- Home

- »

- Advanced Interior Materials

- »

-

Test And Measurement Equipment Market Size Report, 2033GVR Report cover

![Test And Measurement Equipment Market Size, Share & Trends Report]()

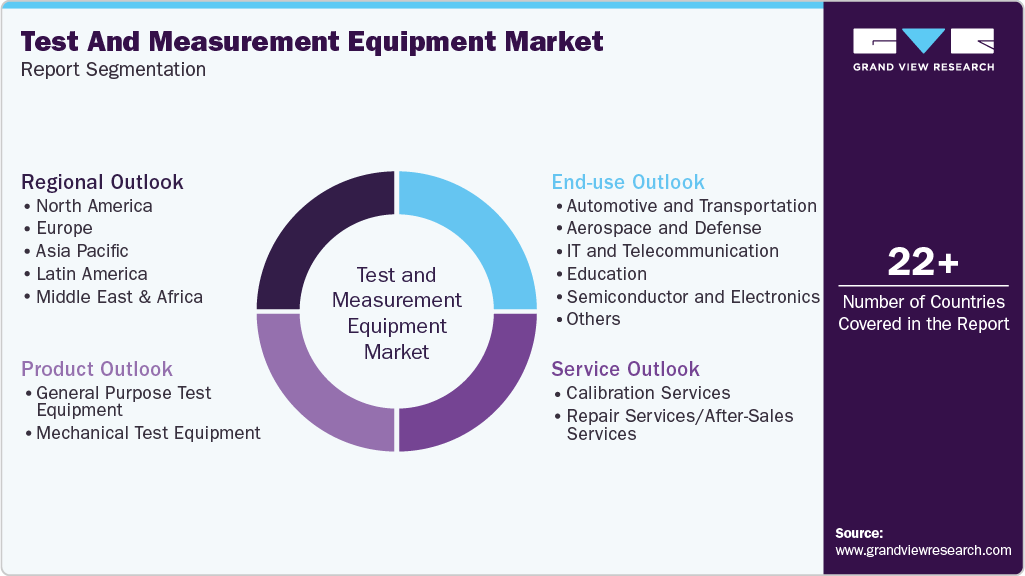

Test And Measurement Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (General Purpose Test Equipment, Mechanical Test Equipment), By Service, By End-use (Aerospace & Defense, Education, Semiconductor & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-600-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Test And Measurement Equipment Market Summary

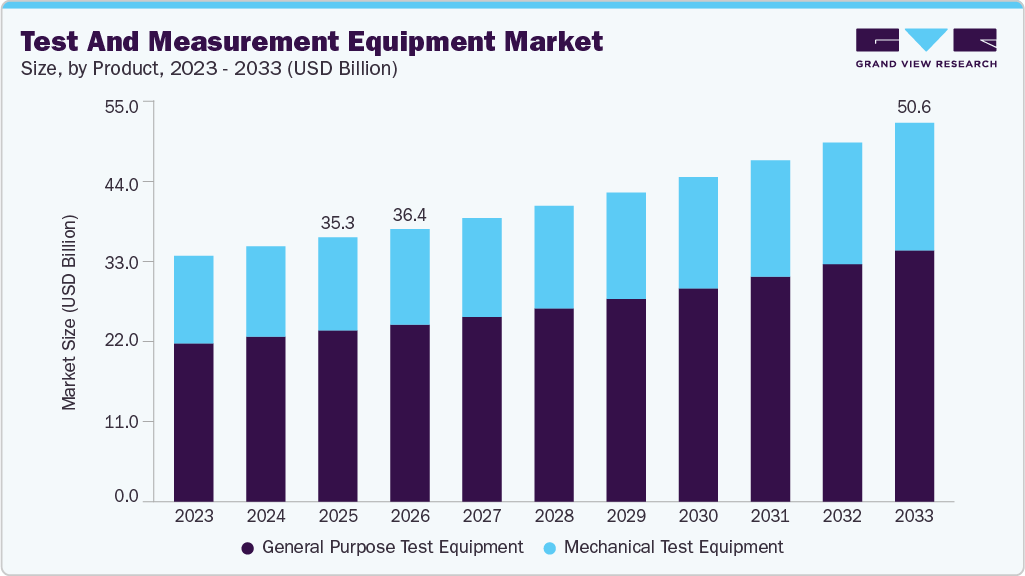

The global test and measurement equipment market size was estimated at USD 35,316.5 million in 2025 and is projected to reach USD 50,627.9 million by 2033, growing at a CAGR of 4.8% from 2026 to 2033. The industry is rapidly driven by the increasing complexity of electronic devices and systems across industries such as automotive, telecommunications, and aerospace.

