- Home

- »

- Next Generation Technologies

- »

-

Sports Devices Market Size, Share & Growth Report, 2030GVR Report cover

![Sports Devices Market Size, Share & Trends Report]()

Sports Devices Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Device (Wearables, Digital Signage, Camera), By Deployment, By Sport, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-138-0

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Sports Devices Market Size & Trends

The global sports devices market size was estimated at USD 3.34 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. The market growth is experiencing a rapid evolution driven by advancements in wearable technology, sports analytics, and smart stadiums. Athletes and fitness enthusiasts are increasingly relying on smart wearables such as fitness trackers, smartwatches, and sports-specific devices to monitor their performance, track biometrics, and receive real-time feedback, thereby expected to fuel the market growth over the forecast period.

The integration of augmented and virtual reality technologies is predominantly reshaping the sports devices industry, revolutionizing the way athletes train and compete. Athletes are now able to fully immerse themselves in virtual environments, allowing them to simulate game scenarios, rehearse strategies, and hone their skills like never before. Furthermore, augmented reality overlays real-time data seamlessly onto the athlete's field of vision, providing valuable insights and analytics during both training sessions and competitive events.

The market has witnessed a significant trend towards the integration of AI cameras in recent years. These advanced AI-powered cameras are revolutionizing the way athletes and coaches analyze and improve performance. Equipped with real-time object recognition, tracking, and analysis capabilities, AI cameras can automatically capture and analyze key moments in sports events, providing invaluable insights into player movements, tactics, and game dynamics. For instance, in March 2023, Baidu, Inc. partnered with Pixellot, to expand into the Chinese sports market. Pixellot's platform leverages AI to autonomously capture, produce, and stream sports games without the need for a camera operator. AI-enabled cameras are adept at tracking players and balls during sporting events. Pixellot will offer support for live game streaming technology, precise advertising placement, and the creation of automated highlights.

Moreover, the application of artificial intelligence (AI) and data analytics to improve athletes' performance is likely to drive market expansion. With the capability to process immense volumes of data, encompassing biometrics, motion data, and historical performance records, these technologies empower athletes with personalized training insights and strategic recommendations derived from their unique data profiles. This personalized approach fosters more informed decision-making and empowers athletes to unlock their full potential. As a result, the market is witnessing substantial growth, as more athletes and sports enthusiasts recognize the invaluable role of data analytics and AI in elevating their performance and achieving their athletic goals.

The COVID-19 pandemic had a profound impact on the market. Initially, the market experienced disruptions due to widespread event cancellations and lockdown measures, which led to decreased consumer spending on sports-related equipment and accessories. However, as people adapted to new fitness routines and training methods during lockdowns, there was a surge in demand for home fitness devices and wearables, including smart sports equipment, fitness trackers, and virtual training solutions. In addition, the pandemic emphasized the importance of health and wellness, driving increased interest in sports devices for personal fitness monitoring and remote coaching. As restrictions eased and sports events resumed, the market regained momentum, driven by a growing emphasis on sports technology and safety solutions for athletes. Overall, the COVID-19 pandemic accelerated the adoption of sports devices for both professional athletes and fitness enthusiasts, reshaping the industry's landscape.

Device Insights

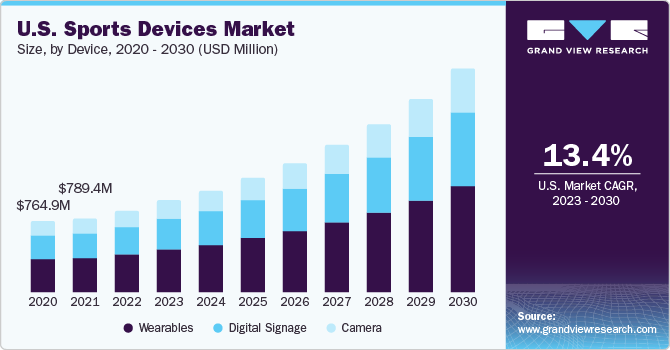

Based on device, the wearables segment is expected to witness the highest CAGR of over 14% during the forecast period. This robust growth is attributed to the increasing demand for fitness trackers, smartwatches, and sports-specific wearables as consumers and athletes alike embrace the benefits of real-time health and performance monitoring. Wearables offer a holistic approach to fitness and training, providing users with valuable data on biometrics, physical activity, and overall health, thereby driving their popularity. Moreover, the integration of advanced sensors, AI capabilities, and enhanced user experiences in wearables is expected to further propel the segment's growth.

