- Home

- »

- Biotechnology

- »

-

Microcarrier Beads Market Size, Share, Industry Report 2030GVR Report cover

![Microcarrier Beads Market Size, Share & Trends Report]()

Microcarrier Beads Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Collagen Coated, Protein Coated, Cationic), By Material (Natural, Synthetic), By Target Cell (CHO, HEK, Vero), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-646-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro Carrier Beads Market Summary

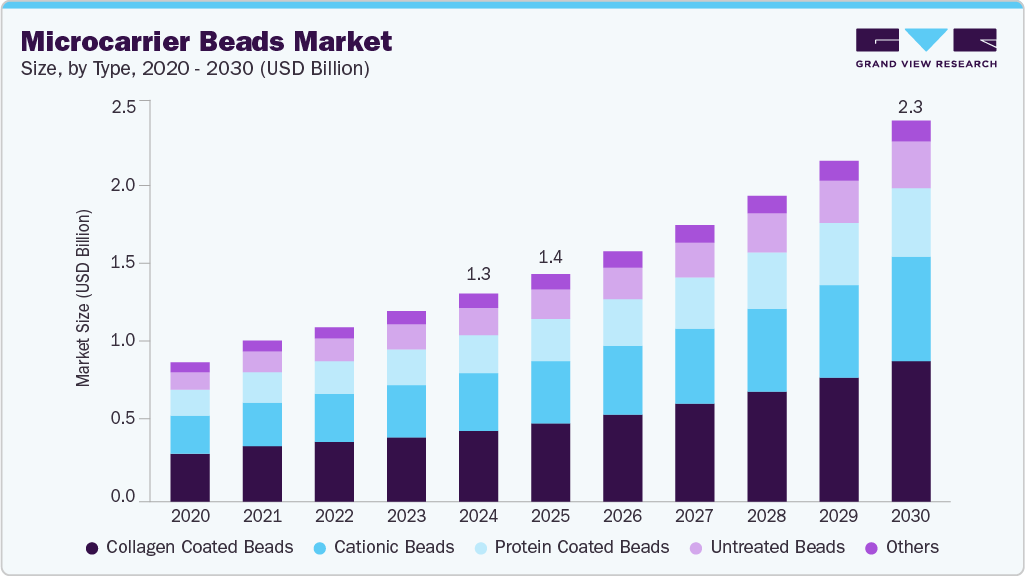

The global microcarrier beads market size was estimated at USD 1.25 billion in 2024 and is projected to reach USD 2.31 billion by 2030, growing at a CAGR of 10.90% from 2025 to 2030. The market growth is driven by increasing demand for cell-based therapies, advancements in biopharmaceutical manufacturing, and the rising adoption of microcarrier-based culture systems for large-scale cell production.

Key Market Trends & Insights

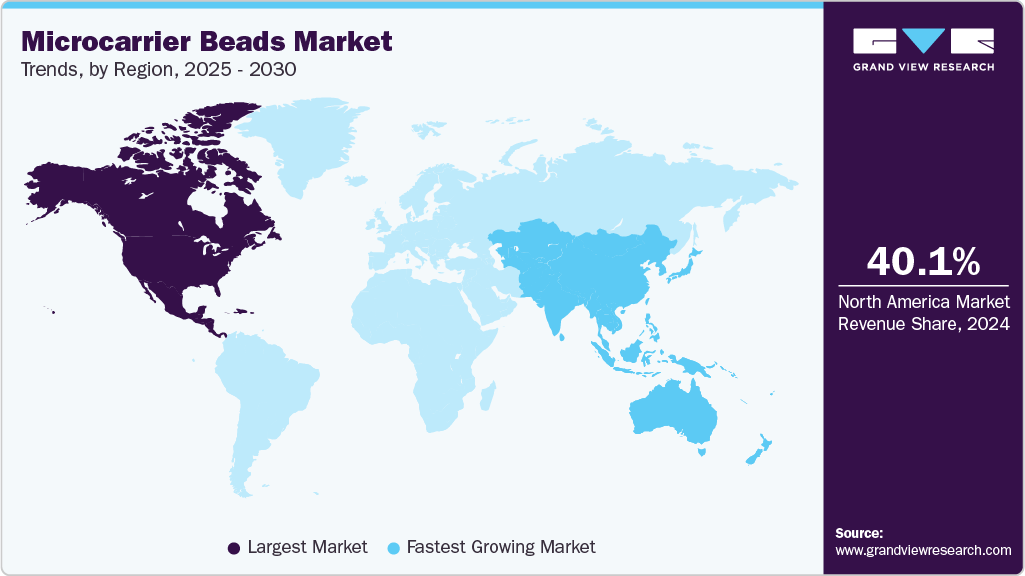

- North America microcarrier beads market held the largest share of 40.05% of the global market in 2024.

