- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Customized Premixes Market Size & Share Report, 2020-2027GVR Report cover

![Customized Premixes Market Size, Share & Trends Report]()

Customized Premixes Market (2020 - 2027) Size, Share & Trends Analysis Report By Nutrient (Vitamins, Minerals), By Form (Powder, Liquid), By Function, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-259-7

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Customized Premixes Market Summary

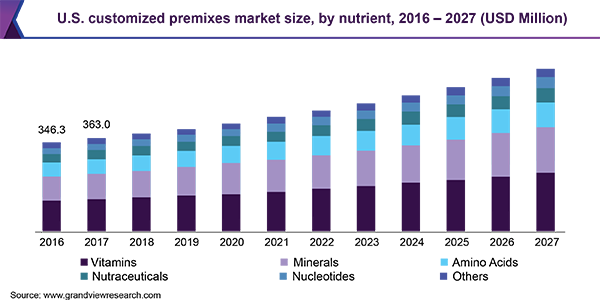

The global customized premixes market size was valued at USD 1.39 billion in 2019 and is projected to reach USD 2.28 billion by 2027, growing at a compound annual growth rate (CAGR) of 6.4% from 2020 to 2027. Growing demand for vitamin and mineral-enriched foods and rising health consciousness among consumers are expected to fuel the industry growth.

Key Market Trends & Insights

- North America dominated the market and accounted for over 36.0% share of the global revenue in 2019.

- Based on nutrient, the vitamins-based nutrient segment led the industry and accounted for more than 36.0% share of the global revenue in 2019.

- Based on form, the powder-based premixes segment led the industry and accounted for more than 57.0% share of the global revenue in 2019.

- Based on function, the energy segment led the market and accounted for more than 33.0% share of the global revenue in 2019.

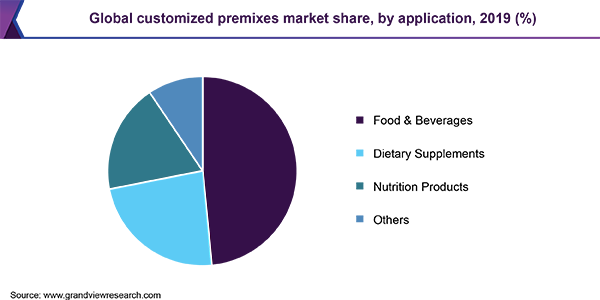

- Based on application, the food and beverage segment led the market and accounted for more than 48.0% share of the global revenue in 2019.

Market Size & Forecast

- 2019 Market Size: USD 1.39 Billion

- 2027 Projected Market Size: USD 2.28 Billion

- CAGR (2020-2027): 6.4%

- North America: Largest market in 2019

Customized premixes are defined as dry or liquid custom blends of a wide array of nutrients, such as vitamins, minerals, amino acids, nutraceuticals, fibers, and nucleotides. The demand for customized premixes has increased at a significant rate on account of the rising consumption of fortified beverages, particularly sports drinks and energy drinks, among sports enthusiasts and athletes across the globe.

Consumers in the U.S. are extremely health-conscious, and thus the demand for functional beverages enriched with various nutrients, such as vitamins, minerals, amino acids, and nucleotide, is high among them. Energy and sports drinks are the most popular type of functional beverages consumed in the country.

The surge in the consumption of dietary supplements as a result of the increasing prevalence of chronic diseases and rising healthcare costs has resulted in increased demand for premixes, particularly vitamins and minerals, owing to their superior health benefits. Vitamins and minerals are essential for various health functions, such as maintaining a healthy immune system and hormonal balance, supporting tissue growth and bone health, and regulating metabolism.

Additionally, the demand for a customized blend of nutrients as per the individual’s requirement has increased, as nutritional deficiency varies from person to person. Furthermore, consumers are accustomed to having access to on-demand and customized services. With the rise of on-demand personalization, the industry is anticipated to grow at a significant rate during the forecast period.

However, increased investment in R&D activities to develop products with specific requirements and achieve accurate fortification without compromising the taste and texture of the products has resulted in high product cost, thereby restraining the industry growth. Moreover, inaccurate labeling of the food products and issues related to change in color, texture, and flavor are likely to pose a challenge to the players operating in the market, which, in turn, is projected to affect the product demand.

Nutrient Insights

The vitamins-based nutrient segment led the industry and accounted for more than 36.0% share of the global revenue in 2019. The widespread use of vitamin premixes in a broad range of applications, including beverages, dairy products, cereals, dietary supplements, sports nutrition, and infant nutrition, is likely to augment the segment growth over the upcoming years.

The minerals-based nutrient segment is likely to witness substantial growth over the forecast period on account of its growing incorporation in manufacturing dairy and cereal products, such as milk, yogurt, cream cheese, and oatmeal. Minerals provide superior health benefits, such as bone health, nerve transmission, muscle contraction, blood pressure regulation, and immune system health.

