- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Profiles And Accessories Market Size Report, 2030GVR Report cover

![Aluminum Profiles And Accessories Market Size, Share & Trends Report]()

Aluminum Profiles And Accessories Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Profiles, Accessories), By End-use (Healthcare, Aerospace, Agriculture & Cultivation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-535-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

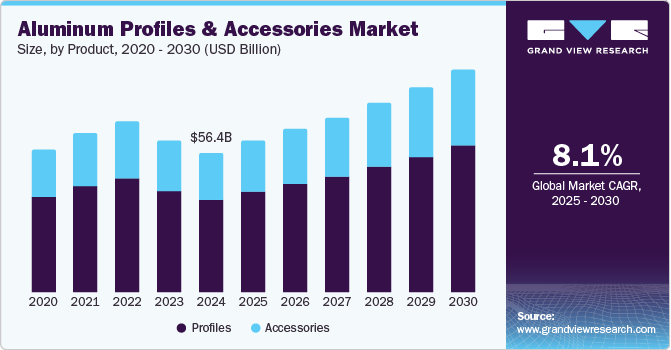

The global aluminum profiles and accessories market size was estimated at USD 56.35 billion in 2024 and is projected to grow at a CAGR of 8.1% from 2025 to 2030. With rapid urbanization and increasing investments in residential, commercial, and industrial infrastructure, the demand for aluminum-based structural components has surged. Modular aluminum profiles are widely used in doors, windows, curtain walls, and structural frameworks due to their lightweight, corrosion resistance, and high strength-to-weight ratio. Governments worldwide invest heavily in smart cities, transportation networks, and green buildings, further fueling market growth.

The push for lightweight materials to enhance fuel efficiency and reduce carbon emissions has led to a significant rise in the use of aluminum in electric vehicles (EVs), railways, and aerospace applications. The growing adoption of EVs, supported by stringent emission regulations and sustainability initiatives, further accelerates demand for aluminum profiles in battery enclosures, chassis, and structural components.

Aluminum is highly recyclable, making it a preferred choice for environmentally conscious industries. The push toward green buildings and sustainable construction practices has increased the use of aluminum profiles in energy-efficient windows, solar panel frames, and heat exchangers. In addition, government regulations promoting sustainable development and carbon footprint reduction are further driving the adoption of aluminum-based solutions across multiple industries.

Technological advancements and innovations in extrusion and alloying processes have enhanced aluminum profiles' performance and application scope. Improved extrusion techniques allow for complex designs and customization, meeting the diverse needs of industries such as electronics, furniture, and industrial machinery. The development of high-strength aluminum alloys has expanded applications in heavy-duty industries, further boosting market growth. In addition, advancements in surface treatment technologies, such as anodizing and powder coating, have improved the durability and aesthetics of aluminum profiles, increasing their appeal across various end-use sectors.

Drivers, Opportunities & Restraints

The growing emphasis on sustainable and energy-efficient building solutions has further boosted the adoption of aluminum profiles in window frames, curtain walls, and structural components. In addition, the rising automotive industry's shift towards EVs has increased the demand for aluminum profiles to reduce vehicle weight and enhance fuel efficiency. The rapid industrialization and infrastructure development in emerging economies also contribute to market growth, as aluminum is widely used in machinery, transportation, and consumer goods manufacturing.

The development of high-strength and recyclable aluminum alloys has expanded the material's application across industries. The increasing adoption of modular construction techniques and prefabricated structures presents further opportunities for aluminum profiles, given their versatility and ease of installation. Moreover, the rising investments in renewable energy projects, such as solar power, drive the demand for aluminum profiles in photovoltaic (PV) panel frames and mounting structures. The ongoing research into 3D printing and precision extrusion techniques creates new possibilities for innovative product designs and customized solutions.

The volatility in bauxite and alumina costs, driven by supply chain disruptions and geopolitical factors, can impact production expenses. In addition, the environmental concerns associated with aluminum smelting and processing, particularly the high carbon emissions, have led to stricter regulations, increasing compliance costs for manufacturers.

Product Insights

The rising trend of sustainable and energy-efficient buildings has led to a surge in the use of aluminum profiles for doors, windows, curtain walls, and structural applications. Their lightweight nature, corrosion resistance, and high strength-to-weight ratio make them an ideal choice for modern architectural designs. In addition, government initiatives promoting green building practices and urbanization projects are further fueling the adoption of aluminum profiles.

Accessories is anticipated to register the fastest CAGR over the forecast period. With the rising adoption of aluminum profiles in modular structures, furniture, and transportation, the need for compatible accessories such as connectors, brackets, end caps, and fasteners has surged. In addition, the trend toward lightweight, corrosion-resistant, and aesthetically appealing designs has encouraged manufacturers to develop innovative accessories that enhance aluminum profiles' functionality and assembly efficiency.