- The microcarrier beads industry in the U.S. is expected to grow significantly over the forecast period.

- Based on type, the collagen-coated beads segment held the highest market share of 34.29% in 2024.

- Based on material, the natural materials segment held the highest market share in 2024.

- Based on the target cell, the CHO segment held the largest share, 32.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.25 Billion

- 2030 Projected Market Size: USD 2.31 Billion

- CAGR (2025-2030): 10.90%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, growing investments in regenerative medicine and tissue engineering, along with technological innovations in microcarrier design and materials, are expected to drive market growth throughout the forecast period.

Rising Demand for Cell-Based Therapies

The rising demand for cell-based therapies is a major driver for the microcarrier beads market. Treatments such as stem cell therapy, regenerative medicine, and immunotherapy require cultivating large quantities of adherent cells for effective clinical applications. Traditional 2D culture methods are limited in scalability and efficiency, making microcarrier beads essential for providing a 3D surface that supports high-density cell growth in bioreactors. For instance, in June 2023, the University of Fukui, Japan, introduced innovative nonwoven microcarriers beads for rapid, large-scale cell culture. These mimic the vivo cellular environment, enhancing cell proliferation and nutrient circulation. This enables manufacturers to produce the billions of cells needed for therapies more cost-effectively and consistently, accelerating the development and commercialization of advanced medical treatments.

Pipeline of Stem Cell based Clinical Trials

NCT Number

Conditions

Sponsor

Phases

Completion Year

NCT02501811

Ischemic Cardiomyopathy

The University of Texas Health Science Center, Houston

PHASE2

2020

NCT03800758

Hematologic Malignancy

Northwestern University

PHASE3

2023

NCT01858740

Accelerated Phase Chronic Myelogenous Leukemia L Remission

Fred Hutchinson Cancer Center

PHASE2

2023

NCT02506959

Plasma Cell Leukemia

M.D. Anderson Cancer Center

PHASE2

2024

NCT00604201

Myelodysplastic Syndrome (MDS) With Refractory Anemia (RA)

National Heart, Lung, and Blood Institute (NHLBI)

PHASE2

2018

NCT01729091

Plasma Cell Leukemia|Plasma Cell Myeloma

M.D. Anderson Cancer Center

PHASE2

2024

NCT02248597

Hematopoietic/Lymphoid Cancer

Wake Forest University Health Sciences

PHASE2

2023

NCT02220985

Accelerated Phase Chronic Myelogenous Leukemia

Fred Hutchinson Cancer Center

PHASE2

2025

NCT02086552

Refractory Plasma Cell Myeloma

Mayo Clinic

PHASE2

2018

NCT00003838

Myeloproliferative Disorders

National Heart, Lung, and Blood Institute (NHLBI)

PHASE2

2020

Source: clinicaltrials.gov, Secondary Research, Grand View Research

Moreover, advancements in immunotherapy and regenerative medicine have increased the need for scalable, standardized, and automated cell culture platforms. Microcarrier beads help meet regulatory requirements by supporting closed-system bioreactor cultivation, which reduces contamination risk and improves type reproducibility. Hence, as more cell therapies enter clinical trials and reach the market, the demand for microcarrier beads will continue to grow, fueled by their ability to efficiently support large-scale adherent cell expansion critical to the success of these innovative treatments.

Growing Biopharmaceutical Industry

The biopharmaceutical industry is experiencing rapid growth driven by the rising demand for biological drugs such as monoclonal antibodies, vaccines, and therapeutic proteins. These biologics are produced using living cells that often require a surface to attach, making many anchorages dependent. Traditional two-dimensional cell culture methods are limited in scalability and efficiency, restricting large-scale production. Microcarrier beads have become an essential technology to overcome these challenges by providing a three-dimensional surface for cells to adhere to within suspension bioreactors. This allows for significantly higher cell densities and improved yields in a smaller volume, enabling manufacturers to meet the increasing demand for biologics more effectively and cost-efficiently.

