- Home

- »

- Next Generation Technologies

- »

-

Edge AI Accelerator Market Size, Industry Report, 2030GVR Report cover

![Edge AI Accelerator Market Size, Share & Trends Report]()

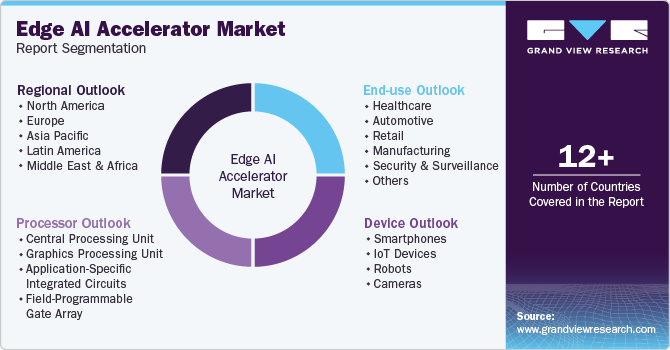

Edge AI Accelerator Market (2025 - 2030) Size, Share & Trends Analysis Report By Processor (CPU, GPU, ASIC, FPGA), By Device (Smartphones, IoT Devices), By End-use (Healthcare, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-477-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Edge AI Accelerator Market Summary

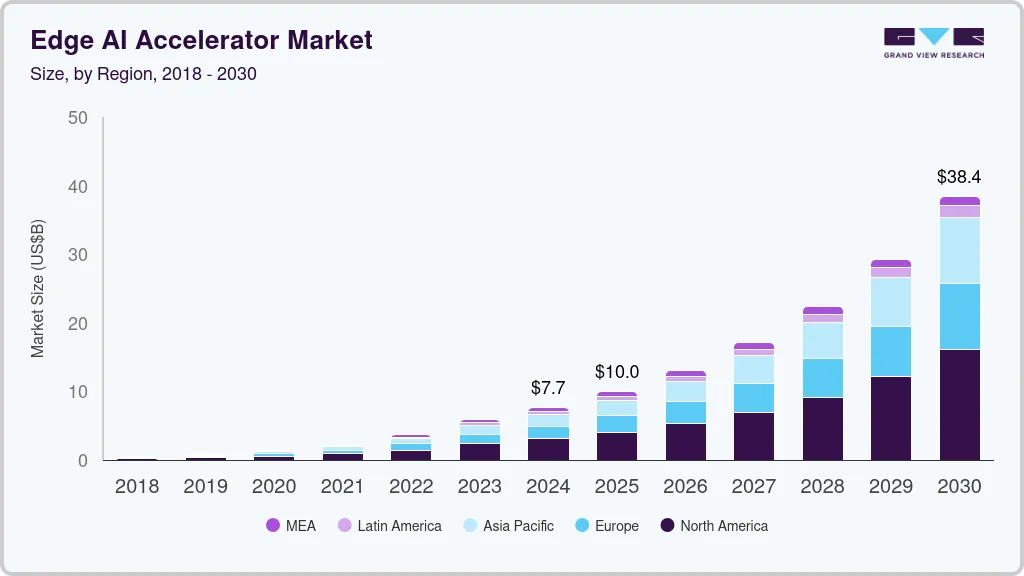

The global edge ai accelerator market size was estimated at USD 7.71 billion in 2024 and is projected to reach USD 38.44 billion by 2030, growing at a CAGR of 30.8% from 2025 to 2030. The edge AI accelerator industry is experiencing significant growth due to the increasing demand for real-time data processing.

