- Home

- »

- Biotechnology

- »

-

Antibody Specificity Testing Market, Industry Report, 2033GVR Report cover

![Antibody Specificity Testing Market Size, Share & Trends Report]()

Antibody Specificity Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Services (Products, Antibody Validation & Specificity Testing Services), By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-731-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antibody Specificity Testing Market Summary

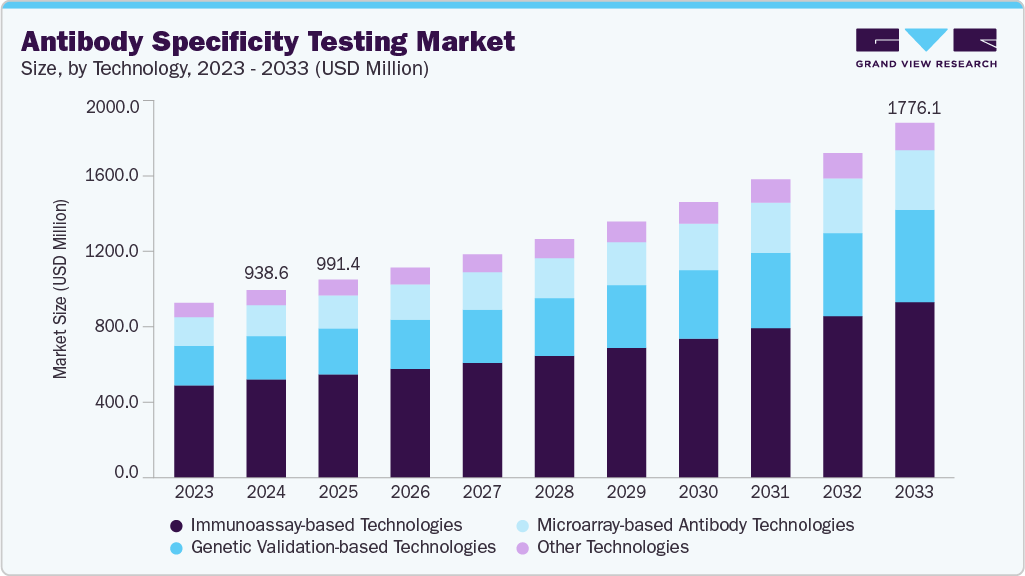

The global antibody specificity testing market size was estimated at USD 938.6 million in 2024 and is anticipated to reach USD 1,776.1 million by 2033, growing at a CAGR of 7.56% from 2025 to 2033. The rising need for high-quality antibodies in life science research, diagnostics, and therapeutic applications fuels the expansion of this market.

Key Market Trends & Insights

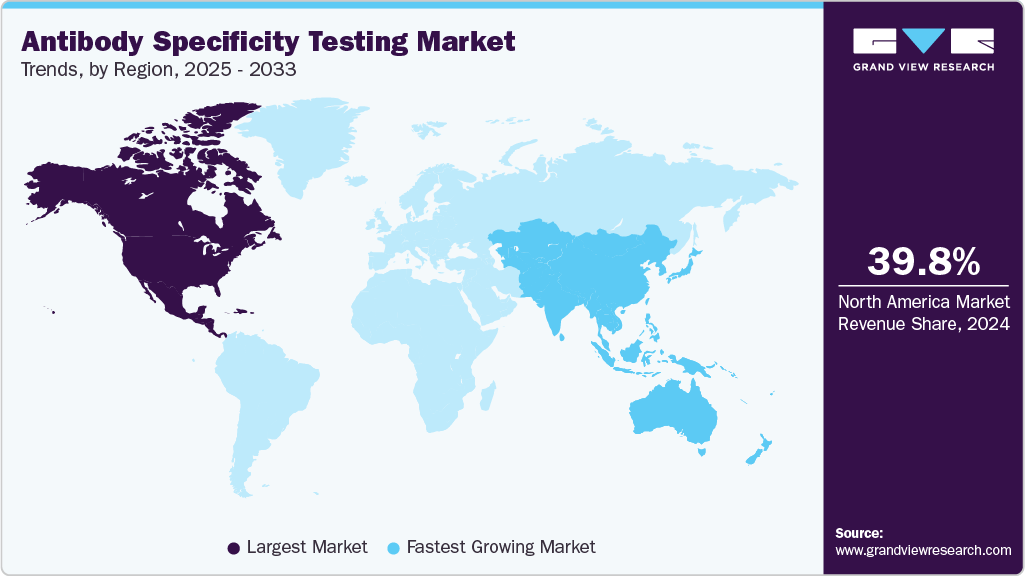

- The North America market held the largest share of 39.77% of the global market in 2024.