Key Market Trends & Insights

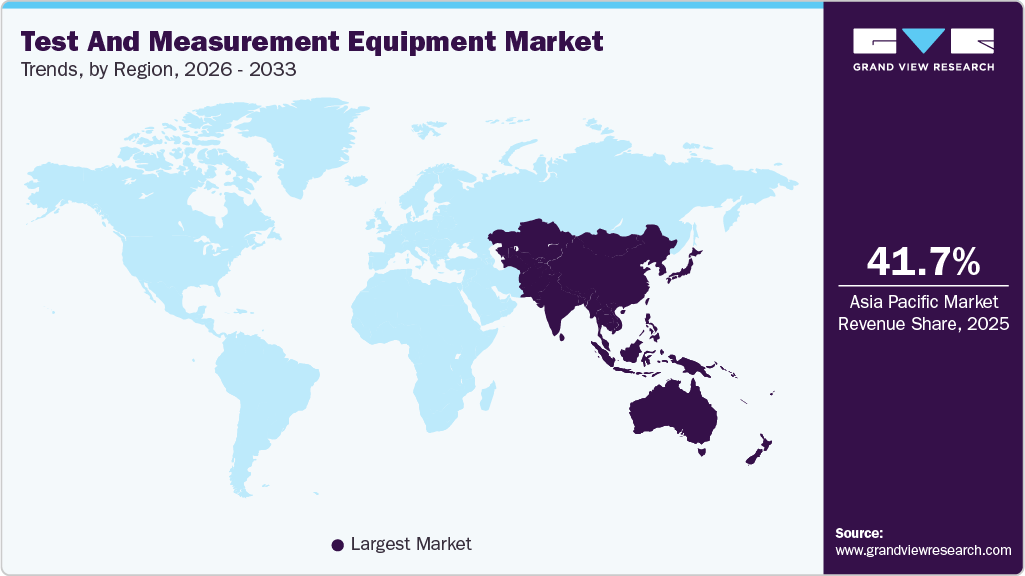

- Asia Pacific dominated the global test and measurement equipment market with the largest revenue share of 41.7% in 2025.

- The China test and measurement equipment market is projected to grow rapidly over the forecast period.

- By product, the general purpose test equipment segment dominated the market, accounting for 64.8% share in 2025.

- By service, the calibration services segment led the market and accounted for a 57.9% share in 2025.

