- Home

- »

- Homecare & Decor

- »

-

Connected Gym Equipment Market, Industry Report, 2033GVR Report cover

![Connected Gym Equipment Market Size, Share & Trends Report]()

Connected Gym Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cardiovascular Training Equipment, Strength Training Equipment), By Application (Business-to-Consumer, Business-to-Business), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-482-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Gym Equipment Market Summary

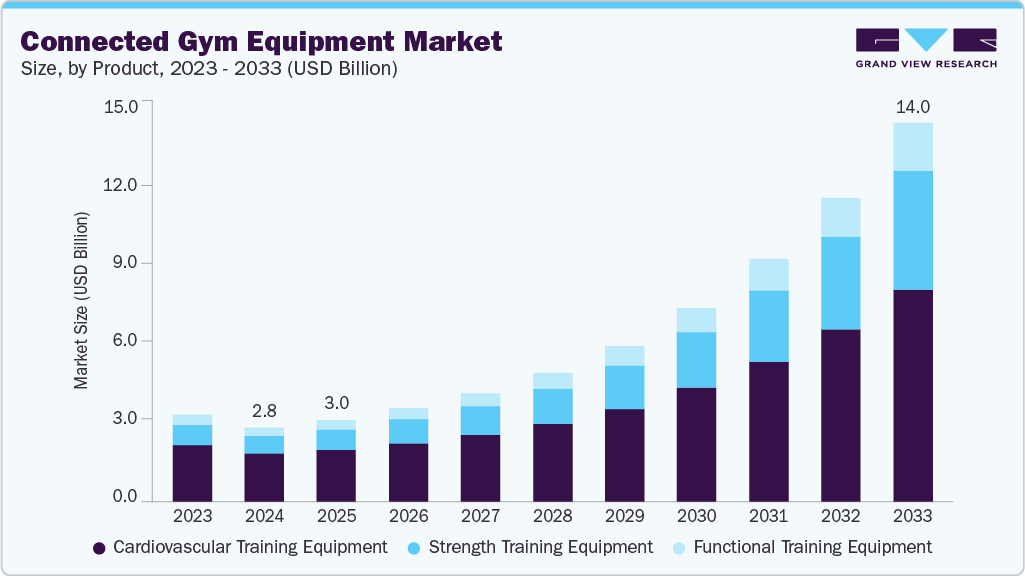

The global connected gym equipment market size was estimated at USD 2,754.7 million in 2024 and is projected to reach USD 14,027.3 million by 2033, growing at a CAGR of 21.1% from 2025 to 2033. The industry is driven by rising health consciousness, accelerated home-fitness adoption post-pandemic, and advancements in technology, particularly AI/ML, IoT, and integration with wearables.

Key Market Trends & Insights

- North America connected gym equipment market held the major share of 51.03% in 2024.

- The connected gym equipment market in the U.S. has witnessed significant growth, driven by increasing consumer interest in health and wellness, alongside advancements in technology.

- Based on product, the cardiovascular training equipment segment held the highest market share of 64.08% in 2024.

- Based on application, the business-to-consumer (B2C) segment held the highest market share in of 76.74% 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,754.7 Million

- 2033 Projected Market Size: USD 14,027.3 Million

- CAGR (2025-2033): 21.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These innovations enable personalized, data-driven workout experiences and interactive features such as virtual and augmented reality. Subscription-based platforms, gamified workouts, and integration with corporate wellness programs enhance user engagement and retention. Rapid urbanization and increasing disposable incomes, especially in emerging markets, are fueling demand. However, barriers such as high equipment costs, data privacy concerns, and limited internet infrastructure continue to challenge widespread adoption

The growth is driven by increasing consumer demand for convenient, personalized, and engaging workout experiences. Integration of AI, IoT, and real-time tracking technologies enables users to monitor performance metrics, receive virtual coaching, and follow adaptive training programs from home or on the go. Rising health awareness, fast-paced lifestyles, and the growing popularity of hybrid fitness models are accelerating adoption. Smart cardio equipment is becoming the preferred choice across residential and commercial settings, offering scalable, interactive solutions that align with modern fitness expectations.

A key trend in this market is the rise of hyper-personalization, where fitness content and routines are tailored to individual needs using advanced analytics and biometric tracking. The convergence of fitness with entertainment, such as gamified workouts and virtual reality experiences, is making fitness more immersive and motivating.