Microcarrier beads improve process control and support automation in bioreactors, which aligns with the industry’s push toward standardized and scalable manufacturing. They facilitate better nutrient and oxygen distribution, enhancing cell viability and type consistency. Microcarrier-based systems also support closed-system cultivation, reducing contamination risks and helping manufacturers comply with stringent regulatory requirements. For instance, in February 2022, researchers at the University of Minnesota Medical School, U.S., demonstrated that microcarrier-based bioreactors could significantly enhance the production of human mesenchymal stem cells (hMSCs) compared to traditional planar cultures, by utilizing small beads as substrates, hMSCs adhered and proliferated at a high surface-to-volume ratio, enabling greater volumetric cell typeivity. This system also facilitated a more consistent nutrient and oxygen supply, reduced contamination risks, and offered easier scalability, making it a more cost-effective approach for cell therapy applications. As the biopharmaceutical sector continues to expand globally, driven by advances in therapies and increased healthcare needs, the adoption of microcarrier technology is expected to grow significantly, making it a critical driver of the microcarrier beads market.

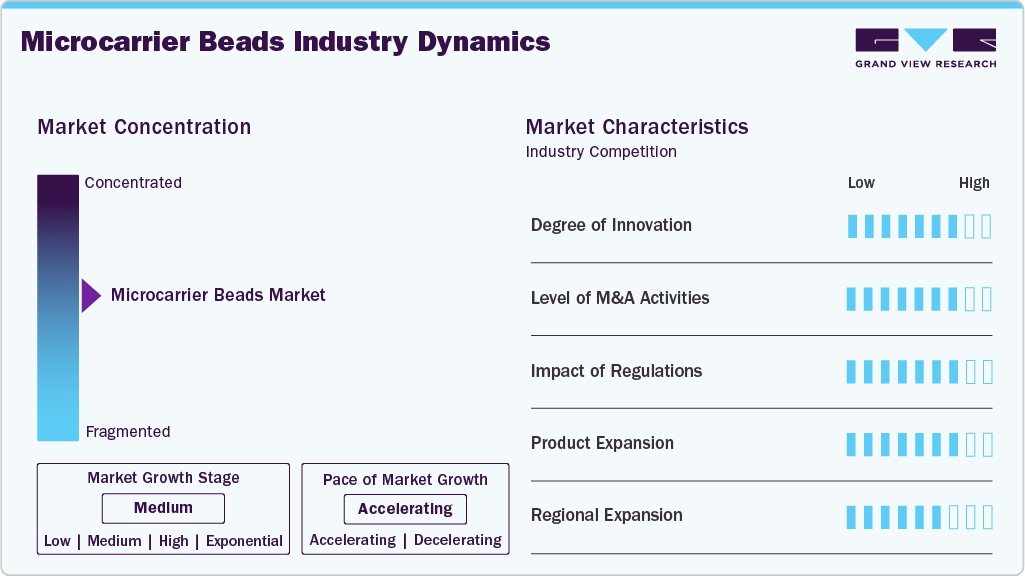

Market Concentration & Characteristics

The microcarrier beads industry is strongly influenced by continuous innovation in bead materials and design, which enhances their performance in large-scale cell culture applications. Innovations like biodegradable microcarriers and macroporous beads, like Cytiva’s Cytopore 2, enhance three-dimensional cell growth and improve nutrient diffusion, leading to higher cell yields and typeivity. This drives broader adoption of microcarrier beads in the biopharmaceutical and cell therapy markets.

The microcarrier beads market has experienced notable mergers and acquisitions as key players seek to strengthen their capabilities in scalable cell culture technologies. For instance, in June 2023, NOVA, the investment arm of Saint-Gobain Life Sciences, invested in denovoMATRIX to expand its presence in the stem cell therapy market. These strategic moves enable companies to integrate complementary technologies, accelerate innovation, and better serve the growing demand in the biopharmaceutical and regenerative medicine sectors, thereby driving market consolidation and expansion.

The impact of stringent regulatory requirements on manufacturing processes is a significant driver for the microcarrier beads market. Regulatory bodies such as the FDA and EMA emphasize the need for consistent, scalable, and contamination-free cell-based therapies and biologics production. Microcarrier beads support these demands by enabling cell cultivation in closed, controlled bioreactor systems that minimize contamination risks and ensure reproducible type quality. Compliance with Good Manufacturing Practices (GMP) and other regulatory standards encourages manufacturers to adopt advanced microcarrier technologies that facilitate standardized, scalable, and traceable cell culture processes. As regulations become increasingly rigorous, especially for cell and gene therapies, the demand for microcarrier beads designed to meet these requirements is expected to grow substantially.