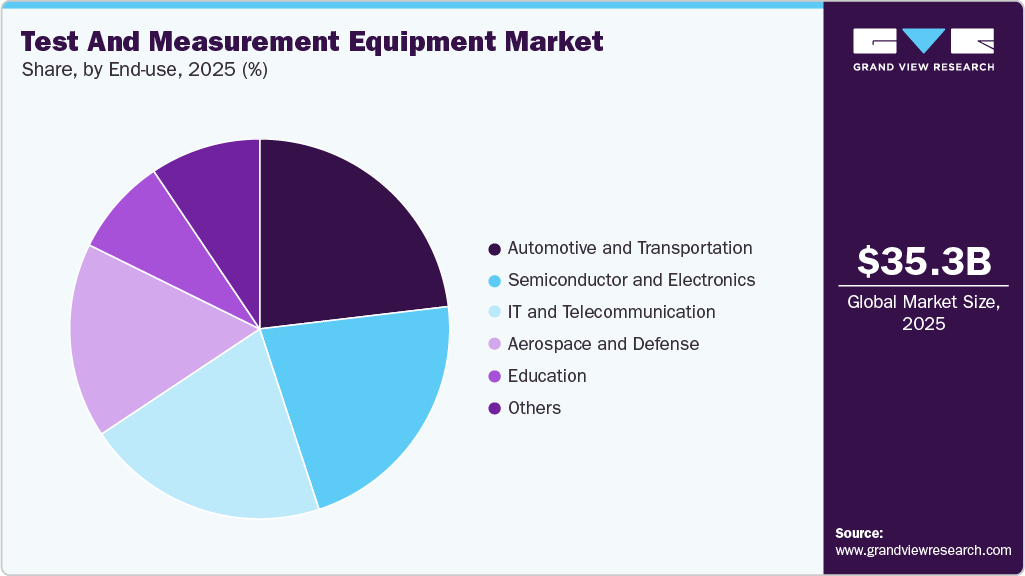

- By end-use, the automotive and transportation segment dominated the market in 2025, accounting for 23.1%.

Market Size & Forecast

- 2025 Market Size: USD 35,316.5 Million

- 2033 Projected Market Size: USD 50,627.9 Million

- CAGR (2026-2033): 4.8%

- Asia Pacific: Largest market in 2025

The rise of emerging technologies such as 5G, IoT, and AI demands precise testing to ensure performance and compliance. In addition, increasing focus on quality assurance, automation, and predictive maintenance is driving demand for advanced test and measurement solutions.

Industries seek tools that ensure consistent product performance, reduce downtime, and anticipate failures before they occur. These systems support efficient operations by enabling real-time monitoring, enhancing reliability, and streamlining production processes through data-driven decision-making and early fault detection.

Market Concentration & Characteristics

The global test and measurement equipment market is moderately fragmented, with a mix of large multinational companies and regional players competing for market share. Key manufacturers are focusing on several strategic initiatives to maintain competitiveness and expand their reach. They are heavily investing in R&D to develop innovative, high-precision, and multifunctional testing solutions tailored to emerging technologies such as 5G, IoT, and electric vehicles.

Innovations in the market are driven by the integration of AI, machine learning, and cloud-based analytics to enhance precision and real-time data processing. Advanced wireless testing for 5G and IoT, automated testing solutions, and modular, software-defined instruments are also emerging. These innovations improve efficiency, adaptability, and accuracy across sectors such as automotive, telecommunications, and electronics, enabling faster development cycles and better quality control.

Strategic collaborations, mergers, and acquisitions are common to enhance product portfolios and global presence. Many are also emphasizing digital transformation by integrating AI and cloud-based analytics into their solutions. For instance, in November 2022, AVL and Rohde & Schwarz partnered to streamline and accelerate automotive development by integrating their advanced testing technologies. This collaboration focused on automating complex validation processes, and improving efficiency and precision in testing automotive components, particularly in connectivity, ADAS, and electric vehicles, supporting faster and more reliable product development.

Regulations play a crucial role in shaping the market by enforcing strict quality, safety, and performance standards across industries. Compliance with international standards such as ISO and IEC, and region-specific guidelines ensures product reliability but also increases development costs and complexity. While they drive innovation and improve equipment standards, these regulations can slow time-to-market and create barriers for smaller players due to the need for continuous updates and certifications.

Drivers, Opportunities & Restraints

The growing demand for high-performance electronics across industries such as consumer devices, semiconductors, and automotive systems is driving the market. As devices become more complex and compact, with greater functionality and integration, ensuring their reliability and precision becomes critical. Advanced testing solutions are required to verify performance, detect faults early, and ensure compliance with stringent quality standards.

Rapid growth of Electric Vehicles (EVs) and Autonomous Technologies, including ADAS, is significantly increasing the need for advanced test and measurement equipment. These vehicles rely on complex power electronics, high-performance sensors, and robust communication systems that must be rigorously tested for safety, reliability, and compliance. This creates strong market opportunities for specialized testing solutions.

High initial costs are a significant barrier in the market. Advanced systems require substantial upfront investment in hardware and software, which can be challenging for small and medium enterprises. These expenses, combined with training and maintenance requirements, often limit adoption, slowing innovation and competitiveness for businesses with constrained budgets.