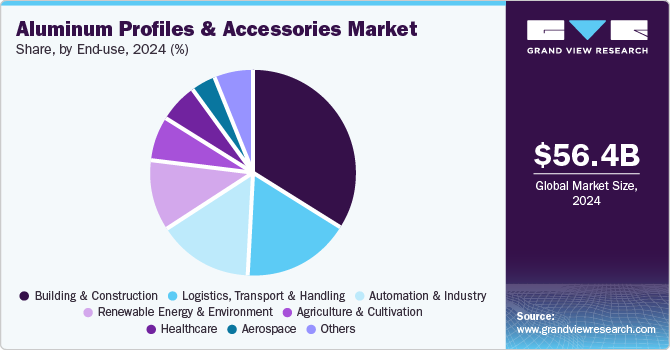

End-use Insights

Aluminum profiles are widely used in doors, windows, curtain walls, facades, and structural components due to their lightweight nature, high strength, and corrosion resistance. Governments worldwide invest heavily in smart city projects, commercial buildings, and residential In addition, further propelling the demand for aluminum-based construction materials. Additionally, aluminum's recyclability aligns with sustainability goals, encouraging its adoption in modern green building initiatives.

Renewable energy & environment is anticipated to register the fastest CAGR over the forecast period. The rising adoption of solar and wind energy infrastructure has significantly boosted the demand for aluminum profiles, which are widely used in solar panel frames, mounting structures, and wind turbine components. Aluminum’s lightweight, high strength and corrosion-resistant properties make it an ideal material for renewable energy applications, ensuring durability and efficiency in harsh environmental conditions.

Regional Insights

Asia Pacific held 64.6% revenue share of the global aluminum profiles & accessories market in 2024. Countries such as China, Japan, South Korea, and India are at the forefront of this growth due to their robust industrial bases and investments in smart factories. China, the world's largest manufacturing hub, has seen a surge in demand for aluminum profiles in the automotive, aerospace, and electronics industries. Meanwhile, Japan and South Korea's focus on precision engineering and robotics has increased the need for modular aluminum solutions in automation frameworks. In addition, India's Make in India initiative fosters local manufacturing, leading to the rising adoption of modular aluminum systems in various industries, including renewable energy and infrastructure.

North America Aluminum Profiles And Accessories Market Trends

Extrusion demand in North America declined in 2024, following a similar downward trend from 2023. The automotive sector faced challenges due to lower-than-expected electric vehicle production, while the transport segment saw reduced demand, particularly in the U.S., due to slower commercial truck and trailer build rates. In the building and construction sector, high interest rates and sluggish activity posed difficulties, though demand began to stabilize at moderate levels towards the end of the year. In addition, weak industrial activity further dampened extrusion demand across industrial segments in the regions.

The U.S. market benefits from a strong industrial base and an increasing adoption of automation and modular design principles, particularly in the automotive, aerospace, and electronics industries. The rising trend of sustainable building practices has also driven demand for aluminum profiles, as they are recyclable and contribute to energy-efficient construction. Key players in the U.S. market are concentrating on innovation and product diversification to address the changing needs of end users. Companies offer a wide range of modular aluminum profiles, including T-slot profiles, which are favored for their versatility in creating custom frames and structures.

Europe Aluminum Profiles And Accessories Market Trends

European countries, particularly Germany, Italy, and France, have a well-established engineering and machinery sector that extensively utilizes modular aluminum profiles in assembly lines, workstations, and automation systems. The push toward Industry 4.0 and smart factories has further accelerated the demand for these lightweight yet durable materials, enabling quick customization and reconfiguration of industrial setups. In addition, stringent EU regulations promoting energy efficiency and sustainability have encouraged manufacturers to adopt aluminum due to its recyclability and lower environmental impact than steel and other materials.

Central & South America Aluminum Profiles And Accessories Market Trneds

In Central & South America, the market is influenced by the region's strategic position as a hub for trade and manufacturing. Countries such as Costa Rica and Panama are seeing increased investment in industrial parks and logistics centers, which require modular aluminum profiles for constructing robust and flexible infrastructure. The rise of nearshoring, where companies relocate production closer to major markets such as the U.S., has also increased demand. This trend is particularly evident in the electronics and automotive industries, where modular aluminum profiles are essential for creating assembly lines and storage systems.

