- Home

- »

- Catalysts & Enzymes

- »

-

U.S. Enzymes Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Enzymes Market Size, Share & Trends Report]()

U.S. Enzymes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbohydrase, Proteases), By Type (Industrial, Specialty), By Source (Microorganisms, Animals), And Segment Forecasts

- Report ID: GVR-4-68040-209-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Enzymes Market Size & Trends

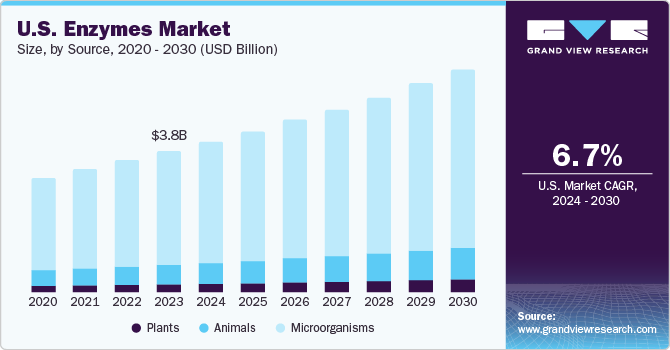

The U.S. enzymes market size was estimated at USD 3.80 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030. The market is driven by the increasing demand for specialty and industrial enzymes from various sectors, such as pharmaceuticals, food & beverages, animal feed, biofuels, detergents, textiles, paper & pulp, and wastewater treatment in the country. The product biodegradable and environment-friendly, which makes them suitable for these applications.

The growing environmental concerns and the rising health consciousness among consumers have resulted in an increased acceptance of enzyme-based nutritional supplements and functional foods across the country. The increased urbanization and rising disposable incomes have led to a change in lifestyle preferences, resulting in a greater consumption of convenience foods. Consequently, there has been a surge in the demand in the food processing industry.

The U.S. enzymes industry is growing at a rapid pace and accounts for 29% share of the global enzymes market. One of the key factors is the growing emphasis on environmentally friendly practices, product quality, and operational efficiency among companies and consumers. Enzymes are gaining traction among U.S. households due to their perceived health benefits, especially in dietary supplements and nutrition drinks. Consumers are becoming more aware of the various applications of enzymes, which has contributed to their growing popularity.

The demand for processed food items like dairy products and bakery goods has increased due to a growing population and changing lifestyle choices. Enzymes are essential in food processing as they improve the quality, texture, and shelf life of products. Enzymatic processes are also preferred by manufacturers of nutritional supplements due to their cost-effectiveness, leading to an increase in enzyme sales.

Although the U.S. enzyme market has shown significant growth potential, it continues to encounter a few challenges. A high capital investment in research and development, coupled with the lack of well-defined regulations, can impede market entry. Regulatory clarity is essential to foster innovation and encourage more players in the market.

Market Concentration & Characteristics

The enzyme market in the U.S. is moderately concentrated, with Novozymes AG, DuPont Danisco, and DSM being the major players in the market. The market is highly innovative, with biotechnology and genetic engineering leading to the development of new product with various functions.

Regulations have a significant impact on the market, as the absence of a uniform regulatory structure for industrial enzymes poses challenges. Depending on their intended use and the method used to allow the substances in food, enzymes are regulated as direct or secondary direct additives, or GRAS, under CFR 21.

Enzymes offer eco-friendly alternatives to traditional processes, aiding in food processing, waste reduction, and sustainable manufacturing practices. They compete with chemical processes, but their high specificity, efficiency, and environmental friendliness make them a preferred choice.

Technological advancements in the industry play a crucial role in shaping the market. Researchers are exploring extremophile enzymes for their unique characteristics and catalytic abilities in extreme conditions. Advances in naturally occurring enzymes through recombinant DNA technologies and protein engineering enable better process compatibility. For instance, cold-active proteases are gaining popularity due to their energy-efficient catalysis at low temperatures.

Enzymes have unique catalytic properties that make them difficult to replace directly. However, alternative technologies such as chemical catalysts exist, but they may not offer the same specificity and efficiency. The demand for enzyme-based solutions remains strong due to their eco-friendly nature and effectiveness.

Type Insights

Industrial enzymes dominated the market with a revenue share of 54% in 2023. The use of industrial enzymes is prevalent in multiple sectors including food and beverages, detergents, animal feed, biofuel, etc. These offer numerous benefits such as enhanced product quality, reduced processing time, and eco-friendliness.

However, the specialty enzymes segment is anticipated to grow at a slightly faster pace in the forecast period of 2024-2030. Specialty enzymes are primarily used in pharmaceuticals, diagnostics, biocatalysts, research, and biotechnology. Their high specificity and selectivity make them suitable for various applications like drug synthesis, disease diagnosis, gene editing, and skincare. The increasing demand for these applications and rising awareness of the health benefits of enzymes are driving the segment growth in the near future.

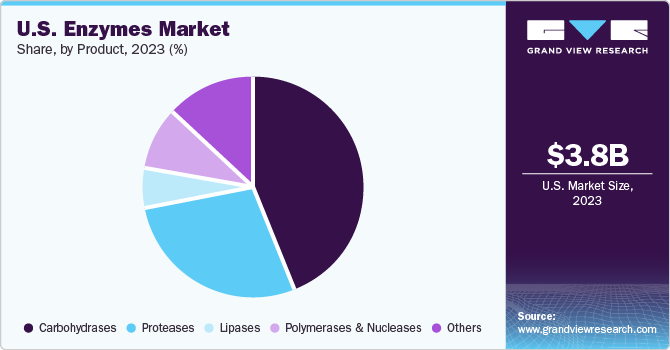

Product Insights

Carbohydrase dominated the market with a revenue share of 43.7% in 2023. Carbohydrase, break down carbohydrates into simple sugars, had the largest share, followed by protease, which break down proteins into amino acids. The high demand for these can be attributed to their extensive usage in the food and beverage industry, especially in the processing of dairy products.

