- Home

- »

- Communications Infrastructure

- »

-

Data Center Energy Storage Market, Industry Report, 2030GVR Report cover

![Data Center Energy Storage Market Size, Share & Trends Report]()

Data Center Energy Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Technology, By Capacity Range, By Data Center Type, By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-574-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Energy Storage Market Summary

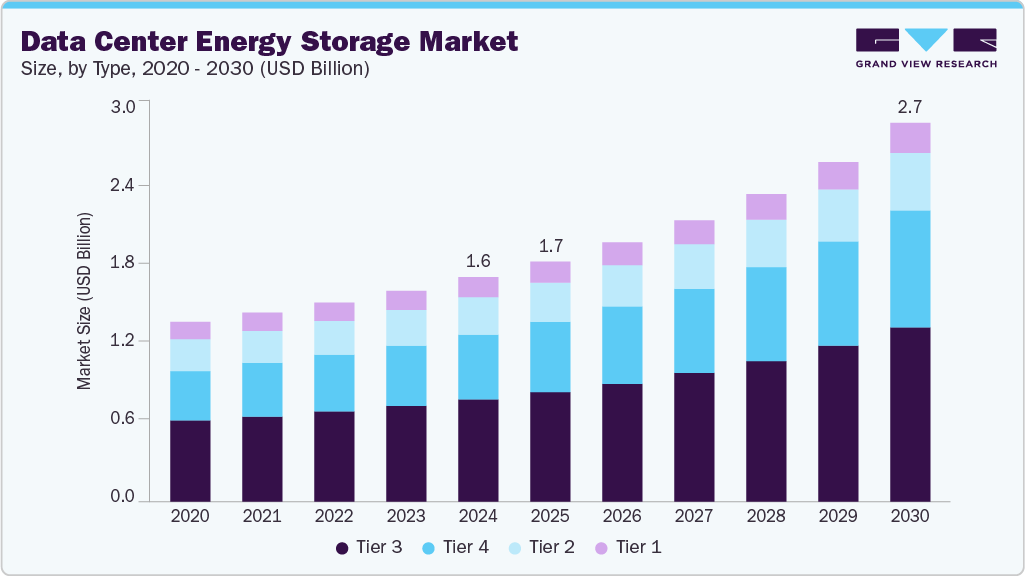

The global data center energy storage market size was estimated at USD 1.58 billion in 2024 and is projected to reach USD 2.67 billion by 2030, growing at a CAGR of 9.5% from 2025 to 2030, driven by the exponential increase in data generation and digital transformation across industries.

Key Market Trends & Insights

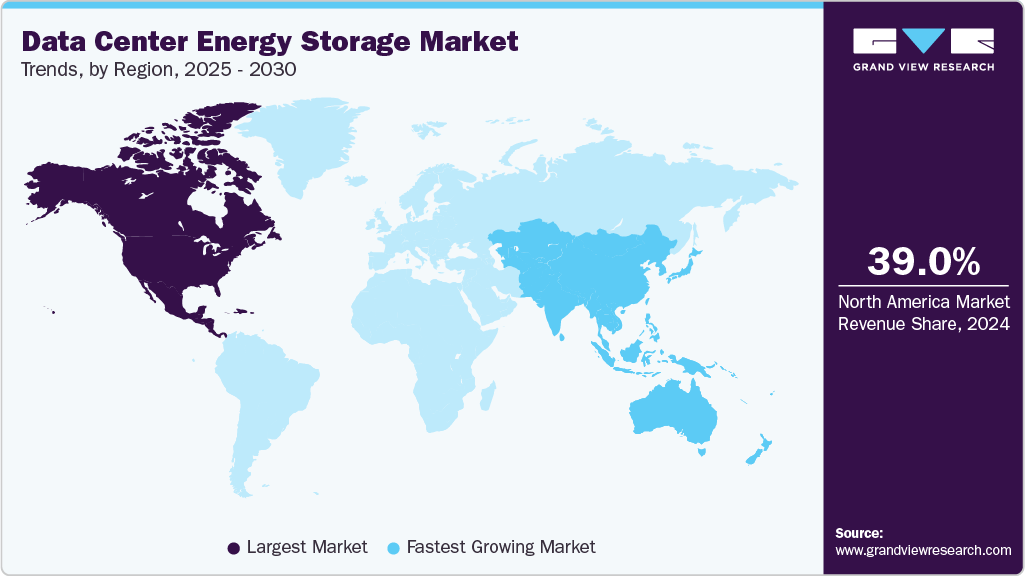

- The North America data center energy storage market dominated the global industry with a share of 39.0% in 2024.

