- Home

- »

- Biotechnology

- »

-

Automated Cell Shakers Market Size, Industry Report, 2030GVR Report cover

![Automated Cell Shakers Market Size, Share & Trends Report]()

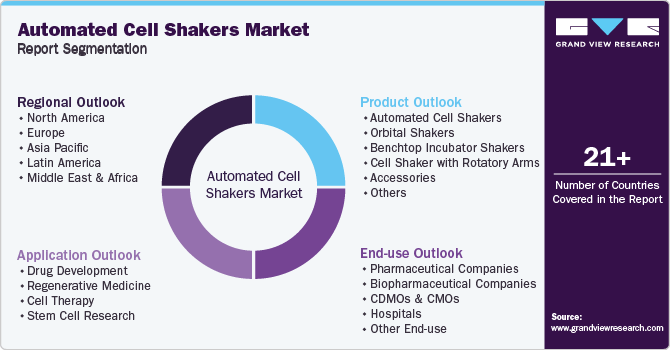

Automated Cell Shakers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Automated Cell Shakers, Orbital Shakers), By Application (Drug Development, Regenerative Medicine, Cell Therapy, Stem Cell Research), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-573-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Cell Shakers Market Trends

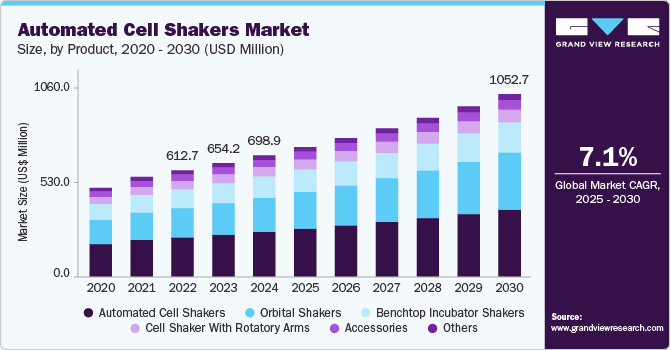

The global automated cell shakers market size was estimated at USD 698.9 million in 2024 and is projected to grow at a CAGR of 7.10% from 2025 to 2030. The increasing demand for advanced laboratory automation systems is significantly boosting the adoption of automated cell shakers.

Key Market Highlights:

- North America held the largest share of 37.49% in 2024, primarily driven by the strong presence of the pharmaceutical and biotechnology industries

- The automated cell shakers market in the U.S. shows significant growth due to strong demand for scalable cell culture technologies

- By product, the automated cell shakers segment dominated the market with the largest revenue share of 36.84% in 2024

- By application, the drug development segment dominated the market with the largest revenue share of 37.81% in 2024

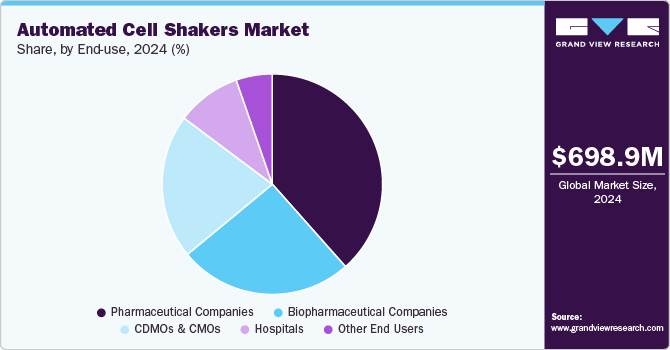

- By end use, the pharmaceutical companies segment dominated the market with the largest revenue share of 38.45% in 2024

Research institutions and pharmaceutical companies are turning to automated solutions to enhance the efficiency of cell culture processes. These systems minimize manual errors, maintain consistency, and improve throughput in biological research. The push for greater reproducibility in cell-based assays is encouraging, using tools that precisely control variables such as shaking speed and temperature. This shift is gaining momentum in areas focused on high-throughput drug screening and large-scale bioproduction.

Growing investment in biotechnology and biopharmaceutical research fuels the demand for advanced laboratory equipment. Companies involved in biologics manufacturing rely on efficient mixing technologies to ensure high cell viability and consistent productivity. Automated cell shakers play a crucial role by offering programmable settings and maintaining stable incubation conditions. These features support precision and repeatability in cell culture processes. Academic institutions are increasingly adopting automated mixing equipment to advance gene therapy and regenerative medicine research. The expanding pipeline of biologic drugs is expected to sustain strong demand for these technologies in research and development.