Product Insights

The General Purpose Test Equipment (GPTE) segment dominated the market, accounting for 64.8% share in 2025, due to rising demand for electronic devices, wireless communication systems, and automotive electronics. Products such as oscilloscopes, signal generators, and multimeters are widely used across industries for maintenance, troubleshooting, and R&D. Increasing investments in 5G, IoT, and semiconductor innovation further boost the need for precise testing tools. Besides, the growing emphasis on product quality and regulatory compliance across sectors supports the expansion of GPTE in the global market.

The mechanical test equipment segment is expected to grow at a CAGR of 4.2% from 2026 to 2033 in terms of revenue. The mechanical test equipment segment is expected to grow due to increasing demand for quality assurance and safety across industries such as automotive, aerospace, construction, and manufacturing. As materials and product designs become more advanced, the need for precise mechanical testing, such as tensile, compression, and impact testing, has grown significantly. In addition, technological advancements like automation and digital integration are enhancing equipment capabilities. Regulatory compliance and the rising focus on product durability and performance are further driving the adoption of mechanical test solutions globally.

Service Insights

The calibration services segment led the market and accounted for a 57.9% share in 2025. Industries such as aerospace, automotive, and telecommunications increasingly rely on precise measurements, necessitating regular calibration to ensure compliance with stringent regulatory standards and to maintain operational efficiency. Technological advancements, including automation, IoT integration, and cloud-based calibration solutions, enhance the accuracy and efficiency of calibration processes. Furthermore, the growing complexity of modern instruments and the emphasis on quality assurance further propel the demand for specialized calibration services. These factors collectively contribute to the expanding role of calibration services in the global market.

The repair services/after-sales services segment is expected to grow at the considerable CAGR of 5.3% CAGR due to increasing reliance on complex and high-value instruments across industries. As businesses prioritize equipment uptime and operational efficiency, the demand for timely maintenance, repairs, and technical support is rising. Extended service contracts, predictive maintenance, and remote diagnostics are becoming common, ensuring minimal disruptions.

End-use Insights

The automotive and transportation segment dominated the market in 2025, accounting for 23.1%. This segment sees strong demand for test and measurement equipment driven by the increasing complexity of modern vehicles, including the rise of electric vehicles (EVs) and autonomous driving technologies. Advanced systems such as battery management, radar, LiDAR, and vehicle-to-everything (V2X) communication require precise testing to ensure safety, performance, and regulatory compliance. Additionally, stringent global safety and emissions standards necessitate comprehensive testing solutions, further fueling demand in this sector.

The IT and telecommunication segment is expected to grow at the fastest CAGR of 5.7% from 2026 to 2033 due to increasing demand for high-speed networks, 5G, and IoT. End users require advanced testing solutions to ensure network reliability, security, and performance. This fuels demand for test equipment, enabling the efficient development, deployment, and maintenance of complex communication systems.

Regional Insights

The test and measurement equipment industry in the Asia Pacific dominates the market as it accounted for a 41.7% share in 2025, driven by strong electronics manufacturing, semiconductor expansion, and rapid industrialization. Countries such as China, Japan, South Korea, and India are investing heavily in telecom infrastructure, EV production, and automation. The presence of large manufacturing hubs fuels consistent demand for both general purpose and advanced testing solutions. Government support for smart manufacturing further strengthens regional leadership.

China Test And Measurement Equipment Market Trends

The China test and measurement equipment market is projected to grow rapidly over the forecast period, driven by its dominant electronics manufacturing base, government initiatives in high-tech industries, and rising demand for advanced testing equipment in the semiconductor and automotive sectors. For instance, in March 2024, China launched a national innovation center for high-end nondestructive testing (NDT) in Beijing to enhance intelligent inspection technologies.

The test and measurement equipment market in India is projected to grow over the forecast period due to rapid industrial expansion, the increasing adoption of modern testing technologies, and the government’s focus on “Make in India” initiatives, boosting demand in the electronics, automotive, and telecommunications industries.

