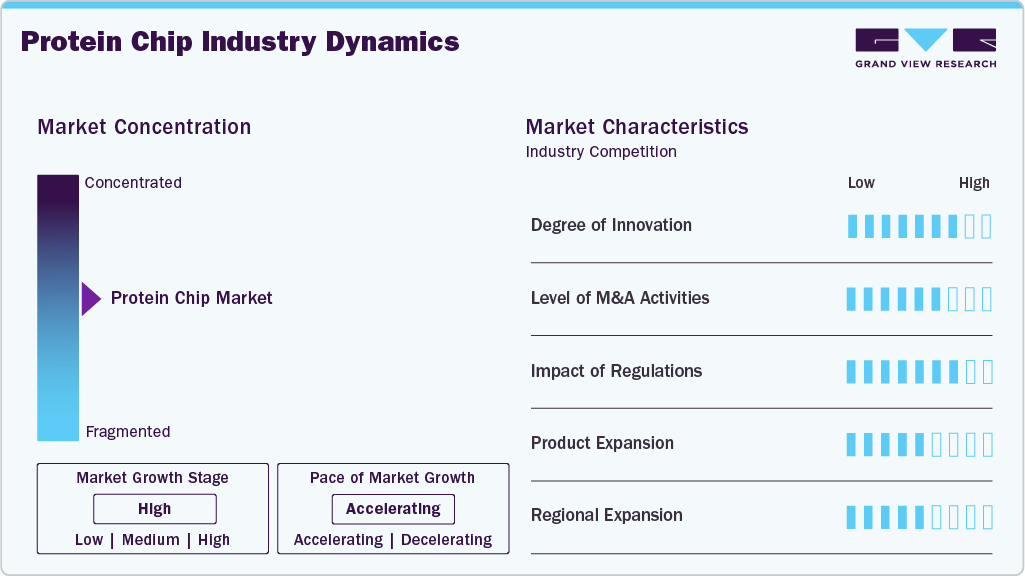

Market Concentration & Characteristics

The degree of innovation in the protein chip industry is exceptionally high because of ongoing developments in array design, detection technologies, and data integration. Modern protein chips have evolved from simple planar arrays to high-density, miniaturized formats capable of analyzing thousands of proteins simultaneously with enhanced sensitivity and specificity. Because of their unrelenting innovation, protein chips are essential in clinical and industrial biotechnology settings, speeding up research and diagnostics and placing them at the forefront of next-generation proteomics.

The protein chip industry has seen a moderate but steady increase in M&A activity, indicative of growing interest from established life sciences companies and up-and-coming biotechnology firms. The main goals of strategic acquisitions are to increase geographic presence, acquire cutting-edge technologies, and diversify product portfolios. For example, larger players frequently purchase niche protein chip developers to incorporate high-throughput proteomic solutions into their more comprehensive genomics, diagnostics, or drug discovery offerings. This trend indicates that consolidation and strategic alliances are important tactics to spur innovation, broaden market reach, and preserve a competitive edge in this maturing market. For instance, in February 2022, MRM Proteomics, Inc. (MRMP) and Agilent Technologies Inc. announced a new co-marketing agreement. This partnership aims to enhance the capabilities of quantitative proteomic applications, facilitating significant scientific discoveries within the research community.

The protein chip industry is greatly impacted by regulations, which include post-market surveillance, quality control, labeling specifications, product approval, and global harmonization initiatives. User safety and product dependability are guaranteed by accurate labeling, reporting of adverse events, and strict adherence to manufacturing standards. Furthermore, market innovation is being shaped by regulatory guidance on new applications like companion diagnostics and personalized medicine, which motivates businesses to create more reliable, clinically validated protein chip platforms.

The protein chip industry currently exhibits a moderate level of product expansion. Manufacturers are creating customized protein chips for immunoprofiling, drug target validation, infectious disease detection, and biomarker discovery. High-density arrays, multiplexed detection, and label-free platforms are examples of chip design advancements that enable researchers to more accurately and sensitively analyze thousands of proteins at once. The value of these products is also being increased by integrating bioinformatics and AI tools, which allows for more thorough data interpretation.

