- Home

- »

- Automotive & Transportation

- »

-

Vehicle Roadside Assistance Market Size Report, 2030GVR Report cover

![Vehicle Roadside Assistance Market Size, Share & Trends Report]()

Vehicle Roadside Assistance Market Size, Share & Trends Analysis Report By Service Type, By Provider, By Vehicle Type (Passenger Cars, Commercial Vehicles), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-415-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Vehicle Roadside Assistance Market Trends

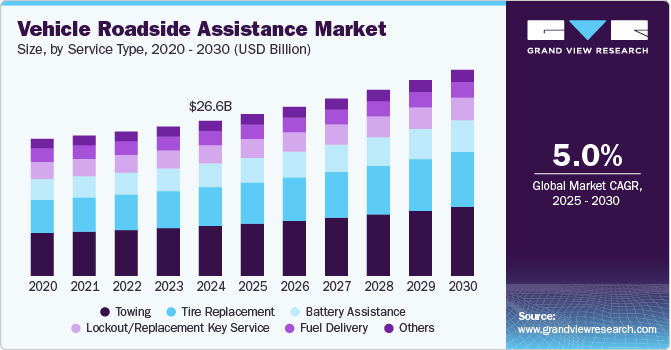

The global vehicle roadside assistance market size was estimated at USD 25.58 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. Vehicle roadside assistance is a service designed to provide emergency help to drivers who experience vehicle-related issues while on the road. It typically includes support for a range of problems that can occur unexpectedly, such as flat tires, battery issues, fuel delivery, lockouts, towing services, and minor mechanical repairs.

The rise in vehicle ownership globally, coupled with increasing traffic volumes, has led to a higher incidence of breakdowns and accidents, thereby driving the demand for roadside assistance services. In addition, the growing awareness of road safety, alongside the expansion of service offerings by major players, including subscription models, is further propelling market growth.

The rising integration of advanced technologies such as artificial intelligence (AI), global positioning system (GPS), telematics, and internet of things (IoT) in roadside assistance operations is propelling the growth of the market. For instance, AI is used to optimize vehicle dispatching by ensuring that the nearest service provider arrives at the customer quickly. AI also analyzes factors such as traffic, location, and the type of service needed to make real-time decisions, enhancing efficiency and response times. In addition, with telematics systems, vehicles can transmit real-time data to service providers, enabling them to quickly diagnose issues and determine the best course of action. This technology allows for faster response times and more accurate service, reducing downtime and enhancing the overall customer experience.

Furthermore, mobile applications are becoming a cornerstone of modern roadside assistance services. These applications offer users a convenient platform to request help, track service progress, and communicate with service providers. Enhanced features such as in-app chat, real-time tracking, and digital payment options streamline the assistance process and improve user satisfaction. Mobile applications also allow for more transparent service tracking and status updates, providing users with greater satisfaction during stressful situations. Thus, the increased adoption of mobile applications provided by roadside assistance providers is further improving the growth of the market.

The rising adoption of electric and autonomous vehicles across the globe is another major trend in the vehicle roadside assistance industry. As these vehicle types become more prevalent, roadside assistance providers are adapting services to address their unique requirements. For electric vehicles (EVs), this means equipping technicians with specialized training and tools for battery issues and charging support. For autonomous vehicles, providers are developing new protocols for handling advanced technology and addressing potential software-related issues. Thus, the rising demand for battery assistance services due to the increased number of electric vehicles on the roads is boosting the market’s growth.

Despite the growth and advancements in the vehicle roadside assistance market, several restraining factors, such as varying levels of service quality and cybersecurity concerns, could hamper the growth of the market. As vehicles, infrastructure, and service platforms become more interconnected through the internet, they become more vulnerable to cyber threats. Hackers could potentially compromise smart road systems or vehicle networks, leading to disruptions such as traffic jams, accidents, or unauthorized access to personal data. This poses a significant risk to operational efficiency, user safety, and privacy. In addition, ensuring robust cybersecurity measures, such as advanced firewalls and secure protocols, requires substantial investment and technical expertise, which can be a barrier for some providers.

Service Type Insights

The towing segment dominated the market in 2023 and accounted for a 32.84% share of the global revenue. With the increasing number of vehicles on the road, the rising incidence of vehicle breakdowns and accidents is driving the demand for vehicle towing services in the market. As urban areas become more congested and long-distance travel more common, the demand for efficient and reliable towing services grows. Furthermore, the vast availability of towing service providers across the globe is boosting the segment’s growth. For instance, with over 63,000 towing and roadside service trucks across the U.S., the American Automobile Association provides roadside assistance to its customers.