North America Test And Measurement Equipment Market Trends

The test and measurement equipment industry in North America is expected to grow steadily at a CAGR of 5.0% over the forecast period, supported by strong industrial and technology-driven demand. The region benefits from high R&D spending, early adoption of advanced testing solutions, and a well-established calibration and service ecosystem. Automotive electrification, aerospace programs, and 5G deployment continue to drive equipment upgrades. Regulatory and quality compliance requirements further sustain market demand.

The U.S. test and measurement equipment market is projected to expand at a CAGR of 5.3% over the forecast period, driven by its advanced infrastructure, presence of key players, emphasis on research and development, and demand across sectors, including defense, automotive, and electronics. For instance, in March 2025, Keysight Technologies introduced two new sampling oscilloscopes specifically designed for testing 1.6T optical transceivers. These advanced instruments offer high-speed, precise signal analysis, supporting next-generation data center and telecommunications applications.

The test and measurement equipment industry in Mexico is driven by expanding automotive manufacturing and electronics assembly activities. Increasing foreign direct investment is boosting demand for quality testing and inspection equipment across production lines. The country’s role as a manufacturing base for North American supply chains supports steady adoption. Growth in industrial automation and export-oriented manufacturing is expected to sustain market momentum.

Europe Test And Measurement Equipment Market Trends

The test and measurement equipment industry in Europe continues to grow steadily, supported by strong industrial automation and advanced manufacturing practices. Strict regulatory and quality standards across the region drive consistent demand for accurate and reliable testing solutions. The push toward electric mobility, renewable energy, and smart factories is increasing equipment adoption. Ongoing investments in R&D further support market expansion.

The Germany test and measurement equipment industry dominates the European market due to its strong automotive, industrial engineering, and manufacturing base. The country’s focus on precision engineering and Industry 4.0 drives high demand for advanced test and measurement systems. Extensive use of automation and machine condition monitoring supports sustained equipment upgrades. Germany’s strong export-oriented industries further reinforce market leadership.

The test and measurement equipment industry in France is emerging as a growing market, driven by aerospace, defense, and electronics manufacturing activities. Investments in digital infrastructure and industrial modernization are increasing the need for advanced testing equipment. The expansion of electric vehicle programs and renewable energy projects also supports demand. Government-backed innovation initiatives contribute to steady market growth.

Latin America Test And Measurement Equipment Market Trends

The test and measurement equipment industry in Latin America is experiencing gradual growth, supported by expanding industrial and infrastructure activities. Demand is rising from automotive manufacturing, electronics assembly, and power generation sectors. Increasing focus on quality control and regulatory compliance is improving equipment adoption. Ongoing telecom network expansion also contributes to market growth.

The Brazil test and measurement equipment industry is a key growth market in the region, driven by automotive production, industrial manufacturing, and energy projects. Investments in factory modernization and automation are increasing the demand for reliable testing and inspection solutions. The country’s large manufacturing base supports steady use of calibration and after-sales services. Continued infrastructure development is expected to sustain market momentum.

Middle East & Africa Test And Measurement Equipment Market Trends

The test and measurement equipment industry in the Middle East & Africa is growing steadily, supported by investments in energy, infrastructure, and industrial development. Demand is driven by oil & gas inspection, power generation testing, and quality assurance across large-scale projects. Increasing focus on safety standards and asset reliability is improving the adoption of advanced testing solutions. Gradual diversification into manufacturing and technology sectors supports long-term growth.

The Saudi Arabia test and measurement equipment industry is emerging as a key growth market, driven by large investments in energy, industrial expansion, and infrastructure projects. The country’s push toward localization and industrial diversification is increasing demand for testing, inspection, and calibration equipment. Growing adoption of automation and condition monitoring supports preventive maintenance practices. Long-term development programs are expected to sustain market growth.

Key Test And Measurement Equipment Company Insights

Some of the key players operating in the market include Keysight Technologies and Fortive Corporation, among others.

-

Keysight Technologies provides electronic design and test solutions for industries such as aerospace, defense, telecommunications, automotive, and semiconductor manufacturing. The company offers a broad portfolio of advanced test and measurement equipment, including oscilloscopes, signal generators, network analyzers, and software tools. Keysight’s solutions enable precise testing, validation, and optimization of complex electronic systems, supporting innovations like 5G, IoT, and autonomous vehicles.

