- Home

- »

- Biotechnology

- »

-

U.S. Gene Synthesis Market Size, Industry Report, 2030GVR Report cover

![U.S. Gene Synthesis Market Size, Share & Trends Report]()

U.S. Gene Synthesis Market (2024 - 2030) Size, Share & Trends Analysis Report By Methods (Solid-phase Synthesis, Chip-based Synthesis), By Services (Antibody DNA Synthesis, Viral DNA Synthesis), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-241-3

- Number of Report Pages: 69

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Gene Synthesis Market Size & Trends

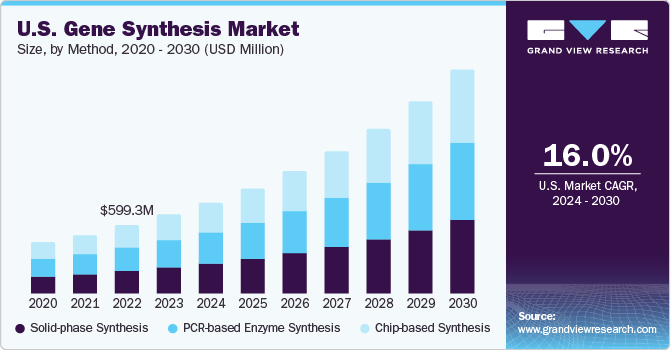

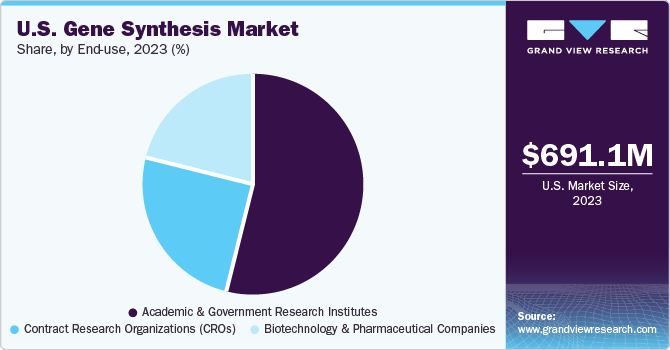

The U.S. gene synthesis market size was estimated at USD 691.1 million in 2023 and is expected to grow at a CAGR of 16.0% from 2024 to 2030. The market growth is significantly influenced by the presence of several key market participants offering gene synthesis services and increasing interest of major biotechnology and pharmaceutical companies in gene & cell therapy development. The expanding field of synthetic biology and increasing application areas in molecular biology arena are opportunistic for market growth. Furthermore, presence of high number of contract research organizations (CROs) providing gene synthesis services is also expected to drive the market growth. For instance, GenScript offers a wide range of services, including custom gene synthesis services and antibody drug development services.

Furthermore, nonprofit organizations including BioBricks confirm the accessibility of synthetic biology technologies for humanitarian purposes. OpenWetWare and other synthetic biology forums act as data sharing platforms and help in delivering researchers with conceptual training. Establishment of such forums and organizations encourages researchers to opt for and study synthetic biology theories as well as develop advanced technologies, which is also a notable growth driver for this market.

In 2023, U.S. gene synthesis market accounted for a market share of over 34% in the global gene synthesis market. Companies are increasingly introducing advanced gene synthesis products and services, which drives the market growth. For instance, Synbio Technologies LLC offers a comprehensive portfolio of gene synthesis services to fulfill customers’ DNA manufacturing needs. The country’s market growth is strengthened by its highly efficient institutions such as the University of Texas at Austin, Massachusetts Institute of Technology, and others. Wide application of gene synthesis has garnered the interest of various companies and scientific communities.

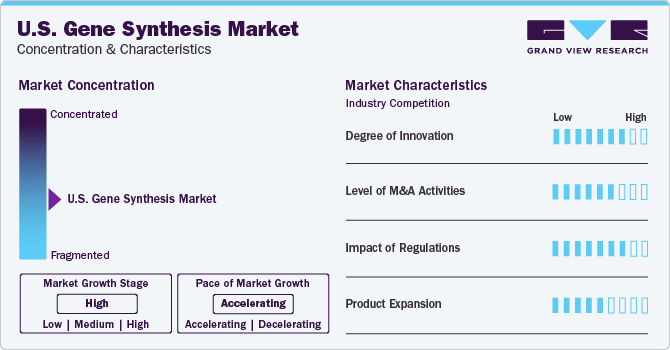

Market Concentration & Characteristics

The industry growth stage is high (CAGR >10%) and pace of the growth depicts an accelerating trend. The U.S. gene synthesis industry is moderately fragmented, which is marked by the presence of large number of companies competing for the market share.

