- Home

- »

- Next Generation Technologies

- »

-

AI Data Center Market Size, Share, Industry Report, 2033GVR Report cover

![AI Data Center Market Size, Share, & Trends Report]()

AI Data Center Market (2026 - 2033) Size, Share, & Trends Analysis By Component (Hardware, Software), By Data Center Type (Hyperscale Data Centers, Colocation Data Centers), By Deployment (On-Premises), By AI Application, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-550-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Data Center Market Summary

The global AI data center market size was estimated at USD 147.28 billion in 2025 and is projected to reach USD 810.61 billion by 2033, growing at a CAGR of 23.9% from 2026 to 2033. The market comprises specialized infrastructure designed to support artificial intelligence (AI) workloads, including high-performance computing (HPC), machine learning (ML), deep learning, and generative AI applications.

Key Market Trends & Insights

- North America held a 37.5% revenue share of the global AI data center market in 2025.

- The U.S. AI data center industry’s growth is driven by rapid AI adoption, hyperscale cloud expansion, and advanced infrastructure.

- By component, the hardware segment held the largest revenue share of 53.7% in 2025.

- By data center type, the hyperscale data center segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 147.28 Billion

- 2033 Projected Market Size: USD 810.61 Billion

- CAGR (2026-2033): 23.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

These data centers are equipped with advanced hardware, including GPUs, TPUs, AI accelerators, and optimized cooling and energy management systems, to support intensive workloads in the AI era data center market. The market is experiencing rapid growth due to the proliferation of AI-driven technologies across industries, including healthcare, finance, automotive, and telecommunications. Key trends include the rise of hyperscale data centers to support large-scale AI training, the expansion of edge computing for real-time AI processing, and increasing investments in sustainable data center designs to mitigate high energy consumption. The generative AI data center market is further reshaping enterprise access to AI through AI-as-a-Service and hybrid cloud models. North America leads the market, followed by Asia-Pacific and Europe, with major contributions from companies such as NVIDIA, Google, and Microsoft.

The AI data center industry is characterized by high capital expenditure, rapid technological advancements, and a competitive landscape dominated by cloud service providers, semiconductor companies, and colocation firms. Hyperscale data centers account for the largest share due to their scalability and efficiency in handling AI workloads, while edge data centers are gaining traction for latency-sensitive applications. The market is also shifting toward modular and liquid-cooled data centers to address heat dissipation challenges. Geographically, the U.S. and China lead in AI infrastructure investments, driven by strong government support and private-sector innovation. For instance, in December 2025, NextEra Energy and Google Cloud expanded their partnership to develop large-scale data center campuses, strengthening capacity in the generative AI data center market. The collaboration also includes enterprise-wide digital transformation using Google Cloud AI. This initiative aims to accelerate AI deployment, strengthen data center capacity, and support the growing demand for energy-efficient, scalable digital infrastructure. Another defining characteristic is the increasing convergence of AI with 5G and IoT, enabling new use cases in autonomous systems and smart cities. However, the market remains highly concentrated, with a few key players controlling a significant portion of AI chip production and cloud-based AI services.

Despite its rapid growth, the market faces several challenges, including high energy consumption and environmental concerns. AI workloads require massive computational power, leading to increased carbon footprints and operational costs, prompting stricter sustainability regulations. Another major restraint is the global semiconductor shortage, which impacts the supply of GPUs and AI chips, delaying infrastructure deployment. Data privacy and security concerns, particularly in regulated industries such as healthcare and finance, also hinder cloud-based AI adoption. Moreover, advances in quantum computing and neuromorphic chips could further transform the AI era data center market, supporting long-term growth and innovation across industries.