Key Market Trends & Insights

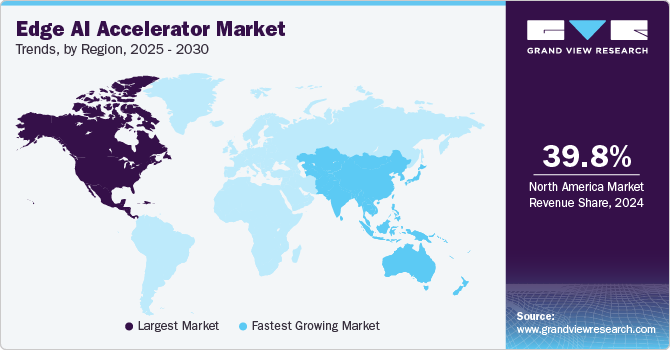

- North America edge AI accelerator market dominated the industry and accounted for a 39.8% share in 2024.

- Asia Pacific edge AI accelerator market is anticipated to register the fastest CAGR over the forecast period.

- Based on processors, the Central Processing Unit (CPU) segment dominated the market with a revenue share of 34.6% in 2024.

- Based on device, the smartphones segment accounted for the largest revenue share in 2024.

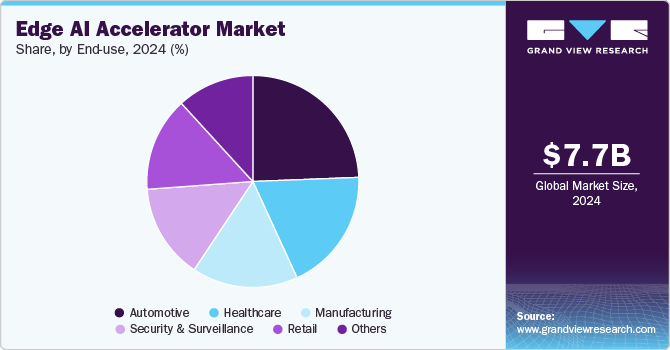

- Based on end-use, the automotive segment generated the highest market revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.71 Billion

- 2030 Projected Market Size: USD 38.44 Billion

- CAGR (2025-2030): 30.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As more devices connect to the internet, the need for instant analysis becomes critical across various industries. Traditional cloud computing methods face challenges like latency, bandwidth limitations, and data privacy concerns, pushing organizations to seek localized solutions.

For instance, NVIDIA Jetson, developed by NVIDIA Corporation, is an AI edge computing platform for real-time processing in robotics, automation, and industry. It is widely used in autonomous vehicles, robotics, and industrial automation. Jetson's edge AI accelerators enable real-time data processing by running AI models directly on devices, reducing the need for cloud computing. This capability enhances operational efficiency and responsiveness in applications ranging from autonomous vehicles to smart factories. Furthermore, advancements in AI algorithms and hardware technologies continue to improve the performance and affordability of these accelerators. As a result, more companies are using edge AI solutions to stay ahead of the competition.

AI accelerators are being integrated into compact devices, enabling real-time processing at the edge. This reduces dependence on external GPUs and cloud computing, allowing for faster and more efficient operations. By processing data locally, devices experience lower latency, improved security, and reduced bandwidth usage. These benefits make edge AI more practical for applications across various industries, including IoT, robotics, and industrial automation. As adoption increases, businesses are leveraging edge AI to enhance decision-making, optimize resource utilization, and enable autonomous systems.

The growing demand for intelligent, low-power computing solutions is driving further advancements in AI hardware and software. For instance, in September 2024, Raspberry Pi Foundation, a U.K. nonprofit promoting computing education, and Sony launched a $70 AI-powered camera module featuring the Sony IMX500 image sensor and an onboard AI accelerator for real-time image processing. It enables neural network models to run directly on the device, simplifying edge AI applications such as object detection and pose estimation without requiring external GPUs.

The growth of the Internet of Things (IoT) significantly contributes to the expansion of the edge AI accelerator market. The proliferation of IoT devices generates massive amounts of data that require immediate processing for effective insights and actions. Edge AI accelerators enable these devices to perform complex computations locally, reducing reliance on cloud infrastructure. This shift helps manage data more securely and efficiently, addressing privacy concerns associated with transmitting sensitive information over the internet. As industries embrace digital transformation, integrating AI capabilities into IoT devices becomes essential for achieving smart operations. The combination of IoT and edge AI accelerators opens up new opportunities for automation, predictive maintenance, and enhanced user experiences. Consequently, businesses are investing in edge AI technologies to capitalize on the potential of their IoT ecosystems fully.