- The antibody specificity testing industry in the U.S. is expected to grow significantly over the forecast period.

- By product & services, the products segment held the largest market share in 2024.

- Based on technology, the immunoassay-based technologies segment held the highest market share of 52.51% in 2024.

- By application, research & development segment held the largest market share in 2024.

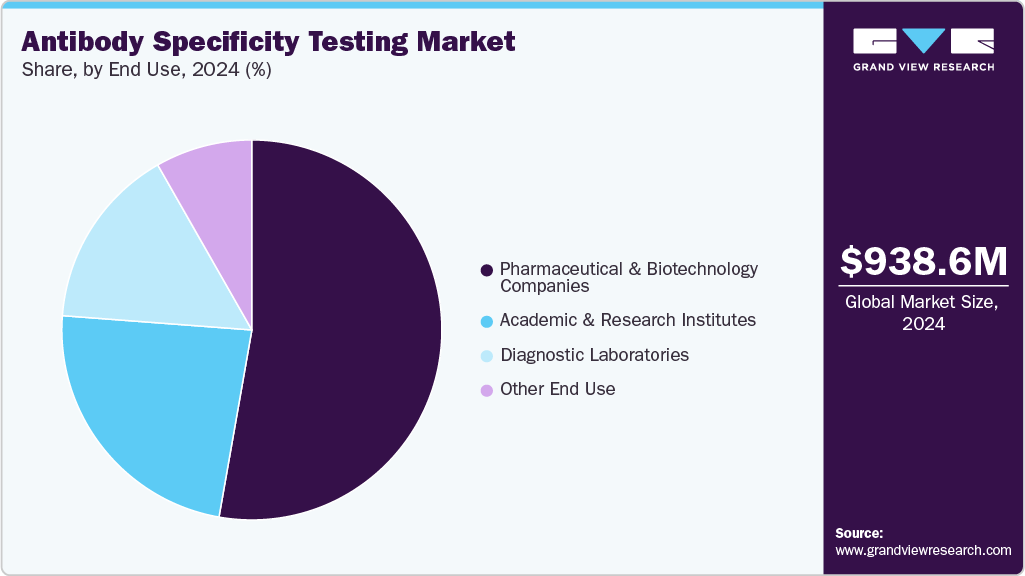

- Based on end use, the pharmaceutical & biotechnology companies segment held the highest market share of 52.77% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 938.6 Million

- 2033 Projected Market Size: USD 1,776.1 Million

- CAGR (2025-2033): 7.56%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing concerns over reproducibility in biomedical studies and stringent regulatory requirements for validated antibodies are accelerating the adoption of advanced specificity testing methods. Moreover, continuous advancements in proteomics, the growing focus on personalized medicine, and the surge in antibody-based drug discovery are expected to create substantial growth opportunities during the forecast period.

Growing Use of Antibody-Based Therapeutics

The rising adoption of antibody-based therapeutics is a key driver propelling the demand for antibody specificity testing. Owing to their high specificity and therapeutic potential, monoclonal antibodies (mAbs) and biosimilars are now widely used in treating cancers, autoimmune disorders, and infectious diseases. However, their clinical effectiveness and safety depend on rigorous validation to confirm that they bind exclusively to their intended targets. Even minor cross-reactivity or off-target effects can compromise efficacy and increase the risk of adverse outcomes, making specificity testing an indispensable step in therapeutic development.

The growing pipeline of advanced antibody therapies, including bispecific antibodies, antibody-drug conjugates (ADCs), and CAR-T cell therapies, further underscores the importance of accurate specificity validation. Pharmaceutical and biotechnology companies increasingly invest in high-quality testing methods to meet regulatory requirements and ensure reliable outcomes across preclinical and clinical stages. As global R&D investments in biologics continue to rise, the antibody specificity testing market is expected to grow strongly and sustainably, fueled by the demand for safe, effective, and compliant antibody-based treatments.

