- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Ocean Plastics Market Size & Share Report, 2030GVR Report cover

![Recycled Ocean Plastics Market Size, Share & Trends Report]()

Recycled Ocean Plastics Market Size, Share & Trends Analysis Report By Product (HDPE, LDPE, PP, PET, PS, PVC, Others), By Dimension (Microplastics, Mesoplastics), By Source, By Application, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-973-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Recycled Ocean Plastics Market Trends

The global recycled ocean plastics market size was estimated at USD 1,754.19 million in 2023 and is expected to grow at a CAGR of 7.7% from 2024 to 2030. Increasing plastic consumption for the production of lightweight components, which are used in automotive, apparel, footwear, and various other industries, is expected to propel the growth of the recycled ocean plastics market over the forecast period. Moreover, increasing concerns regarding plastic pollution, harmful emissions associated with the use of petrochemicals, and depleting crude oil reserves have been driving the demand for recycled ocean plastics.

The global recycled ocean plastics market is expected to witness growth in the coming years owing to the surging demand for ocean-based recycled plastics from various end-use industries, including textiles, footwear, and others. The apparel industry is flourishing in countries such as China, the U.S., Japan, and France owing to growing demand for environment-friendly and ethically produced clothing.

The global production of recycled plastic materials is mainly from Asia Pacific & Southeast Asia, North America, and Europe. The increasing usage of recycled plastics in many industries such as textiles, automotive, packaging, electrical & electronics, and building & construction is anticipated to increase the demand for recycled plastics across the globe.

According to United Nations Environment Programme (UNEP) research, plastic accounts for 85% of all marine trash. By 2040, 23-37 million metric Kilotons of garbage will be introduced to the ocean each year, tripling the quantity of plastic waste in the oceans. As a result, all marine species, from plankton and shellfish to birds, turtles, and mammals, is at risk of toxicity, asphyxia, behavioral disruption, and hunger.

With rising concerns over the use of plastics, an increase in demand for alternatives to conventional plastics has been observed in the market. With the pace of innovation and new product development, manufacturers in the market are shifting their focus toward the use of recycled plastics as these reduce the carbon footprint associated with the manufacturing process. Companies are continuously developing product lines using recycled materials to address the concerns regarding the toxic effects of plastic waste. A large number of small- and medium-scale businesses have committed to using recycled or sustainably sourced materials by a specific time frame.

Market Concentration & Characteristics

The market is moderately fragmented, with key participants involved in R&D and technological innovations. Notable companies include Ocean Plastic Technologies, United By Blue, Patagonia, Inc., 4Ocean, Textil Santanderina, and SEAQUAL INITIATIVE among others. Several players are engaged in framework development to improve their market share.

Recycled Ocean Plastics market is characterized by moderate level of product substitutes. Even though recycled plastics are gaining popularity all over the world, the growth of recycled plastics is not free from hindrances. The main restraint of the market is the higher cost of recycled plastics to the end user as compared to that of conventional plastics. Production of recycled plastics requires machinery & equipment and most importantly plastic waste collection services, which act as a fixed cost and cannot be altered in the most optimistic situation. On the other hand, the cost associated with conventional plastic resin production depends largely on global crude oil prices.

However, the recycled ocean plastics market is moderately innovative. The key market players are increasingly developing innovative solutions to consolidate their position while being highly competitive. For instance, in January 2024, The World Bank launched a USD 100 million Plastic Waste Reduction-Linked Bond to support projects that collect and recycle plastic waste in Ghana and Indonesia. The bond is structured as an outcome-based investment, where investors receive a financial return linked to the generation of plastic credits and carbon credits from the projects.

Product Insights

Polyethylene Terephthalate (PET) held the largest share of 36.8% in 2023. Recycled ocean PET is estimated to witness significant growth over the forecast period owing to ease of collection in the form of PET bottles. This resin is relatively cheaper, which further aids the growth of PET in Asia Pacific recycled plastics market. Recycled ocean polyethylene terephthalate is widely utilized in automotive, packaging, food & beverage, and consumer goods industries for manufacturing fibers, films & sheets, food & beverage containers, mattresses, car seating, cushions, carpets, fleece jackets, comforter fill, and various others.