The rising incidence of chronic diseases drives increased investment in cell-based research for targeted therapy development. As cell culture techniques become more complex, laboratories require equipment that ensures consistent performance and minimal contamination. Automated cell shakers address these needs by enabling standardized workflows and reducing manual handling. Their compatibility with laboratory information management systems (LIMS) boosts data tracking and operational efficiency. This integration streamlines processes and enhances reproducibility across various research applications. As a result, demand for automated cell shakers is steadily increasing in research, clinical, and industrial environments.

Advancements in Laboratory Automation Technology:

The industry is experiencing strong momentum due to rapid advancements in laboratory automation. For instance, devices like IntelliStack Incubator Shakers and CO₂ Incubator Shakers now feature programmable shaking modes, real-time monitoring, and integration with broader lab systems, improving process control. Such enhancements reduce human error and boost operational efficiency in both research and industrial labs. Automation also allows for higher throughput and consistency, critical in replicable cell culture experiments. As laboratories continue modernizing, the demand for high-tech automated shakers is growing steadily.

Increasing Demand for Biopharmaceuticals:

The surge in biopharmaceutical development is a significant driver for the industry. These instruments provide the controlled environments necessary for reliable cell growth, vital in drug development and protein production. Large-scale culture processes benefit from automated shakers by ensuring uniform agitation and optimal growth conditions. The expanding need for cell-based therapies and personalized medicine further accelerates market demand. Automated solutions are becoming central to production workflows as biopharma manufacturing scales up.

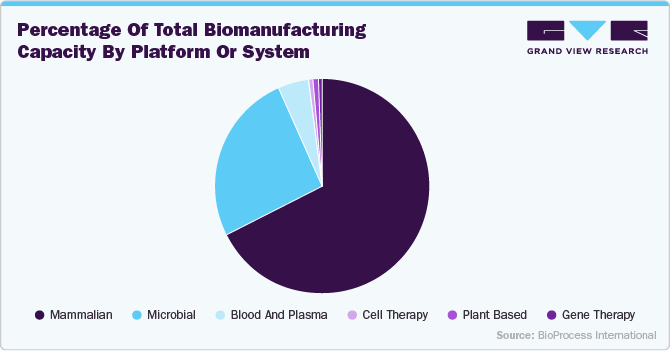

The pie chart from BioProcess International shows that mammalian cell culture systems, mainly using CHO cells, make up about 67.7% of global biomanufacturing capacity. This reflects the growing demand for complex biopharmaceuticals like monoclonal antibodies, which require advanced production methods. Microbial systems and emerging platforms like gene and cell therapies hold smaller shares, with gene therapy below 0.5%. To meet rising demand, the industry is improving productivity through higher titers and adopting single-use technologies instead of expanding large facilities. This shift toward efficiency and flexibility supports faster, more scalable biologics production. As a result, demand for automated cell shakers is expected to increase, as they enable consistent, high-throughput cell culture, essential for modern biomanufacturing.

Market Concentration & Characteristics

The industry is marked by continuous innovation, driven by the demand for more efficient and versatile solutions in cell culture applications. Companies focus on enhancing shaker designs, incorporating advanced features such as temperature and speed control, real-time monitoring, and automation to improve cell growth and productivity. Innovations in materials and integration with other laboratory automation systems are also critical to meet the growing demands for high-throughput processing. As research in biotechnology, pharmaceuticals, and agriculture accelerates, the market will likely see further breakthroughs in shaker technology. Companies with strong R&D capabilities position themselves as leaders in this competitive market.

The industry has witnessed moderate mergers and acquisitions (M&A) activities, with companies seeking to expand their product portfolios and gain access to new technologies. M&A is a strategic approach to increase market presence, particularly by acquiring firms with specialized shaker technologies or complementary automation solutions. For instance, in May 2023, Cytiva and Pall Life Sciences completed their integration to form a global leader in biotechnology innovation and solutions. The merger expanded their bioprocessing capabilities, enhancing their ability to support biologics and vaccine development. This strategic move strengthened their position in the biotechnology market, accelerating innovation and efficiency.

Such consolidations enable players to improve their competitive edge by offering more comprehensive solutions to customers in the research and manufacturing sectors. Additionally, strategic acquisitions allow for the integration of cutting-edge technologies into existing platforms. However, the level of M&A is relatively low compared to other biotechnology sectors.