Advancements in Proteomics & Genomics

Rapid advancements in proteomics and genomics drive demand for antibody specificity testing. Proteomics research, which involves large-scale analysis of proteins and their interactions, depends heavily on antibodies as primary detection and validation tools. High-throughput proteomic platforms require antibodies with exceptional specificity to accurately identify proteins, quantify expression levels, and map signaling pathways. Any cross-reactivity can compromise data reliability, leading to false interpretations and wasted research efforts. Similarly, in genomics and single-cell analysis, antibodies are widely used to validate gene editing outcomes, monitor protein expression, and study complex biological systems at the molecular level. These applications necessitate highly specific antibodies, making validation technologies indispensable.

Moreover, integrating antibody-based assays with cutting-edge technologies such as CRISPR, next-generation sequencing (NGS), and spatial transcriptomics further strengthens the need for robust specificity testing. CRISPR applications require validated antibodies to confirm gene editing efficiency and detect off-target effects, ensuring accurate and reproducible results. As proteomics and genomics research continues to accelerate, fueled by initiatives in precision medicine, biomarker discovery, and translational research, the demand for advanced antibody specificity testing solutions is expected to rise sharply. This trend positions antibody validation as a critical enabler of innovation in life sciences and healthcare.

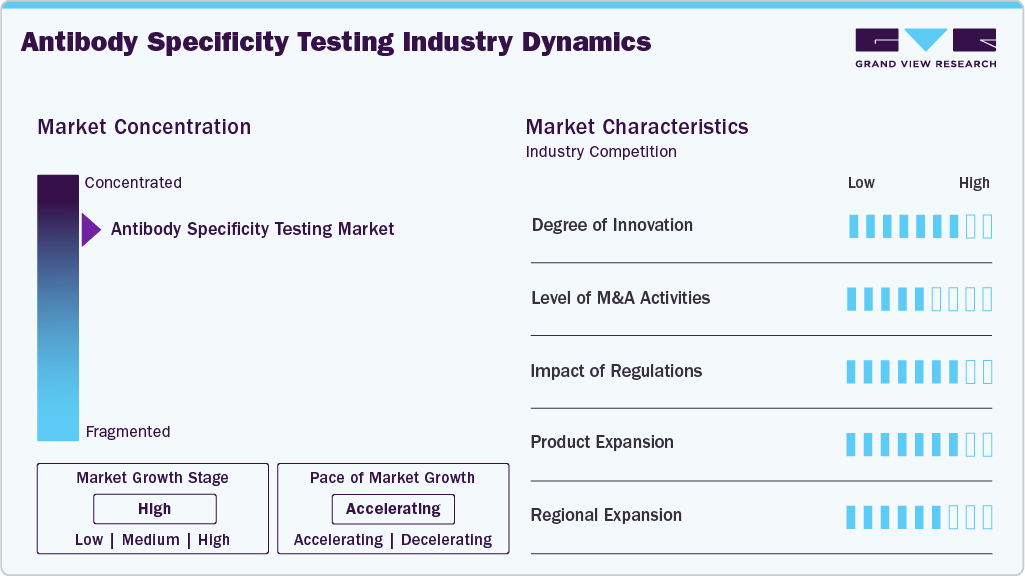

Market Concentration & Characteristics

The antibody specificity testing industry demonstrates a high degree of innovation, driven by the shift from traditional validation methods such as Western blotting and ELISA toward advanced approaches including mass spectrometry-based validation, CRISPR-mediated epitope tagging, single-cell proteomics, and high-content imaging. Emerging technologies such as automation, AI-driven analytics, and machine learning further boost reproducibility, reduce errors, and enable high-throughput testing. For instance, in March 2025, researchers in the U.S. launched AI-powered antibody drug development, transforming developability assessment by enabling faster, data-driven, cost-effective, and precise biologics innovation through intelligent optimization. With growing applications in proteomics, spatial biology, and precision medicine, innovation in antibody specificity testing continues to expand, positioning the market as a critical enabler of reliable research, diagnostics, and therapeutic development.

The level of mergers and acquisitions (M&A) in the antibody specificity testing industry is moderate, largely driven by strategic moves from established life science and biotechnology companies to strengthen their antibody validation and proteomics portfolios. Leading players frequently acquire smaller firms specializing in niche validation technologies, advanced assay platforms, or AI-driven analytics to expand their capabilities and address reproducibility challenges in antibody-based research.

