- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Plastics Market Size, Share, Industry Report 2033GVR Report cover

![Automotive Plastics Market Size, Share & Trends Report]()

Automotive Plastics Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Acrylonitrile Butadiene Styrene, Polyurethane, Polyvinyl Chloride), By Process (Injection Molding, Blow Molding, Thermoforming), By Application (Power Trains, Electrical Components, Interior Furnishings), By Region, And Segment Forecasts

- Report ID: 978-1-68038-193-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Plastics Market Summary

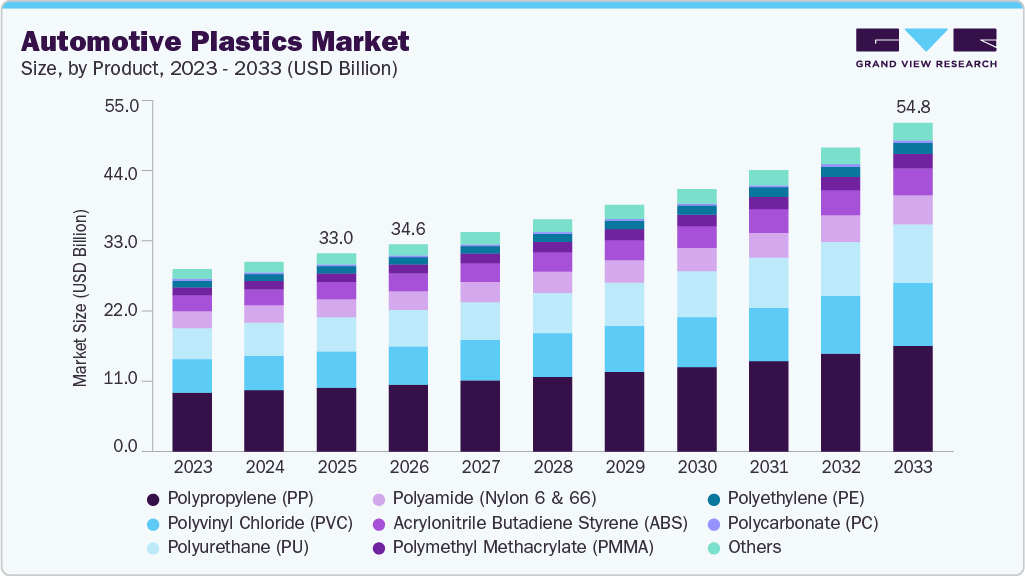

The global automotive plastics market size was estimated at USD 33.02 billion in 2025 and is projected to reach USD 54.82 billion by 2033, growing at a CAGR of 6.8% from 2026 to 2033. Globally, increased prominence on vehicle weight reduction, greater vehicle design capabilities, and pollution control are important drivers boosting growth of the market.

Key Market Trends & Insights

- Asia Pacific dominated the automotive plastics market with the largest revenue share of 46.57% in 2025.

- China dominates regional demand as it is one of the world’s largest automotive producer and a global hub for EV manufacturing.

- By product, the polypropylene (PP) segment dominated the automotive plastics market, accounting for a revenue share of 32.36% in 2025.

- By process, the injection-molding segment led the automotive plastics market and accounted for the largest revenue share of 56.05% in 2025.