Regulations significantly shape the industry, particularly in the life sciences and pharmaceutical sectors, where compliance with Good Manufacturing Practice (GMP) standards is crucial. Manufacturers must ensure that their products meet stringent health and safety regulations for clinical and commercial use. Regulatory bodies like the FDA and EMA often have specific requirements for automated laboratory equipment used in drug development or diagnostic processes. This regulatory environment encourages companies to invest in developing compliant and certified products, but also presents challenges related to approval timelines and costs. Companies must navigate these regulations to achieve market entry and ensure long-term success.

Product expansion in the industry is driven by the need to cater to a broad range of research applications, from basic cell culture to large-scale production. Manufacturers increasingly diversify their product offerings by developing shakers with multiple functionalities, such as integrated sensors and real-time data analytics. Shakers designed for specialized applications like microbiology, stem cell research, or drug discovery are becoming more prevalent. This product diversification helps companies attract new customers while meeting the evolving needs of various industries. Enhanced customization and scalability options are also integral to product expansion in this market.

Companies are expanding operations across regions to capture emerging opportunities. Established players in North America and Europe focus on high-performance products for the pharmaceutical and biotechnology sectors. For instance, in March 2023, Kuhner Shaker announced via its website the completion of a new production hall at its Birsfelden, Switzerland headquarters. The facility spanned several thousand square meters and housed over 70 employees across key departments. It was designed to boost manufacturing capacity for shaker systems, bioreactors, and related components. In Asia-Pacific, companies invest in local manufacturing and strategic partnerships to enhance accessibility. Latin America and the Middle East are also growing as demand for research tools rises. This regional expansion allows companies to reach diverse customer bases and adapt to local regulations. The strategy helps address the unique needs of various markets.

Product Insights

The automated cell shakers segment dominated the market with the largest revenue share of 36.84% in 2024, driven by increasing demand for high-throughput screening and laboratory process automation. Growing reliance on reproducible and efficient culture conditions in cell-based research has boosted the use of these systems. The ability of automated shakers to handle large sample volumes with minimal human intervention has significantly improved productivity. For instance, Thermo Fisher Scientific introduced its Cytomat 2 C-LiN series with integrated shaking and incubation functions, tailored for automated workflows in drug discovery. Rising adoption in pharmaceutical, biotech, and academic research institutions has further accelerated this trend. Enhanced integration capabilities with bioreactors and liquid handling systems have strengthened their utility in advanced workflows.

The orbital shakers segment is projected to grow at the fastest CAGR over the forecast period, fueled by increasing use in tissue engineering, stem cell research, and vaccine development. Their versatility in supporting various applications, including microbial culture and protein expression, has widened their adoption. Demand for user-friendly, energy-efficient systems with programmable features has influenced purchasing decisions across small and medium laboratories. For example, Benchmark Scientific Inc.’s Incu-Shaker Mini Plus, launched recently, offers compact orbital motion with digital control, ideal for low-volume, space-constrained research setups. Platform stability and noise reduction advancements have improved their suitability for sensitive environments. Compatibility with diverse vessel types, such as flasks and microplates, has made orbital shakers a preferred choice.

Application Insights

The drug development segment dominated the market with the largest revenue share of 37.81% in 2024, which can be attributed to the rising use of cell-based assays for toxicity testing, compound screening, and lead optimization. Demand for precise and consistent cell culture conditions has made automated cell shakers critical tools in early and late-stage drug research. These devices ensure uniform mixing and improved gas exchange, reducing variability in assay results. The push for accelerated timelines and reduced costs has encouraged investment in automated systems. Integration with robotics and real-time data capture tools has further optimized workflows. Increasing complexity in biologic drug development has also led to greater dependence on advanced shaking technologies.

The regenerative medicine segment is projected to grow at the fastest CAGR over the forecast period, due to expanding research into stem cells, tissue engineering, and organoid development. Automated cell shakers support the precise cultivation of fragile cell types under optimal environmental conditions. They help maintain consistent shear forces, reducing cell damage during extended culture periods. A notable example is Kuhner’s LT-X shaker, which has been widely adopted in regenerative medicine labs for its precision in handling sensitive cell lines. Rising investments in personalized therapies and 3D bioprinting have created demand for scalable and reliable culture solutions. Continuous improvements in shaker design, including multi-tiered platforms and real-time monitoring features, have supported more complex experimental setups.

