- Home

- »

- Next Generation Technologies

- »

-

U.S. 5G Infrastructure Market Size, Industry Report, 2030GVR Report cover

![U.S. 5G Infrastructure Market Size, Share & Trends Report]()

U.S. 5G Infrastructure Market (2024 - 2030) Size, Share & Trends Analysis Report By Spectrum (Sub-6 GHz, mmWave), By Component (Hardware, Services), By Network Architecture, By Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-246-2

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. 5G Infrastructure Market Size & Trends

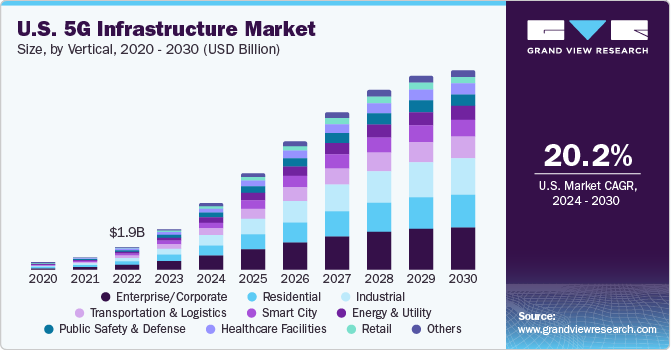

The U.S. 5G infrastructure market size was estimated at USD 3.52 billion in 2023 and is anticipated to grow at a CAGR of 20.2% from 2024 to 2030. There has been a constant growth in data traffic in the United States, aided by the increasing use of smartphones by the population and the introduction of attractive and affordable service plans by companies. The rising consumption of video and audio content by people is another factor highlighting the need for reliable connectivity, which can be offered by 5G networks. 5G technology has a very low latency rate, which has helped improve user experience while also creating new avenues for innovative applications, driving market growth.

The U.S. accounted for 21.07% revenue share of the global 5G infrastructure market. Government funding to improve network infrastructure acts as a major factor for market expansion. A major reason for this has been the growing focus on building smart cities, which offer improved public safety & security, energy management, and transportation features to consumers. For instance, 5G enables first responders to collaborate across different agencies using a dedicated public safety network that allows for reliable and fast communications. In the space of energy and utilities, 5G offers advantages such as stronger connectivity, as well as better efficiency and automation. It is expected that leveraging 5G can further improve the operational efficiency of smart grids when compared to conventional grids.

Another growth driver for the 5G infrastructure industry in the U.S. is the increasing adoption of Internet of Things (IoT) technology. A majority of the businesses in the country are preferring the use of IoT in their operations to improve performance and efficiency. The interconnected devices that are part of this technology can effectively manage and control different functions and tasks remotely, helping realize business process automation across different verticals. This calls for the presence of a seamless and high-speed data connectivity solution to manage large volumes of information and data efficiently, which 5G can conveniently offer to customers.

The rapidly rising popularity of augmented reality (AR) and virtual reality (VR) in several major industries in the U.S., including healthcare, defense, and manufacturing, has highlighted the importance of a well-established 5G infrastructure in the country. In construction, project managers can view 3D CAD/BIM models using AR to visualize structures before even starting work on them, making the process cost- and time-efficient. Medical professionals are aiming to make extensive use of AR and VR technologies to ease difficulties in operating procedures and conduct remote surgeries. Currently, there have been notable use cases where AR and VR have helped patients by addressing mental health issues and pain management. Such complex applications require high-speed internet connectivity that can be offered conveniently by 5G, driving the market’s growth.

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. With a view to boost the 5G economy in the U.S., there have been significant investments made in innovation centers by leading companies to launch advanced services in the coming years. In April 2023, the government launched the Public Wireless Supply Chain Innovation Fund with the aim to invest USD 1.5 billion for developing open and interoperable networks. Leading players such as Nokia and Verizon are undertaking partnerships to introduce advanced solutions and drive growth.