- The data center energy storage market in the U.S. is expected to grow at a CAGR of 7.1% over the forecast period.

- By type, the Tier 3 segment dominated the market and accounted for the revenue share of over 45.0% in 2024.

- By technology, the lithium-ion batteries segment dominated the market and accounted for the highest share in 2024.

- By capacity range, the 1 MW to 10 MW segment dominated the market and accounted for revenue share of 36.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.58 Billion

- 2030 Projected Market Size: USD 2.67 Billion

- CAGR (2025-2030): 9.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With the rapid adoption of cloud computing, artificial intelligence, Internet of Things (IoT), and big data analytics, there is a growing demand for reliable and uninterrupted power supply in data centers. This surge fuels the need for advanced energy storage solutions to support backup power systems, maintain uptime, and ensure operational continuity during grid failures or power fluctuations. The rising emphasis on sustainability and energy efficiency also contributes to the growth of the data center energy storage industry. As governments and corporations strive to reduce carbon footprints and comply with stringent environmental regulations, data centers increasingly integrate renewable energy sources such as solar and wind into their power infrastructure. Energy storage systems play a critical role in balancing the intermittent nature of these renewable sources, enabling data centers to maintain stable power delivery and reduce dependence on diesel generators or fossil fuels.

Moreover, technological advancements in battery technologies, such as lithium-ion, flow batteries, and solid-state storage, enhance energy density, efficiency, and lifespan while reducing operational costs. These innovations make energy storage more economically viable and scalable for data center applications. Edge computing is driving the growth of micro and modular data centers in remote or distributed locations. This trend increases the demand for localized energy storage to enhance resiliency and reduce latency requirements. For instance, in January 2025, the General Authority for Statistics (GASTAT) in Saudi Arabia officially launched its new Micro Data Center, a strategic initiative to enhance access to accurate and detailed statistical information. This advanced platform is designed to support decision-makers, policymakers across the public and private sectors, researchers, and individuals interested in data and analytics.

Type Insights

The Tier 3 segment dominated the market and accounted for the revenue share of over 45.0% in 2024, driven by the increasing demand for high availability and robust business continuity among enterprises and service providers. Tier 3 data centers are designed to offer concurrently maintainable infrastructure, with an expected uptime of 99.982%, making them a preferred choice for businesses that require minimal service disruptions without incurring the high capital expenditures.

The Tier 4 is anticipated to be the fastest-growing segment at a CAGR of 10.7% during the forecast period, driven by the rising adoption of artificial intelligence, real-time analytics, and other latency-sensitive workloads that cannot tolerate downtime. These workloads are primarily hosted in Tier 4 data centers, which rely heavily on sophisticated energy storage systems to provide instantaneous backup power in the event of grid failure or equipment malfunction. In addition, with growing emphasis on sustainability and regulatory compliance, Tier 4 operators are shifting toward energy storage solutions that support integration with renewable energy sources while reducing carbon emissions and operational costs.

Technology Insights

The lithium-ion batteries segment dominated the market and accounted for the highest revenue share in 2024, driven by its superior performance characteristics compared to traditional lead-acid batteries. Key factors propelling this growth include higher energy density, longer life cycle, faster charge/discharge rates, and reduced footprint, all of which make lithium-ion technology ideal for modern data center environments. Lithium-ion batteries offer the speed and reliability required for seamless switchover to backup power during outages as data centers evolve to support more intensive computing workloads and demand uninterrupted uptime.

The flow batteries segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing need for long-duration energy storage and sustainable power management solutions. Unlike traditional lithium-ion batteries, flow batteries store energy in liquid electrolytes, allowing for independent scaling of power and capacity. This makes them particularly attractive for large-scale or hyperscale data centers that require extended backup durations, enhanced energy resiliency, and load-leveling capabilities. The ability of flow batteries to provide sustained power for several hours, without significant degradation, positions them as a strategic asset for data centers aiming to maintain uptime during prolonged grid outages or periods of renewable energy intermittency.