The introduction of novel platforms for DNA synthesis with advanced technological solutions that cater to the demand of researchers is driving the growth potential. For instance, in June 2021, DNA Script introduced SYNTAX platform, which is the first bench-top nucleic acid printer driven by Enzymatic DNA Synthesis (EDS) technology. The system is an automated and integrated printer that simultaneously produces 96 DNA oligos, each with a length of over 60 nucleotides. These nucleotides are ready to use in molecular biology and genomics operations without the need for additional processing. By enabling fast, on-site DNA synthesis oligos for use in genomics processes such as amplicon sequencing, qPCR, mutagenesis, and endpoint PCR, DNA Script aims to ramp up the development cycle for assay enhancement.

The U.S. gene synthesis industry is characterized by significant M&A and collaboration activities undertaken by key manufacturers. Key companies are collaborating with other relevant companies to strengthen their portfolio and expand their reach. For instance, in July 2023, Ginkgo Bioworks, in partnership with Sumitomo Chemical Co., Ltd. announced a new program for the mass development of functional chemicals with the help of synthetic biology.

Regulatory agencies, such as FDA, have established several guidance documents demonstrating the preclinical and clinical activities key for regulation and review of genetically modified products. These regulatory bodies are being supportive toward manufacturing and use of advanced gene synthesis systems. For instance, in January 2020, the FDA published new draft guidelines on gene therapy development, which includes guidelines for testing of retroviral vector-based therapies. In addition, various funding programs have been initiated by the governments to accelerate development in this space.

Method Insights

Solid-phase synthesis held the largest market share at 35.4% in 2023. Adoption of solid-phase synthesis is driven by unique advantages that make it feasible for widespread uses. For instance, the technique allows for acceleration of synthesis reaction by use of solution-phase reagents in large excess and can be carried out without the need of a purification process after each step. Furthermore, it also has high flexibility and suitability for integration of automation and deployment of computer-controlled solid-phase synthesizers that can increase the efficiency of the synthesis process. In addition, the segment is expected to witness growth due to increasing penetration of automated solid-phase synthesis methods for preparation of large amounts of DNA for specific applications.

PCR-based enzyme synthesis is projected to exhibit significant growth rate over the forecast period. PCR-based enzymatic approaches for DNA synthesis have gained traction due to limitations of chemical synthesis process, such as a production of desired quality DNA for only up to a limited length, and environmental impact of the harsh chemicals used. Similarly, with growing applications of synthetic biology in various domains, demand for alternative DNA synthesis options has been increasing.

Services Insights

Antibody DNA synthesis captured the highest market share of 60.9% in 2023. Gene synthesis has been proven a powerful tool for development and production of highly sensitive and specific antibodies. These antibodies can be used for various applications, such as ELISA assay, FISH, Western blot, and IHC. Advancements in the field of recombinant antibody technology have further led to the development of engineered antibody molecules for diagnosis, research, and therapy. Researchers and manufacturers are focusing on specific antibody development against different diseases. Recombinant antibodies and monoclonal antibodies are used in the treatment of cancers, autoimmune diseases, HIV-AIDS, and several other infectious diseases.

The viral DNA synthesis segment is expected to grow at the fastest CAGR during the forecast period. As regulations in biosecurity restrict the access to dangerous pathogens in a laboratory setting, gene synthesis technologies are gaining impetus by offering an alternative for studying and exploring highly infectious viruses. Synthesis of viral genomes also aids in identifying the pathogenicity and gene functions of any organism, allowing for development of better treatment or disease prevention options. These applications of viral DNA synthesis services are expected to drive the segment growth.

Application Insights

The gene & cell therapy development segment held the largest market share of 35.6% in 2023. Several initiatives have been undertaken by biotechnology and pharmaceutical companies to promote cell and gene therapy treatments. For instance, in May 2021, a few life science companies collaborated to launch the initiative “The Cell & Gene Collective” to raise awareness for gene and cell therapy. The spectrum of companies includes Novartis, bluebird bio, Astellas, and Bristol Myers Squibb. The Cell & Gene Collective has undertaken a number of initiatives like first virtual Patient Advocacy Summit and public survey of 1,500 people. This initiative aims to tackle barriers against gene and cell therapy and gain public support for its use in treatment.

The disease diagnosis segment is expected to grow at the fastest CAGR during the forecast period. Gene synthesis is being increasingly used for disease diagnosis due to growing disease burden worldwide and a rising need for enhancement in medical diagnostics. As opposed to conventional antibody-based diagnostics platforms that are expensive, slow, and not suitable for testing of rapidly emerging pathogens or orphan diseases, synthetic biology offers bio-molecular engineering approaches that can overcome these limitations.