The digital signage segment accounted for a significant market share of over 35% in 2022, owing to the increasing adoption of digital signage solutions in sports venues, stadiums, and arenas to enhance the fan experience and provide real-time information. Digital signage serves as a means to display scores, and statistics as well as deliver engaging content, advertisements, and promotional messages, creating a dynamic and immersive environment for spectators. Furthermore, the segment's growth is driven by advancements in display technology, such as high-resolution LED screens and interactive displays, which are transforming the way sports events are viewed.

Deployment Insights

Based on deployment, the on-premise segment accounted for the highest market share of over 61% in 2022 and is expected to maintain its dominance throughout the forecast period. This is attributed to the preference of sports organizations and venues for on-premise sports devices and systems, which provide localized control, reliability, and real-time data access. On-premises solutions are integral to ensuring the seamless operation of various sports technologies, such as scoreboard systems, ticketing solutions, and security systems within stadiums and arenas. In addition, the requirement for low-latency data processing and instant response times in live sports events reinforces the application of on-premises installations.

The cloud segment is expected to grow at a CAGR of over 14% from 2023 to 2030. Cloud technologies enable sports organizations, teams, and athletes to access data, analytics, and training resources remotely, enhancing collaboration and flexibility. Moreover, the cloud's capacity for data storage and processing is ideal for managing the vast volumes of performance data generated in the sports industry. As sports stakeholders increasingly embrace cloud-based solutions for athlete management, fan engagement, and data analytics, the cloud segment is expected to fuel the market growth over the forecast period.

Sport Insights

Based on sport, cricket is expected to grow at a CAGR of over 15% from 2023 to 2030. This surge is attributed to the increasing global popularity of cricket, particularly in emerging markets. As cricket continues to gain a substantial following, there is a growing demand for sports devices and technology tailored to the sport. These devices encompass a range of equipment such as smart cricket bats, wearable sensors for performance analysis, and advanced cricket training tools. In addition, the advent of cricket leagues and tournaments, combined with a focus on enhancing player performance and fan engagement, is driving investments in cricket-specific sports devices, thereby fueling the segment's growth over the forecast period.

The football sports segment accounted for the highest market share of approximately 24% in 2022. This growth is attributed to the enduring global popularity of football, which boasts an immense fan base and numerous professional leagues and tournaments. The segment's dominance reflects the consistent demand for sports devices and technology tailored specifically to football players and enthusiasts. These devices encompass a wide range of innovations, including player tracking systems, and wearable sensors designed to enhance performance, training, and fan engagement. As football continues to be a driving force in the sports world, investments in football-specific sports devices are expected to remain robust, solidifying its position as a key growth segment within the sports technology industry.

Component Insights

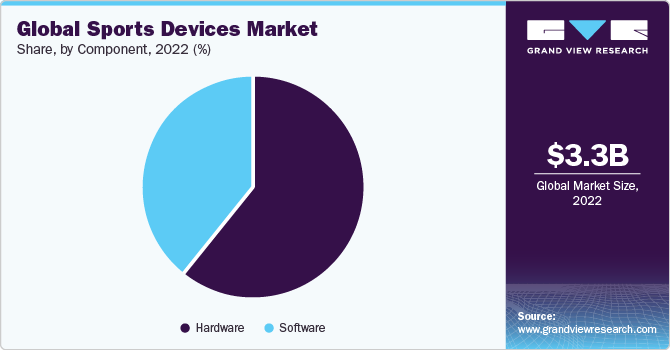

Based on component, the hardware segment accounted for the highest market share of over 61% in 2022, owing to the demand for physical sports devices and equipment, including wearables, sensors, sports-specific gadgets, and smart sports equipment. Athletes, sports teams, and fitness enthusiasts increasingly rely on these hardware components to track performance metrics, enhance training regimens, and optimize their competitive edge. Furthermore, advancements in sensor technology, durability, and accuracy have bolstered the appeal of hardware devices, contributing to their strong market presence.

The software segment is expected to grow at the highest CAGR of over 14% during the forecast period. This surge is attributed to the increasing reliance on sports-specific software applications and platforms that are empowering athletes and sports enthusiasts with advanced analytics, training regimens, and performance optimization tools. Sports software is evolving rapidly in real-time data analysis. Moreover, the integration of artificial intelligence and machine learning capabilities within sports software is expected to further accelerate its adoption, making it a necessary part of the sports device’s ecosystem. As athletes and teams recognize the value of data-driven insights, the software segment is set to play a pivotal role in shaping the future of sports technology.

