- Home

- »

- Plastics, Polymers & Resins

- »

-

Southeast Asia Plastic Compounding Market Size Report, 2030GVR Report cover

![Southeast Asia Plastic Compounding Market Size, Share & Trends Report]()

Southeast Asia Plastic Compounding Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Polyethylene, Elastomers, Ethylene Vinyl Acetate, Polypropylene, Thermoplastic Vulcanizates), By Application, By Country, And Segment Forecasts

- Report ID: GVR-3-68038-489-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

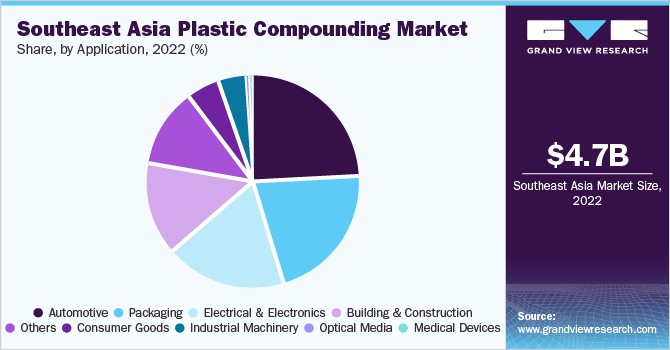

The Southeast Asia plastic compounding market size was valued at USD 4,730.55 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.79% from 2023 to 2030. Growing automotive industry in the region along with favorable FDI norms by governments is further projected to facilitate investment in the Southeast Asia. Plastic compounding is a technique that involves melting polymers with specific additives to modify the product physical, aesthetically pleasing, electrical, and thermal properties. The ongoing development of self-cleaning technology in several end-use industries across the globe is another driving factor of plastic compounding in the Southeast Asia.

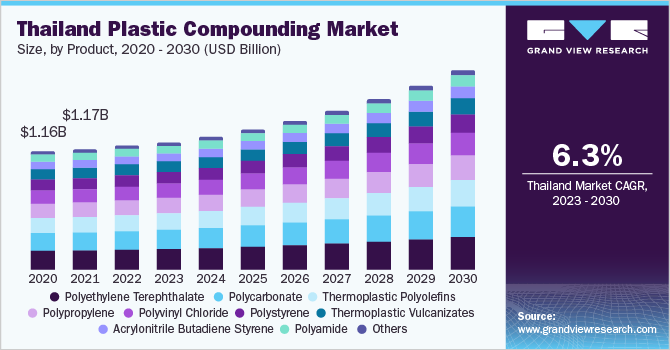

Thailand dominated the SEA Plastic Compounding Market and is expected to be one of the fastest-growing markets in the region in 2022. The key manufacturing sectors, such as automotive and electrical & electronics, are expected to experience healthy expansion, which is projected to have a significant impact on the rising plastic demand in the country.

Growing urbanization, increasing health consciousness, and rising awareness regarding the environment is expected to augment demand for plastic compounding in the various application sectors during the forecast period. Moreover, the outbreak of COVID-19 has further catalyzed the demand for online shopping for packaged and processed food owing to several restrictions on the movement and social distancing measures imposed by the government, which, in turn, is expected to boost the demand for plastic compounding in the country.

Strong economic growth coupled with approval of 100% FDI by the government, high standard of living, rapid urbanization and progress in smart city projects, and cheap labor is anticipated to spur end-use industries including general industry, consumer goods and automotive in the forecast period. In addition, the adoption of high-end technology devices and declining electronics prices are anticipated to fuel the market growth in the forecast period.

Product Insights

Polyethylene Terephthalate (PET) product dominated the Southeast Asia plastic compounding market and accounted for more than 13.93% of the total market share, in terms of revenue, in 2022. PET is widely used in the packaging of soft drinks bottles and beer containment. It is an ideal material for thermal insulation and flexible food packaging owing to some of its properties. PET is often used as a substrate in thin film solar cells. Polyethylene terephthalate may exist as both as amorphous and a semi-crystalline polymer or maybe in both states depending on its processing technique and thermal history. It is used in fiber for clothing as well as containers for food and liquids.

Polypropylene is widely used in automotive applications. Rising automotive manufacturing in SEA markets has propelled automotive sector growth, both in terms of vehicle sales and domestic production. The consumption of plastic compounds in automotive applications is expected to grow in the forecast period owing to continuous growth in automotive production in the markets along with the government regulations to reduce vehicle weight and improve fuel efficiency.

Polycarbonate segment is anticipated to witness a considerable growth in the forecast period. It is widely used in consumer goods segment for infant feeding polycarbonate bottles, extruded lighting canopy, dishwasher resistant tableware, food storage containers and others owing to its good chemical resistance and UV performance. The shifting trends in work culture to work from home and various restrictions on the movement of people to contain the spread of coronavirus have led to a rise in demand for packed food, packaged water bottles, and food containers in the recent period. This, in turn, is expected to augment the demand for polycarbonate in packaging application.

Application Insights

Automotive accounted for the largest application segment in the global expanded polypropylene foam market with more than 24.40% of the total market share, in terms of revenue, in 2022. Polyethylene terephthalate (PET) and polypropylene compounds (PP) are widely used in various automotive applications such as exterior body parts, ignition, moldings, roof trim, front grilles, bumpers, casing & housings, cladding, and others.