Additionally, increasing integration with wearable devices and mobile apps is creating a seamless fitness ecosystem, allowing users to track not only physical activity but also sleep, nutrition, and stress levels. Strength training-focused connected equipment is gaining popularity alongside traditional cardio machines, reflecting evolving consumer preferences. Moreover, the adoption of connected fitness solutions is expanding beyond individual users to include corporate wellness programs, hospitality sectors, and educational institutions.

As more people embraced digital solutions for their fitness needs, the demand for connected gym equipment, which integrates with smartphones and wearable devices, has significantly surged. This trend was particularly evident in regions with high smartphone penetration and internet connectivity, such as North America, Europe, and parts of Asia. Furthermore, the heightened awareness about the importance of maintaining good health has led to an increased focus on fitness and wellness.

This shift in mindset prompted more individuals to invest in home fitness equipment that could offer personalized workout experiences. Connected fitness equipment, with its ability to provide real-time feedback and track progress, has become a popular choice for fitness enthusiasts looking to achieve their health goals from the comfort of their homes.

In addition, the integration of advanced technologies into gym equipment played a significant role in driving market growth. Innovations such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) enabled the development of smart fitness equipment that could offer tailored workout programs, monitor performance, and provide insights into users’ fitness levels. For instance, AI-powered fitness equipment analyzes users’ movements and suggests adjustments to improve their form and prevent injuries.

Moreover, the increasing popularity of virtual fitness classes and online training programs contributed to the growth of the connected gym equipment market. Many fitness brands, such as CorePower Yoga and Peloton, and gyms started offering virtual classes that could be accessed through connected devices, allowing users to participate in live or on-demand workouts from anywhere.

Additionally, the growing adoption of wearable fitness technology fueled the demand for connected gym equipment. Devices such as smartwatches and fitness trackers have increasingly become essential tools for monitoring various health metrics, including heart rate, calories burned, and sleep patterns. When paired with connected gym equipment, these wearables provide a comprehensive view of users’ fitness journeys, enabling them to make data-driven decisions about their workouts and overall health. Such synergy between wearables and gym equipment created a more cohesive and engaging fitness ecosystem.

Consumer Surveys & Insights

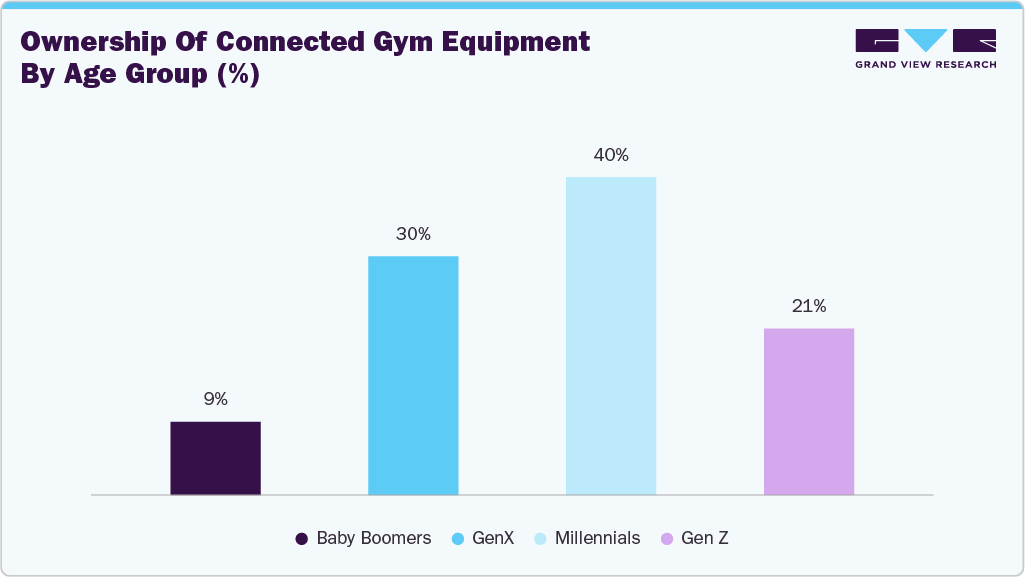

The industry demonstrates diverse age-based adoption patterns, reflecting varying health goals, digital affinity, and purchasing power across demographic cohorts. Millennials (aged 25-40 years) and Generation X (aged 41-56 years) constitute the largest consumer segments within this market. Millennials exhibit high adoption driven by their familiarity with digital technologies, prioritization of fitness and wellness as integral lifestyle components, and strong preference for personalized, data-driven workout experiences.