The AI data center market offers numerous growth opportunities, particularly in developing energy-efficient, sustainable infrastructure. Innovations in liquid cooling, renewable energy integration, and modular data center designs can address environmental concerns while improving efficiency. The expansion of edge AI for applications such as autonomous drones, robotics, and IoT devices offers a lucrative growth avenue. Emerging markets in Asia-Pacific, Latin America, and Africa also offer untapped opportunities as digitalization and AI adoption increase. Furthermore, the rise of quantum computing and neuromorphic chips could revolutionize AI data centers by enabling faster and more efficient processing. Partnerships between governments, tech firms, and energy providers can further accelerate market growth by fostering innovation and infrastructure development. As AI becomes integral to business operations, the demand for specialized data centers will continue to rise, creating long-term opportunities for stakeholders.

Component Insights

The hardware segment accounted for the largest revenue share of 53.7% in 2025, driven by the increasing demand for high-performance computing (HPC) infrastructure, including GPUs, TPUs, and specialized AI chips. These components are essential for handling large-scale AI workloads, accelerating data processing and model training, and reflecting the growing AI impact on data center market dynamics. The rise of generative AI and large language models (LLMs) has further accelerated investments in hardware as enterprises seek to build robust AI-ready data centers. Moreover, advancements in semiconductor technology, such as the development of more energy-efficient chips, support market growth. For instance, in November 2025, OpenAI and Foxconn announced a collaboration to support U.S. manufacturing of next-generation AI data center hardware. The partnership focuses on co-designing AI infrastructure, strengthening domestic supply chains, and producing critical data center components in the U.S., aiming to accelerate AI deployment and improve supply chain resilience across the AI data center market. However, the high cost of AI hardware remains challenging for smaller enterprises, prompting some to opt for cloud-based solutions. Despite this, the hardware segment is expected to maintain its leadership as AI adoption expands across industries.

The services segment is expected to register the fastest CAGR over the forecast period. This growth is fueled by the increasing complexity of AI deployments and the need for expert support in managing infrastructure. This segment includes consulting, integration, maintenance, and managed services, which are essential for optimizing AI workflows and ensuring seamless operations. As enterprises transition to AI-driven models, demand for professional services is rising across regions, including the Japan data center market, where hybrid and multi-cloud adoption is growing. The continued AI impact on data center market is also evident in the expansion of edge computing and IoT applications, creating opportunities for service providers to deliver customized, scalable solutions. With AI becoming a strategic priority, the services segment is poised for sustained expansion.

Data Center Type Insights

The hyperscale data center segment accounted for the largest revenue share of the global AI data center market in 2025, owing to their ability to handle massive AI workloads and support scalable infrastructure for cloud providers and large enterprises in the AI era data center market. Hyperscale facilities offer economies of scale, reducing operational costs while delivering high computational power for training complex AI models, including those driving the generative AI data center market. Major tech companies such as Google, Amazon, and Microsoft invest heavily in data centers to meet the growing demand for AI-as-a-service (AIaaS) platforms. The segment’s dominance is further reinforced by the need for low-latency processing and energy-efficient designs, which are critical for sustainable AI operations. As AI applications become more pervasive, hyperscale data centers will continue to play a pivotal role globally and within the Japan data center market. This trend is also evident in emerging markets, where large-scale investments are driving the development of hyperscale AI data centers. For instance, in January 2026, RT-One and Hitachi Energy signed an agreement to develop electrification infrastructure for Latin America’s largest AI data center platform in Brazil. The project includes hyperscale campuses in Uberlândia and Maringá, with modular expansion planned. Hitachi Energy will provide high-voltage systems to ensure reliable, efficient, and sustainable power for large-scale AI and cloud data center operations.

The edge data center segment is expected to register the fastest CAGR over the forecast period from 2026 to 2033, reflecting evolving requirements in the AI-era data center market. The market growth is fueled by the need for real-time data processing and low-latency applications in industries such as autonomous vehicles, healthcare, and smart manufacturing, which are increasingly supported by the generative AI data center market. Edge data centers bring computational power closer to the source of data generation, enabling faster decision-making and reducing bandwidth constraints. The proliferation of IoT devices and 5G networks drives demand for decentralized AI processing as businesses seek to minimize latency and enhance user experiences. Furthermore, edge computing supports privacy-sensitive applications by processing data locally rather than transmitting it to centralized clouds. With advancements in miniaturized AI hardware and distributed architectures, the edge data center segment is expected to grow significantly in the coming years.