The growing use of amino acids in applications including dietary supplements, infant nutrition, clinical nutrition and dietetics, animal feed, and pharmaceuticals is likely to contribute significantly to the market growth. Some of the essential amino acids used in the end-use products, such as dietary supplements, animal feed, and pharmaceuticals, include histidine, lysine, and methionine, among others.

Nutraceuticals-based premixes are expected to witness steady growth over the next few years owing to the increasing consumption of food supplements, specialty nutrition products, functional drinks, and energy drinks across the globe. The rising level of disposable income, changing lifestyle, and shift in trend towards healthier dietary intake are likely to promote the consumption of nutraceuticals among consumers, thereby fueling the segment growth.

Form Insights

The powder-based premixes segment led the industry and accounted for more than 57.0% share of the global revenue in 2019. The powdered form of premixes is widely preferred over its liquid counterpart owing to its superior benefits, including cost-effectiveness, convenient packaging, stability, and flexibility. Powder premixes are also being preferred for supplements that are consumed in large quantities.

Powdered premixes are easy to pack and handle, and thus are preferred by the end-use industries, such as food and beverage and dietary supplements. Spray and freeze-drying are the commonly used processes used to make powder premixes. The spray drying method is popular among companies owing to its shorter cycle time, larger scalability, and cost-effectiveness compared to the freeze-drying method.

The liquid premixes are flexible with dosing and are absorbed faster. The liquid form offers ease of mixing in various formulations due to the presence of high-water content. Additionally, the liquid form is popular in the food and beverage industry on account of its better suitability for making products, such as yogurt, smoothies, and energy drinks.

However, bulk packaging of liquid form results in inconvenience in handling and occupies more space. Moreover, liquid premixes are expensive as compared to powder premixes, have a shorter life span, and often require refrigeration due to which powder premixes are more preferred over liquid premixes.

Function Insights

The energy segment led the market and accounted for more than 33.0% share of the global revenue in 2019. Energy obtained from consuming fortified food and beverage products is used to perform physical tasks and maintain the body’s essential functions, such as cell growth and repair, blood transport, and respiration. Dietary supplements rich in vitamin B12, iron, calcium, chromium, and magnesium are consumed widely to boost and maintain energy levels in the body.

Micronutrients are crucial for a well-functioning immune system. Vitamins, selenium, zinc, and iron are the most commonly used micronutrients for the proper functioning of the immune system. Vitamin C and vitamin D play a key role in boosting immunity in individuals. The spread of COVID-19 has resulted in a significant increase in the consumption of nutritious products to boost immunity.

Functional foods fortified with minerals and vitamins are being widely consumed for improving bone and joint health. Rising consumer inclination towards the use of bone health supplements from an early age to prevent and/or reduce complications at a later stage is likely to augment the product demand.

The surge in demand for functional drinks induced with health benefits, including improved immunity, energy boost, and digestive health, is anticipated to propel the overall market growth. Additionally, the growing consumption of dietary supplements to combat issues related to digestion health, weight management, and vitality is projected to further fuel the segment growth over the forecast period.

Application Insights

The food and beverage segment led the market and accounted for more than 48.0% share of the global revenue in 2019. Customized premixes are widely used in producing beverage products, such as nutritional drinks, carbonated water, energy drinks, sports drinks, fruit juices, isotonic beverages, and other non-carbonated beverages. Additionally, increasing usage of customized premixes in manufacturing food products, including dairy, cereals, and bakery and confectionaries, is likely to propel the segment growth over the upcoming years.

The busy lifestyle, which encourages on-the-go eating trends, has resulted in the prevalence of chronic diseases, such as heart diseases, cancer, and diabetes, across various demographics of the population. Therefore, the rising consumption of nutrient-rich and fortified food products is anticipated to augment the demand for customized premixes in the food and beverages industry.

The consumption of dietary supplements has increased at a significant rate as a result of changing lifestyles, an aging population, and rising health consciousness among consumers. Additionally, an increase in the number of weight management programs is likely to fuel the demand for dietary supplements, thereby driving the demand for customized premixes over the upcoming years.

The growing incorporation of vitamins, minerals, and amino acids in manufacturing nutrition products in various industries, such as infant nutrition, clinical nutrition, and sports nutrition, is likely to fuel the segment growth. Furthermore, growing concerns regarding the health of infants and mothers are likely to fuel the demand for clinical nutrition products, which, in turn, is projected to drive the segment.

Regional Insights

North America dominated the market and accounted for over 36.0% share of the global revenue in 2019. High demand for micronutrient enriched food products due to the prevalence of chronic diseases, such as diabetes, cancer, and osteoporosis, is the prime factor propelling the regional market growth. The presence of key premixes manufacturers, such as Prinova Group LLC and ADM Animal Nutrition, is another important factor propelling the industry growth in the region.

