- Home

- »

- Communication Services

- »

-

U.S. Telecom Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Telecom Services Market Size, Share & Trends Report]()

U.S. Telecom Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type (Mobile Data Services, Machine-to-Machine Services), By Transmission (Wireline, Wireless), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-243-8

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Telecom Services Market Size & Trends

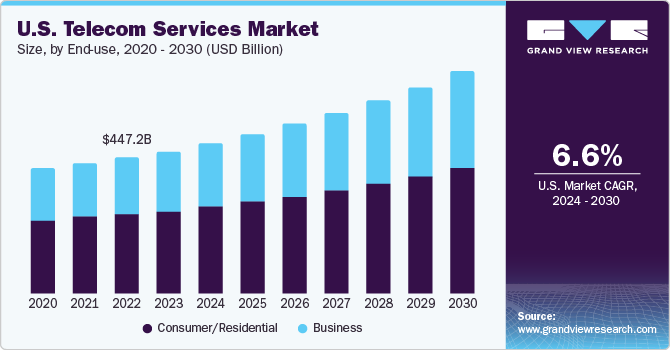

The U.S. telecom services market size was estimated at USD 468.08 billion in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030. The presence of major telecom service providers in the United States, such as Verizon, AT&T, and T-Mobile, along with several others, is expected to drive market expansion in the coming years. These companies are engaged in mergers & acquisitions, as well as product launch activities, to drive their revenue shares. Furthermore, these companies are expanding their geographical presence across the country through the installation of towers and the establishment of R&D centers, aiding market expansion. For instance, in January 2024, DISH Wireless received a substantial grant of USD 50 million from the U.S. Department of Commerce's National Telecommunications and Information Administration for developing the Open RAN Center for Integration & Deployment (ORCID).

The U.S. accounted for a 24.83% revenue share in the global telecom services market in 2023. There is increased spending on 5G infrastructure by service providers in the country, aided by the fast growth of the smartphone ecosystem and demand for faster network speeds. A report by BCG states that by 2030, the U.S. 5G sector would contribute around USD 1.4-1.7 trillion in terms of economic growth. Another report by The Brattle Group in 2023 stated that there would be a six-fold increase in mobile traffic by 2033, highlighting the need for a strong telecom infrastructure. Leading companies are in the process of understanding and planning the deployment of 6G technology via strategic partnerships, which would create further growth avenues for the market.

The high rate of smartphone adoption in the U.S. has translated to a steadily increasing requirement for high-speed mobile and data services. A report published by Pew Research in January 2024 stated that smartphone ownership, as well as general cell phone ownership, has grown in the country. 97% of the American population owns some kind of cell phone; according to the research, 9 out of 10 people are smartphone users. These phones require efficient connectivity to allow for a seamless calling and internet usage experience. A shift to the remote working model during the COVID-19 pandemic heightened the adoption of online meetings and calls in business organizations, driving the demand for high-speed and reliable telecom services.

The still-growing popularity of streaming services that offer access to unlimited video and audio content, as well as other forms of media, such as games, has led to partnerships between telecom companies and streaming service providers. For instance, T-Mobile has a Magenta Plan that includes a Netflix Basic Plan (SD streaming on a single screen), while Verizon has an Unlimited Plus plan that can get users a Disney Bundle. Such developments are expected to intensify competition among players, leading to substantial market growth.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of its growth is accelerating. The untapped potential of 5G, rapid proliferation of AI & machine learning (ML), adoption of edge computing, and increasing usage of cybersecurity solutions are expected to drive innovations among telecom service providers in the U.S. In addition, heavy investments by organizations in the Industrial Internet of Things (IIoT) to revolutionize their business models, save energy & maintenance costs, and improve employee productivity are expected to create several growth avenues for telecom companies, as they need to build a robust internet network.

There are several major names currently populating the U.S. telecom services market, as the country has been a global leader in this pace. As a result, there are frequent new product launches, which helps drive industry growth. For instance, in December 2023, Lumen Technologies, a leading telecom service provider, announced the launch of a customized Wi-Fi 7 capable device that claims to provide faster speeds as well as an enhanced Wi-Fi experience to the company’s Quantum Fiber multi-gig user base, as compared to Wi-Fi 6/6E solutions.

The telecom market in the U.S. is highly regulated, leading to companies requiring to keep an eye on updated guidelines and regulations and accordingly design their products and services. The Federal Communications Commission (FCC) is the leading body that brings into effect guidelines to ensure fairness and transparency in this industry. For instance, in November 2023, the FCC introduced rules that would allow it to penalize companies should they fail to offer equal Internet access to communities without proper justification, irrespective of their race, religion, community, and income level. Such developments and regulations are expected to shape this industry in the coming years.

There is a low to moderate risk of product substitutes in the market, since the default application areas of telecommunications, such as data, internet, and voice, are already strongly established. Moreover, significant progress in the 5G infrastructure in the country, as well as its rising adoption among users, is expected to solidify its growth. The threat of substitute products generally comes from alternatives available for wired/fixed-line telephones, as well as satellite communication services that offer advanced capabilities and better geographical reach.