Regional expansion is a key growth driver in the protein chip industry as businesses seek to broaden their global reach and enter emerging markets with growing investments in healthcare and research. North America and Europe dominate the market because of their well-established research infrastructure and widespread use of proteomics technologies. Nonetheless, the growing biotechnology industries, rising healthcare costs, and encouraging government policies drive rapid growth in Asia-Pacific, Latin America, and the Middle East. Regional diversification promotes long-term, sustainable growth by expanding market reach and reducing the risks of relying too heavily on a few well-established markets.

Product Insights

The analytical microarrays led the market with the largest revenue share of 54.81% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the growing technological advancements. These platforms offer high-throughput capabilities, allowing for the simultaneous analysis of thousands of proteins in a single experiment. Continued advancements in microarray technology, such as improved sensitivity, resolution, and multiplexing capabilities, make them highly attractive for researchers and practitioners. For instance, in March 2023, Spectrum Solutions announced its acquisition of Alimetrix, Inc., a molecular diagnostic laboratory accredited by CLIA and CAP, specializing in tailored qualitative and quantitative assay development.

The functional protein microarray segment is expected to grow significantly during the forecast period. Functional protein microarrays are valuable tools for discovering and developing novel drugs. They facilitate the identification of drug intervention protein targets, allow for the screening of compound libraries for potential drug candidates, and assist in assessing the specificity and efficacy of drugs. Demand remains high for functional protein microarrays in drug discovery because of the continued need for new therapeutics and increased attention on personalized medicine.

Application Insights

The antibody characterization segment led the market with the largest revenue share of 56.88% in 2024. Antibody characterization is necessary for various biomedical research and clinical applications. It is important in antibody-based therapeutics development, biomarker discovery, disease diagnosis, protein interaction studies, and immunodiagnostics. Antibody characterization applications are a mainstay in the global market due to their versatility across various domains. For instance, in April 2023, researchers from the KTH Royal Institute of Technology in Stockholm, Sweden, developed a microfluidic chip to make it easier to track the production of monoclonal antibodies (mAbs). With the help of this protein cartridge, up to four different proteins can be examined simultaneously in cell cultures in a bioreactor.

The clinical diagnostics segment is expected to grow at the fastest CAGR over the forecast period. Protein chips are used in biomarker discovery for various diseases, including cancer, cardiovascular, infectious, autoimmune, and neurological disorders. As the need for early disease detection, accurate diagnosis, and prognosis assessment rises, there is a growing demand for protein chip-based assays in clinical diagnostics. Moreover, in November 2023, Octave Bioscience, Inc. was awarded a USD 10 million grant from The Michael J. Fox Foundation to develop and validate a multi-analyte protein biomarker test for assessing Parkinson's disease.

End Use Insights

Based on end-use, the academic & research institutes segment led the market with the largest revenue share of 51.71% in 2024. Academic & research institutes conduct various research projects spanning basic science, translational research, and applied studies. Protein chip technology offers researchers a powerful tool for studying protein-protein interactions, biomarker discovery, drug screening, and disease mechanisms. For instance, in February 2024, a group of researchers from Aston University and the University of Warwick obtained a USD 1.97 million grant in February 2024 to create membrane proteins to support sustainable manufacturing and assist in drug discovery. Protein chips are therefore widely used by academic and research institutions to achieve their goals.

The diagnostic laboratories segment is expected to grow at the fastest CAGR during the forecast period. Protein chips are essential for improving diagnostic capabilities and transforming healthcare delivery in diagnostic centers. These organizations use protein chips to facilitate quick and precise disease diagnosis. Infectious diseases, genetic disorders, cancer, and other complex diseases can be diagnosed with the help of protein chips, which enable the detection of particular biomarkers or genetic variations linked to various conditions. They provide high-throughput analysis, enabling the screening of several samples simultaneously and expediting patient care. For example, CCM Biosciences introduced CCM Protein Upregulation in September 2023, using cutting-edge technology to improve vital protein activity to target genetic diseases, Alzheimer's, Parkinson's, and infertility.

Regional Insights

North America dominated the protein chip market with a share of 40.15% in 2024. The growth is primarily driven by its strong funding for proteomics and biomarker discovery, advanced research infrastructure, and well-established biotechnology and pharmaceutical sectors. North America's dominance in the global market has also been strengthened by the rapid innovation and commercialization of protein chip technologies brought about by broad partnerships between academic institutions, research organizations, and private businesses. For instance, in November 2023, March Biosciences, a US-based clinical-stage biotechnology company, disclosed a USD 4.8 million investment from the Cancer Focus Fund for its Phase II clinical trial on MB-105, exploring its efficacy in relapsed T-cell leukemias and lymphomas. MB-105, a chimeric antigen receptor-T cell (CAR-T) therapy, specifically targets CD5, a protein commonly found in both normal and malignant T-cells.