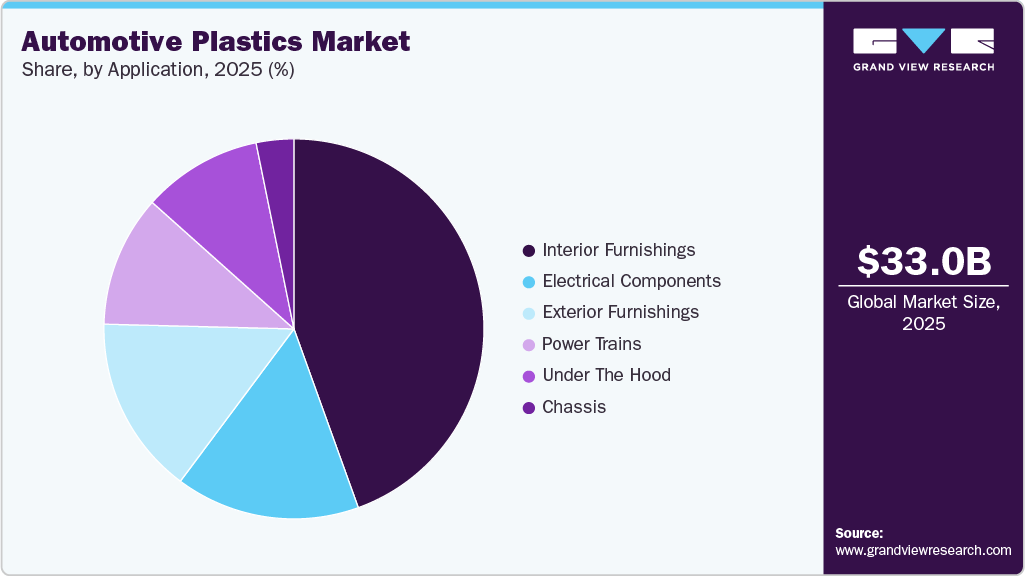

- By application, the interior furnishings segment led the market for automotive plastics and accounted for the largest revenue share of more than 44% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 33.02 Billion

- 2033 Projected Market Size: USD 54.82 Billion

- CAGR (2026-2033): 6.8%

- Asia Pacific: Largest market in 2025

Plastics are majorly used in automobile parts and components as they are easy to manufacture and offer improved designs, can be obtained from renewable raw materials. The automotive plastic market is a thriving sector that has experienced substantial growth.

Plastics have become integral to the design and production of vehicles, offering numerous benefits such as enhanced safety, weight reduction, improved fuel efficiency, and increased design flexibility. Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Polyurethane (PU),and Polyvinyl Chloride (PVC), are most commonly utilized materials for vehicle parts and component applications. Plastics undergo five different stages while recycling, including washing, identification, shredding, sorting, and classification, and extruding into a final component or product.

Drivers, Opportunities & Restraints

Manufacturers of lightweight automobiles are increasing the demand for automotive polymers. Stringent environmental and safety standards enforced by various governments have compelled car original equipment manufacturers (OEMs) to replace metal components with polymer components.These rules have compelled vehicles to use lighter materials, such as plastics. Advanced plastics materials increase fuel efficiency while retaining vehicle safety and performance.

The market is further expanding due to growing demand for electric vehicles. Electric vehicles are more efficient than traditional vehicles, lightweight, and run on renewable energy sources. Growing global demand for electric vehicles is expected to contribute to higher revenues in this market over the forecast period.

Increased environmental awareness, government subsidies and incentives, and OEM investments in EV industry. Volkswagen, BMW, Tesla Motors, Ford, General Motors, and Toyota are among the major automakers that have entered electric vehicle market. EVs are more efficient, self-sufficient, and superior to gas alternatives. As a result, growing demand for EVs presents an opportunity for automotive plastics market to expand.

A key restraint in the automotive plastics market is the growing concern over environmental sustainability and recycling challenges, as many plastics used in vehicles, such as polypropylene, polyurethane, and PVC, are difficult to recycle and contribute to waste management issues. Moreover, volatile raw material prices, particularly petrochemical feedstocks, increase production costs and reduce profitability.

Strict government regulations on emissions and plastic usage, combined with the rising demand for sustainable alternatives, are further limiting market growth. High initial investment costs for advanced lightweight plastic technologies and competition from metals and composites also act as barriers, slowing adoption despite the benefits of weight reduction and fuel efficiency.