Regulations significantly impact the antibody specificity testing industry, as global agencies and scientific organizations increasingly emphasize the need for reproducibility, transparency, and standardized validation practices. Journals, funding agencies, and regulatory bodies such as the NIH, FDA, and European Medicines Agency (EMA) have issued stricter guidelines requiring validated antibodies to ensure accuracy in preclinical research and clinical applications. These regulatory pressures drive demand for advanced specificity testing solutions, as researchers and biopharma companies must comply with quality standards to secure approvals, publish findings, and advance antibody-based therapeutics. At the same time, the absence of universally harmonized validation protocols continues to pose challenges, creating opportunities for companies that can provide standardized, compliant, and scalable testing platforms.

Product expansion is emerging as a key growth strategy in the market for antibody specificity testing, with leading players actively broadening their portfolios to meet the rising demand for reliable and reproducible validation solutions. Companies are introducing advanced assay kits, multiplexed platforms, and automation-enabled workflows that enhance throughput and accuracy in testing. Partnerships with academic institutions, research labs, and biopharma firms are further accelerating product innovation and customization. This continuous product diversification strengthens market competitiveness and ensures that end users have access to more precise, standardized, and scalable antibody validation tools.

Regional expansion has become a central strategy for companies operating in the industry, as demand rises globally across research, diagnostics, and biopharmaceutical development. North America and Europe remain dominant due to strong R&D infrastructure, funding support, and stringent regulatory standards emphasizing antibody validation. However, companies are increasingly targeting Asia Pacific, particularly China, Japan, and India, where rapid growth in biomedical research, expanding biopharma pipelines, and government-backed precision medicine initiatives are driving adoption of specificity testing solutions. Strategic collaborations, distribution partnerships, and establishing local manufacturing or service facilities are enabling global players to strengthen their presence in high-growth emerging markets while addressing region-specific regulatory and cost considerations.

Product & Services Insights

The products segment accounted for the largest market share in 2024, driven by the rising demand for high-quality antibody validation tools, kits, and reagents that ensure accuracy and reproducibility in research outcomes. Increasing adoption of advanced consumables and assay kits for antibody specificity testing in academic and pharmaceutical research has further strengthened the dominance of this segment. Moreover, continuous product innovations by leading market players to improve the sensitivity, efficiency, and reliability of antibody validation solutions are expected to sustain the growth momentum of this segment over the forecast period.

The antibody validation & specificity testing services segment is projected to register the fastest growth rate throughout the forecast period, supported by the increasing outsourcing of antibody validation and specificity testing to specialized contract research organizations (CROs) and service providers. The need for expert analytical capabilities, cost efficiency, and access to advanced technologies is driving researchers and biopharmaceutical companies to rely on service-based models. Moreover, the growing complexity of antibody-based therapeutics and diagnostics has created a strong demand for specialized testing services to ensure accuracy, reproducibility, and regulatory compliance, fueling this segment's rapid expansion.

Technology Insights

The immunoassay-based technologies segment dominated the market with a share of 52.51% in 2024, owing to its wide applicability, high sensitivity, and cost-effectiveness in antibody specificity testing. Techniques such as ELISA, western blotting, and immunohistochemistry remain the gold standards for evaluating antibody specificity in research and clinical applications. The segment’s strong adoption is further supported by its ease of use, scalability, and ability to deliver reproducible results across diverse experimental settings.

The genetic validation-based technologies segment is expected to grow at the fastest CAGR of 9.07% throughout the forecast period, driven by the increasing adoption of CRISPR/Cas9 and RNAi approaches to confirm antibody specificity at the genetic level. These techniques allow precise knockdown or knockout of target genes, enabling more reliable validation than traditional methods. The rising focus on reproducibility in biomedical research, coupled with the growing use of genetically engineered cell lines and model systems, is fueling demand for genetic validation-based testing. Moreover, advancements in gene editing tools and the expanding application of antibodies in precision medicine are anticipated to accelerate the growth of this segment.

Application Insights

The research & development segment held the largest share in 2024, primarily due to the extensive use of antibody specificity testing in academic institutes, biotechnology firms, and pharmaceutical companies to ensure reproducibility and reliability in experimental outcomes. Growing investments in life science research, rising emphasis on biomarker discovery, and the expanding pipeline of antibody-based therapeutics have further strengthened the dominance of this segment.