Type expansion is a key driver of the microcarrier beads industry, as manufacturers continuously develop new microcarrier types tailored to diverse cell lines and applications. Innovations include microcarriers beads with improved biocompatibility, customizable surface chemistries, and biodegradable materials that cater to specific therapeutic needs such as stem cell therapy, vaccine production, and regenerative medicine. Companies are expanding their type portfolios to offer microcarriers beads compatible with various bioreactor systems, including stirred tanks and wave bioreactors, to provide greater flexibility and scalability. For instance, in May 2022, denovoMATRIX launched a novel microcarrier designed to advance cell and gene therapy manufacturing, expanding the availability of high-quality mesenchymal stromal cells (MSCs) for stem cell-based therapies. This ongoing type diversification meets the evolving demands of the biopharmaceutical and cell therapy industries and enables manufacturers to capture new market segments and increase adoption globally.

Regional expansion is a significant growth driver in the microcarrier beads market, as increasing investments in biotechnology and biopharmaceutical infrastructure across emerging markets create new opportunities. Countries in Asia-Pacific, such as China, India, Japan, and South Korea, are witnessing rapid advancements in cell therapy research, vaccine manufacturing, and biologics production, driving demand for scalable cell culture solutions like microcarrier beads. Expansion into these high-growth regions allows microcarrier manufacturers to tap into new customer bases, diversify revenue streams, and meet the rising global demand for advanced cell-based therapies and biologics.

Type Insights

The collagen-coated microcarrier beads segment dominates the industry with the highest market share of34.29% in 2024, driven by their superior biocompatibility and ability to mimic the natural extracellular matrix (ECM), which enhances cell adhesion, proliferation, and differentiation. These properties make collagen-coated microcarriers beads particularly valuable in vaccine production, cell therapy, and regenerative medicine applications. Leading companies are actively investing in developing and expanding collagen-coated microcarrier types to meet the growing demand. For instance, Sartorius AG offers animal component-free and protein-coated microcarrier beads designed for adherent cell culturing, catering to various research and production needs. Such initiatives reflect the industry's commitment to advancing collagen-coated microcarrier technologies, thereby facilitating the growth of cell-based treatments and biopharmaceutical production.

The Cationic Beads segment is expected to grow significantly during the forecast period, driven by their unique properties that enhance cell attachment and transfection efficiency. These positively charged beads facilitate electrostatic interactions with negatively charged cell membranes, making them particularly effective in applications such as gene therapy and viral vector production. The increasing focus on gene therapy research and the development of effective gene delivery systems are expected to drive the demand for cationic microcarriers in the coming years.

Material Insights

Natural microcarriers dominated the microcarrier beads market in 2024. Natural bead materials primarily include substances like gelatin, collagen, alginate, chitosan, and agarose derived from biological sources. These materials are favored for their excellent biocompatibility, biodegradability, and ability to mimic the natural extracellular matrix closely, providing an ideal environment for cell attachment, growth, and differentiation. Due to their natural origin, these microcarriers beads reduce the risk of toxicity and immune reactions, which is especially important for therapeutic applications. As a result, natural microcarrier beads are increasingly preferred in clinical-scale cell culture and biomanufacturing processes, driving innovation and growth in the microcarrier market.

Synthetic microcarrier is expected to grow at a significant CAGR during the forecast period. Synthetic bead materials such as polystyrene, dextran, polyvinyl alcohol (PVOH), and other polymers are crucial in large-scale cell culture and biomanufacturing applications. Polystyrene is widely used due to its mechanical strength, uniform bead size, and ease of surface modification, allowing enhanced cell attachment and proliferation for various cell types. Dextran, a hydrophilic polysaccharide, offers excellent biocompatibility and low immunogenicity, making it ideal for suspension cultures and sensitive cell lines. PVOH (polyvinyl alcohol) is valued for its hydrogel-like properties, high surface-area-to-volume ratio, and biocompatibility, supporting robust cell growth in bioreactors. For instance, in August 2024, a study published in the Chemical Engineering Journal optimized synthetic hydrogel-based Cytogel microcarriers beads for high-efficiency, enzyme-free dermal fibroblast expansion, enhancing collagen production and phenotype preservation, advancing scalable regenerative cell therapy manufacturing. These artificial materials can be chemically modified to optimize surface chemistry and cell interactions, enabling scalable and reproducible cell expansion in applications such as vaccine production, regenerative medicine, and therapeutic protein manufacturing. Their versatility, consistency, and ability to be tailored for specific processes are key factors driving the growth of the microcarrier industry globally.