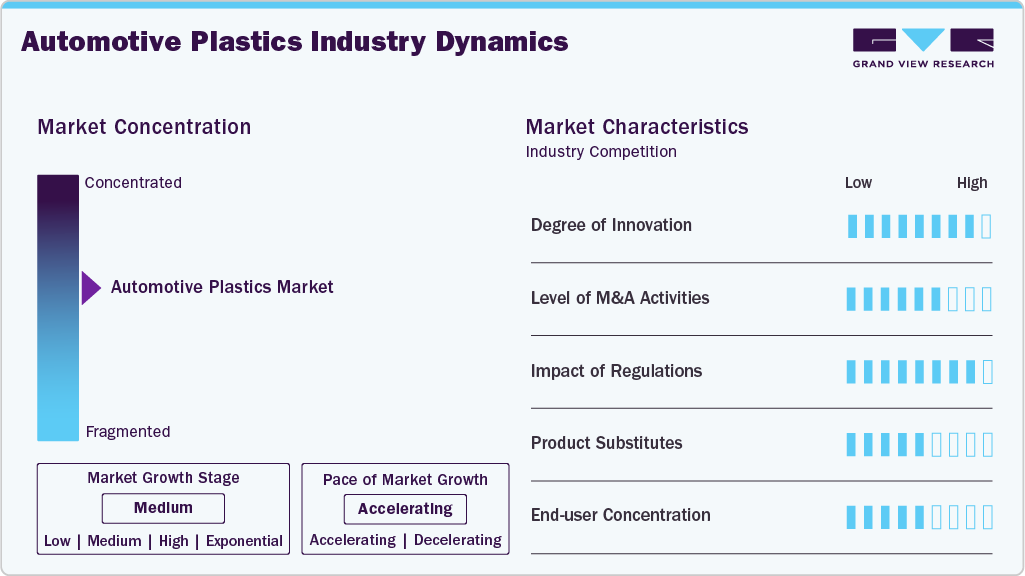

Market Concentration & Characteristics

The market growth stage of the automotive plastics market is medium, and the pace is accelerating. The market exhibits high degree of innovation as the automotive plastics sector is a hotbed of materials and process innovation driven by lightweighting, electrification and sustainability goals. Advances include high-performance engineering polymers, glass- and carbon-fiber reinforced thermoplastics, multi-material over molding, and functional films/coatings.

Level of M&A activities is moderate to high, as global tier-1 suppliers, chemical majors and specialty compounders seek scale, technology access and regional footprint. Strategic acquisitions often target capability gaps or are vertical plays to secure resin supply and circularity credentials. At the same time, private equity is investing in niche converters and clean-tech plastics firms, fueling consolidation among mid-size players and accelerating roll-out of new material platforms.

Impact of regulations is significant as vehicle CO₂ and fuel-efficiency standards, end-of-life vehicle (ELV) directives, and extended producer responsibility (EPR) regimes shape material choices and lifecycle requirements. Safety and fire-retardancy standards, chemical restrictions and recyclability mandates force OEMs and suppliers to redesign components and substitute problematic additives.

There is a moderate threat of substitutes, as metals remain direct substitutes for plastics in structural applications when stiffness or heat resistance is essential, while engineered composites compete for high-performance, lightweight components. For interiors and trim, bio-based polymers, natural-fiber composites and engineered foams can substitute conventional plastics where sustainability or tactile properties are important.

Product Insights

Polypropylene (PP) dominated the automotive plastics market, accounting for a revenue share of 32.36% in 2025. This growth can be attributed to rising product demand from end use industries such as packaging, electrical and electronics, construction, consumer products, and automotive.

Polypropylene finds application in both rigid and flexible packaging owing to its physical and chemical properties. Apart from this, it offers excellent chemical and electrical resistance at very high temperatures. PP is quite lightweight compared to other plastics making it suitable for application in automotive sector for reducing overall weight of vehicles, which, in turn, helps reduce fuel consumption and carbon dioxide emissions.

Polycarbonate (PC) is expected to grow the fastest CAGR of 7.5% over the forecast period, due to its high impact resistance, optical clarity, heat tolerance and lightweight properties. These characteristics make it ideal for replacing glass and metal in several high-performance applications. PCs are widely used in headlamp lenses, sunroof panels, interior light housing, instrument clusters, pillar trims and glazing components, where durability, dimensional stability and design flexibility are essential.

Polyvinyl chloride is used in a broad range of domestic and industrial products such as shower curtains, raincoats, window frames, and indoor plumbing. Its primary automotive uses include underbody coatings, floor modules, sealants, passenger compartment parts, wiring harnesses, and external parts.

Process Insights

The injection molding segment led the automotive plastics market and accounted for the largest revenue share of 56.05% in 2025. The high share is attributed to applications of broad range of injection-molded plastics in automotive industry to manufacture door handles, console and dashboard covers and brackets, engine hoses and tubes, radio covers and other electrical internal components. Furthermore, it is used for producing bezel panels, controls and covers for sunroof, knobs for shifter levers, and convertible roof assemblies.

Injection molding is one of the most common processes used in automotive industry to mold plastic. It is a process of creating customized plastic parts and fittings by injecting molten plastic material into a metal mold under high pressure. Modern innovations to minimize error rate have increased importance of injection molding technology in mass production of complicated plastic molds.