Generation X, meanwhile, represents a significant revenue-contributing segment, characterized by higher disposable incomes and a pronounced focus on preventive health management and convenience-driven fitness solutions. Their purchasing decisions are influenced by value propositions around holistic health monitoring, injury prevention, and flexible hybrid fitness options that integrate home workouts with gym-based programs.

The chart presents ownership of connected gym equipment across different age groups, revealing distinct generational preferences and behaviors. Millennials show the highest ownership, indicating their strong inclination toward integrating technology with wellness. This can be attributed to their higher purchasing power than younger individuals and a lifestyle prioritizing fitness and convenience.

Gen X follows closely, reflecting a balance between disposable income and growing health consciousness as they age. While they may not adopt new tech as quickly as Millennials, they value connected fitness devices' practicality and efficiency, especially for home workouts and personalized routines. Gen Z shows lower ownership levels. This could stem from limited financial resources or a preference for more social or app-based fitness solutions rather than investing in physical equipment. Baby Boomers have the lowest ownership, likely due to less familiarity with newer technologies, a lower perceived need for advanced fitness tracking, or a preference for traditional fitness methods. This generational divide highlights how income, lifestyle, tech comfort, and health priorities influence the adoption of connected fitness solutions.

Product Insights

Based on product, the cardiovascular training equipment segment led the market with the largest revenue share of 64.08% in 2024. Market growth was stimulated by the increasing awareness of cardiovascular health and the rising prevalence of lifestyle-related diseases such as obesity and heart disease. Consumers have increasingly sought to improve their heart health and overall fitness, leading to a surge in demand for connected cardiovascular training equipment, such as treadmills, stationary bikes, and elliptical machines. In addition, technological advancements, including AI and IoT, enabled the development of smart cardio machines that could offer personalized workout programs, real-time feedback, and performance tracking. For instance, AI-powered treadmills adjust speed and incline based on the user’s fitness level and goals, providing a more tailored and effective workout experience.

The strength training equipment category is expected to grow at a considerable CAGR during the forecast period due to the increasing popularity of weightlifting and muscle mass development. The market witnessed a significant demand for connected strength training equipment, such as smart dumbbells, barbells, and weight machines, with more individuals focusing on building strength and improving their physical fitness. These devices offer users precise and immediate feedback on their performance, allowing them to track their progress and make data-driven adjustments to their workouts. Additionally, the integration of connected strength training equipment with fitness apps and wearable devices significantly attracted users as they can sync their workouts with apps to receive real-time feedback, set goals, and track their progress over time.

Application Insights

Based on application, the business-to-consumer (B2C) segment led the market with a revenue share of 76.74% in 2024. the business-to-consumer (B2C) segment refers to smart exercise machines, fitness trackers, and platforms that provide personalized workouts, real-time feedback, and progress tracking. These devices are designed for personal use and offer digital integration and advanced connectivity features. This market is witnessing strong growth, driven largely by the rising consumer preference for exercising at home. A 2023 survey conducted by Gymless.org on 176,000 fitness enthusiasts discovered that 37.9% of respondents prefer working out at home.

The business-to-business (B2B) segment is projected to grow at a CAGR of 24.5% over the forecast period from 2025 to 2033. Connected fitness equipment for business-to-business (B2B) refers to the sale and integration of digitally enabled workout machines, such as smart treadmills, bikes, rowers, and strength systems, directly to commercial clients like gyms, fitness centers, hotels, corporate wellness programs, senior living facilities, and rehabilitation clinics. According to the survey conducted by Gymless.org, in 2023, among 176,000 fitness enthusiasts, 47.4% of respondents preferred working out at the gym.

The rising public awareness of the importance of regular physical activity and holistic wellness has fueled demand for gym memberships and prompted clubs to diversify their offerings by leveraging these technological advancements and aligning with broader health and wellness trends. According to the survey, the number of fitness clubs in the U.S. has grown consistently to meet a diverse population's varied fitness preferences and needs. In 2024, there are roughly 41,000 fitness clubs nationwide, highlighting a rising trend toward specialized and niche fitness experiences.