End-use Insights

The pharmaceutical companies segment dominated the market with the largest revenue share of 38.45% in 2024, driven by increasing focus on biologics and large-scale cell culture operations. Automated cell shakers offer efficiency, accuracy, and consistency needed for high-volume drug production. Integration with upstream and downstream bioprocessing systems has allowed seamless data tracking and quality control. For instance, Sartorius’ Certomat CT Plus orbital shaker is widely used in GMP-certified pharmaceutical facilities for its ability to maintain strict process parameters. Demand for reduced manual labor and minimized contamination risk has strengthened adoption. The growing pipeline of cell-based therapeutics and vaccines has also increased reliance on automated equipment.

The CDMOs & CMOs segment is projected to grow at the fastest CAGR over the forecast period, fueled by rising outsourcing of cell-based manufacturing and research services. These organizations require flexible, scalable systems to meet diverse client needs across preclinical and commercial stages. Automated cell shakers provide the standardization and throughput essential for contract-based workflows. A recent example is INFORS HT’s Multitron Pro, which has seen expanded use among CMOs for its modular design and adaptability to various shaking conditions. The trend toward time-efficient, cost-effective production models has made automation a critical investment. As demand for tailored biologics and gene therapies rises, CDMOs & CMOs are expected to expand their automated equipment portfolios.

Regional Insights

North America automated cell shakers market dominated due to the strong presence of biotechnology and pharmaceutical firms such as Thermo Fisher Scientific and Agilent Technologies. Advanced laboratory infrastructure supports frequent high-performance cell culture equipment adoption in research hubs like Boston and San Diego. High research spending across academic and private institutions continues to raise demand for automated systems. Strategic collaborations, such as those between Harvard University and biotech startups, increase the usage of lab automation tools. Rising demand for precision medicine drives investments in cell culture technologies used in oncology and immunotherapy research. Continuous innovation by regional companies boosts the integration of advanced shaking platforms in commercial laboratories.

U.S. Automated Cell Shakers Market Trends

The automated cell shakers market in the U.S. shows significant growth due to strong demand for scalable cell culture technologies across institutions like the National Institutes of Health (NIH). Expanding biologics and cell therapy pipelines at firms such as Amgen and Gilead push pharmaceutical companies to adopt automation. The presence of key market players, including Eppendorf and BioTek Instruments, facilitates the availability of a wide range of cell shakers. Rapid adoption of high-throughput screening in CROs like Charles River Laboratories increases reliance on automated devices. Growth in contract research services encourages investment in efficient lab equipment to reduce process time. Strong intellectual property frameworks support innovation in automated cell shaking technologies used in vaccine production.

Europe Automated Cell Shakers Market Trends

The automated cell shakers market in Europe exhibits consistent growth due to a strong demand from biomanufacturing sectors in countries such as Switzerland and the Netherlands. Increasing focus on laboratory efficiency drives the adoption of automation tools across research institutions like the European Molecular Biology Laboratory (EMBL). Expansion of biosimilar production by companies such as Sandoz boosts demand for scalable and precise cell culture methods. A well-established academic and healthcare infrastructure contributes to consistent market penetration. Partnerships between biotech firms and universities, such as the Oxford-AstraZeneca collaboration, support broader use of automated laboratory systems. Emphasis on reducing human error and improving repeatability enhances the appeal of computerized shakers in both clinical and academic settings.

The UK automated cell shakers market is driven by the growth in pharmaceutical R&D, particularly through entities like GlaxoSmithKline. Rising demand for reproducible cell culture outcomes encourages lab automation in university hospitals and biotech firms. The presence of world-class research institutions such as the Francis Crick Institute promotes the adoption of high-end laboratory devices. Growing investments in biologics, including monoclonal antibodies, stimulate the need for robust shaking systems. A strong clinical trials landscape in regions such as Cambridge supports the integration of automation to improve throughput, and the market benefits from increased interest in reducing manual intervention in routine lab processes across biopharma companies.

The automated cell shakers market in Germany is critical due to its strong life sciences industry and institutions like the Max Planck Institutes. High standards in pharmaceutical manufacturing at firms such as Bayer increase demand for precise and reliable lab equipment. Major biotech clusters in Berlin and Munich enhance collaboration and adoption of advanced technologies. Growth in bioprocessing applications for therapies such as CAR-T requires consistent and controlled cell culture conditions. Emphasis on quality and process standardization supports the uptake of automated shaking systems in GMP-certified labs. Strong focus on technological excellence drives interest in customizable and programmable devices offered by German manufacturers.