U.S Protein Chip Market Trends

The protein chip market in the U.S. is expected to grow at the fastest CAGR over the forecast period due to many market players in the U.S. undergoing various strategic initiatives, such as collaborations and partnerships.

Europe Protein Chip Market Trends

The protein chip market in Europe was identified as a lucrative region in this industry. This can be attributed to strong biotechnology and pharmaceutical sectors. Several biotechnology and pharmaceutical companies are getting established, rising startups are collaborating, and many research institutions anticipate boosting market growth.

The UK protein chip market is expected to grow at the fastest CAGR over the forecast period. Good healthcare infrastructure & accessibility, increasing investment in precision medicine initiatives, and rising preference for chronic disorders are anticipated to drive market growth in the UK.

The protein chip market in Germany is growing, supported by a substantial number of local providers of biotechnology and pharmaceutical tools, strong government research funding, advanced laboratory infrastructure, and increasing collaborations between universities and industry players. These collectively drive innovation and adoption of proteomic technologies across clinical and research applications.

Asia Pacific Protein Chip Market Trends

The protein chip market in the Asia Pacific is anticipated to grow at the fastest CAGR of 10.63% over the forecast period. The region is experiencing significant growth in the biotechnology and pharmaceutical sectors, due to factors like rising healthcare costs, the prevalence of chronic diseases, and increased research and development in the biotechnology and pharmaceutical industries. The demand for cutting-edge technologies like protein chips is rising as biotechnology and pharmaceutical companies in the area look to improve their capabilities in drug discovery, personalized medicine, and diagnostics.

China protein chip market is expected to grow at the fastest CAGR over the forecast period. This is attributed to the rising geriatric population, which is anticipated to increase the demand for various drugs, thereby boosting the market growth.

The protein chip market in Japan is expected to grow at a significant CAGR over the forecast period. Primary factors such as the presence of several pharmaceutical and biotechnology companies, rising health consciousness, and increasing demand for preventive healthcare are anticipated to boost the demand for protein chips for various research and clinical purposes.

MEA Protein Chip Market Trends

The protein chip market in the Middle East & Africa is expected to grow at an exponential CAGR over the forecast period, due to several key factors. These include growing government efforts to raise healthcare standards, growing adoption of advanced diagnostic technologies, rising chronic disease prevalence, increased investments in healthcare infrastructure and research, and growing partnerships with foreign businesses and partners.

Kuwait protein chip market is emerging, owing to the increasing healthcare expenditures to improve healthcare infrastructure and services, rising investments in biomedical research, growing adoption of advanced diagnostic technologies, and government initiatives aimed at promoting precision medicine and supporting biotechnology innovations.