Regional Insights

North America connected gym equipment market held the major share of 51.03% in 2024. Connected gym equipment market in North Americais fueled by the growing health awareness, increasing prevalence of lifestyle-related diseases, and a strong shift toward home-based and hybrid fitness models. The widespread adoption of smart devices, wearables, and AI-powered fitness platforms enables personalized workouts and real-time tracking, enhancing user engagement. Younger demographics like Gen Z and millennials are driving demand with higher spending on wellness, while corporate wellness programs and insurance partnerships are expanding the market further. The integration of sustainability and data-driven coaching also fuels continued growth and innovation.

According to the survey, more than 80% of U.S. consumers now view wellness as a priority in their daily lives. The mindset around fitness is evolving, from an intense, performance-driven approach to one that emphasizes mindfulness and overall well-being. Virtual fitness participation in Canada has seen a dramatic rise, with around 4.5 million Canadians now regularly engaging with digital fitness platforms, a 300% jump compared to pre-2020 figures. Research shows that 65% of fitness enthusiasts in Canada intend to continue with a hybrid model, blending virtual and in-person workouts. Additionally, corporate wellness is becoming a key growth driver, as 72% of Canadian employers now provide digital wellness benefits as part of their employee health initiatives.

U.S. Connected Gym Equipment Market Trends

The connected gym equipment market in the U.S. has witnessed significant growth, driven by increasing consumer interest in health and wellness, alongside advancements in technology. The market is characterized by a surge in demand for smart fitness devices that integrate with digital platforms, providing users with a personalized workout experience and real-time feedback. These devices, which range from smart bikes and treadmills to rowing machines and strength training equipment, are often paired with subscription-based fitness apps that offer virtual classes, workout tracking, and progress monitoring.

Key drivers of this market include rising health consciousness, convenience, and the shift towards home-based fitness solutions, particularly accelerated by the COVID-19 pandemic. Additionally, the growing integration of Artificial Intelligence (AI) and machine learning (ML) in fitness equipment has enhanced the ability to deliver more tailored workout plans and improve user engagement. Despite strong growth, challenges persist, including the high upfront costs of connected gym equipment and the need for continuous innovation to retain customer loyalty in a competitive market. The future of the U.S. connected gym equipment market is expected to be influenced by further technological advancements, the expansion of fitness ecosystems, and increasing consumer adoption of digital health solutions, leading to sustained market expansion.

Asia Pacific Connected Gym Equipment Market Trends

The connected gym equipment market in Asia Pacific is experiencing robust growth, driven by rising health consciousness, urbanization, and increasing penetration of smart technologies. The region is witnessing a surge in demand for home-based fitness solutions, largely accelerated by the COVID-19 pandemic, which shifted consumer behavior toward digital health and wellness alternatives. With an expanding middle class and growing internet access, countries in the Asia Pacific are embracing connected fitness as both a lifestyle upgrade and a health necessity. The market is also supported by increased investments in fitness startups, digital infrastructure, and health-tech innovations.

In China, connected fitness has become a booming industry. Brands like Keep and Xiaomi have gained significant traction with affordable smart fitness equipment and app-based platforms offering AI coaching and virtual classes. For instance, according to the General Admission of Sport of China, Keep (fitness app), saw a remarkable increase in revenue during the first quarter of 2022.

Europe Connected Gym Equipment Market Trends

The connected gym equipment market in Europe is evolving rapidly, with consumers increasingly embracing hybrid models that combine in-person gym experiences with virtual training. Post-pandemic recovery in markets like the UK and Germany has accelerated this trend, prompting many gym operators to bundle memberships with digital content. Simultaneously, virtual fitness has become a core component of corporate wellness programs, particularly in sectors such as technology, finance, and government, where employers are offering virtual coaching, app subscriptions, and group challenges.

The adoption of wearables, such as smartwatches and fitness bands, continues to rise, often integrated with smart home equipment like connected bikes, mirrors, and strength systems for real-time feedback and personalized training. At the same time, there is growing consumer demand for holistic wellness platforms that integrate physical fitness with mental health, nutrition, and sleep tracking, particularly among younger, urban users.

Key Connected Gym Equipment Companies Insights

Key players operating in the connected gym equipment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

-

Peloton Interactive Inc. is a dominant player in the connected gym equipment space, known for its high-end indoor cycling bikes and treadmills. Based in New York, Peloton has achieved significant popularity by offering a subscription-based model that integrates live and on-demand fitness classes with its equipment. The company has diversified its product portfolio, adding new devices such as the Peloton Guide for strength training and expanding its digital presence with Peloton App access for users without Peloton hardware. Peloton’s global reach spans North America, Europe, and Asia, capitalizing on the growing trend of home fitness and digital engagement.