Polystyrene (PS) segment is anticipated to witness fastest growth over the forecast period. Polystyrene is used in the packaging, electrical & electronics, and construction industries. It is resistant to photolysis and, hence, is non-degradable. In addition, virgin polystyrene production contributes to global warming way more than carbon dioxide emissions that makes it essential for recycling. The global demand for recycled ocean polystyrene is expected to witness steady growth during the forecast period owing to the high collection cost of expanded polystyrene.

Dimension Insights

Macroplastics (5 - 50 cm) held the largest share of 48.0% in 2023 and is characterized by the inherent properties of the material. Macroplastics consist of a wide variety of plastics, from small plastic fragments to large objects such as shipwrecks and trawl bags. They are commonly found in rivers, oceans, and freshwater environments wherein they pose a serious threat to wildlife and ecosystems.

Mesoplastics (0.5 - 5 cm) segment is anticipated to witness substantial growth over the forecast period. Mesoplastics are plastic debris with a size ranging from 0.5-5 cm. It is found in various ecosystems, including wetlands, coral reefs, and mangroves. The market for recycled ocean plastics, including microplastics and macroplastics, is growing worldwide due to increased environmental concerns, government regulations, technological advancements, and consumer awareness.

Source Insights

Plastic bottle held the largest share of 44.4% in 2023 and is characterized by the inherent properties of the material. The segment is expected to witness the fastest growth rate over the forecast period. Plastic bottles are the major source of recycled ocean plastics as they find various applications across industries for packaging strong medicines, agrochemicals, homecare products, pharmaceuticals, personal care products, fruit drinks, edible & non-edible oils, water, and carbonated drinks, among others.

Fishing Line segment is anticipated to witness fastest growth over the forecast period. The ever-growing global population has led to increased demand for nutrient-dense foods such as protein. The fishing industry is mainly driven by the growing demand for seafood products around the world. With the growing population and changing diets, the need for fish as a protein and an important source of nutrition is increasing. This is expected to boost the consumption of fishing lines, resulting in a rise in fishing line waste in oceans.

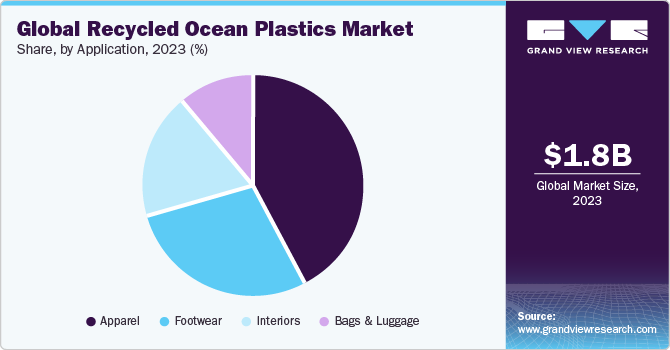

Application Insights

In terms of revenue, apparel emerged as the largest application segment with a market share of over 42% in 2023, and this trend is projected to continue over the forecast period. Recycled PET resins are widely used for textile production. Recycled PET bottles are converted into eco-friendly fabrics, which are then combined with natural fibers to be woven or knitted into 100% eco-friendly fabrics suitable for garments.

Footwear application is expected to grow at a significant rate in the coming years. The growing population and number of environmentally conscious consumers in the region have boosted the sales of eco-friendly footwear, which has contributed to the growth of the recycled ocean plastics market. Recycled ocean plastics, such as PET, PVC, and PU, are widely used in several footwear applications including soles, straps, and elastic components.

Moreover, recycled ocean plastics are used in several interior applications in automotive, construction, and consumer electronics. Recycled polyethylene terephthalate, polypropylene, polystyrene, and polyethylene are widely used in the production of automotive interior parts such as under-the-hood components, powertrains, electrical components, interior furnishings, and others. This is owing to their low cost, reduced carbon emissions, lightweight, corrosion resistance, design flexibility, and durability.