Lipases assist in the digestion, transportation, and processing of various dietary lipids, such as fats, oils, and triglycerides. The burgeoning market demand for phospholipase as a biocatalyst in agriculture, biodiesel, bioremediation, cosmetics, detergents, food, leather, nutraceuticals, and oil, among others, is expected to drive the overall industry growth.

Source Insights

The microorganisms source dominated the market with a revenue share of 80.4% in 2023. This is due to the increasing demand for fungi-based enzymes in various applications. These are highly suitable for vegetarians and are expected to drive market growth positively.

The animal source segment is the second-largest contributor of revenue in 2023. These are taken from the pancreas and stomach of swine and cattle and are used to treat pancreatic-related diseases like pancreatic cancer, exocrine pancreatic insufficiency, and pancreatitis. The pharmaceutical sector's demand for animal-based product is expected to increase further.

Plant-based are derived from plants and include lipase, protease, cellulase, and amylase, among others. The demand for plant-based products is increasing as they are known to alleviate digestive disorders like acid indigestion, heartburn, and acid reflux.

Key U.S. Enzymes Company Insights

The enzyme market in the U.S. is witnessing substantial growth due to the increasing demand in diverse end-use applications such as research, biotechnology, pharmaceuticals, food & beverage, nutraceuticals, paper & pulp, and detergents. Prominent market players are pursuing various mergers & acquisitions and forming joint ventures to expand their businesses.

Some of the key players operating in the market include Novozymes, DuPont, DSM, AB Enzymes, and BASF SE.

-

Novozymes is a prominent global leader in the field of bio-solutions, with a focus on the research, development, and production of industrial enzymes and microorganisms. The organization strives to improve industrial performance while simultaneously preserving the planet's resources. Key areas of emphasis include Bio-Agriculture, Bio-Energy, Food & Beverages, Animal Health & Nutrition, and Household Care

-

DuPont, a U.S.-based chemical, coatings, and fiber manufacturer, originally specialized in the production of gunpowder and other explosives. Over the years, the company has expanded its product line through extensive acquisitions

-

AB Enzymes is an industrial biotech company that specializes in enzymes and their applications in targeted markets. In addition to providing a broad range of proven product brands, the company can also modify or customize enzyme solutions to meet the functional and technical requirements of customers

-

BASF SE, the largest chemical producer worldwide, is a European multinational company with its headquarters located in Ludwigshafen, Germany. BASF SE has subsidiaries and joint ventures in over 80 countries, operating six integrated production sites and 390 other production sites across Europe, Asia, Australia, the Americas, and Africa

Key U.S. Enzymes Companies:

- Novozymes

- DuPont

- AB Enzyme

- BASF SE

- DSM (Koninklijke DSM N.V.)

- Amano Enzymes Inc.

- Kerry Group

- Engrain LLC

- Amano Enzyme

- AG Scientific

Recent Developments

-

In February 2024, Novozymes completed a merger with another biotechnology company Chr Hansen to form a new entity called Novonesis

-

In May 2023, DSM completed its merger with Firmenich, forming a new company called DSM-firmenich

-

In December 2023, Amano Enzymes found a way of improving the juiciness of textured vegetable proteins. This could be beneficial, especially for making vegan food juicier, meatier, and less processed

U.S. Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.05 billion

Revenue forecast in 2030

USD 5.98 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, product, source

Key companies profiled

Novozymes, DuPont, AB Enzyme, BASF SE, DSM (Koninklijke DSM N.V.), Amano Enzymes Inc., Kerry Group, Engrain LLC, Amano Enzyme, AG Scientific

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Enzymes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. enzymes market report based on type, product, and source:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Enzymes

-

Food & Beverages

-

Meat Processing

-

Dairy Products

-

Beverages

-

Bakery & Confectionery

-

Other Food Products

-

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceutical

-

Personal Care & Cosmetics

-

Wastewater

-

Others

-

-

Specialty Enzymes

-

Pharmaceutical

-

Research & Biotechnology

-

Diagnostics

-

Biocatalyst

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrases

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plants

-

Animals

-

Microorganisms

-

Frequently Asked Questions About This Report

b. The U.S. enzymes market size was estimated at USD 3.80 billion in 2023 and is expected to reach USD 4.05 billion in 2024.

b. The U.S. enzymes market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 5.98 billion by 2030.

b. Industrial enzymes dominated the U.S. enzymes market with a share of 54.0% in 2023. This is attributable to the use of industrial enzymes is prevalent in multiple sectors including food and beverages, detergents, animal feed, biofuel, etc.

b. Some key players operating in the U.S. enzymes market include Novozymes, DuPont, AB Enzyme, BASF SE, DSM (Koninklijke DSM N.V.), Amano Enzymes Inc., Kerry Group, Engrain LLC, Amano Enzyme, AG Scientific, among others.

b. Key factors that are driving the market growth include increasing demand for specialty and industrial enzymes from various sectors, such as pharmaceuticals, food & beverages, animal feed, biofuels, detergents, textiles, paper & pulp, and wastewater treatment in the country. The product biodegradable and environment-friendly, which makes them suitable for these applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.