Moreover, blow molding process is also widely used in automotive industry owing to its advantage of making more complex products in various designs and shapes that would otherwise be challenging with other technologies with the cost of end product being significantly higher. This process allows companies to increase their production output in a relatively short period while maintaining flexibility in terms of design and materials.

The thermoforming process is projected to grow at the fastest CAGR of 7.4% from 2026 to 2033 in the automotive plastics market. This is due to its ability to produce large, lightweight, and complex parts with high efficiency and lower tooling costs compared to injection molding. In this process, plastic sheets, commonly ABS, PC/ABS blends, PMMA, and polypropylene, are heated until pliable and then shaped over molds using vacuum or pressure forming. Thermoforming is widely used for interior and exterior components such as door panels, dashboard skins, trunk liners, bumpers, wheel arch liners, and protective underbody panels.

Application Insights

Interior furnishings segment led the market for automotive plastics and accounted for the largest revenue share of more than 44% in 2025. Growing demand for automotive plastics in an area such as seat covers, body and light panels, seat bases, load floors, steering wheels, headliners, and rear package shelves and fascia systems is projected to boost market for automotive plastics.

The power train segment is expected to expand at a substantial CAGR of 7.6% during the forecast period. Automotive plastics are increasingly being adopted to replace traditional metals, helping manufacturers achieve weight reduction, improved fuel efficiency, and enhanced thermal performance. Plastics such as high-temperature polyamides, PEEK, PPS, and reinforced polypropylene are widely used for engine covers, air intake manifolds, turbocharger ducts, oil pans, thermostat housings, and transmission components. These materials offer excellent heat resistance, chemical stability, vibration dampening, and corrosion resistance-critical properties for components exposed to extreme temperatures and lubricants.

Regional Insights

Asia Pacific automotive plastics market remains the largest and fastest-growing market with a revenue share of 46.57% in 2025, driven by massive vehicle production, expanding EV manufacturing, and strong supply chain integration across China, Japan, South Korea, and India. The region benefits from abundant raw material availability, cost-effective manufacturing, and increasing adoption of lightweight materials to meet fuel-efficiency and emission norms.

Major OEMs and Tier-1 suppliers are rapidly incorporating engineering plastics into interiors, exteriors, and powertrain components, especially in EV platforms, where plastics support thermal management, battery safety, and weight reduction. Government incentives for EV adoption and local production-particularly in China and India-further reinforce the demand outlook.

China Automotive Plastics Market Trends

China dominates regional demand as it is one of the world’s largest automotive producer and a global hub for EV manufacturing. Automakers such as BYD, SAIC, and Geely are heavily integrating plastics into vehicle structures, interiors, and battery systems to increase efficiency and reduce costs. The country also hosts a strong domestic plastics processing industry, producing polypropylene, ABS, PC, and polyamides at competitive prices.

North America Automotive Plastics Market Trends

North America’s automotive plastics market is supported by a mature automotive industry, strong R&D capabilities, and rising EV investments from companies like Tesla, GM, and Ford. Regulatory pressures to improve fleet fuel efficiency, combined with consumer demand for premium interiors, lightweight components, and enhanced safety features, are key growth drivers.

U.S. Automotive Plastics Market Trends

The U.S. market is characterized by rapid innovation and high-value applications of automotive plastics, particularly in EVs and autonomous vehicles. Manufacturers increasingly rely on lightweight polymers to meet CAFE standards and support electrification goals. Plastics are extensively used for under-the-hood applications, battery housing, lightweight body panels, and interior features.

Europe Automotive Plastics Market Trends

Europe remains a key hub for advanced automotive plastics due to strict emissions regulations, high EV penetration, and strong sustainability commitments. OEMs like Volkswagen, BMW, Renault, and Stellantis are increasingly shifting toward lightweight, recyclable plastics to meet EU Green Deal targets. The region’s push toward circularity is further encouraging the adoption of bio-based plastics and closed-loop material systems.

Automotive plastics market Germany is witnessing growth due to the country’s dominance, known for its premium vehicle manufacturing base, which includes BMW, Mercedes-Benz, Audi, and Porsche. The country leads in technical innovations for EVs, lightweight chassis solutions, and high-precision plastic components for powertrain and ADAS systems. Germany’s stringent environmental regulations and strong focus on high-quality engineering encourage OEMs to adopt advanced polymers and composites to reduce vehicle weight and improve efficiency.