End-use Insights

The academic and government research institutes segment accounted for the largest share of 54.5% in 2023. The segment is also expected to grow at a significant pace over the forecast period. Academic research in the field of synthetic biology has recently received increased focus on studies of model organisms. Scientific interests in transfer of genes across organisms for testing of genetic hypotheses or determination of new traits and functionalities of model organisms is a leading research area. Recent biological research has been influenced by targeted genome editing tools, such as CRISPR/Cas9 and various other optogenetics tools.

In addition, with the advent of enzyme-based synthesis methods, DNA synthesis is becoming affordable and easy to perform even on laboratory benchtops. Similarly, the increased flexibility and speed provided by latest methods has enabled an enhanced feasibility for researchers to experiment with the technique. These factors are anticipated to fuel the growing penetration of the technique in various research institutions and contribute to market growth.

Key U.S. Gene Synthesis Company Insights

Some of the key companies involved in gene therapy include Asklepios BioPharmaceuticals, CRISPR Therapeutics, Editas Medicine, Homology Medicines, Intellia Therapeutics, Pfizer, Passage Bio, Poseida Therapeutics, Sangamo Therapeutics, and Prevail Therapeutics, Thermo Fisher Scientific, Inc.; GenScript; and Brooks Automation, Inc, among others. Companies are expanding their global footprint by establishing collaborations, partnerships, and acquisitions to tap in new markets and countries. Collaborations with healthcare providers and research institutions, such as the Mayo Clinic and academic medical centers, are opportunistic to access expertise and assess their technologies.

Key U.S. Gene Synthesis Companies:

- GenScript

- Brooks Automation, Inc. (GENEWIZ)

- Boster Biological Technology

- Twist Bioscience

- ProteoGenix, Inc

- Biomatik

- ProMab Biotechnologies, Inc.

- Thermo Fisher Scientific, Inc.

- Integrsated DNA Technologies, Inc.

- OriGene Technologies, Inc.

Recent Developments

-

In November 2023, Twist Bioscience announced the launch of Twist Express Genes, an innovative gene synthesis service with an order to shipping turnaround time of over 5-7 business days.

-

In May 2023, GenScript unveiled the launch of GenTitan, the first-ever miniature commercial semiconductor platform that uses integrated circuits for delivering DNA synthesis with high throughput.

U.S. Gene Synthesis Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.96 billion

Growth rate

CAGR of 16.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Method, services, application, end-use

Country Scope

U.S.

Key companies profiled

GenScript; GENEWIZ; Boster Biological Technology; Twist Bioscience; ProteoGenix, Inc.; Biomatik; ProMab Biotechnologies, Inc.; Thermo Fisher Scientific, Inc.; Integrated DNA Technologies, Inc.; OriGene Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gene Synthesis Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. gene synthesis market based on method, services, application, and end-use:

-

Method Outlook (Revenue, 2018 - 2030)

-

Solid-phase Synthesis

-

Chip-based Synthesis

-

PCR-based Enzyme Synthesis

-

-

Services Outlook (Revenue, 2018 - 2030)

-

Antibody DNA Synthesis

-

Viral DNA Synthesis

-

Others

-

-

Application Outlook (Revenue, 2018 - 2030)

-

Gene & Cell Therapy Development

-

Vaccine Development

-

Disease Diagnosis

-

Others

-

-

End-use Outlook (Revenue, 2018 - 2030)

-

Biotechnology and Pharmaceutical companies

-

Academic and Government Research Institutes

-

Contract Research Organizations (CROs)

-

Frequently Asked Questions About This Report

b. The U.S. gene synthesis market size was estimated at USD 691.1 million in 2023

b. The U.S. gene synthesis market is expected to grow at a compound annual growth rate of 16.0% from 2024 to 2030 to reach USD 1.96 billion by 2030.

b. Based on application, the gene & cell therapy development segment held the largest market share of 35.6% in 2023.

b. Some of the key players in the market are GenScript; GENEWIZ; Boster Biological Technology; Twist Bioscience; ProteoGenix, Inc.; Biomatik; ProMab Biotechnologies, Inc.; Thermo Fisher Scientific, Inc.; Integrated DNA Technologies, Inc.; and OriGene Technologies, Inc.

b. Some of the key factors driving the market include rising investments in synthetic biology, advent of enzymatic DNA synthesis process, technological advancements in the DNA synthesis platforms, and declining price of DNA synthesis & sequencing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.