There is a significant end-user base for telecom services, owing to their obvious benefits in improving connectivity across different environments. The business segment has made several technological breakthroughs in recent years that have made the presence of a strong telecom network a necessity.

Transmission Insights

In terms of transmission, the wireless segment accounted for the largest revenue share of 75.9% in 2023. There has been rapid growth in the deployment of Wireless Local Area Networks (WLANs), especially in public spaces, such as airports, cafeterias, and office buildings. Also, significant developments have been made in the wireless infrastructure in the U.S., leading to a 117-time increase in network speeds since 2010, as per a report by the CTIA. The country’s wireless traffic in 2022 rose to 73.7 trillion megabytes; this number is expected to rise to 210 trillion MBs by 2027. This positive trend showcases the strong position of wireless infrastructure in the U.S.

The imminent launch of 6G wireless communications is expected to significantly boost the demand for wireless networks in the United States. In early 2023, the Biden Administration announced plans to take major steps in this space by meeting with government, corporate, and academic experts, to advance the mobile internet and cloud computing segments. New developments and innovations are also frequent in this area, leading to sustained market expansion. For instance, in September 2023, World Mobile Networks launched its 4G services in the U.S., with the launch of a 5G service planned for 2024. The company makes use of blockchain technology to realize P2P connectivity and enhance network participation, bringing affordable services to underserved areas.

End-use Insights

The consumer/residential segment accounted for the largest revenue share of 58.0% in 2023 on account of the rising usage of smartphones as well as the growing popularity of smart homes in the United States. The adoption of IoT devices, such as smart locks, thermostats, and security systems requires seamless internet connectivity to empower homeowners with real-time monitoring and automation of tasks, making telecom a major pillar in this area. Furthermore, the exponential growth of the OTT service segment has provided a further boost to market revenue, leading users to shift permanently to wireless internet services. According to an Insider report, around 245 million people (72.2% of the population) in the U.S. were projected to view OTT videos at least once monthly in 2023. The demand for high-speed connectivity in video game streaming is another factor driving the revenue of telecom service providers in the country.

The business segment is expected to advance at the fastest CAGR of 7.1% from 2024 to 2030 owing to the rising technological advancements in business establishments and the need to keep customers satisfied. A strong telecom network helps companies communicate effectively with their clients, while also providing them the tools to function effectively across different locations. Telecom operators provide services in major industries, such as manufacturing, retail, healthcare, BFSI, education, and government & defense, with each sector demanding a specific set of requirements that providers must be flexible enough to address. For instance, the adoption of telemedicine in hospitals, the introduction of e-learning in classrooms, and the use of collaborative robots in manufacturing have resulted in significant growth in the U.S. telecom service industry.

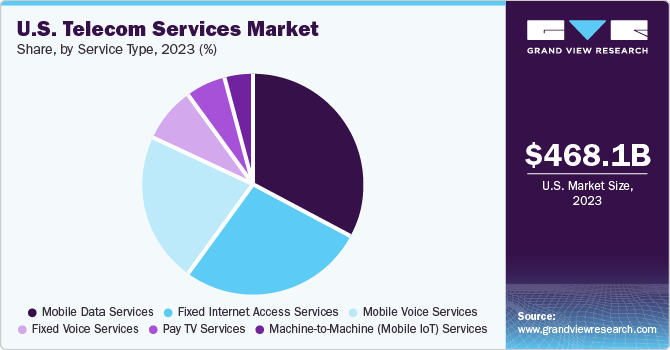

Service Type Insights

Based on services, the mobile data services segment accounted for the largest revenue share of 33.5% in 2023 aided by the rapidly rising usage of smartphones among consumers. Furthermore, business professionals in the U.S. have shown an increasing preference for the adoption of 5G smartphones as it helps them conduct their tasks seamlessly, which has translated to a substantial demand for telecom services. In addition, there has been a noticeable increase in the popularity of cloud gaming services and video streaming in 4K resolutions, especially in households in recent years. This has compelled telecom operators to launch attractive pricing options for data services, driving segment growth.

The fixed internet access services segment accounted for a significant revenue share in 2023, aided by the rising demand for internet connectivity in households, along with the rising usage of connected devices in the U.S. There is still a sizeable population in the country that does not have access to reliable and fast home broadband services, offering an opportunity for service providers to provide fixed internet access to such communities. Companies, such as Verizon, Rise Broadband, and T-Mobile, offer different plans for fixed wireless, while many local providers also populate this segment to provide services to areas that may not be covered by national providers.

Key U.S. Telecom Services Company Insights

AT&T, Inc.; Verizon Communications, Inc.; Comcast Corporation; and T-Mobile are the leading providers of telecom services in the United States.