Target Cell Type Insights

The CHO segment held the largest share, 32.26%, in 2024, as microcarrier beads are pivotal in enhancing the scalability and efficiency of CHO cell cultures. They are extensively used in producing monoclonal antibodies and recombinant proteins. They offer a high surface-area-to-volume ratio, facilitating increased cell density in bioreactor systems. Recent studies have demonstrated that microcarrier cultures can achieve higher cell proliferation and monoclonal antibody production than traditional suspension cultures, making them a preferred choice for large-scale biopharmaceutical manufacturing.

Mesenchymal Stem Cells (MSCs) are anticipated to grow with the fastest CAGR during the forecast period. MSCs are a primary target cell type for microcarrier-based culture systems due to their significance in regenerative medicine, immunomodulation, and cell therapy. Microcarriers beads provide a three-dimensional surface that enhances MSC adhesion, proliferation, and differentiation while supporting large-scale, clinically relevant cell yields. For instance, in June 2020, an article published in Frontiers in Bioengineering and Biotechnology reviewed the microcarrier bioreactor culture of human mesenchymal stem cells, highlighting the impacts of bioprocessing parameters on therapeutic potency and scalability for clinical manufacturing. As clinical demand for MSC-based therapies increases, particularly in treating orthopedic disorders, cardiovascular diseases, and autoimmune conditions, microcarriers beads have become critical for Good Manufacturing Practice (GMP) compliant and cost-effective production processes.

Application Insights

The biopharmaceutical production segment held dominant market share in 2024, driven by the growing demand for biologics and personalized medicines. Increasing investments in biopharmaceutical research and manufacturing, advancements in cell culture technologies, and stringent regulatory standards have fueled the need for high-quality purification and separation materials. This segment benefits from the expanding pipeline of biopharmaceutical types and the rising adoption of innovative production techniques, making it a key contributor to market growth.

The Regenerative Medicine segment is expected to witness the fastest growth over the forecast period, propelled by increasing research and development activities focused on tissue engineering and cell therapy. This expansion drives advances in stem cell technologies, the growing prevalence of chronic diseases, and the rising demand for innovative treatments to repair or replace damaged tissues. Moreover, supportive government initiatives and investments in regenerative medicine are accelerating the adoption of advanced biomaterials and therapies, making this segment a significant growth area in the market.

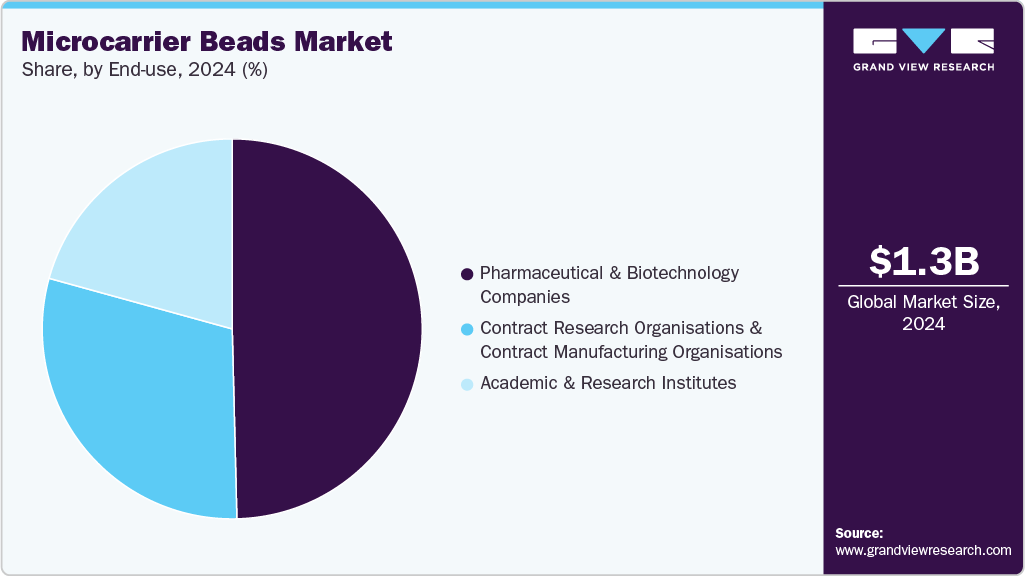

End-use Insights

The pharmaceutical & biotechnology companies segment accounted for the largest market share of 49.61% in 2024, driven by the growing demand for advanced drug development and bioprocessing solutions. Increased investment in research and development, coupled with the rising focus on biologics and personalized medicines, has fueled the need for innovative technologies and materials. Moreover, the expansion of biopharmaceutical pipelines and stringent regulatory requirements for drug purity and safety have further strengthened the dominance of this segment in the microcarrier beads industry.