The tire replacement segment is projected to witness significant growth from 2024 to 2030. The increasing prevalence of vehicle ownership, coupled with the wear and tear that tires undergo, creates a demand for tire replacement services. In addition, the rise in awareness about vehicle maintenance and safety encourages drivers to seek timely assistance for tire-related issues. Moreover, the integration of tire replacement services into comprehensive roadside assistance packages enhances their appeal, providing added convenience for consumers. This trend is further supported by partnerships between roadside assistance providers and tire manufacturers, which facilitate quicker access to tire replacement and repair services, thereby fueling the segment’s growth.

Provider Insights

The auto manufacturer segment dominated the market in 2023. Many automotive manufacturers are integrating roadside assistance services directly into their vehicle offerings, often as part of their warranty or service packages, which ultimately drives the segment’s growth. This integration provides a seamless experience for vehicle owners, ensuring that help is readily available in the event of a breakdown. Auto manufacturers such as Ford Motor Company, Tesla, Inc., Nissan Motor Corporation, and Chevrolet, among others, provide roadside assistance for their customers. For instance, Ford Motor Company provides roadside assistance for the first five years or up to 60,000 miles, offering to tow customers' electric vehicles to the nearest charging station, Ford dealership, or, if the customer’s home is within 50 miles, directly to their residence.

The motor insurance segment is projected to witness significant growth from 2024 to 2030. Motor insurance companies offer roadside assistance services as part of their auto insurance policies. Insurers often partner with third-party service providers to deliver roadside assistance, leveraging their networks to ensure wide coverage and rapid response times. In addition, insurers use data analytics to optimize dispatching and manage claims efficiently, improving operational efficiency and reducing costs. Some of the motor insurance companies include Allianz Partners, Liberty Mutual Insurance, Reliance General Insurance, and many others.

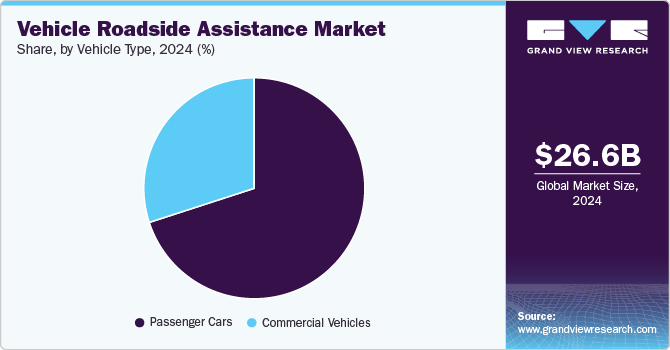

Vehicle Type Insights

The passenger cars segment dominated the market in 2023. The increasing sales of electric and ICE-powered passenger cars, such as SUVs, sedans, and luxury cars, are driving the growth of the segment. According to the International Energy Agency, in 2023, SUVs represented 48% of global car sales. This is driven by several factors, including the appeal of SUVs as a status symbol, their enhanced comfort features, and effective marketing strategies such as additional roadside assistance employed by leading automakers.

The commercial vehicles segment is projected to witness significant growth from 2024 to 2030. The increasing volume of goods transported and the expansion of e-commerce have led to a higher demand for logistics and transportation services, which in turn drives the need for reliable roadside assistance for commercial fleets. In addition, heavy commercial vehicles often operate in challenging conditions, covering extensive distances and navigating difficult terrains. Whether facing a tire blowout on a remote highway or an engine malfunction in the middle of the night, ensuring safety is crucial. Roadside assistance services offer critical support for drivers and operators, delivering timely and efficient help when unforeseen issues arise. Thus, rising demand for heavy truck roadside assistance services across the globe is further driving the segment’s growth.

Regional Insights

The vehicle roadside assistance market in North Americais expected to witness notable growth from 2024 to 2030. The adoption of telematics and connected car technologies is driving the market's growth in the region. Moreover, the integration of roadside assistance with insurance policies is becoming more common in the region, extending the market reach and increasing accessibility for a diverse customer base, thereby driving the market’s growth.

U.S. Vehicle Roadside Assistance Market Trends

The vehicle roadside assistance market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.The high vehicle ownership rate in the U.S. creates a continuous demand for reliable roadside support. Consumer demand for rapid and effective service further fuels market growth in the country as drivers increasingly seek comprehensive and responsive assistance solutions.

Europe Vehicle Roadside Assistance Market Trends

The vehicle roadside assistance market in Europe dominated globally in 2023 with a 36.12% share of the global revenue.The vast presence of several roadside assistance providers across the region is a major factor driving the market’s growth. Viking Assistance Group AS, ARC Europe, Allianz Partners, and Falck A/S are some of the vehicle roadside assistance providers in the region. For instance, Falck A/S provides comprehensive roadside assistance services across Europe. The company’s services include towing, on-the-spot roadside assistance, and car maintenance on a subscription basis to ensure the vehicle remains in peak condition.