Deployment Insights

The cloud-based segment accounted for the largest share of the AI data center industry in 2025, as organizations increasingly leverage cloud platforms for their flexibility, scalability, and cost-efficiency in deploying AI solutions. Cloud providers offer pre-configured AI tools and services, reducing the need for significant upfront capital investment in on-premises infrastructure. The rise of AIaaS has further propelled this segment, enabling businesses of all sizes to access cutting-edge AI capabilities without maintaining their own data centers. In addition, cloud platforms facilitate collaboration and data sharing across geographically dispersed teams, enhancing productivity. However, concerns around data privacy and regulatory compliance remain challenges, prompting some enterprises to adopt hybrid approaches. Despite this, the cloud-based segment is expected to maintain its lead as AI adoption grows.

The hybrid segment is expected to grow at the fastest CAGR during the forecast period, fueled by the need for a balanced approach that combines the scalability of the cloud with the control and security of on-premises infrastructure. Many enterprises, particularly in regulated industries such as finance and healthcare, adopt hybrid deployments to meet compliance requirements while benefiting from cloud-based AI tools. Hybrid models also allow organizations to process sensitive data locally while offloading less critical workloads to the cloud, optimizing costs and performance. The increasing integration of AI with edge computing further drives hybrid adoption as businesses seek to unify centralized and decentralized processing. As AI workloads become more diverse, the hybrid segment is poised for substantial growth, offering a versatile solution for modern data center needs. Moreover, technology providers are forming strategic partnerships to support the development of hybrid AI data center architectures. For instance, in October 2025, OpenAI and Samsung Group signed a letter of intent to collaborate on global AI data center development. The partnership combines Samsung’s semiconductor, cloud, and infrastructure capabilities with OpenAI’s AI models to support hybrid AI data center architectures, including advanced memory solutions, enterprise AI services, and innovative data center designs, thereby strengthening scalable, flexible AI infrastructure. This collaboration is expected to accelerate the adoption of hybrid AI data center models by integrating on-premises infrastructure with cloud-based AI capabilities, enabling scalable, flexible deployment across the AI data center market.

AI Application Insights

The AI model training segment accounted for the largest share of the AI data center industry in 2025, due to its critical role in developing and refining machine learning algorithms, which require immense computational resources and vast datasets. As enterprises and research institutions invest heavily in generative AI, computer vision, and natural language processing (NLP), the generative AI data center market is driving strong demand for high-performance data centers capable of supporting intensive training workloads in the AI era data center market. Hyperscale data centers and specialized hardware, such as GPUs, are essential for reducing training time and improving model accuracy, with growing adoption across regions including the Japan data center market. The segment’s dominance is further reinforced by the competitive race among tech giants to build larger and more sophisticated AI models. Collaborations between technology leaders are increasingly driving advancements in industrial AI applications and infrastructure. For instance, in June 2025, Siemens and NVIDIA expanded their partnership to advance industrial AI by combining NVIDIA’s accelerated computing with the Siemens Xcelerator platform. The collaboration supports AI model training, simulation, and deployment for manufacturing, enabling data-driven factory operations and improved productivity across global industrial environments. This strengthens the hybrid AI data center and AI training infrastructure segment, increasing demand for industrial-focused AI computing. However, the environmental impact of energy-intensive training processes is prompting innovations in greener computing solutions.