The clinical diagnostics segment is expected to grow fastest throughout the forecast period, driven by the increasing reliance on highly specific antibodies for accurate disease detection and monitoring. The rising prevalence of cancer, infectious diseases, and autoimmune disorders has created a strong demand for diagnostic assays with enhanced specificity and reproducibility. Moreover, advancements in companion diagnostics and personalized medicine further accelerate the adoption of antibody specificity testing in clinical laboratories.

End Use Insights

The pharmaceutical & biotechnology companies segment captured the largest market share of 52.77% in 2024, owing to the extensive use of antibody specificity testing in drug discovery, therapeutic antibody development, and quality assurance processes. These companies heavily invest in validation technologies to ensure their antibody-based products' accuracy, safety, and efficacy. The growing pipeline of biologics and biosimilars, coupled with increasing collaborations and partnerships with research institutions, has further strengthened the demand for antibody specificity testing solutions. Moreover, the rising focus on precision medicine and regulatory compliance has reinforced the dominant position of pharmaceutical and biotechnology companies in the market.

The diagnostic laboratories segment is projected to grow fastest in the market during the forecast period. This growth is attributed to the increasing demand for highly specific and validated antibodies in routine diagnostic testing, particularly for cancer, infectious diseases, and autoimmune disorders. With the rising emphasis on accurate and early disease detection, diagnostic laboratories are increasingly adopting advanced antibody validation technologies to improve test reliability and clinical outcomes.

Regional Insights

North America antibody specificity testing industry dominated globally in 2024, accounting for the largest revenue share of 39.77%. This strong regional position is attributed to well-established biotechnology and pharmaceutical companies, significant investment in life science research, and stringent regulatory requirements emphasizing antibody validation and reproducibility. Moreover, the region benefits from advanced research infrastructure, a high adoption rate of innovative technologies such as proteomics and single-cell analysis, and substantial funding support from government agencies like the NIH. These factors have positioned North America as the leading hub for antibody specificity testing solutions, with continued growth expected as demand for antibody-based therapeutics and diagnostics rises. For instance, in October 2021, Canada-based Rapid Novor Inc. introduced its MATCHmAb rapid peptide mapping technology, enabling affordable, high-coverage antibody sequence verification to address reproducibility challenges and ensure reliable antibody validation for research and therapeutic development.

U.S Antibody Specificity Testing Market Trends

The antibody specificity testing industry in the U.S. is growing rapidly, supported by strong NIH funding, rising biopharma R&D, and the expanding pipeline of antibody-based therapeutics. Adopting advanced technologies such as mass spectrometry, CRISPR-based tagging, and single-cell proteomics enhances reproducibility and accuracy. Moreover, the FDA's emphasis on quality and the increasing focus on precision medicine and biomarker discovery drive wider use of rigorous antibody validation solutions. For instance, in July 2024, Bio-Rad Laboratories, a United States-based company, expanded its Pioneer Antibody Discovery Platform by launching the SpyLock service. This service enables rapid prototyping and advanced screening of bispecific antibodies to accelerate therapeutic development.

Europe Antibody Specificity Testing Market Trends

The Europe antibody specificity testing industry is driven by strong academic research, robust biopharmaceutical pipelines, and stringent regulatory standards prioritizing antibody validation and reproducibility. Funding from organizations such as Horizon Europe and national research programs is accelerating the adoption of advanced validation technologies. Growing demand for precision medicine, biomarker discovery, and clinical diagnostics further supports market expansion across leading countries, including Germany, the UK, and France.

The UK antibody specificity testing industry is supported by a strong academic research base, government-backed life science initiatives, and the presence of leading biopharmaceutical companies. Programs under the UK Life Sciences Vision and partnerships with institutions such as the Francis Crick Institute are fostering the adoption of advanced validation technologies. Moreover, the country’s focus on precision medicine, biomarker development, and translational research drives demand for reliable antibody testing solutions.

The antibody specificity testing industry in Germany is expanding steadily, fueled by the country’s strong biopharmaceutical industry, advanced research infrastructure, and government support for life science innovation. Leading research institutes such as the Max Planck Society and Fraunhofer Institutes are actively driving the adoption of advanced validation technologies, further supporting the regional demand for antibody testing products.