-

AT&T Inc., headquartered in Dallas, Texas, is a leading global telecommunication, media, and technology service provider. The company operates primarily in three business segments, including communications, Latin America, and WarnerMedia. In the communication segment, the company provides wireline & wireless telecom, video, and broadband & Internet services; IP-based and video streaming services using satellites; and audio programming services under the AT&T PREPAID, AT&T, and DIRECTV brands to business and residential customers

-

Verizon Communications, Inc., headquartered in New York City, is a major mobile communication service provider. Verizon and its subsidiaries provide services including communications, information & entertainment products, and services to consumers, businesses, and government agencies. The company engages mainly in three business segments - wireless, wireline, and corporate & others. The wireless segment offers wireless communications products and services. The wireline segment offers communications products and services comprising security & managed network services, video & data services, and domestic & long-distance voice services to business consumers, individuals, and government customers

Some other notable companies involved in the market include United States Cellular Corporation; Charter Communications; Lumen Technologies, Inc.; and Altice USA, Inc.

-

Altice USA, headquartered in New York City, is a provider of broadband communications and video services in the United States. The company delivers video, broadband, mobile, and its own content & advertising services to around 5 million business and residential customers in 21 states of the country, via its Optimum brand. The company provides VoIP telephone services, along with mobile services including talk, data, and text. It further offers Ethernet, IP-based VPNs, Internet, and telephone services to its user base

-

Lumen Technologies, headquartered in Louisiana, provides network services, communications, security, voice services, cloud solutions, and managed services. The company mainly caters to business, residential, state, local, and federal agencies. It markets its solutions and services through inbound call centers, telemarketing, direct sales representatives, and third parties, such as retailers, satellite television providers, door-to-door sales agents, and digital marketing companies

Key U.S. Telecom Services Companies:

- AT&T Inc.

- Comcast Corporation

- Verizon Communications Inc.

- T-Mobile US Inc.

- Charter Communications, Inc.

- United States Cellular Corporation

- Lumen Technologies Inc.

- Altice USA, Inc.

- Cox Communications, Inc.

- DISH Network Corporation

Recent Developments

-

In February 2024, AT&T announced that it would be providing fiber-enabled broadband services to over 2000 business and residential locations in the town of Sevastopol, Wisconsin. The project planning and engineering is expected to start in the first quarter of 2024, with the completion of the network buildout projected in 2 years. This development follows similar initiatives by the company in other parts of the country, such as Boonville (Indiana) and Egg Harbor (Wisconsin)

-

In January 2024, T-Mobile announced the completion of extensive network enhancements to offer 5G coverage across over 48,000 square miles of Upstate New York. Notable areas that have received 5G as part of this project include Fort Drum, Albany Airport, Lake Placid, and Clarkson University, among others. This multi-year investment has led to the addition of around 400 new cell sites, as well as upgrades for over 800 existing towers in the region

-

In January 2024, UScellular announced that it had received a grant of USD 2.1 million for building 4 cell sites, as part of the second grant round of the Missouri Cell Towers Grant Program. The funding would enable the company to provide additional coverage in the counties of Adair, Ralls, Knox, Marion, Shelby, Macon, Texas, and Pulaski counties in Missouri. UScellular had received a grant of USD 5.8 million in the first round of funding

-

In September 2023, Cox Private Networks announced that its partnership with InifiniG had led to an expansion of the company’s solution portfolio via the launch of Neutral Host as a Service (NHaaS), leading to the availability of reliable cellular from multiple MNOs in environments that have weak indoor cellular coverage

U.S. Telecom Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 725.68 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, transmission, end-use

Country scope

U.S.

Key companies profiled

AT&T Inc.; Comcast Corp.; Verizon Communications Inc.; T-Mobile US Inc.; Charter Communications, Inc.; United States Cellular Corp.; Lumen Technologies Inc.; Altice USA, Inc.; Cox Communications, Inc.; DISH Network Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Telecom Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. telecom services market report based on service type, transmission, and end-use:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Fixed Voice Services

-

Fixed Internet Access Services

-

Mobile Voice Services

-

Mobile Data Services

-

Pay TV Services

-

Machine-to-Machine (Mobile IoT) Services

-

-

Transmission Outlook (Revenue, USD Million, 2017 - 2030)

-

Wireline

-

Wireless

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer/Residential

-

Business

-

IT & Telecom

-

Manufacturing

-

Healthcare

-

Retail

-

Media & Entertainment

-

Government & Defense

-

Education

-

BFSI

-

Energy & Utilities

-

Transportation & Logistics

-

Travel & Hospitality

-

O&G and Mining

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. telecom services market size was estimated at USD 468.08 billion in 2023 and is expected to reach USD 493.50 billion in 2024.

b. The U.S. telecom services market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 725.68 billion by 2030.

b. The mobile data services segment dominated the U.S. telecom services market with a share of 33.5% in 2023. The segment growth is aided by the rapidly rising usage of smartphones among consumers.

b. Some key players operating in the U.S. telecom services market include AT&T Inc.; Comcast Corporation; Verizon Communications Inc.; T-Mobile US Inc.; Charter Communications, Inc.; United States Cellular Corporation; Lumen Technologies Inc.; Altice USA, Inc.; Cox Communications, Inc.; DISH Network Corporation.

b. Key factors that are driving the market growth include the rapid spread of digitalization in the U.S. and increased spending on communication infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.