Capacity Range Insights

The 1 MW to 10 MW segment dominated the market and accounted for the revenue share of over 36.0% in 2024, driven by the expansion of mid-sized and large enterprise data centers and regional colocation and cloud facilities. This capacity range offers a practical balance between energy resiliency and cost-efficiency. It is ideal for Tier 2 and Tier 3 data centers that require reliable backup power for mission-critical operations but may not need the extensive scale of hyperscale deployments. As the digital economy grows, especially in emerging markets, demand for data centers within this capacity bracket is rising, driving the need for scalable and efficient energy storage systems.

The above 10 MW segment is expected to grow at a significant CAGR over the forecast period, owing to the increasing focus on energy resilience and grid independence. With data centers becoming critical national infrastructure, especially in digital sovereignty and cybersecurity, operators invest in above-10 MW energy storage systems to minimize reliance on unstable grid power and avoid costly downtime. These systems enable full-scale, instant power backup, frequency regulation, and load balancing capabilities, essential for fault-tolerant operations in Tier 4 data centers and mission-critical environments.

Data Center Type Insights

The colocation data centers segment dominated the market and accounted for the revenue share of over 34.0% in 2024, driven by the increasing outsourcing of IT infrastructure by enterprises seeking scalable, cost-effective, and resilient hosting environments. As businesses across sectors prioritize digital transformation, they increasingly turn to colocation providers to reduce capital expenditure and gain access to secure, high-performance facilities. This rising demand pushes colocation operators to invest in robust and flexible energy storage systems to ensure uninterrupted service delivery and meet stringent uptime commitments outlined in service-level agreements (SLAs).

The hyperscale data center is the fastest-growing segment with a significant CAGR during the forecast period due to the expansion of global cloud service providers, social media giants, and AI/ML-focused enterprises. These facilities, typically exceeding 10 MW of IT load and hosting hundreds of thousands of servers, demand massive, uninterrupted power supplies to ensure service continuity, high availability, and data integrity. As hyperscalers deploy new infrastructure at unprecedented rates to support cloud computing, video streaming, e-commerce, and generative AI workloads, the need for high-capacity, high-efficiency energy storage systems has become critical.

Application Insights

The uninterruptible power supply (UPS) segment dominated the market and accounted for the revenue share of over 52.0% in 2024, driven by the evolution of UPS technology, particularly the transition from legacy valve-regulated lead-acid (VRLA) systems to lithium-ion-based and modular UPS systems. These next-generation systems offer higher energy density, longer life cycles, faster recharge times, and reduced maintenance requirements, making them increasingly attractive to data center operators aiming to reduce total cost of ownership (TCO). Modular UPS systems also allow scalable deployments that align with growing IT load, helping operators avoid overprovisioning and unnecessary energy costs.

Renewable energy integration is the fastest-growing segment, with a significant CAGR during the forecast period due to escalating environmental concerns, rising energy costs, and corporate sustainability mandates. As data centers are among the world’s most energy-intensive infrastructures, operators are under increasing pressure to reduce carbon emissions and dependence on fossil fuels. Many are investing in onsite and offsite renewable energy sources to meet these goals, primarily solar and wind.