-

NordicTrack (ICON Health & Fitness, Inc.) is another key player, recognized for its range of connected gym equipment, including smart treadmills, ellipticals, and strength training devices. Headquartered in Logan, Utah, NordicTrack has incorporated cutting-edge technology into its products, offering interactive training programs and real-time performance tracking. The company has built a loyal customer base by blending innovative design with integrated digital content, attracting both retail and online consumers. NordicTrack's global distribution network strengthens its position in the market, particularly as consumers seek versatile and technology-driven fitness solutions.

Key Connected Gym Equipment Companies:

The following are the leading companies in the connected gym equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Peloton Interactive Inc.

- iFIT Health & Fitness

- Technogym S.p.A.

- Life Fitness

- Tonal Systems, Inc.

- EGYM GmbH

- Precor Incorporated

- Ergatta, Inc.

- Echelon Fitness Multimedia LLC

- Johnson Health Tech Co., Ltd.

Recent Developments

-

In October 2025, Peloton Interactive expanded its global footprint with the launch of its inaugural fitness technology showcase in Dubai, UAE. The event, held at the Dubai Opera House, focused on introducing Peloton’s connected gym equipment to the Middle Eastern market. Scheduled for October 15-17, the showcase featured Peloton's latest smart treadmills, cycling bikes, and strength training products, accompanied by live and on-demand fitness classes. In collaboration with the Dubai Tourism Authority, this event reinforces Peloton's commitment to expanding its presence in the growing fitness market in the Middle East, aligning with the region's increasing focus on health and wellness. The initiative also supports Dubai’s vision as a global wellness hub, attracting fitness enthusiasts and reinforcing Peloton's position as a leader in the connected fitness space.

-

In May 2025, NordicTrack collaborated with the International Olympic Committee (IOC) to launch a new line of Olympic-themed connected gym equipment. The collection includes a series of smart ellipticals, treadmills, and rowing machines, each featuring official Olympic branding and digital workouts inspired by Olympic athletes. The launch took place at the 2025 Summer Olympics in Paris, where NordicTrack hosted a special event to showcase the new line at the Olympic Village. This collaboration enhances NordicTrack’s product range by tying it to the prestige of the Olympic Games, allowing users to engage with elite-level training experiences from home. The initiative strengthens NordicTrack's global brand presence and connects fitness technology with the spirit of athletic achievement, tapping into the worldwide Olympic fan base.

Connected Gym Equipment Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 3,026.3 million

Revenue forecast in 2033

USD 14,027.3 million

Growth rate (revenue)

CAGR of 21.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Peloton Interactive Inc.; iFIT Health & Fitness; Technogym S.p.A.; Life Fitness; Tonal Systems, Inc.; EGYM GmbH; Precor Incorporated; Ergatta, Inc.; Echelon Fitness Multimedia LLC; Johnson Health Tech Co., Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Connected Gym Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global connected gym equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular Training Equipment

-

Smart Treadmills

-

Smart Bikes

-

Connected Rowers

-

Others (Elliptical Trainers, Stair Climbers, etc.)

-

-

Strength Training Equipment

-

Functional Training Equipment

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Business-to-Consumer (B2C)

-

Business-to-Business (B2B)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global connected gym equipment market size was estimated at USD 2,754.7 million in 2024 and is expected to reach USD 3,026.3 million in 2025.

b. The global connected gym equipment market is projected to grow at a compound annual growth rate (CAGR) of 21.1% from 2025 to 2033, reaching USD 14,027.3 million by 2033.

b. The North America region dominated the global connected gym equipment market, accounting for a 51.03% share in 2024. This is attributable to the rapid development of the health and fitness industry in the U.S., with the highest number of health clubs and memberships.

b. Some key players operating in the global connected gym equipment market include Peloton Interactive Inc., iFIT Health & Fitness, Technogym S.p.A., Life Fitness, Tonal Systems, Inc., EGYM GmbH, Precor Incorporated, Ergatta, Inc., Echelon Fitness Multimedia LLC, and Johnson Health Tech Co., Ltd., among others.

b. Key factors that are driving the market growth include rapid digitalization of the health and fitness industry which in turn has resulted in the utilization of smart machines and devices to exercise along with the introduction of platforms that integrate sports equipment with coaching software.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.