Region Insights

The North America PEEK market is projected to witness strong growth over the coming years. North America is one of the major consumers of plastics owing to the high demand from automotive, electrical & electronics, packaging, and construction sectors, which leads to a large amount of plastic waste generation. Recycled ocean plastics find application in various industries as they are easy to mold and can produce desired shapes while reducing the carbon emission from virgin plastic production and plastic waste recycling.

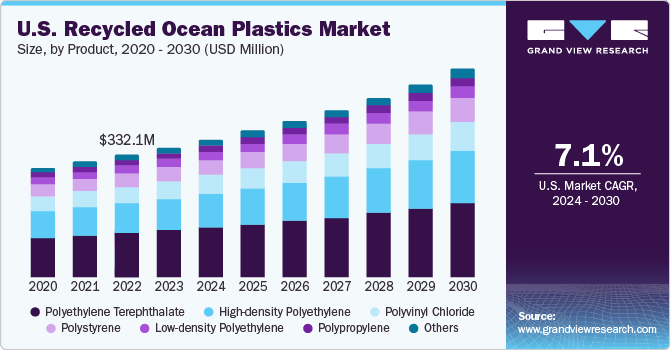

U.S. Recycled Ocean Plastics Market Trends

The U.S. TPV Market held the largest share in the region in 2023. Various cities in the U.S., such as Seattle, Phoenix, and Austin, have plastic recycling incentives where residents are charged for landfill waste streams and not the cost of recycling waste streams. Cities such as Charlotte, Houston, and Chicago are the least-performing cities in terms of plastic recycling. The U.S. Food and Drug Administration has approved the use of recycled plastics, including ocean plastics, such as polyethylene terephthalate, polystyrene, polyvinyl chloride, and polyolefin in food packaging solutions.

Asia Pacific Recycled Ocean Plastics Market Trends

Asia Pacific dominated the recycled ocean plastics market and accounted for more than 44.8% share of the global revenue in 2023. Asia Pacific is witnessing increased soft beverage consumption owing to growing population and rising disposable income. This further drives the growth of recycled ocean plastics market in the region as there is an increased waste generation in form of plastic bottles.

Recycled ocean plastics market in China led the market in 2023. China accounts for a significant portion of oceanic plastic pollution. Yangtze River of the country, which is the third-longest river in the world, has a significant number of inhabitants living nearby who dispose of their plastic waste in it. This makes the river one of the most prominent ocean polluters in the world. These circumstances also promote the requirement for an improved solution to recycle waste. Moreover, the large population and increased demand for plastics in the country are expected to contribute to the growth of recycled ocean plastics market in China over the forecast period.

India recycled ocean plastics market is projected to witness a substantial growth over the forecast period. The Government of India has proactively taken measures to mitigate the negative impact of plastic pollution through the launch of the Swachh Bharat Abhiyan campaign, ban on single-use plastic items such as plates, cups, straws, and bags, and promotion of the circular economy approach related to plastics. These factors are expected to boost the consumption of recycled ocean plastics.

Europe Recycled Ocean Plastics Market Trends

Europe has the highest plastic recycling rate owing to the adoption of the circular economy by the European Commission for reducing plastic waste. In Europe, recycled ocean plastics are used to promote sustainability and reduce environmental impact. Plastic Europe is working closely with the European Union to introduce 10 million Kilotons of recycled plastics in Europe and further increase the recycling rate by 2025.

Recycled ocean plastics market in Germany dominated the region in 2023. Germany uses recycled plastics, such as polyethylene terephthalate (PET) and polystyrene (PS), in the manufacturing of benches for public spaces and food-grade plastic bottles for beverages. This rise in recycling is expected to lead to better environmental sustainability in the country.

UK recycled ocean plastics market is poised to grow at a significant CAGR through the forecast period. The fishery is a significant industry in the UK, and its landing was worth USD 76.6 million in June 2023. It is one of the leading causes of plastic pollution in the ocean. Fishing operations, such as using nets, traps, and other fishing gear, often result in the loss or abandonment of plastic materials. This rising ocean pollution and its ill effects are expected to drive the recycled ocean plastics market.