As there are several established names involved in 5G developments, a steady launch of novel solutions and services has been witnessed in recent years. For instance, in June 2023, Nokia announced that it had been selected by Charter Communications for its targeted 5G designing and deployment by leveraging Nokia’s AirScale equipment solutions that include 5G RAN. As a result of this development, Charter would be able to offer wireless 5G, faster speeds, and enhanced coverage to its Spectrum Mobile customers. Such developments are expected to propel market expansion.

The Federal Communications Commission (FCC) takes charge of forming regulations and guidelines for network providers to follow in the United States. The FCC encourages the private sector to increase its investments in 5G networks. It has modernized regulations such as the 5G Fund for Rural America, One-Touch Make-Ready, and revising its rules to enable companies to invest more easily in next-generation networks. In recent years, the focus has been on auctioning high-band, mid-band, and low-band spectrum to further improve the 5G infrastructure of the country.

There is a low risk of substitutes for 5G infrastructure, as it offers significant advantages over previous generations such as higher speeds and lower latency that have ensured its continued success in terms of adoption in the country. Its varied applications in industrial, commercial, and residential segments have meant that its adoption will remain significant in the coming years. The imminent introduction of 6G connectivity will have an impact on this industry, although this concept is still at a very nascent stage.

The high-speed services offered by 5G have enhanced its popularity among major industries such as retail, gaming, healthcare, smart cities, transportation, and enterprises, among others. These sectors have seen an influx of technologies such as AR, VR, IoT, and connected solutions that have highlighted the importance of a seamless connectivity experience as a means to improve organizational efficiency and productivity. As a result, major 5G infrastructure providers have been in the process of introducing customized solutions to drive their growth.

Spectrum Insights

The sub-6 GHz segment accounted for 71.63% of the revenue share in 2023. Networks in this segment range from 1 GHz to 6 GHz, with 3.5 GHZ being the most well-known frequency globally. Although the higher frequency mmWave technology offers much faster speeds, it is not always reliable and faces issues in passing through obstacles, resulting in a limited range. The sub-6 GHz spectrum offers no such issues to users, despite having limited speed, as it is very reliable and offers a longer range due to its use of older 4G-like frequencies. This has led to the preference of major smartphone makers and chip manufacturers for providing sub-6GHz 5G network support in their products. Additionally, the use of particular wireless communication technologies such as massive MIMO and beamforming further help improve signal quality in this segment.

The mmWave technology segment is expected to advance at the fastest CAGR during the forecast period. The most notable benefit of mmWave is that it offers exponentially higher connectivity speeds exceeding 1 Gbps. With a noticeable growth in the streaming and gaming population of the U.S., the need for higher speeds and lower latency is expected to bring more focus on the mmWave spectrum in the coming years. There is demand for this segment from industries too, owing to the increasing deployment of factory robots and automated guided vehicles (AGVs) that require low latency and high bandwidth to operate efficiently. A survey by Counterpoint among smartphone users in the U.S. found that 60% of the respondents checked the 5G mmWave capability while buying a 5G smartphone, indicating its growing adoption in the country.

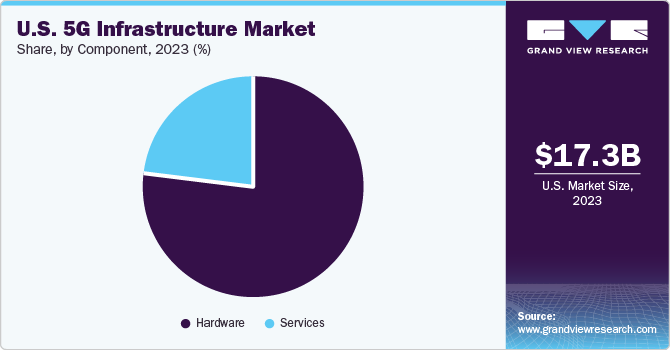

Component Insights

The hardware segment accounted for the largest revenue share of 77.11% in 2023. RAN is a leading contributor to the demand in this segment. Significant investments made in RAN infrastructure and the rising implementation of Open RAN (O-RAN) throughout the U.S. are expected to drive this segment’s growth. Companies leverage professional services to adopt and integrate 5G RAN effectively into their current network infrastructure, driving this growth. In February 2024, the government announced an investment of USD 42 million to advance 5G O-RAN standard development to offer more software and hardware options for wireless providers. Such initiatives are expected to boost the demand for hardware components.