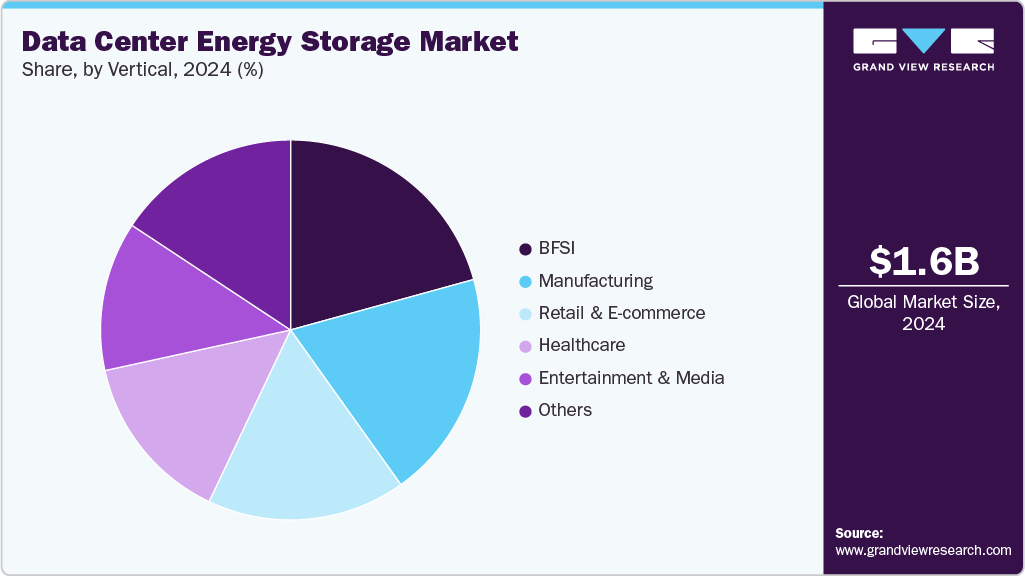

Vertical Insights

The BFSI segment dominated the market and accounted for the revenue share of over 20.0% in 2024, driven by the sector’s need for exceptional data security, uninterrupted uptime, and rapid transaction processing. Financial institutions increasingly rely on data centers to host core banking systems, payment processing platforms, trading applications, and customer data repositories, all of which demand high availability and low latency. The sector’s stringent regulatory requirements for data integrity, disaster recovery, and business continuity elevate the importance of reliable energy storage systems that ensure continuous operations even during power outages or grid instability.

The entertainment & media segment is the fastest-growing segment with a significant CAGR over the forecast period due to the sector’s increasing reliance on digital content delivery, high-performance computing, and global streaming platforms. With the exponential rise in video-on-demand (VoD), online gaming, live sports broadcasting, and immersive experiences like AR/VR and the metaverse, data centers supporting E&M workloads are under immense pressure to deliver ultra-low latency, uninterrupted service, and massive storage capacity. To ensure high availability and real-time data processing, robust and scalable energy storage systems have become critical for supporting 24/7 media delivery.

Regional Insights

The North America data center energy storage market dominated and accounted for a share of nearly 39.0% in 2024, driven by increasing investments in renewable energy integration and smart grid modernization. Utilities and data center operators are collaborating to develop grid-interactive data centers that use energy storage to provide demand-side flexibility, frequency regulation, and peak load management. These capabilities are crucial in managing the region’s aging grid infrastructure while meeting escalating digital infrastructure demands from AI, cloud, and 5G sectors.

U.S. Data Center Energy Storage Market Trends

The data center energy storage market in the U.S. is expected to grow significantly at a CAGR of 7.1% from 2025 to 2030, driven by strong government incentives and tax credits under programs like the Inflation Reduction Act, which are accelerating the deployment of energy storage in data centers. Moreover, hyperscale cloud providers and colocation giants headquartered in the U.S. are pursuing net-zero goals, prompting large-scale adoption of advanced battery systems to support renewable energy procurement strategies and reduce dependence on diesel-based backup power.

Europe Data Center Energy Storage Market Trends

The data center energy storage market in Europe is anticipated to grow considerably from 2025 to 2030 due to strict environmental regulations and the EU Green Deal, which are compelling data centers to transition to sustainable operations. Energy storage systems are critical for meeting stringent carbon neutrality and energy efficiency targets, particularly as more countries introduce binding legislation for green data infrastructure, such as the Climate Neutral Data Centre Pact and national data center energy caps.

The UK data center energy storage market is expected to grow rapidly in the coming years, owing to the rapid expansion of edge and regional data centers outside, in areas with weaker grid infrastructure. Energy storage systems are being deployed to manage intermittent power supply, stabilize voltage levels, and reduce reliance on grid upgrades, which are often delayed due to regulatory and land-use constraints.

The data center energy storage market in Germanyheld a substantial market share in 2024 due to the implementation of grid congestion charges and energy-efficiency compliance regulations, which are encouraging operators to deploy battery systems that support peak shaving, load leveling, and participation in frequency control markets. With Germany also emerging as a hub for AI, cloud, and fintech infrastructure in Europe, demand for resilient, low-latency, and sustainable power backup solutions is rising, making energy storage a vital part of next-generation data center strategies.

Asia Pacific Data Center Energy Storage Market Trends

The data center energy storage market in Asia Pacific is the fastest-growing region and is expected to register the highest CAGR of 11.4% from 2025 to 2030, due to rising internet penetration, digitalization, and government-led smart city initiatives. Countries across the region are rapidly building new data centers, especially in underserved Tier 2 and Tier 3 cities. Energy storage enables operators to manage unstable grid conditions, reduce diesel use, and implement hybrid power solutions that combine solar or wind with batteries for improved cost efficiency and uptime.