Central & South America Recycled Ocean Plastics Market Trends

Central & South America recycled ocean plastics market is progressing at a significant growth rate. Central & South America includes countries such as Brazil, Argentina, Peru, Chile, Venezuela, Ecuador, and a few others. Increasing demand for footwear in the region and surging environmental concerns among consumers have led manufacturers to utilize recycled ocean plastics to develop sustainable solutions.

Middle East & Africa Recycled Ocean Plastics Market Trends

The market for recycled ocean plastics in MEA has rebounded in recent years. Startups are introducing creative recycling solutions to minimize ocean plastics while being profitable. Ocean Sole, a Kenya-based company, is creatively upcycling discarded flip flops, often made of plastics or rubber that pollute oceans and landfills.

Key Recycled Ocean Plastics Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, LyondellBasell Industries Holdings B.V. announced an innovative collaboration to transform end-of-life maritime waste into innovative recycled plastics. The partnership involves a prominent German automaker and a recycling company with expertise in mechanically recycling plastic waste. LyondellBasell developed a new recycled plastic grade called CirculenRecover PPC TRC 2179N, which can be used for injection molding. This new recycled plastic is made by collecting and sorting end-of-life fishing nets, processing them into a high-quality plastic recyclate, and then compounding it with virgin materials by LyondellBasell. The injection-molded parts made from this recycled plastic are expected to be used as trim pieces in the interiors of various car models, allowing automakers to increase the use of post-consumer plastic waste and improve the sustainability of their products.

Key Recycled Ocean Plastics Companies:

The following are the leading companies in the recycled ocean plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Ocean Plastic Technologies

- United By Blue

- Patagonia, Inc.

- 4Ocean

- Textil Santanderina

- SEAQUAL INITIATIVE

- Waterhaul

- BIONIC

- Bureo

- Aquafil S.p.A.

- Tide Ocean S.A.

- Plastix

- POPSICASE

- Parley

Recycled Ocean Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,869.96 million

Revenue forecast in 2030

USD 2,913.25 million

Growth rate

CAGR of 7.7% from 2024 to 2030

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, dimension, source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Japan; China; India; Indonesia; Vietnam

Key companies profiled

Ocean Plastic Technologies, United By Blue, Patagonia, Inc., 4Ocean, Textil Santanderina, SEAQUAL INITIATIVE, Waterhaul, BIONIC, Bureo, Aquafil S.p.A., Tide Ocean S.A., Plastix, POPSICASE, Parley

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Ocean Plastics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global recycled ocean plastics market report based on product, dimension, source, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

High-density Polyethylene (HDPE)

-

Low-density Polyethylene (LDPE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Polystyrene (PS)

-

Polyvinyl Chloride (PVC)

-

Others

-

-

Dimension Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Microplastics (0.05 - 0.5 cm)

-

Mesoplastics (0.5 - 5 cm)

-

Macroplastics (5 - 50 cm)

-

Megaplastics (Above 50 cm)

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Plastic Bottle

-

Plastics Bags

-

Fishing Line

-

Straws & Stirrers

-

Plastic Beverage Holder (six rings)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Apparel

-

Footwear

-

Interiors

-

Bags & Luggage

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

Denmark

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Key factors driving the recycled ocean plastics market growth include growing demand for recycled ocean products such as sunglasses and shoes and increasing investment in the recycling of plastics across developed economies.

b. The global recycled ocean plastics market size was estimated at USD 1,754.19 million in 2023 and is expected to reach USD 1,869.96 million in 2024.

b. The global recycled ocean plastics market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 2,913.25 million by 2030.

b. The Asia Pacific dominated the recycled ocean plastics market with a share of 44.8% in 2023. The increasing government spending on the recycling of plastics has been one of the major trends impacting the market in North America.

b. Some of the key players operating in the recycled ocean plastics market include Ocean Plastic Technologies, The Ocean Cleanup, Oceanworks, OCEANPLASTIK SRO, Textil Santanderina, Seaqual Initiative, and Waterhaul.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."