The autonomous systems & robotics segment is expected to grow at the fastest CAGR during the forecast period. This growth is fueled by advancements in AI-driven automation across industries such as manufacturing, logistics, and healthcare. These applications rely on real-time data processing and decision-making, necessitating robust data center infrastructure to support low-latency operations within the AI era data center market. Edge data centers play a crucial role by enabling localized processing for robotics and autonomous vehicles, with expanding deployments in regions including the Japan data center market. The integration of AI with IoT and 5G networks continues to accelerate adoption, reinforcing the expansion of the generative AI data center market and creating new opportunities for intelligent automation. As enterprises increasingly adopt autonomous systems to improve efficiency and safety, this segment is expected to experience significant growth.

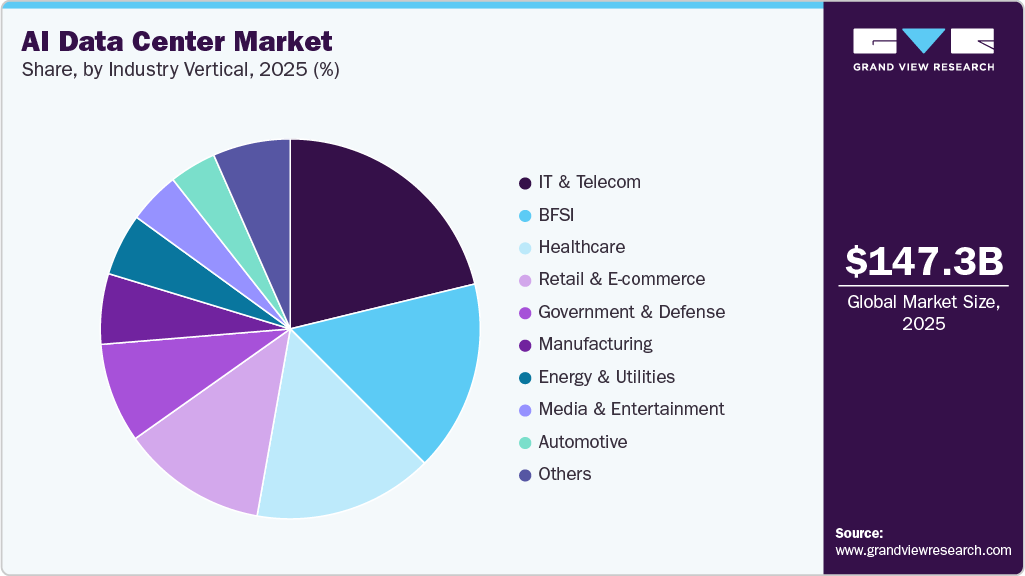

Industry Vertical Insights

The IT & telecom segment accounted for the largest share of the AI data center market in 2025, driven by early adoption of AI for network optimization, customer service automation, and cybersecurity. Telecom operators leverage AI to manage vast amounts of data traffic, predict network failures, and enhance user experiences through personalized services. The industry’s reliance on hyperscale data centers and cloud platforms has further solidified its leadership in AI infrastructure investment. Moreover, the rollout of 5G networks is driving demand for AI-powered analytics and edge computing solutions. As digital transformation accelerates, the IT & telecom sector will continue to drive AI data center growth.

The automotive segment is expected to register the fastest growth during the forecast period, due to the increasing integration of AI in autonomous driving, connected vehicles, and smart manufacturing. Autonomous vehicles generate massive amounts of data that require real-time processing, necessitating high-performance data centers and edge computing solutions. Automotive manufacturers also use AI for predictive maintenance, supply chain optimization, and in-car personalization. The rise of electric and self-driving cars further boosts investments in AI infrastructure. As the automotive sector embraces AI-driven innovation, its reliance on advanced data centers will continue to grow. Collaborations that improve compute efficiency and scalability are helping meet these automotive AI demands. For instance, in October 2025, Arm and Meta announced a strategic partnership to improve AI efficiency across compute layers, from low‑power devices to data center infrastructure. Meta will use Arm’s power‑efficient platforms for AI workloads, optimized with open source tools. The collaboration aims to enhance performance and reduce energy use for large‑scale AI systems. This partnership supports the automotive AI and AI data center markets by driving energy‑efficient compute solutions that enable faster model training and lower power consumption in both vehicle systems and hyperscale data centers.