The MidHaul sub-segment is expected to witness the fastest growth in the hardware segment through 2030. In 4G architecture, the Distributed Radio Access Network (D-RAN) architecture, the baseband unit (BBU) is at the base of a macro cell tower. However, in 5G infrastructure, the 5G RAN moves from the Remote Radio Head and traditional BBU to a Centralized Unit (CU), Active Antenna Unit, and Distributed Unit (DU) architecture. Here, MidHaul refers to the link between DC and CU. The performance requirements of the MidHaul transport network are expected to support reaches up to 100 km with a latency of 5 milliseconds or less. Companies are deploying MidHaul infrastructure to improve user experience, driving this sub-segment’s growth over the forecast period.

Network Architecture Insights

The non-standalone segment held the largest revenue share of 81.13% in 2023. Non-standalone network architecture is an economical option that makes use of current 4G infrastructure to improve Enhanced Mobile Broadband (eMBB) services without needing a complete rebuild of the infrastructure. Current mobile network operators that aim to provide their customers with high-speed connectivity via 5G-enabled devices are better served by the non-standalone architecture. Most of the leading wireless providers in the U.S., such as Verizon and AT&T, began offering their 5G services through the deployment of non-standalone networks for use cases such as AR/VR gaming and streaming UHD videos, aiding segment expansion.

The standalone segment is projected to advance at the fastest CAGR through 2030, aided mainly by the increasing number of initiatives for building 5G standalone infrastructure in the United States. For instance, AT&T Labs announced the development of an industry-first 5G SA Uplink 2-carrier aggregation data call in the country in order to offer more reliable services to its customers. The standalone architecture makes use of a dedicated 5G core to offer benefits such as ultra-low latency, faster upload speeds, high reliability, as well as edge functions. The growing popularity of connected technologies and concepts such as smart factories are expected to exponentially drive segment growth in the coming years.

Vertical Insights

The enterprise/corporate segment accounted for the largest revenue share of 20.11% in 2023, as a majority of the businesses have realized the need for higher data bandwidth in their operations to improve productivity. 5G allows companies to move large data volumes without any network issues, while its low-latency feature makes it a necessity for businesses that make use of IoT. Additionally, the COVID-19 pandemic has increased the consumer expectation in terms of enterprises offering a seamless digital experience, which has driven 5G adoption in this vertical. The booming spaces of virtual meetings and cloud computing also have highlighted the requirement of 5G, as they demand reliable and uninterrupted connectivity for effective data exchange and communication.

The industrial segment is expected to witness the fastest CAGR from 2024 to 2030. The U.S. is witnessing a rapid rate of adoption of concepts such as smart factories and Industrial IoT, signifying the need for high-speed wireless connectivity. The extensive adoption of drones, sensors, and AGVs (automated guided vehicles as a means to enhance the efficiency and safety of employees is driving the adoption of advanced 5G infrastructure. Moreover, 5G enables faster and more accurate data collection from equipment and machinery sensors to improve their maintenance scheduling, improving longevity and significantly reducing process disruptions. All these factors are expected to have a decisive role in the increased deployment of 5G in the industrial setting.

Key U.S. 5G Infrastructure Company Insights

Some of the key companies in the U.S. market for 5G infrastructure include Ericsson, Cisco Systems, Corning, Hewlett Packard Enterprise Development LP, and Nokia Corporation. These companies are involved mainly in building partnerships with notable service providers across the country to offer high-quality user experience, as well as launch of innovative solutions and services. Moreover, regulations and guidelines by government bodies also play an important role in shaping industry growth.

-

Nokia Corporation has its U.S. headquarters located in Dallas, Texas. The company is a major telecommunications and consumer electronics provider globally and is also engaged in the deployment of 5G networks. It operates through four business groups, namely Mobile Networks, Network Infrastructure, Cloud and Network Services, and Nokia Technologies. Nokia provides multi-vendor and multi-network telecom software solutions under the Nokia software segment. This segment additionally focuses on 5G, digital, automation, and portfolio integration platforms.