Asia Pacific Antibody Specificity Testing Market Trends

The Asia Pacific antibody specificity testing industry is projected to grow at a significant CAGR of 8.26% over the forecast period, driven by expanding biopharmaceutical research, increasing government investments in life sciences, and a rising focus on precision medicine initiatives across countries such as China, Japan, and India. Rapid adoption of advanced proteomics and genomics technologies, along with the growing prevalence of chronic and infectious diseases, further boosts demand for reliable antibody validation solutions. Moreover, collaborations between global players and regional research institutions accelerate technology transfer and market expansion in this high-growth region.

The China antibody specificity testing industry is experiencing rapid growth, supported by strong government investment in biomedical research and expanding biopharmaceutical manufacturing capabilities. National initiatives such as Made in China 2025 and precision medicine programs are accelerating the adoption of advanced validation tools. Moreover, pervasive chronic and infectious diseases and the growth of antibody-based therapeutics and diagnostics drive demand for high-quality antibody testing solutions. Collaborations between domestic companies and global players further enhance access to innovative technologies, positioning China as a key growth hub in the Asia Pacific market.

The antibody specificity testing industry in Japan is driven by strong government support for life sciences, advanced research infrastructure, and a growing focus on precision medicine. National initiatives such as the Japan Revitalization Strategy and investments in next-generation sequencing, proteomics, and regenerative medicine are fostering the adoption of antibody validation technologies. Moreover, the country’s rapidly aging population and increasing demand for antibody-based diagnostics and therapeutics fuel market growth. Collaborations between Japanese research institutes, universities, and global biopharma companies further accelerate innovation and strengthen Japan’s position in the regional landscape.

MEA Antibody Specificity Testing Market Trends

The Middle East & Africa antibody specificity testing industry is developing, showing promising growth potential, driven by rising investments in healthcare infrastructure and biomedical research. Countries such as the UAE, Saudi Arabia, and South Africa increasingly focus on precision medicine and biopharmaceutical R&D, creating opportunities to adopt antibody validation technologies. Strategic collaborations with global life science companies, as well as establishing biobank and genomic programs in the region, further support market expansion. However, limited research funding and a shortage of specialized infrastructure in parts of Africa remain key challenges, concentrating growth in a few leading regional hubs.

The Kuwait antibody specificity testing industry is at an early stage, supported by Kuwait Vision 2035 initiatives to modernize healthcare and strengthen biomedical research. Growing interest in precision medicine and collaborations with global institutions create opportunities, though limited local R&D infrastructure has kept the market relatively nascent.

Key Antibody Specificity Testing Company Insights

-

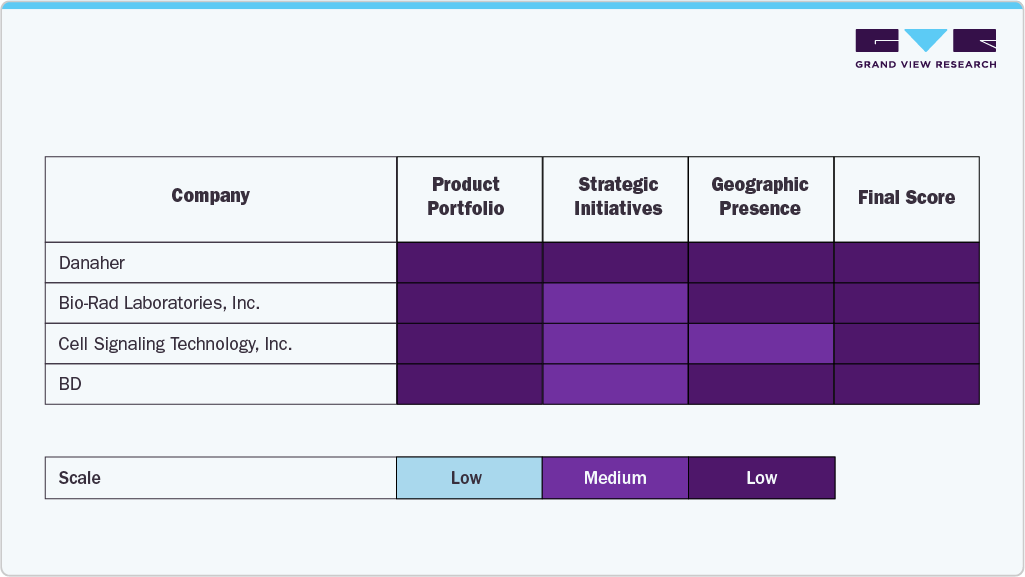

The industry is characterized by several established players who dominate through robust product portfolios, advanced validation technologies, and sustained investments in research and development. Leading companies such as Danaher, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., and Merck KGaA hold a significant share of the market, spurred by their wide range of antibody validation tools, global distribution networks, and commitment to high standards of reproducibility and quality assurance.