The academic and research institutions segment is expected to grow significantly over the forecast period due to the increasing focus on advanced scientific research and innovation in biotechnology, pharmaceuticals, and regenerative medicine. Growing government funding, rising collaborations with industry players, and expanding research projects to develop novel therapies and technologies are driving demand. Moreover, the need for specialized materials and equipment in experimental and preclinical studies is fueling the growth of this segment.

Regional Insights

North America holds the largest share of 40.05% in the microcarrier beads industry, driven primarily by the U.S. The region's advanced biopharmaceutical sector, strong presence of key market players, and continuous investment in research and development fuel the demand for microcarrier beads. The U.S. leads in adopting advanced cell culture techniques, especially for vaccine production and regenerative medicine, thus boosting market growth. Continuous type approvals and the bio-manufacturing market's growth drive the microcarriers beads market's presence in North America. The region's robust biopharmaceutical sector and ongoing collaborations and partnerships further enhance the market growth.

U.S. Microcarrier Beads Market Trends

The U.S. dominates the North American microcarrier beads market due to its leading biopharmaceutical industry and high adoption rate of innovative cell culture technologies. The country witnesses substantial investment in biopharmaceutical R&D, including cell-based therapies and vaccines. Moreover, the increased utilization of microcarriers beads for cell-based vaccine manufacturing, advancements in technology that support cell production using microcarriers beads, higher investments in cell and gene therapy research, a preference for single-use technologies, and a rise in R&D expenditure for biopharmaceutical production. For instance, in August 2023, Astellas Pharma Inc. and Poseida Therapeutics, Inc. announced a strategic partnership. This aims to support Poseida’s efforts in advancing cancer cell therapy, which in turn could increase the demand for microcarriers beads in the US due to the growing number of chronic disease cases and the approval of various cell and gene therapies. Increasing collaborations between academic institutions and industry players stimulate innovation in microcarrier bead applications.

Europe Microcarrier Beads Market Trends

Europe is a key market for microcarrier beads, supported by robust pharmaceutical and biotechnology industries in countries like Germany and the UK. The growing focus on regenerative medicine, vaccine production, and increasing government funding for advanced bioprocessing technologies drives the demand in this region. For instance, in February 2022, the UK pledged around USD 192 million to the Coalition for Epidemic Preparedness Innovations to boost vaccine development. Moreover, stringent European regulatory standards also encourage the development of high-quality and reliable microcarrier beads.

The UK microcarrier beads market benefits from its strong biopharma ecosystem and government initiatives promoting innovation in life sciences. Numerous biotech startups and research institutions focusing on regenerative medicine and vaccine development contribute to the rising demand for microcarrier beads. The UK’s regulatory framework also fosters the adoption of cutting-edge technologies in cell culture processes.

The Germany microcarrier beads market is one of the leading markets in Europe for microcarrier beads, owing to its strong pharmaceutical manufacturing base and emphasis on research in biotechnology. The country’s commitment to developing innovative therapies, including cell and gene therapies, fuels demand for microcarrier beads. Moreover, Germany’s advanced infrastructure for bioprocessing and increasing clinical trials related to cell culture technologies support market growth. For instance, in November 2018, Sartorius AG opened its Cell Culture Technology Center at the Scientific Hub of Ulm, Germany, to develop cell lines & cell culture media. Thus, it will increase the demand for microcarrier beads and further boost market growth.

Asia Pacific Microcarrier Beads Market Trends

Asia Pacific is anticipated to grow at the fastest CAGR of 12.36% throughout the forecast period due to increasing investments in biopharmaceutical manufacturing, expanding healthcare infrastructure, and the rising prevalence of chronic diseases with an increasing aging population. For instance, in September 2024, India reported that 21% of older adults had at least one chronic condition, higher in urban areas (29%) than rural areas (17%). Hypertension and diabetes were most common, affecting 68%. Multi-morbidity impacted 23%, especially women and older age groups. Chronic disease prevalence was linked to education, wealth, and urban living. Moreover, Countries like China and Japan play pivotal roles, with significant government support and growing R&D activities in biotechnology driving market expansion. The region’s cost-effective manufacturing environment also attracts global players to set up production facilities.

The China microcarrier beads market leads the Asia Pacific market, propelled by rapid growth in its biopharmaceutical industry and increasing focus on advanced cell culture methods. Government initiatives to boost biotechnology and healthcare infrastructure development, as well as the growing adoption of bioprocessing technologies, contribute significantly to market growth. China’s expanding vaccine manufacturing and regenerative medicine sectors further stimulate demand. For instance, in April 2022, VectorBuilder announced an investment of USD 500 million to build a new cell and gene therapy research & manufacturing facility in Guangzhou, China. This investment is expected to drive the microcarrier beads market in China.