-

Cisco Systems, Inc., headquartered in San Jose, California, is involved in the design, manufacture, and sales of computer networking products, solutions, and services. The company offers products in areas such as Networking, Wireless & Mobility, and Security. Its product portfolio consists of switches, routers, access points, controllers, SecureX platform, and secure firewall, among others. Moreover, these products are offered to service providers, small businesses, and mid-sized businesses. Cisco provides customers with intelligent networks and technology architectures built on integrated products, services, and software platforms.

Key U.S. 5G Infrastructure Companies:

- Altiostar

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Airspan Networks Holdings Inc.

- CommScope Inc.

- Corning

- NEC Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Development LP

- Casa Systems

- Mavenir

- Comba USA

Recent Developments

-

In February 2024, CommScope announced that it would be supporting third-party Open RAN Distributed Units on its leading ‘ERA’ distributed antenna system and the O-RAN-compliant ONECELL small cell. The company further announced seamless support for O-RAN on its in-building radios. These steps would ensure greater speeds and flexibility in 5G enterprise installations

-

In February 2024, Bluesky, Communications and Ericsson introduced a non-standalone 5G network to improve connectivity and user experience in the U.S. territory of American Samoa. This development would allow Bluesky, which provides telecom and network services in this region, to leverage functional 5G features and capabilities for improving data rates and bringing more regional coverage

-

In January 2024, Airspan Networks Holdings Inc. announced that it had entered the Utilities market, through a partnership with GCT Semiconductor, Inc., which designs and supplies advanced IoT, LTE, and 5G semiconductor solutions. The partnership would lead to the development of a cutting-edge RF module to be used across various devices. AirSpan also announced that it had joined the 450 MHz alliance to promote and utilize this spectrum for the utilities industry

U.S. 5G Infrastructure Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 17.26 billion

Growth rate

CAGR of 20.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, spectrum, network architecture, vertical

Key companies profiled

Altiostar; Nokia Corporation; Samsung Electronics Co., Ltd.; Telefonaktiebolaget LM Ericsson; Airspan Networks Holdings Inc.; CommScope Inc.; Corning; NEC Corporation; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; CASA SYSTEMS; Mavenir; Comba USA

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. 5G Infrastructure Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. 5G infrastructure market report based on component, spectrum, network architecture, and vertical:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

RAN

-

Core Network

-

Backhaul & Transport

-

FrontHaul

-

MidHaul

-

-

Services

-

Consulting

-

Implementation & Integration

-

Support & Maintenance

-

Training & Education

-

-

-

Spectrum Outlook (Revenue, USD Million, 2018 - 2030)

-

Sub-6 GHz

-

Low Band

-

Mid Band

-

mmWave

-

-

Network Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Non-Standalone

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Enterprise/Corporate

-

Smart City

-

Industrial

-

Energy & Utility

-

Transportation & Logistics

-

Public Safety & Defense

-

Healthcare Facilities

-

Retail

-

Agriculture

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. 5G infrastructure market size was estimated at USD 3.52 billion in 2023 and is expected to reach USD 5.72 billion in 2024.

b. The U.S. 5G infrastructure market is expected to grow at a compound annual growth rate of 20.2% from 2024 to 2030 to reach USD 17.26 billion by 2030.

b. The hardware segment dominated the U.S. 5G infrastructure market with a share of 77.11% in 2023. Significant investments made in RAN infrastructure, along with the rising implementation of Open RAN (O-RAN) throughout the U.S., are expected to drive growth.

b. Some key players operating in the U.S. 5G infrastructure market include Altiostar; Nokia Corporation; Samsung Electronics Co., Ltd.; Telefonaktiebolaget LM Ericsson; Airspan Networks Holdings Inc.; CommScope Inc.; Corning; NEC Corporation; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; CASA SYSTEMS; Mavenir; Comba USA.

b. Key factors that are driving the market growth include the continuing rise in data traffic and the resulting need for network capacity expansion and the rising adoption of Internet of Things (IoT) technology in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.