Latin America Automotive Plastics Market Trends

Latin America’s automotive plastics market is expected to gradually expand as countries like Brazil are strengthening local vehicle production and attracting investments from global automakers. Plastics are increasingly used to reduce costs, improve fuel efficiency, and modernize vehicle interiors. While economic fluctuations influence short-term demand, long-term growth is supported by rising adoption of compact cars, flexible manufacturing operations, and the shift toward more durable, lightweight polymer materials.

Middle East & Africa Automotive Plastics Market Trends

The Middle East & Africa market is driven by a combination of expanding automotive assembly operations, rising aftermarket demand, and increasing use of durable plastics in commercial and utility vehicles. Infrastructure development and regional manufacturing incentives, particularly in the UAE, South Africa, and Morocco, are attracting global component manufacturers. Demand is particularly strong for durable, heat-resistant plastics suitable for harsh climatic conditions.

Saudi Arabia automotive plastics market is growing due to government-led efforts to diversify the economy and build local automotive manufacturing under Vision 2030. Investments in EV infrastructure, partnerships with global automakers, and increasing interest in localized component production are boosting demand for advanced plastics in interiors, exteriors, and under-the-hood applications.

Key Automotive Plastics Market Company Insights

Global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers and regulations. Companies in market compete on the basis of product quality offered and technology used for production of automotive plastics. Major players, in particular, compete on the basis of application development capability and new technologies used for product formulation.

Key Automotive Plastics Companies:

The following are the leading companies in the automotive plastics market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- SABIC

- Dow Inc.

- AkzoNobel N.V.

- Covestro AG

- Evonik Industries AG

- Borealis AG

- Royal DSM N.V.

- Magna International, Inc.

- Teijin Limited

Recent Developments

-

In October, 2025, Mitsui Chemicals, Inc. and Polyplastics Co., Ltd. announced a partnership to streamline marketing operations for engineering plastics, specifically the ARLEN polyamide and AURUM thermoplastic polyimide brands. The collaboration leverages Polyplastics’ extensive customer network to meet rising demand in automotive applications and strengthen competitiveness in the high‑performance engineering plastics market.

-

In May 2025, Toyoda Gosei announced the development of a horizontal recycling technology for automotive plastics, enabling high‑quality recycled polypropylene from end‑of‑life vehicles (ELVs) to be reused in new car parts with performance equivalent to virgin material. This innovation, first applied in Toyota Camry interior parts such as glove boxes and plans to expand applications to more interior and exterior components as part of its 2030 Business Plan focused on decarbonization.

Automotive Plastics Market Report Scope

Report Attribute

Details

Market Size Value In 2026

USD 34.60 billion

Revenue Forecast In 2033

USD 54.82 billion

Growth rate

CAGR of 6.8% from 2026 to 2033

Historical Data

2021 - 2025

Forecast Period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, competitive landscape, growth factors, and trends

Market Report Segmentation

Product, process, application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key Companies Profiled

BASF SE; SABIC; Dow Inc.; AkzoNobel N.V.; Covestro AG; Evonik Industries AG; Borealis AG; Royal DSM N.V.; Magna International Inc.; Teijin Limited

Customization Scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Plastics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global automotive plastics market report based on product, process, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polypropylene (PP)

-

PP LGF 20

-

PP LGF 30

-

PP LGF 30Y

-

Others

-

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyethylene (PE)

-

Polycarbonate (PC)

-

Polymethyl Methacrylate (PMMA)

-

Polyamide (PA)

-

Others

-

-

Process Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Injection Molding

-

Blow Molding

-

Thermoforming

-

Other

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Power Trains

-

Electrical Components

-

Interior Furnishings

-

IMD or IML

-

Others

-

-

Exterior Furnishings

-

Under the Hood

-

Chassis

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive plastics market size was estimated at USD 33.02 billion in 2025 and is expected to reach USD 33.02 billion in 2025.

b. The global automotive plastics market is expected to grow at a compound annual growth rate of 6.8% from 2026 to 2033 to reach USD 54.82 billion by 2033.

b. The polypropylene segment led the global automotive plastics market and accounted for the largest revenue share of more than 32.36% in 2025 attributed to rising product demand from end-use industries such as packaging, electrical and electronics, construction, consumer products, and automotive

b. The injection molding segment led the global automotive plastics market and accounted for the largest revenue share of more than 56.05% in 2025.

b. The interior furnishings segment led the global automotive plastics market and accounted for the largest revenue share of more than 44% in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.