Japan data center energy storage market is expected to grow rapidly in the coming years, driven by the country's vulnerability to natural disasters such as earthquakes and typhoons. These risks necessitate robust disaster recovery and energy resilience strategies, making battery storage a critical component in business continuity planning. In addition, Japan’s energy transition policies promote low-carbon technologies, pushing data centers to adopt clean backup power over fossil fuel alternatives.

The data center energy storage market in Chinaheld a substantial market share in 2024, and its growth was propelled by government mandates to curb data center energy consumption and carbon intensity. The East Data, West Computing initiative promotes relocating data centers to inland regions with access to renewable energy, where large-scale battery storage is needed to stabilize grid operations and maintain service continuity in remote, power-variable environments.

Key Data Center Energy Storage Company Insights

ABB, Delta Electronics, Inc., Eaton, GE Vernova, and Huawei Technologies Co., Ltd are key data center energy storage players. The companies focus on various strategic initiatives to gain a competitive advantage over their rivals, including new product development, partnerships and collaborations, and agreements. The following are some instances of such initiatives.

-

In May 2025, ABB introduced BESS-as-a-Service, a Battery Energy Storage Systems-as-a-Service, a no-capital-expenditure, subscription-based solution to accelerate the adoption of clean and resilient energy. Targeting industries such as data centers, logistics, and commercial infrastructure, the offering provides access to advanced energy storage without upfront investment, supporting a seamless transition to net-zero operations.

-

In November 2024, Eaton introduced its xStorage battery energy storage system to help commercial and industrial customers advance their decarbonization and electrification goals. The system supports onsite renewable energy, optimizes energy costs, and enhances resilience by enabling off-grid operation during outages.

-

In October 2024, Delta Electronics, Inc. unveiled its latest innovation for the data center industry, the UZR Gen3 Series UPS Li-ion Battery System. This next-generation lithium-ion battery rack is designed to deliver enhanced safety, reliability, and lower total cost of ownership. Seamlessly integrating with Delta’s existing power and cooling solutions, the UZR Gen3 marks a major advancement in critical power management technology.

Key Data Center Energy Storage Companies:

The following are the leading companies in the data center energy storage market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Delta Electronics, Inc.

- Eaton

- GE Vernova

- Huawei Technologies Co., Ltd.

- Legrand

- Mitsubishi Electric Power Products Inc.

- Saft

- Schneider Electric

- Vertiv Group Corp.

Data Center Energy Storage Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.69 billion

Revenue forecast in 2030

USD 2.67 billion

Growth rate

CAGR of 9.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, technology, capacity range, data center type, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB; Delta Electronics, Inc.; Eaton; GE Vernova; Huawei Technologies Co., Ltd.; Legrand; Mitsubishi Electric Power Products Inc.; Saft; Schneider Electric; Vertiv Group Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Energy Storage Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center energy storage market report based on type, technology, capacity range, data center type, application, vertical, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tier 1

-

Tier 2

-

Tier 3

-

Tier 4

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium-Ion Batteries

-

Lead-Acid Batteries

-

Flow Batteries

-

Compressed Air Energy Storage

-

Flywheel Energy Storage

-

Ultracapacitors

-

-

Capacity Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 100 kW

-

101 kW to 1 MW

-

1 MW to 10 MW

-

Above 10 MW

-

-

Data Center Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Colocation Data Centers

-

Hyperscale Data Centers

-

Enterprise Data Centers

-

Telecommunication Data Centers

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Uninterruptible Power Supply (UPS)

-

Load Shifting and Peak Shaving

-

Renewable Energy Integration

-

Backup Power

-

Grid Stabilization

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

BFSI

-

Manufacturing

-

Retail & E-commerce

-

Entertainment & Media

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center energy storage market size was estimated at USD 1.58 billion in 2024 and is expected to reach USD 1.69 billion in 2025.

b. The global data center energy storage market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 to reach USD 2.67 billion by 2030.

b. The data center energy storage market in North America held a significant share of nearly 39.0% in 2024, driven by the increasing investments in renewable energy integration and smart grid modernization

b. Some key players operating in the data center energy storage market include ABB, Delta Electronics, Inc., Eaton, GE Vernova, Huawei Technologies Co., Ltd., Legrand, Mitsubishi Electric Power Products Inc., Saft, Schneider Electric, Vertiv Group Corp., among others.

b. Key factors driving market growth include the exponential increase in data generation and digital transformation across industries. With the rapid adoption of cloud computing, artificial intelligence, the Internet of Things (IoT), and big data analytics, there is a growing demand for a reliable and uninterrupted power supply in data centers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.