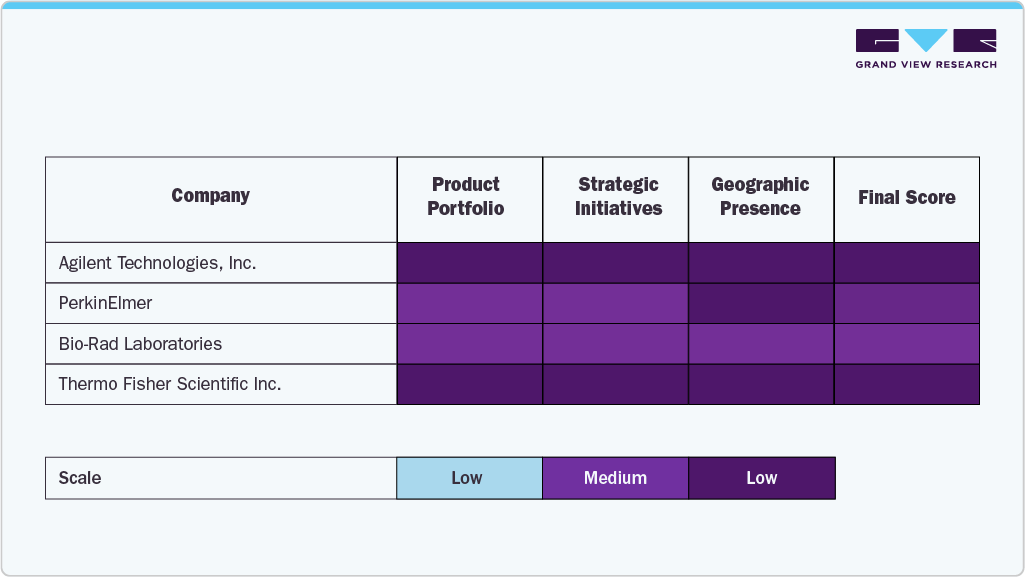

Key Protein Chip Company Insights

The protein chip industry is characterized by several well-established players who maintain dominance through extensive product portfolios, strategic collaborations, and consistent investments in research and development. Leading companies such as Agilent Technologies, Inc., PerkinElmer, Bio-Rad Laboratories, Thermo Fisher Scientific Inc., and Sigma-Aldrich Corporation have secured significant market share because of their advanced protein chip platforms, high-throughput capabilities, and comprehensive global distribution networks.

Other businesses are growing their market share by providing cutting-edge protein chip solutions and application-specific arrays that meet the demands of pharmaceutical companies, clinical diagnostics labs, and biotechnology research institutes. These businesses include Illumina, Inc., Shimadzu Corporation, Roche Diagnostics, RayBiotech, and Danaher. These products facilitate high-throughput proteomic analyses, biomarker identification, and protein profiling, speeding up personalized medicine, disease diagnostics, and drug development efforts.

The market is increasingly impacted by factors related to product innovation, scalability, affordability, and regulatory compliance as the need for precision medicine, proteomics research, and biomarker-driven diagnostics increases. These factors are anticipated to influence the market's future course, guaranteeing that it aligns with more general healthcare, research, and technological objectives.

Key Protein Chip Companies:

The following are the leading companies in the protein chip market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- PerkinElmer

- Bio-Rad Laboratories

- Thermo Fisher Scientific Inc.

- Sigma-Aldrich Corporation

- Illumina, Inc.

- Shimadzu Corporation

- Roche Diagnostics

- RayBiotch

- Danaher

Recent Developments

-

In September 2025, Illumina launched Illumina Protein Prep in the U.S., offering NGS-based proteomics for large-scale research, enhancing drug discovery, biomarker identification, and multiomics insights across clinical and translational studies.

-

In January 2024, Agilent Technologies announced the launch of the ProteoAnalyzer system, an innovative automated parallel capillary electrophoresis system designed for protein analysis. This new platform enhances efficiency and simplifies the analysis of intricate protein mixtures, a crucial step in analytical workflows spanning the pharmaceutical, biotechnology, food analysis, and academic sectors.

Protein Chip Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.28 billion

Revenue forecast in 2033

USD 4.14 billion

Growth rate

CAGR of 7.74% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Agilent Technologies; PerkinElmer; Bio-Rad Laboratories; Thermo Fisher Scientific; Sigma-Aldrich Corporation; Illumina; Shimadzu Corporation; Roche Diagnostics; RayBiotech; Danaher

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Protein Chip Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global protein chip market based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Analytical Microarrays

-

Functional Protein Microarrays

-

Reverse Phase Protein Microarrays

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Antibody Characterization

-

Clinical Diagnostics

-

Proteomics

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the protein chip market Agilent Technologies; PerkinElmer; Bio-Rad Laboratories; Thermo Fisher Scientific; Sigma-Aldrich Corporation; Illumina; Shimadzu Corporation; Roche Diagnostics; RayBiotech; and Danaher.

b. The protein chip market has generated significant growth in recent years owing to growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, increasing diagnostic applications, and Ongoing technological advancements.

b. The global protein chip market size was estimated at USD 2.12 billion in 2023 and is expected to reach USD 2.25 billion in 2024.

b. The global protein chip market is expected to grow at a compound annual growth rate of 6.88% from 2024 to 2030 to reach USD 3.36 billion by 2030.

b. North America has accounted for the largest revenue share of 48.17% in 2023 for the protein chip market. The market is driven by factors such as presence of leading biotechnology and pharmaceutical companies, strong research and academic infrastructure, and early adoption of advanced technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.