Regional Insights

The sports devices industry in the Middle East & Africa region is expected to witness the highest CAGR of 15.1% during the forecast period. This surge is attributed to several factors, including increasing investment in sports infrastructure, the rise of sports tourism, and growing interest in various sports, both traditional and modern, in the region. Governments and private entities are investing heavily in sports facilities and events, attracting international competitions and athletes. In addition, the rise of sports leagues and academies is fueling demand for sports devices and technology, ranging from performance analytics to fan engagement tools.

Europe accounted for the highest market share of over 29% in 2022, owing to the robust sports culture, deep-rooted tradition in various sports, and significant investments in sports infrastructure and technology. European countries host a plethora of prominent sports leagues, events, and championships, fostering a strong demand for cutting-edge sports devices and technology among athletes and fans alike. In addition, Europe's commitment to promoting physical fitness and well-being has driven investments in sports-related innovations, including wearables, smart sports equipment, and fan engagement solutions.

Key Companies & Market Share Insights

The market players are adopting various strategic initiatives, such as product launches, collaboration, and partnerships, to sustain their position in the market. In addition, they are focused on providing comfort, upgrading their product, and taking significant steps to launch their products in new markets. For instance, in March 2023, Masimo Corp., a medical technology company introduced its latest innovation in the wearable technology sector: the Masimo Freedom smartwatch. This cutting-edge smartwatch is designed to transform the wearable technology landscape, offering users the autonomy to manage their personal health and safeguard their privacy effectively. It achieves this by delivering precise and uninterrupted health monitoring, coupled with an innovative hardware feature specifically engineered to minimize radiation exposure and protect user privacy. Such strategies by key players are expected to fuel market growth over the forecast period. Some prominent players in the global sports devices market include:

-

Adidas AG

-

Apple, Inc.

-

Catapult Sports Pty Ltd.

-

Fitbit Inc.

-

Garmin Ltd.

-

Google LLC

-

Huawei Technologies Co., Ltd.

-

Panasonic Corporation

-

Samsung Electronics, Inc.

-

ShotTracker Inc.

-

Sony Corporation

-

STATS LLC

-

Stretch Sense Limited

-

Under Armour, Inc.

-

Xiaomi Corporation

Sports Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.65 billion

Revenue forecast in 2030

USD 8.91 billion

Growth rate

CAGR of 13.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, device, deployment, sport, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Mexico; South Africa; UAE; Saudi Arabia

Key companies profiled

Apple, Inc.; Sony Corporation; Fitbit Inc.; Garmin Ltd.; Catapult Sports Pty Ltd.; Under Armour, Inc.; Google LLC; Samsung Electronics, Inc.; Xiaomi Corporation; Huawei Technologies Co., Ltd.; Adidas AG; ShotTracker Inc.; STATS LLC; Panasonic Corporation; Stretch Sense Limited

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Sports Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports devices market report based on component, device, deployment, sport, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearables

-

Digital Signage

-

Camera

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Sport Outlook (Revenue, USD Million, 2018 - 2030)

-

Football

-

Cricket

-

Baseball

-

Basketball

-

Rugby

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global sports devices market is expected to grow at a compound annual growth rate of 13.6% from 2023 to 2030 to reach USD 8.91 billion by 2030.

b. Europe accounted for the highest market share of over 29% in 2022, owing to the robust sports culture, deep-rooted tradition in various sports, and significant investments in sports infrastructure and technology.

b. Some key players operating in the sports devices market include Apple, Inc., Sony Corporation, Fitbit Inc., Garmin Ltd., Catapult Sports Pty Ltd., Under Armour, Inc., Google LLC, Samsung Electronics, Inc., Xiaomi Corporation, Huawei Technologies Co., Ltd., Adidas AG, ShotTracker Inc., STATS LLC, Panasonic Corporation, Stretch Sense Limited.

b. Key factors that are driving the sports devices market growth include advancements in wearable technology, integration of augmented and virtual reality technologies, and the application of artificial intelligence (AI) and data analytics to improve athletes' performance is likely to drive the market expansion.

b. The global sports devices market size was estimated at USD 3.34 billion in 2022 and is expected to reach USD 3.65 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."