Asia Pacific Automated Cell Shakers Market Trends

The automated cell shakers market in Asia Pacific records the fastest growth rate, driven by expanding biotech and pharmaceutical sectors in South Korea, India, and Singapore. Increasing adoption of automation in research labs supports regional market acceleration, with institutions like A*STAR in Singapore investing in robotic cell culture platforms. Rapid industrialization and improved lab capabilities attract investments in lab equipment across urban hubs. Academic institutions focus on modernizing their lab infrastructure, as seen with initiatives at Tsinghua University and the Indian Institute of Science. Rising healthcare demand fuels growth in drug discovery and cell-based research for conditions such as cancer and diabetes. The presence of local manufacturers like Esco Lifesciences improves product accessibility and affordability.

China automated cell shakers market is growing rapidly due to expansion in life sciences research and biomanufacturing zones in cities like Shanghai and Shenzhen. Increased funding in pharmaceutical R&D by companies such as WuXi AppTec drives demand for laboratory automation solutions. A surge in biologics and vaccine development, including COVID-19 vaccine research, supports wider use of automated shakers. Growth in academic research and biotech startups enhances the adoption of cell culture devices across university-affiliated labs. Local innovation and manufacturing by firms such as Mindray improve access to automated equipment for high-throughput environments. A broad focus on modernization in research infrastructure further strengthens market positioning.

The automated cell shakers market in Japan holds a steady position due to its advanced healthcare and research environment, supported by institutions like RIKEN. Continuous R&D in regenerative medicine and biologics at companies such as Takeda increases demand for reliable lab automation tools. A strong focus on quality and precision supports using programmable shaking platforms in stem cell research. High adoption of robotics and lab automation in pharma companies enhances interest in integrated systems. An aging population drives biomedical research, increasing the use of cell-based assays in age-related disease studies. Collaborations between academia and industry promote continuous innovation in lab technologies across regional research centers.

Middle East & Africa Automated Cell Shakers Market Trends

The automated cell shakers market in the Middle East and Africa is gradually expanding due to rising investments in life sciences facilities across cities such as Dubai and Johannesburg. Research institutions are modernizing lab facilities to meet global standards in biotechnology and pharma. Growth in private healthcare services, including specialty hospitals, raises demand for advanced diagnostic and research tools. Regional partnerships with global biotech firms such as Roche enhance access to automation technologies in university-linked labs. The focus on training and education through workshops and collaborations improves the adoption of lab equipment. Increasing interest in precision medicine and personalized therapies supports the use of automated shaking platforms in molecular biology studies.

Saudi Arabia automated cell shakers market is witnessing market growth driven by diversification into biotechnology and pharmaceuticals through national strategies such as Vision 2030. New research centers such as the King Abdullah International Medical Research Center support demand for automated lab equipment. Expansion of healthcare services in cities like Riyadh encourages the adoption of efficient and scalable research tools. Investment in academic research through institutions such as KAUST promotes the use of advanced laboratory systems. A growing number of biotech startups stimulates interest in automated cell culture solutions for therapeutic development. Strategic collaborations with international firms such as Pfizer enhance access to innovative shaking and incubation technologies.

The automated cell shakers market in Kuwait is supported by the modernization of laboratory infrastructure in public and private medical facilities. Increased focus on medical research and diagnostics at institutions like Kuwait University raises demand for precision instruments. Investments in healthcare and life sciences support the need for efficient lab workflows and modern cell culture methods. Partnerships with foreign institutions, including those in the UK and Germany, encourage knowledge transfer and technology adoption. The development of research parks and biotech incubators promotes access to advanced laboratory equipment. Rising academic interest in biotechnology supports broader use of automation in molecular and cell biology labs.