The increasing focus on energy efficiency is driving the adoption of edge AI accelerators across various industries. These accelerators consume less power than traditional cloud-based processing, making them ideal for resource-constrained environments. Google’s Coral Edge TPU supports real-time AI processing with minimal energy use, benefiting applications such as IoT, smart cameras, and industrial automation. Reducing reliance on cloud computing helps lower energy consumption and enhances data privacy by processing information locally. Industries face mounting pressure to adopt sustainable technologies that align with environmental regulations and corporate sustainability goals. As organizations focus on energy efficiency, demand for edge AI accelerators is expected to grow, driving AI adoption.

Processors Insights

The Central Processing Unit (CPU) segment dominated the edge AI accelerator market with a revenue share of 34.6% in 2024. Central Processing Unit (CPU) is a dominant force in AI, driving advancements across industries with its ability to process and analyze large volumes of data efficiently. Its applications, ranging from image recognition to autonomous systems, have revolutionized traditional processes. The development of advanced neural network architectures has further expanded its capabilities, enabling breakthroughs in complex problem-solving. Major Processor companies and research institutions continue to invest heavily in Central Processing Unit (CPU), ensuring its dominance in AI innovation. This widespread adoption has made Central Processing Unit (CPU) integral to industries such as healthcare, finance, and entertainment.

Application-Specific Integrated Circuits (ASICs) are experiencing significant growth in the edge AI accelerator industry due to their efficiency and performance. These processors are designed for specific AI workloads, offering faster processing speeds and lower power consumption compared to general-purpose chips. Their compact design makes them ideal for edge devices, enabling real-time AI processing without relying on cloud computing. Industries such as automotive, healthcare, and consumer electronics are increasingly adopting ASICs for AI-driven applications. The demand for energy-efficient AI solutions is pushing companies to invest in ASIC development for edge computing. Advancements in semiconductor technology are enhancing ASIC capabilities, improving processing efficiency and cost-effectiveness.

Device Insights

The smartphones segment accounted for the largest revenue share in 2024. Smartphones lead the market because of their extensive adoption and the incorporation of sophisticated AI capabilities. They are equipped with powerful CPUs and GPUs, enabling efficient processing of AI tasks directly on the device. The convenience of having AI capabilities readily available enhances the overall smartphone experience, driving demand. Moreover, the continuous innovation in smartphone technology, such as improved camera systems and voice recognition, relies heavily on edge AI processing. Manufacturers are increasingly adding edge AI accelerators to improve functionality and user experience, strengthening smartphones' leading position in the market.

The IoT devices segment is predicted to foresee significant growth in the forecast period due to their increasing prevalence in various industries, including healthcare, agriculture, and smart cities. AI processing is increasingly integrated into IoT devices for real-time decision-making. This reduces reliance on cloud computing and enhances efficiency. This trend is driving the demand for edge AI accelerators. Companies are developing specialized hardware to optimize performance in resource-constrained environments. For instance, in January 2025, Synaptics Incorporated, a U.S.-based computer manufacturing company, and Google LLC are collaborating to integrate Google's Graphics Processing Unit (GPU) core with Synaptics Astra hardware for Edge AI in IoT. This collaboration aims to accelerate AI device development for applications involving vision, voice, and other data processing needs.