-

Fortive Corporation is a diversified industrial technology company with a strong presence in the market. Through its subsidiaries, Fortive provides a wide range of precision instruments and solutions used for industrial automation, quality control, and research applications. Their portfolio includes tools for electrical testing, flow measurement, calibration, and data acquisition, serving industries like manufacturing, healthcare, and energy.

Key Test And Measurement Equipment Companies:

The following key companies have been profiled for this study on the test and measurement equipment market

- Keysight Technologies

- Fortive Corporation

- AMETEK, Inc.

- Rohde & Schwarz

- National Instruments (NI)

- Teledyne Technologies

- VIAVI Solutions

- Anritsu Corporation

- Yokogawa Electric Corporation

- Advantest Corporation

- EXFO Inc.

- Fujian Lilliput Optoelectronics Technology Co., Ltd (OWON)

- IKM Instrutek

- Uni-Trend Technology Co., Ltd.

- Particle Measuring Systems (Spectris)

Recent Developments

-

In April 2025, Bosch launched a new range of electrical testing equipment designed specifically for professionals. The lineup includes devices like non-contact voltage testers, clamp meters, and digital multimeters.

-

In January 2025, Teradyne and Infineon Technologies announced a strategic partnership to advance power semiconductor testing. As part of the collaboration, Teradyne will acquire Infineon's automated test equipment (ATE) technology and the associated development team based in Regensburg, Germany.

Test And Measurement Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 36,415.5 million

Revenue forecast in 2033

USD 50,627.9 million

Growth Rate

CAGR of 4.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million & CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Keysight Technologies; Fortive Corporation; AMETEK, Inc.; Rohde & Schwarz; National Instruments (NI); Teledyne Technologies; VIAVI Solutions; Anritsu Corporation; Yokogawa Electric Corporation; Advantest Corporation; EXFO Inc.; Fujian Lilliput Optoelectronics Technology Co., Ltd (OWON); IKM Instrutek; Uni-Trend Technology Co., Ltd.; Particle Measuring Systems (Spectris)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Test And Measurement Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global test and measurement equipment market report on the basis of product, service, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

General Purpose Test Equipment

-

Oscilloscopes

-

Signal Generators

-

Multimeters

-

Logic Analyzers

-

Spectrum Analyzers

-

Bert (Bit Error Rate Test)

-

Network Analyzers

-

Others

-

-

Mechanical Test Equipment

-

Non-Destructive Test Equipment

-

Machine Vision Inspection

-

Machine Condition Monitoring

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Calibration Services

-

Repair Services/After-Sales Services

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive and Transportation

-

Aerospace and Defense

-

IT and Telecommunication

-

Education

-

Semiconductor and Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the market are Keysight Technologies, Fortive Corporation, AMETEK, Inc., Rohde & Schwarz, National Instruments (NI), Teledyne Technologies, VIAVI Solutions, Anritsu Corporation, Yokogawa Electric Corporation, Advantest Corporation, EXFO Inc., Fujian Lilliput Optoelectronics Technology Co., Ltd (OWON), IKM Instrutek, Uni-Trend Technology Co., Ltd., and Particle Measuring Systems (Spectris).

b. Key factors driving the test and measurement equipment market include rising demand for advanced electronics, rapid growth in 5G and IoT technologies, increased adoption of electric vehicles, stringent quality and safety regulations, and expansion in industrial automation. Technological advancements and R&D investments further boost market growth across various sectors.

b. Asia Pacific dominates the test and measurement equipment market and accounted for 41.7% share, driven by strong electronics manufacturing, semiconductor expansion, and rapid industrialization. Countries like China, Japan, South Korea, and India are investing heavily in telecom infrastructure, EV production, and automation.

b. The global test and measurement equipment market size was estimated at USD 35,316.5 million in 2025 and is expected to reach USD 36,415.5 million in 2026.

b. The global test and measurement equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2026 to 2033 to reach USD 50,627.9 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.