Asia Pacific Vehicle Roadside Assistance Market Trends

The vehicle roadside assistance market in Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030.Growing urban populations and increased vehicle ownership in countries such as China and India are major factors behind the market's growth in the region. Rising disposable incomes and an increasing middle-class population are leading to higher vehicle sales, which ultimately drive the demand for vehicle roadside services.

Key Vehicle Roadside Assistance Company Insights

The key companies in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Vehicle Roadside Assistance Companies:

The following are the leading companies in the vehicle roadside assistance market. These companies collectively hold the largest market share and dictate industry trends.

- GEICO

- Viking Assistance Group AS

- ARC Europe

- Allstate Insurance Company

- Agero, Inc.

- Prime Assistance Inc.

- SOS International A/S

- Allianz Partners

- American Automobile Association

- Best Roadside Service

- Access Roadside Assistance

- National General Motor Club

- Liberty Mutual Insurance

- Chevrolet

- Ford Motor Company

- Nissan Motor Corporation.

Recent Developments

-

In May 2023, Progressive Insurance launched Heavy Truck Roadside Assistance Coverage for its commercial auto policyholders. This coverage is available across the U.S. and in 10 Canadian provinces, regardless of the policy's origin state. It is designed to support regional, local, and long-haul truckers.

-

In March 2022, Volvo Trucks North America unveiled a service tracking feature for its Volvo Action Service roadside assistance program. This advanced tracker, with a digital, user-friendly interface, is designed to improve the customer experience during unexpected stops. The feature brings operational benefits, including automatic dispatching, increased efficiency, and enhanced insights for the preferred vendor network.

Vehicle Roadside Assistance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.58 billion

Revenue forecast in 2030

USD 35.36 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service type, provider, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

GEICO, Viking Assistance Group AS, ARC Europe, Allstate Insurance Company, Agero, Inc., Prime Assistance Inc., SOS International A/S, Allianz Partners, American Automobile Association, Best Roadside Service, Access Roadside Assistance, National General Motor Club, Liberty Mutual Insurance, Chevrolet, Ford Motor Company, Nissan Motor Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicle Roadside Assistance Market Report Segmentation

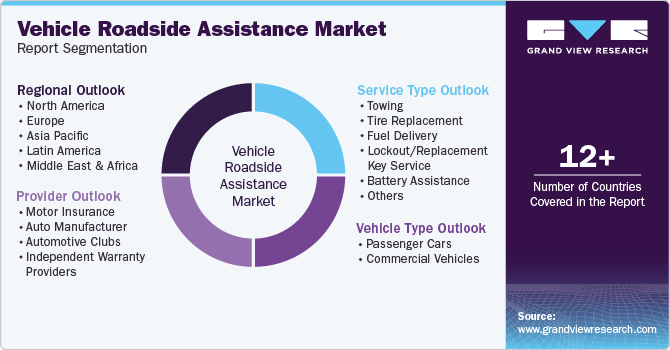

The report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle roadside assistance market report based on service type, provider, vehicle type, and region:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Towing

-

Tire Replacement

-

Fuel Delivery

-

Lockout/Replacement Key Service

-

Battery Assistance

-

Others

-

-

Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Motor Insurance

-

Auto Manufacturer

-

Automotive Clubs

-

Independent Warranty Providers

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The towing segment dominated the market in 2023 and accounted for a 32.84% share of global revenue. An increasing number of vehicles on the road, thus the rising incidence of vehicle breakdowns and accidents, is driving the demand for vehicle towing services in the market. As urban areas become more congested and long-distance travel more common, the demand for efficient and reliable towing services grows.

b. Some of the players operating in the vehicle roadside assistance market include GEICO, Viking Assistance Group AS, ARC Europe, Allstate Insurance Company, Agero, Inc., Prime Assistance Inc., SOS International A/S, Allianz Partners, American Automobile Association, Best Roadside Service, Access Roadside Assistance, National General Motor Club, Liberty Mutual Insurance, Chevrolet, Ford Motor Company, Nissan Motor Corporation.

b. The rise in vehicle ownership globally, coupled with increasing traffic volumes, has led to a higher incidence of breakdowns and accidents, thereby driving the demand for roadside assistance services. Additionally, the growing awareness of road safety, alongside the expansion of service offerings by major players, including subscription models, is further propelling market growth.

b. The global vehicle roadside assistance market size was estimated at USD 25.58 billion in 2023 and is expected to reach USD 26.58 billion in 2024.

b. The global vehicle roadside assistance market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030, reaching USD 35.36 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."