End-use Insights

The automotive segment generated the highest market revenue in 2024 due to the growing adoption of real-time AI processing for autonomous driving and advanced driver-assistance systems (ADAS). Automakers increasingly integrated edge AI accelerators to enhance vehicle safety, improve navigation, and optimize energy efficiency. The rising demand for electric vehicles (EVs) further drove the need for AI-powered systems to manage battery performance and predictive maintenance. Regulatory requirements for enhanced safety features also encouraged manufacturers to invest in AI-driven solutions. Moreover, consumer expectations for smarter, more connected vehicles accelerated the adoption of edge AI technologies. These factors collectively positioned the automotive segment as the highest revenue contributor in the market.

The manufacturing is projected to grow significantly over the forecast period due to the increasing push for automation and smart factories. Edge AI enables real-time data processing, which is essential for optimizing production processes and enhancing efficiency. As manufacturers adopt predictive maintenance strategies, edge AI accelerators facilitate quick analysis of equipment data, minimizing downtime and reducing operational costs. Furthermore, the integration of AI technologies allows for improved quality control and supply chain management, leading to better overall performance. The ongoing digital transformation in manufacturing is driving the adoption of edge AI solutions, making it a key area for market expansion.

Regional Insights

North America edge AI accelerator market dominated the industry and accounted for a 39.8% share in 2024. In North America, the market growth is driven by significant technological advancements and a strong presence of key players in the semiconductor and AI industries. The region benefits from substantial investments in research and development, leading to innovations in AI applications across various sectors, including automotive and healthcare. The widespread adoption of smart devices and IoT technologies further fuels demand for edge AI solutions, enabling real-time data processing and analytics.

U.S. Edge AI Accelerator Market Trends

The edge AI accelerator industry in the U.S. is expected to grow significantly over the forecast period. The U.S. holds a dominant position in the edge AI accelerator market, fueled by its robust technology ecosystem and a high concentration of key industry players. The region is home to leading semiconductor manufacturers and tech companies that are at the forefront of AI innovation, driving advancements in edge computing solutions. A focus on research and development encourages innovation, speeding up the use of edge AI in areas like healthcare, automotive, and smart cities.

Europe Edge AI Accelerator Market Trends

Europe is witnessing steady growth in the edge AI accelerator industry, primarily fueled by initiatives aimed to digital transformation and Industry 4.0. The region's focus on sustainability and energy efficiency drives the integration of edge AI solutions into manufacturing and smart city projects. Security and Surveillances are supporting innovation through funding and policies that promote AI research and development, which enhances the competitive sector. Moreover, European automotive manufacturers are increasingly adopting edge AI technologies to develop advanced driver-assistance systems and autonomous vehicles.

Asia Pacific Edge AI Accelerator Market Trends

Asia Pacific edge AI accelerator market is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is rapidly emerging as a significant player in the edge AI accelerator market, driven by a surge in manufacturing and technology adoption. Countries such as China, Japan, and South Korea are investing heavily in AI research, particularly in sectors such as automotive, electronics, and telecommunications. The region's growing IoT ecosystem is creating vast opportunities for edge AI applications, facilitating improved operational efficiency and real-time data analysis. Moreover, the rising demand for smart devices and consumer electronics is propelling market growth as manufacturers seek to incorporate advanced AI capabilities.

Key Edge AI Accelerator Company Insights

Some of the key companies in the edge AI accelerators industry include Apple Inc.; Google LLC; IBM Corporation; Intel Corporation; and Microsoft. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

NVIDIA Corporation has expanded its edge AI accelerator offerings with powerful GPUs and system-on-modules designed for real-time AI processing. Its Jetson platform enables efficient AI computing for robotics, autonomous vehicles, and smart cities. The company continues to enhance AI inference capabilities with software optimizations and partnerships in various industries. These advancements strengthen NVIDIA’s position in delivering high-performance edge AI solutions.

-

Qualcomm Technologies, Inc. has integrated edge AI accelerators into its Snapdragon processors to enhance AI capabilities in mobile devices, IoT, and automotive applications. Its AI Engine improves on-device processing for tasks such as computer vision and voice recognition. The company has also collaborated with partners to optimize AI workloads for energy-efficient, low-latency performance. These developments reinforce Qualcomm’s role in advancing edge AI across multiple sectors.