Regional Insights

North America held a 37.5% revenue share of the global AI data center market in 2025, driven by strong investments from tech giants, a mature cloud computing ecosystem, and rapid AI adoption across industries in the AI era data center market. The region benefits from the presence of leading hyperscalers such as Google, Amazon, and Microsoft, which are aggressively expanding their AI-ready data center infrastructure to support generative AI, machine learning, and big data analytics. Government initiatives, such as the U.S. CHIPS and Science Act, further accelerate semiconductor and AI infrastructure investments. For instance, in October 2025, Brookfield and Bloom Energy agreed on a USD 5 billion strategic partnership to build and power AI infrastructure, combining Brookfield’s financing and development with Bloom’s onsite fuel cell technology. The collaboration aims to design AI factories that deliver scalable, reliable power and compute capacity for advanced AI workloads. This investment will strengthen the North America market by expanding access to clean, reliable power solutions and accelerating the deployment of large‑scale AI computing facilities. Furthermore, North America’s advanced digital economy and high demand for low-latency applications in finance, healthcare, and autonomous vehicles fuel market growth. However, challenges such as energy consumption and regulatory scrutiny around data privacy remain key concerns. Despite this, North America is expected to maintain its leadership through continued innovation and strong private-sector investment.

U.S. AI Data Center Market Trends

The AI data center industry in the U.S. is expected to grow significantly, driven by its robust technological ecosystem, significant venture capital funding, and the presence of global AI innovators such as NVIDIA, OpenAI, and Meta. The country accounts for the majority of hyperscale data center deployments, with Silicon Valley, Virginia, and Texas emerging as key hubs. The rise of generative AI and large language models (LLMs) has intensified the demand for high-performance computing (HPC) infrastructure, prompting massive investments in GPU clusters and advanced cooling solutions. The U.S. government policies supporting domestic semiconductor manufacturing further enhance the AI impact on data center market. However, power constraints and environmental concerns push data center operators to adopt sustainable practices, such as renewable energy and liquid cooling. With AI becoming integral to economic competitiveness, the U.S. is poised to remain the epicenter of AI data center growth.

Europe AI Data Center Market Trends

The AI data center industry in Europe is anticipated to grow significantly from 2026 to 2033. As seen in the AI Act, the EU’s focus on AI governance is shaping the market by encouraging ethical and secure AI deployments, influencing the AI impact on data center market. Germany, the Netherlands, and Ireland are witnessing significant data center investment due to their favorable regulatory environments and robust connectivity infrastructure. Sustainability is a key priority, with operators adopting green energy and innovative cooling technologies to meet EU carbon neutrality goals. The rise of AI in manufacturing (Industry 4.0), healthcare, and smart cities is further boosting demand. This growing demand for AI-ready infrastructure is driving collaborations and innovations across the region. For instance, in November 2025, Schneider Electric and NVIDIA announced a strategic partnership to develop sustainable, AI-ready infrastructure for Europe, including advanced power and cooling systems and high-density rack systems. The collaboration supports EU AI initiatives and enables the rapid deployment of AI factories. This initiative is expected to strengthen Europe’s AI data center segment and accelerate market growth. However, high energy costs and limited land availability pose challenges. Despite this, Europe’s emphasis on innovation and regulation ensures steady growth.

The AI data center market in the UK is projected to experience significant growth from 2026 to 2033. The UK’s National AI Strategy aims to position the country as a global AI leader, driving demand for advanced data center infrastructure. Financial services, healthcare, and retail sectors are major adopters of AI, necessitating low-latency and high-security data centers. However, Brexit-related uncertainties and energy supply challenges could impact growth. Despite these hurdles, the UK’s robust digital economy and innovation-friendly policies will sustain its position as a key European market.