The Japan microcarrier beads market is anticipated to account for a significant share of the Asia Pacific microcarriers beads industry, as it has one of the region's most developed pharmaceutical and biotechnology sectors. Moreover, the high prevalence of chronic diseases and rare genetic disorders has led to increased R&D activities for developing novel therapies and vaccines, creating a high demand for microcarrier solutions for research purposes.

Middle East & Africa Microcarrier Beads Market Trends

The microcarrier beads market in the Middle East and Africa (MEA) is witnessing significant growth, propelled by the expansion of the biopharmaceutical sector and the increasing demand for cell and gene therapies. This growth is driven by the rising incidence of chronic diseases and infectious ailments, necessitating advanced therapeutic solutions. Microcarriers beads, essential for large-scale cell culture processes, are increasingly adopted in biopharmaceutical production, particularly for therapeutic protein and vaccine manufacturing. Integrating automation in cell and gene therapy manufacturing, using systems such as Lonza's Cocoon and Miltenyi's CliniMACS Prodigy, enhances production efficiency and scalability, further fueling market expansion.

The Kuwait microcarrier beads market is emerging as a key market in MEA due to its strategic focus on enhancing healthcare infrastructure and biotechnology capabilities. Government initiatives to improve healthcare services and promote pharmaceutical research drive interest in advanced bioprocessing technologies, including microcarrier beads. The growing demand for vaccines and biologics in the region further supports market growth in Kuwait.

Key Microcarrier Beads Company Insights

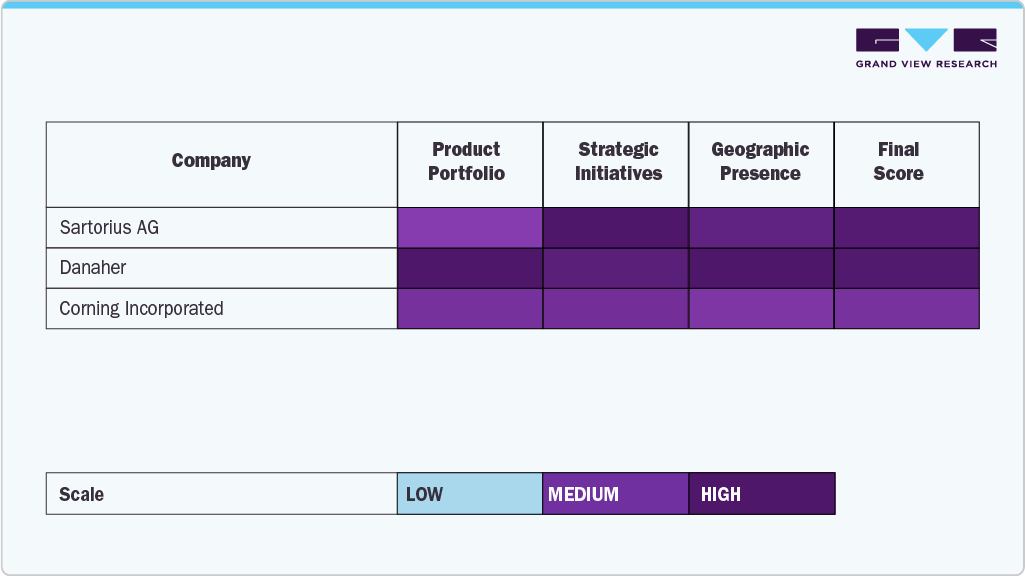

The microcarrier beads market is shaped by a mix of global leaders and specialized innovators, each contributing to the advancement of scalable cell culture technologies. Major players such as Danaher Corporation, Sartorius AG, Corning Incorporated, and Merck KGaA dominate the competitive landscape through their extensive type portfolios, global manufacturing networks, and sustained investment in R&D. These companies are recognized for their capabilities in delivering high-performance microcarriers beads compatible with both traditional and single-use bioreactors, enabling efficient production of cell-based therapies, biologics, and vaccines.

Leading firms, including Corning Incorporated, Danaher Corporation (via Cytiva and Pall Life Sciences), Sartorius AG, and Corning, continue to play a pivotal role in shaping the microcarrier beads market through innovations in surface chemistry, type scalability, and bioprocess optimization. Their solutions support high-yield cell expansion platforms used in regenerative medicine, cell therapy, and large-scale biologicals manufacturing, making them integral to modern bio-manufacturing ecosystems.