Middle East & Africa Aluminum Profiles And Accessories Market Trends

Countries in the Gulf Cooperation Council (GCC), such as the UAE, Saudi Arabia, and Qatar, are leading the demand due to their focus on smart cities, commercial construction, and industrial projects. The region's emphasis on sustainable and lightweight building materials has made aluminum profiles a preferred choice for construction, automation, and renewable energy applications. In addition, the growing adoption of modular construction techniques in the Middle East, particularly for residential and commercial projects, further boosts the market.

Key Aluminum Profiles And Accessories Company Insights

Some of the key players operating in the market include Norsk Hydro ASA, Parker Hannifin Corp, and others.

-

Norsk Hydro ASA is a Norwegian multinational company specializing in aluminum and energy production. Hydro is one of the world's leading aluminum producers, with a strong presence across the entire aluminum value chain-from bauxite mining and alumina refining to primary aluminum production and recycling. The company offers a comprehensive range of high-quality, lightweight, and durable aluminum solutions for various industrial applications. Due to their versatility and ease of assembly, these modular profiles are widely utilized in automation, machine frames, workstations, conveyors, and structural frameworks.

-

Parker Hannifin Corp is a global leader in motion and control technologies. The company operates through various segments, including Aerospace Systems, Engineered Materials, Filtration, Fluid Connectors, Instrumentation, Motion Systems, and more. The company offers an extensive range of products and accessories for versatile applications across various industries. These profiles are engineered to provide structural support for automation systems, machine frames, workstations, and safety enclosures.

Key Aluminum Profiles And Accessories Companies:

The following are the leading companies in the aluminum profiles and accessories market. These companies collectively hold the largest market share and dictate industry trends.

- 80/20

- Bosch Rexroth AG

- Flexlink

- HepcoMotion LTD.

- item Industrietechnik GmbH

- Kanya AG

- MiniTec

- mk Technology Group

- Norsk Hydro ASA

- Paletti

- Parker Hannifin Corp

Recent Developments

-

In September 2024, Norsk Hydro ASA opened a new aluminum recycling plant in Székesfehérvár, Hungary, adjacent to its existing aluminum extrusion plant. The recycling facility will initially process 15,000 tons of post-consumer scrap annually, with plans to increase capacity to meet the rising demand for low-carbon and recycled aluminum. This investment aligns with Hydro's strategy to expand its recycling capacity in Europe and provide advanced, sustainable aluminum solutions to industries like automotive.

Aluminum Profiles And Accessories Report Scope

Report Attribute

Details

Market size value in 2025

USD 61.48 billion

Revenue forecast in 2030

USD 90.55 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; South Korea; Brazil; Argentina; UAE

Key companies profiled

Norsk Hydro ASA; Parker Hannifin Corp; Flexlink; 80/20; item Industrietechnik GmbH; Bosch Rexroth AG; HepcoMotion Ltd.; mk Technology Group; MiniTec; Kanya AG; Paletti Bottom of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Profiles And Accessories Market Report Segmentation

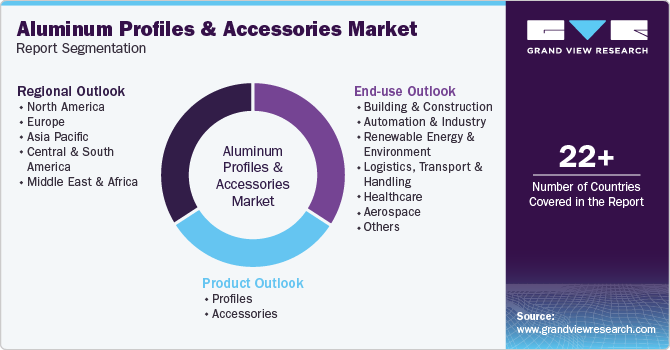

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aluminum profiles & accessories market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Profiles

-

Accessories

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automation & Industry

-

Renewable Energy & Environment

-

Logistics, Transport and Handling

-

Healthcare

-

Aerospace

-

Agriculture & Cultivation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aluminum profiles and accessories market size was estimated at USD 56.35 billion in 2024 and is expected to reach USD 61.48 million in 2025.

b. The global aluminum profiles and accessories market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 90.55 billion by 2030.

b. The profiles segment dominated the market with a revenue share of over 66% in 2024.

b. Some of the key vendors of the global aluminum profiles & accessories market are Norsk Hydro ASA, Parker Hannifin Corp, Flexlink, 80/20, item Industrietechnik GmbH, Bosch Rexroth AG, HepcoMotion Ltd., mk Technology Group, MiniTec, Kanya AG, Paletti, among others.

b. The key factor that is driving the growth of the global aluminum profiles & accessories market is the growing demand from industries such as construction, automotive, and manufacturing. Increasing urbanization and infrastructure development are boosting the need for lightweight, durable, and corrosion-resistant materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.