The Germany AI data center market accounted for the largest share in 2025. Key industries, including automotive, manufacturing, and finance, are investing heavily in AI infrastructure to enhance efficiency and innovation. The country’s strong focus on data security and compliance with EU regulations makes it an attractive destination for AI-driven operations. Energy-efficient and sustainable data center solutions are gaining priority as environmental concerns rise. Leading technology providers are expanding their presence to support AI workloads and high-performance computing. Significant investments by global tech players are further reinforcing Germany’s position as a hub for AI infrastructure. For instance, in November 2025, Google announced a USD 6.3 billion investment in Germany through 2029, including new and expanded AI data centers, office infrastructure, and sustainability initiatives. The upgrades will enhance cloud and AI capabilities, support local jobs, and strengthen AI service delivery. This investment is expected to accelerate growth and innovation in the AI infrastructure segment. Overall, the market shows promising potential, balancing technological advancement and regulatory stability.

Asia Pacific AI Data Center Market Trends

Asia Pacific is expected to register the fastest growth, fueled by digitalization, expanding cloud services, and government-led AI initiatives in countries such as China, India, and Japan data center market. The region’s large population, booming e-commerce, and smart city projects drive demand for AI-powered analytics and edge computing. Hyperscalers are expanding aggressively, with Singapore, Hong Kong, and Sydney serving as key hubs. However, uneven infrastructure development, power shortages, and data localization laws in some countries pose challenges. To meet this rising demand and support regional AI expansion, leading companies are forming strategic partnerships. For instance, in October 2025, Hitachi and OpenAI signed a Memorandum of Understanding to collaborate on next-generation AI infrastructure and expand global data centers. The partnership will focus on sustainable operations and accelerated AI deployment. This collaboration is expected to strengthen the Asia Pacific AI data center segment and drive regional market growth and innovation. Despite this, APAC’s dynamic growth and increasing AI adoption across sectors position it as the fastest-growing market globally.

The AI data center market in China held a dominant share in 2025. The government’s “New Infrastructure” plan prioritizes AI data centers, with companies such as Alibaba, Tencent, and Huawei leading deployments. China’s focus on self-sufficiency in semiconductors and AI chips is reshaping the market, though U.S. export controls present hurdles. Domestic demand for AI in surveillance, fintech, and manufacturing is surging, but energy constraints and regulatory tightening could slow growth. Nevertheless, China remains a dominant force in the global AI data center race.

The South Korea AI data center market is experiencing robust growth, supported by advanced 5G networks, strong semiconductor expertise, and government initiatives such as the Digital New Deal. Seoul is a major hub, with hyperscalers and local firms such as Naver and Kakao investing heavily in AI infrastructure. The gaming, automotive, and electronics industries are key adopters of AI, driving demand for high-performance data centers. However, land scarcity and energy costs are challenges. To capitalize on this demand and enhance AI capabilities, leading companies are forming strategic infrastructure partnerships. For instance, in June 2025, SK Group and AWS announced a partnership to build an AI Zone data center in Ulsan, South Korea, featuring AI-optimized computing, hybrid cooling, and advanced network infrastructure. Scheduled to begin operations by 2027, this project will strengthen South Korea’s market and support regional growth in cloud and AI services. With continued innovation and public-private partnerships, South Korea is set to be a key player in the APAC market.

Key AI Data Center Company Insights

Key players operating in the rugged server industry are Hewlett Packard Enterprise Development LP; Advanced Micro Devices, Inc.; Advantech Co., Ltd.; Arista Networks, Inc.; and Intel Corporation. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2025, NVIDIA and Nokia announced a strategic partnership to develop AI-powered RAN solutions for 5G-Advanced and 6G networks, supported by NVIDIA’s USD 1 billion investment in Nokia. The collaboration enables edge AI processing and enhanced network efficiency, strengthening the AI data center segment and accelerating growth in telecom infrastructure for next-generation connectivity.