-

Specialized players such as Cell Signaling Technology, Inc., BD, Novus Biologicals, OriGene Technologies, Inc., Creative Diagnostics, and GenScript are expanding their market presence by offering innovative validation solutions, customized antibody testing services, and application-specific products that address the diverse needs of academic research, diagnostics, and biopharmaceutical development. These companies increasingly leverage collaborations with research institutions and industry partners to strengthen their capabilities and enhance customer reach.

-

Market leaders continue to shape the competitive landscape by integrating cutting-edge technologies such as high-content imaging, mass spectrometry-based validation, CRISPR-mediated tagging, and AI-driven analytics into their offerings. This approach improves reproducibility and supports the growing adoption of antibody specificity testing in drug discovery, biomarker development, and precision medicine.

-

The market is witnessing a dynamic interplay between established expertise and emerging innovators. Strategic alliances, product expansions, and advances in validation technologies fuel competition, with companies that successfully combine scientific innovation with customer-centric solutions well-positioned to drive sustained growth in this evolving sector.

Key Antibody Specificity Testing Companies:

The following are the leading companies in the antibody specificity testing market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Cell Signaling Technology, Inc.

- BD

- Novus Biologicals

- OriGene Technologies, Inc.

- Creative Diagnostics

- GenScript

Recent Developments

-

In June 2025, Bio-Rad Laboratories expanded its recombinant monoclonal anti-idiotypic antibody portfolio by introducing antibodies against Perjeta, Tremfya, Ilaris, Benlysta, and Hemlibra, alongside a new Human IgM-FcSpyCatcher reagent.

-

In April 2025, Creative Diagnostics launched Monkeypox Virus Neutralizing Antibody Test services, using PRNT technology to support vaccine development, therapeutic research, and immune response assessment against monkeypox.

-

In March 2024, Bio-Rad Laboratories launched validated antibodies for rare cell and circulating tumor cell enumeration, enhancing tumor heterogeneity and cancer progression studies through its Celselect Slides and Genesis Cell Isolation System.

Antibody Specificity Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 991.4 million

Revenue forecast in 2033

USD 1,776.1 million

Growth rate

CAGR of 7.56% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Danaher; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Cell Signaling Technology, Inc.; BD; Novus Biologicals; OriGene Technologies, Inc.; Creative Diagnostics; GenScript

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibody Specificity Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global antibody specificity testing market report on the basis of product & services, technology, application, end use, and region:

-

Product & Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Products

-

Antibodies

-

Control & Standards

-

Kits & Reagents

-

Gene Validation Tools

-

-

Antibody Validation & Specificity Testing Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Immunoassay-based Technologies

-

Western Blotting

-

Immunochemistry

-

Flow Cytometry

-

Others

-

-

Genetic Validation-based Technologies

-

Microarray-based Antibody Technologies

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Research & Development

-

Drug Discovery & Development

-

Proteomics & Biomarker Discovery

-

-

Clinical Diagnostics

-

Infectious Diseases

-

Oncology

-

Immunology & Autoimmune Disorders

-

Neurodegenerative Disorders

-

Metabolic Disorders

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Diagnostic Laboratories

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antibody specificity testing market size was estimated at USD 938.6 million in 2024 and is expected to reach USD 991.4 million in 2025.

b. The global antibody specificity testing market is expected to witness a compound annual growth rate of 7.56% from 2025 to 2033 to reach USD 1,776.1 million in 2033.

b. Based on technology, the immunoassay-based technologies segment held the highest market share of 52.51% in 2024, driven by their high sensitivity, specificity, and cost-effectiveness. Widespread adoption in research and clinical diagnostics further boosts their dominance in the market.

b. The key players competing in the antibody specificity testing market include Danaher; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Cell Signaling Technology, Inc.; BD; Novus Biologicals; OriGene Technologies, Inc.; Creative Diagnostics; GenScript.

b. The antibody specificity testing market is driven by the growing demand for reliable antibodies in research and diagnostics, rising concerns over reproducibility in scientific studies, and stricter regulatory guidelines for antibody validation. Additionally, advancements in antibody engineering and increasing applications in therapeutics further accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.