In addition, implementation of emission norms and vehicular weight regulations in automotive industry owing to rising greenhouse gas emissions is anticipated to propel the demand for plastic compounds over the forecast period. Increasing disposable income, growing middle-class population, availability of cheap labor, and other factors are contributing to increase in automobile production in the region.

The demand for plastic compounding in packaging industry is driven by growing urbanizations in countries such as Thailand, Indonesia, and Singapore. Several regulatory authorities have established regulations for packing materials used in applications involving food contact. Compounding polypropylene offers a cost-effective packaging solution that improves impact resistance, flexibility, clarity, and process effectiveness. High demand for polyethylene in packaging industry has majorly contributed toward the growth of plastic compounding market.

Country Insights

Thailand dominated the Southeast Asia plastic compounding market in 2022 and accounted for more than 25.52% of the overall market revenue share.Thailand is expected to be one of the largest and fastest-growing markets over the forecast period owing to the growing demand for the product from major applications including packaging, automotive, and construction.

The packaging sector in Indonesia is expected to witness significant growth over the coming years owing to the increasing R&D activities in the country to promote innovation in construction industry is anticipated to promote the role of plastics in indoor and outdoor applications of residential and commercial buildings. Thus, all the aforementioned factors together are likely to fuel the demand for plastic compounding in packaging sector over the forecast period.

In recent years, the rising demand for plastic compounding for manufacturing various interior elements of residential and commercial buildings and automobiles is expected to drive the market growth over the projected period. The presence of several automobile and construction companies in the region is expected to have a positive impact on the demand for plastic compounding in the forecast period.

The multinational companies in Singapore has increased the number of manufacturers with increased production capacity projecting lower profitability for a medium term. The export of machinery such as computers and vehicles has witnessed a decent surge over the past few years, which is expected to boost the requirement of plastics, especially in industrial sector. The construction industry is likely to grow significantly due to the growing residential and commercial sectors, which is further anticipated to drive expanded polystyrene consumption over the forecast period.

Key Companies & Market Share Insights

Due to the increased demand for plastic compounded products from the packaging, construction, and automotive industries, major manufacturers are continuously working on producing polymers for plastic compounding. For instance, In August 2022, Polyplastics Asia Pacific Sdn Bhd announced the expansion of their product portfolio in plastic compounding with the addition of Topas COC, Duracon POM, and Laperos LCP. These products will be used to address the growing demand from various end-use industries automotive, medical, and electrical & electronics.

A majority of the regional companies are expected to increase their polymer offerings to Thailand, Singapore, Malaysia, and Indonesia owing to high market growth potential in these countries given the expansion of the market. Some of the prominent players operating in the Southeast Asia plastic compounding market are:

-

BASF SE

-

SABIC

-

LyondellBasell Industries N.V.

-

Kraton Polymers Inc.

-

RTP Company

-

The 3M Company

-

Teijin Plastics

-

Polyplastics Asia Pacific Sdn Bhd

-

Melchers Malaysia

-

Helistrom Sdn Bhd

-

Sheng Foong Plastic Industries Sdn Bhd

Southeast Asia Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4835.18 million

Revenue forecast in 2030

USD 7171.89 million

Growth rate

CAGR of 5.79% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

Thailand; Indonesia; Malaysia; Vietnam; Singapore; Philippines

Key companies profiled

BASF SE; SABIC; LyondellBasell Industries N.V.; Kraton Polymers Inc.; RTP Company; The 3M Company; Teijin Plastics; Polyplastics Asia Pacific Sdn Bhd; Melchers Malaysia; Helistrom Sdn Bhd; Sheng Foong Plastic Industries Sdn Bhd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Plastic Compounding Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Southeast Asia plastic compounding market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Low-density Polyethylene (LDPE)

-

High-density Polyethylene (HDPE)

-

Others (LLDPE, MDPE)

-

-

Elastomer (Rubber)

-

Styrene Acrylonitrile (SAN)

-

Ethylene Propylene Diene Monomer (EPDM)

-

Styrene Butadiene Styrene (SBS)

-

-

Ethylene Vinyl Acetate (EVA)

-

Polypropylene (PP)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyolefins (TPO)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Electrical & Electronics

-

Packaging

-

Consumer Goods

-

Industrial Machinery

-

Medical Devices

-

Optical Media

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thailand

-

Indonesia

-

Malaysia

-

Vietnam

-

Singapore

-

Philippines

-

Frequently Asked Questions About This Report

b. The Southeast Asia plastic compounding market size was estimated at USD 4.73 billion in 2022 and is expected to reach USD 4.83 billion in 2023.

b. The Southeast Asia plastic compounding market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 7.17 billion by 2030.

b. The automotive segment dominated the Southeast Asia plastic compounding market with a share of 24.12% in 2022. This is attributable to the rising demand for lightweight vehicles and stringent environmental regulations regarding CO2 emissions.

b. Some key players operating in the Southeast Asia plastic compounding market include BASF SE; SABIC; LyondellBasell Industries N.V.; Kraton Polymers Inc.; RTP Company; The 3M Company; Helistrom Sdn Bhd; and Sheng Foong Plastic Industries Sdn Bhd.

b. Key factors that are driving the Southeast Asia plastic compounding market growth include increasing demand for substitution for glass, metals, wood, and natural rubber in the automotive and construction industry and rising demand from medical device and packaging applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.