-

In October 2025, Bharti Airtel and Google announced a partnership to establish India’s first AI hub in Visakhapatnam, including gigawatt-scale data centers, subsea cables, and high-speed networks. The USD 15 billion investment (2026-2030) will enhance India’s digital infrastructure, accelerate AI adoption, and is expected to drive significant growth in the country’s AI data center market.

-

In October 2025, ABB and NVIDIA are collaborating to develop gigawatt-scale AI data centers with advanced 800 VDC power architectures, high-efficiency UPS, and DC distribution systems. The partnership focuses on scalable, energy-efficient power solutions to support dense AI workloads. This initiative is expected to drive growth and innovation in the global AI data center segment.

Key AI Data Center Companies:

The following key companies have been profiled for this study on the AI data center market.

- Advanced Micro Devices, Inc.

- Advantech Co., Ltd.

- Arista Networks, Inc.

- Cisco Systems, Inc.

- Dell Technologies

- Google LLC

- Hewlett Packard Enterprise Development LP

- Hitachi Vantara LLC

- Intel Corporation

- IBM Corporation

- Juniper Networks, Inc.

- Microsoft Corporation

- NetApp

- Nutanix

- NVIDIA Corporation

AI Data Center Market Report Scope

Report Attribute

Details

Market size in 2026

USD 180.57 billion

Revenue forecast in 2033

USD 810.61 billion

Growth rate

CAGR of 23.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, data center type, deployment, AI application, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Advanced Micro Devices, Inc.; Advantech Co., Ltd.; Arista Networks, Inc.; Cisco Systems, Inc.; Dell Technologies, Google LLC; Hewlett Packard Enterprise Development LP; Hitachi Vantara LLC; Intel Corporation; IBM Corporation; Juniper Networks, Inc.; Microsoft Corporation; NetApp; Nutanix; NVIDIA Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Data Center Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the AI data center market report based on component, data center type, deployment, AI application, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Computer Servers

-

Storage Solutions

-

Network Switches

-

Power Solutions

-

Others

-

-

Software

-

Services

-

-

Data Center Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hyperscale Data Centers

-

Enterprise Data Centers

-

Colocation Data Centers

-

Edge Data Centers

-

Modular & Portable Data Centers

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-Based

-

Hybrid

-

-

AI Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

AI Model Training

-

AI Model Inference

-

Big Data Analytics

-

Computer Vision Processing

-

Natural Language Processing (NLP)

-

Autonomous Systems & Robotics

-

Cybersecurity & Fraud Detection

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecom

-

BFSI

-

Healthcare

-

Retail & E-commerce

-

Manufacturing

-

Government & Defense

-

Energy & Utilities

-

Media & Entertainment

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI data center market size was estimated at USD 147.28 billion in 2025 and is expected to reach USD 180.57 billion in 2026.

b. The global AI data center market is expected to grow at a compound annual growth rate of 23.9% from 2026 to 2033 to reach USD 810.61 billion by 2033.

b. Some key players operating in the AI data center market include Advanced Micro Devices, Inc.; Amazon Web Services, Inc.; Arista Networks, Inc.; Cisco Systems, Inc.; Dell Technologies; Google LLC; Hewlett Packard Enterprise Development LP; Hitachi Vantara LLC; Intel Corporation; International Business Machines Corporation; Juniper Networks, Inc.; Microsoft Corporation; NetApp; Nutanix; and NVIDIA Corporation.

b. Key factors that are driving the market growth include The AI data center market presents numerous growth opportunities, particularly in the development of energy-efficient and sustainable infrastructure. Innovations in liquid cooling, renewable energy integration, and modular data center designs can address environmental concerns while improving efficiency.

b. North America dominated the AI data center market with a share of 37.5% in 2025. This is driven by strong investments from tech giants, a mature cloud computing ecosystem, and rapid AI adoption across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.