Key Edge AI Accelerator Companies:

The following are the leading companies in the edge AI accelerator market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- EdgeCortix Inc.

- Hailo Technologies Ltd.

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation (IBM)

- Intel Corporation

- Google LLC

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Rapidus Corporation

Recent Developments

-

In July 2024, EdgeCortix Inc., an edge AI company in Japan, introduced the SAKURA-II edge AI accelerator optimized for energy-efficient processing of generative AI tasks. This next-generation accelerator delivers 60 trillion operations per second at just 8 W. It features advanced capabilities such as sparse computation and high DRAM capacity, making it a powerful solution for industries such as manufacturing, security, and telecommunications.

-

In June 2024, ADLINK Technology Inc. is showcasing innovative edge AI solutions at COMPUTEX 2024, collaborating with NVIDIA Corporation to enhance applications in smart manufacturing, healthcare, smart transportation, and AI graphics. Key products include the DLAP-211-Orin Series for optimizing smart parking, MLB-IGX medical box PC for real-time medical navigation, and the NEON-2000-ONO Series AI smart camera to improve manufacturing efficiency, all utilizing NVIDIA's advanced AI and GPU technologies for edge computing.

-

In June 2024, Raspberry Pi collaborated with HAILO TECHNOLOGIES LTD to launch the Raspberry Pi AI Kit. This kit combines the Raspberry Pi 5 with a Hailo-8L accelerator for efficient AI processing at the edge. It targets both industrial users and enthusiasts, offering high computing power with low energy consumption.

-

In July 2023, Silicom Ltd. launched its first Edge AI product line in collaboration with HAILO TECHNOLOGIES LTD, an Israeli AI technology company. Hailo’s AI accelerators are integrated into Silicom’s Edge platforms to enhance performance for various AI use cases at an attractive price. This partnership aims to unlock new applications such as behavior analytics, facial recognition, and vehicle analytics.

Edge AI Accelerator Market Report Scope

Report Attribute

Details

Market value in 2025

USD 10.03 billion

Revenue forecast in 2030

USD 38.44 billion

Growth rate

CAGR of 30.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Processor, device, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Apple Inc.; EdgeCortix Inc.; Hailo Technologies Ltd.; Huawei Technologies Co., Ltd.; International Business Machines Corporation (IBM); Intel Corporation; Google LLC; NVIDIA Corporation; Qualcomm Technologies, Inc.; Rapidus Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edge AI Accelerator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edge AI accelerator market report based on processor, device, end use, and region:

-

Processor Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Processing Unit (CPU)

-

Graphics Processing Unit (GPU)

-

Application-Specific Integrated Circuits (ASICs)

-

Field-Programmable Gate Array (FPGA)

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

IoT Devices

-

Robots

-

Cameras

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Automotive

-

Retail

-

Manufacturing

-

Security and Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global edge AI accelerator market size was estimated at USD 7.719 billion in 2024 and is expected to reach USD 10,034.8 million in 2025.

b. The global edge AI accelerator market is expected to grow at a compound annual growth rate of 30.8% from 2025 to 2030 to reach USD 38.44 billion by 2030.

b. North America dominated the edge AI accelerator market with a share of 39.8% in 2024. This is attributable to its robust technological infrastructure, the presence of major tech companies driving innovation, and substantial investments in research and development.

b. Some key players operating in the edge AI accelerator market include Apple Inc., EdgeCortix Inc., Hailo Technologies Ltd., Huawei Technologies Co., Ltd., International Business Machines Corporation (IBM), Intel Corporation, Google LLC, NVIDIA Corporation, Qualcomm Technologies, Inc., and Rapidus Corporation.

b. Key factors that are driving the market growth include the surge in demand for high-performance computing, technological advancements in AI accelerators, integration of AI with edge computing, the proliferation of IoT devices, and the growing need for real-time processing across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.