Key Automated Cell Shakers Companies Insights

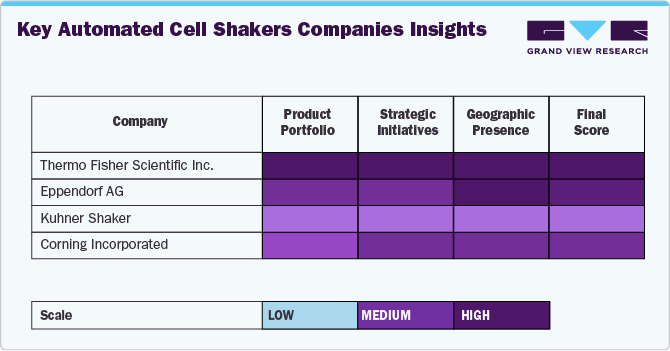

The above figure provides a comparative analysis of four major players in the automated cell shakers market. Thermo Fisher Scientific scores high across all parameters, indicating a strong overall market position. Comprehensive product offerings, aggressive expansion strategies, and broad global reach make it a market leader. Eppendorf AG is also positioned high in all three categories, reflecting significant investment in R&D and expansion. Kuhner Shaker positioning indicates a strong core offering, but may be less aggressive in partnerships, acquisitions, or pipeline expansion. At the same time, Corning Incorporated displays medium-to-high performance, particularly in strategic initiatives.

Key players adopted the most strategies, including partnerships, collaborations, and product launches. Companies such as Thermo Fisher Scientific launched the fully integrated IntelliStack Incubator and CO₂ Incubator Shakers for precise and reproducible cell culture control to expand their market reach globally.

Key players operating in the automated cell shakers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Automated Cell Shakers Companies:

The following are the leading companies in the automated cell shakers market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Eppendorf AG

- Ohaus Corporation

- Benchmark Scientific

- Corning Incorporated

- Grant Instruments

- Kuhner Shaker

- Infors AG

- Boekel Scientific

- VELP Scientifica Srl

Recent Developments

-

In March 2025, Caron Scientific launched the 7406 Incubator Shaker at the EU Advanced Therapies conference. The unit featured the highest capacity in a compact footprint, H₂O₂ fogging sterilization, and a dry humidity control system without standing water. It offered faster turnaround, minimized contamination risks, and efficiently met GMP compliance needs.

-

In October 2024, Eppendorf introduced the CellXpert CS220, the first CO₂ incubator shaker with a built-in 180°C sterilisation cycle. Tailored for mammalian cell cultivation, it enhanced contamination prevention, accommodated more flasks, and included a streamlined chamber for simplified cleaning. The device also showcased a compact design, delivering the highest platform-to-footprint ratio.

-

In June 2024, Thermo Fisher Scientific launched the fully integrated IntelliStack Incubator and CO₂ Incubator Shakers for precise and reproducible cell culture control. The stackable units featured a 10-inch touchscreen, 5L capacity, and flexible configurations with CO₂ and non-CO₂ shakers. The solution targets biotech, biopharma, and academic sectors, supports automated cell therapy production, and addresses contamination risks.

Automated Cell Shakers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 747.2 million

Revenue forecast in 2030

USD 1.05 billion

Growth rate

CAGR of 7.10% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

Thermo Fisher Scientific Inc.; Eppendorf AG; Ohaus Corporation; Benchmark Scientific; Corning Incorporated; Grant Instruments; Kuhner Shaker; Infors AG; Boekel Scientific; VELP Scientifica Srl

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Cell Shakers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automated cell shakers market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Cell Shakers

-

Orbital Shakers

-

Benchtop Incubator Shakers

-

Cell Shaker with Rotatory Arms

-

Accessories

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Development

-

Regenerative Medicine

-

Cell Therapy

-

Stem Cell Research

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies,

-

CDMOs & CMOs

-

Hospitals

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global automated cell shakers market size was estimated at USD 698.9 million in 2024 and is expected to reach USD 747.2 million in 2025.

b. The global automated cell shakers market is expected to grow at a compound annual growth rate of 7.10% from 2025 to 2030 to reach USD 1.05 billion by 2030.

b. North America dominated the automated cell shakers market due to the strong presence of biotechnology and pharmaceutical firms such as Thermo Fisher Scientific and Agilent Technologies. Advanced laboratory infrastructure supports frequent high-performance cell culture equipment adoption in research hubs like Boston and San Diego. High research spending across academic and private institutions continues to raise demand for automated systems.

b. Some key players operating in the automated cell shakers market include Thermo Fisher Scientific Inc., Eppendorf AG, Ohaus Corporation, Benchmark Scientific, Corning Incorporated, Grant Instruments, Kuhner Shaker, Infors AG, Boekel Scientific, VELP Scientifica Srl

b. The increasing demand for advanced laboratory automation systems is significantly boosting the adoption of automated cell shakers. Research institutions and pharmaceutical companies are turning to automated solutions to enhance the efficiency of cell culture processes. These systems minimize manual errors, maintain consistency, and improve throughput in biological research.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.