Companies such as Bio-Rad Laboratories, Inc., HiMedia Laboratories Pvt. Ltd., and Repligen Corporation (via Tantti Laboratory Inc.) are expanding their presence in the market through specialized offerings and technology integration. These firms are investing in new type development tailored for specific cell lines, including mesenchymal stem cells (MSCs) and induced pluripotent stem cells (iPSCs), while also enhancing the performance of microcarriers beads for use in serum-free and xeno-free environments, key for clinical and commercial cell therapy production.

The microcarrier beads market is gaining momentum due to heightened demand for efficient and scalable cell culture platforms. Strategic collaborations, facility expansions, and type innovations are intensifying competition. As the demand for cell-based treatments, vaccines, and biopharmaceuticals accelerates, companies that combine advanced bioprocessing technologies with flexibility, affordability, and regulatory alignment will be well-positioned to lead the next wave of growth in this evolving sector.

Key Microcarrier Beads Companies:

The following are the leading companies in the microcarrier beads market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher Corporation

- Sartorius AG

- Corning Incorporated

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- HiMedia Laboratories Pvt. Ltd.

- Repligen (Tantti)

- Percell Biolytica

- Darling Ingredients

- KURARAY CO., LTD.

Recent Developments

-

In July 2024, Repligen Corporation announced the acquisition of Tantti Laboratory Inc., a Taiwan-based biomaterials company specializing in macroporous chromatography beads for purifying viral vectors and nucleic acids. This strategic move enhances Repligen's capabilities in new modality bioprocessing. Tantti's DuloCore technology and Repligen's AVIPure affinity ligands offer high throughput and rapid mass transfer, addressing scalability challenges in biological manufacturing.

-

In April 2024, Kuraray Co., Ltd. launched Scapova CL PVA hydrogel microcarriers beads in Japan and the United States. Designed for regenerative medicine, these microcarrier beads offer enhanced cell culture efficiency by providing a robust, debris-free environment for adherent cells. Their high elasticity ensures durability in stirred bioreactor conditions, and their transparency facilitates easy cell observation. Establishing a Tokyo-based laboratory supported the launch to expand applications and foster customer engagement.

Microcarrier Beads Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.37 billion

Revenue forecast in 2030

USD 2.31 billion

Growth rate

CAGR of 10.90% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, target cell, application end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Danaher Corporation; Sartorius AG; Corning Incorporated; Merck KGaA; Bio-Rad Laboratories, Inc.; HiMedia Laboratories Pvt. Ltd.; Repligen (Tantti); Percell Biolytica; Darling Ingredients; KURARAY CO., LTD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Microcarrier Beads Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global microcarrier beads market on the basis of type, material, target cell application, end-use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Collagen Coated Beads

-

Cationic Beads

-

Polystyrene

-

PVOH

-

Others

-

-

Protein Coated Beads

-

Collagen

-

Cellulose

-

Polystyrene

-

Others

-

-

Untreated Beads

-

Cellulose

-

Polystyrene

-

Dextran

-

Others

-

-

Others

-

Alginate

-

PVOH

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Materials

-

Cellulose

-

Collagen

-

Alginate

-

Other Natural Materials

-

-

Synthetic Materials

-

Polystyrene

-

Dextran

-

PVOH

-

Other Synthetic Materials

-

-

-

Target Cell Outlook (Revenue, USD Million, 2018 - 2030)

-

CHO

-

HEK

-

Vero

-

MSCs

-

iPSCs

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Vaccine Production

-

Therapeutic Production

-

-

Regenerative Medicine

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations & Contract Manufacturing Organizations

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microcarrier beads market was estimated at USD 1.25 billion in 2024 and expected to reach USD 1.37 billion in 2025.

b. The global microcarrier beads market is growing at a compound annual growth rate (CAGR) of 10.90% from 2025 to 2030 and is projected to reach USD 2.31 billion by 2033

b. The collagen-coated microcarrier beads segment dominates the industry with the highest market share of 34.29% in 2024, driven by their superior biocompatibility and ability to mimic the natural extracellular matrix (ECM), which enhances cell adhesion, proliferation, and differentiation.

b. key players in the market include Sartorius AG; Corning Incorporated; Merck KGaA’ Bio-Rad Laboratories, Inc.; HiMedia Laboratories Pvt. Ltd.; Repligen (Tantti); Percell Biolytica; Darling Ingredients; KURARAY CO., LTD.

b. The market growth is driven by increasing demand for cell-based therapies, advancements in biopharmaceutical manufacturing, and the rising adoption of microcarrier-based culture systems for large-scale cell production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.