The growing consumption of nutritional supplements among the aging population in North America is likely to drive the demand for customized premixes in the dietary supplement application. As per CRN Consumer Survey on Dietary Supplements in 2019, around 77% of adults in the U.S. consume dietary supplements. Additionally, with the growing aging population in the country, the demand for new and innovative functional products has increased significantly, which, in turn, is anticipated to positively influence the market growth in North America.

The market in Europe is driven by high consumption of healthy and nutritional drinks, particularly sports drinks and energy drinks, among the youngsters and working population. Additionally, increasing health consciousness among the consumers in the region is fueling the demand for premixes-based fortified foods that promote better health, increase longevity, and prevent the onset of chronic diseases.

The market in Asia Pacific is projected to witness substantial growth over the upcoming years on account of increasing consumption of dietary supplements and healthy foods, coupled with growing health awareness and rising per capita disposable income. The demand for fortified staple food products increased rapidly amid the COVID-19 outbreak in the region, particularly in Southeast Asian countries.

Key Companies & Market Share Insights

The industry is highly competitive owing to the presence of various prominent and well-established players and some small players. The companies are adopting strategies, such as mergers & acquisitions, expansion, and new product developments, to gain a competitive advantage over other players in the market. Koninklijke DSM N.V. is the leading company in the global market, wherein the company caters to all end-use industries in the market. It is emphasizing on new product developments using natural ingredients.

In August 2019, DSM introduced new consumer-driven and customizable premixes made with botanicals as a result of growing consumer interest in health concerns and naturalness. Furthermore, in March 2019, DSM planned to launch a range of natural nutrient premixes created with botanicals at the Vitafoods Europe 2019 event. These innovative premixes were targeted at the dietary supplement manufacturers that are emphasizing on combining botanicals with DSM’s essential micronutrients and unique nutraceuticals. Some prominent players in the global customized premixes market include:

-

Koninklijke DSM N.V.

-

Glanbia plc

-

Corbion N.V.

-

Vitablend Netherland B.V.

-

Prinova Group LLC

-

Jubilant Life Sciences Limited

-

SternVitamin GmbH & Co. KG

-

Wright Enrichment Inc.

-

Provimi Animal Nutrition India Pvt. Ltd.

-

Utrix S.A.L

-

ADM Animal Nutrition

-

Pristine premixes

-

BI Nutraceuticals

-

Farbest Brands

-

Piramal Group

Customized Premixes Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.47 billion

Revenue forecast in 2027

USD 2.28 billion

Growth Rate

CAGR of 6.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nutrient, form, function, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; Spain; France; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Koninklijke DSM N.V.; Glanbia plc; Corbion N.V.; Vitablend Netherland B.V.; Prinova Group LLC; Jubilant Life Sciences Limited; SternVitamin GmbH & Co. KG; Wright Enrichment Inc.; Provimi Animal Nutrition India Pvt. Ltd.; Utrix S.A.L; ADM Animal Nutrition; Pristine premixes; BI Nutraceuticals; Farbest Brands; Piramal Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global customized premixes market report on the basis of nutrient, form, function, application, and region:

-

Nutrient Outlook (Revenue, USD Million, 2016 - 2027)

-

Vitamins

-

Minerals

-

Amino Acids

-

Nucleotides

-

Nutraceuticals

-

Others

-

-

Form Outlook (Revenue, USD Million, 2016 - 2027)

-

Powder

-

Liquid

-

-

Function Outlook (Revenue, USD Million, 2016 - 2027)

-

Bone Health

-

Skin Health

-

Energy

-

Immunity

-

Digestion

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Food & Beverages

-

Beverages

-

Dairy Products

-

Cereals

-

Bakery & Confectionary

-

Others

-

-

Dietary Supplements

-

Nutrition Products

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The customized premixes market size was estimated at USD 1.39 billion in 2019 and is expected to reach USD 1.47 billion in 2020.

b. The customized premixes market is expected to grow at a compound annual growth rate of 6.4% from 2020 to 2027 to reach USD 2.28 billion by 2027.

b. On the basis of nutrient, the vitamins-based premixes segment dominated the customized premixes market with a share of 36.2% in 2019.

b. Some of the key players operating in the global customized premixes market include Koninklijke DSM N.V., Glanbia plc, Corbion N.V., Vitablend Netherland B.V., Prinova Group LLC, Jubilant Life Sciences Limited, SternVitamin GmbH & Co. KG, Wright Enrichment Inc., Provimi Animal Nutrition India Pvt. Ltd, Utrix S.A.L, ADM Animal Nutrition, Pristinepremixes, BI Nutraceuticals, Farbest Brands, Piramal Group.

b. The key factors that are driving the customized premixes market include increasing consumption of fortified food products as a result of rising health concerns among the consumers, rising healthcare costs, and increasing government initiatives aimed at promoting the consumption of nutrition enriched products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.