- Home

- »

- Electronic Devices

- »

-

Display Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Display Market Size, Share & Trends Report]()

Display Market (2025 - 2033) Size, Share & Trends Analysis Report By Display Technology (LCD, OLED, Micro-LED), By Panel Size (Microdisplays, Large Panels), By Resolution (8K, 4K), By Panel Type, By Product (Smartphone, Television Sets), By End-use (BFSI, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-796-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Display Market Summary

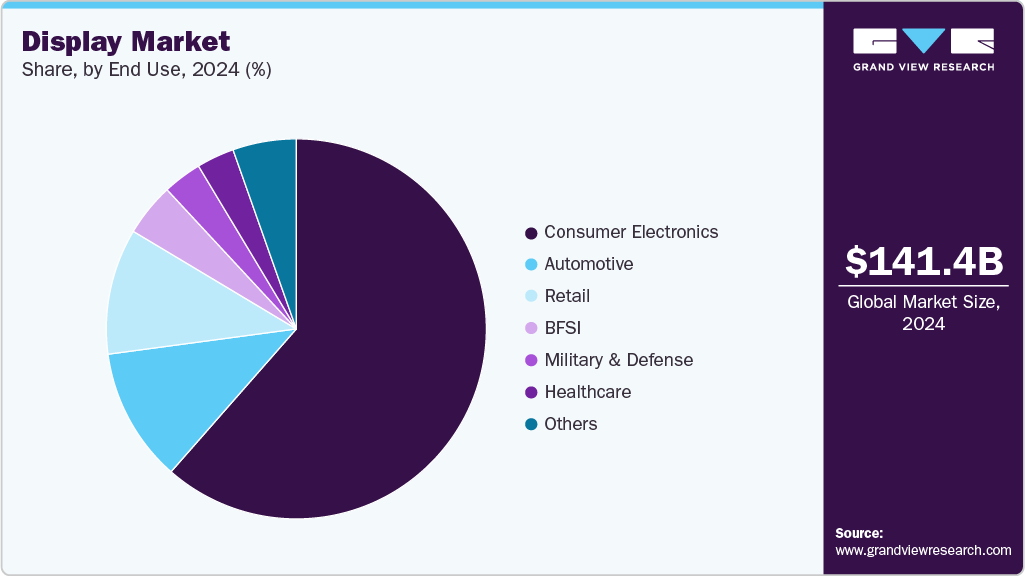

The global display market size was estimated at USD 141.36 billion in 2024 and is projected to reach USD 216.69 billion by 2033, growing at a CAGR of 5.0% from 2025 to 2033. The automotive sector is rapidly integrating advanced display technologies, including digital dashboards, head-up displays (HUDs), and rear-seat entertainment systems.

Key Market Trends & Insights

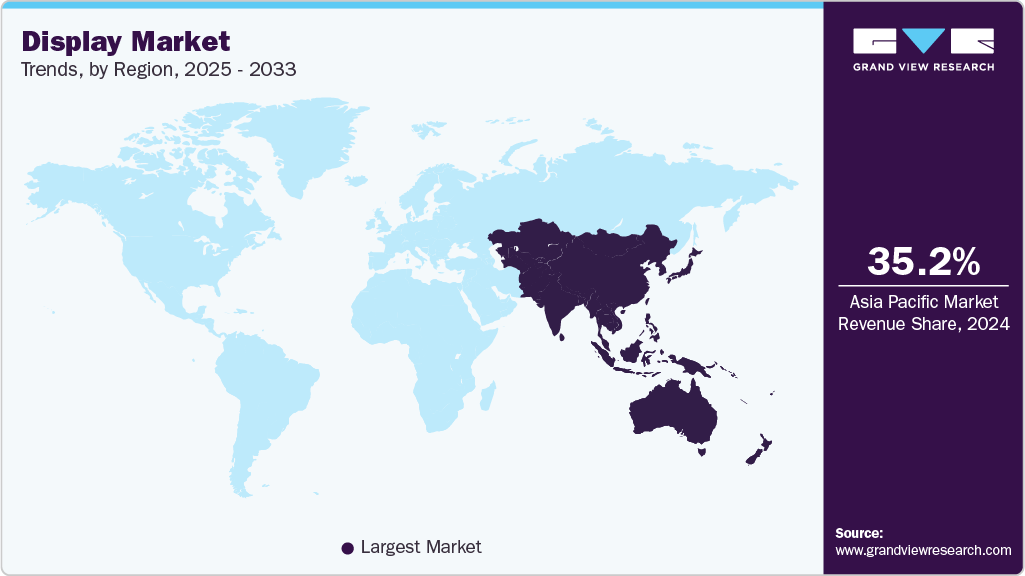

- Asia Pacific dominated the global market with the largest revenue share of 35.19% in 2024.

- The Japan display market is expected to grow rapidly in the coming years.

- By display technology, the LCD led the market and held the largest revenue share of 51.0% in 2024.

- By panel size, the large panels segment dominated the market and accounted for the largest revenue share in 2024.

- By resolution, the full high definition (FHD) segment dominated the market and accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 141.36 Billion

- 2033 Projected Market Size: USD 216.69 Billion

- CAGR (2025-2033): 5.0%

- Asia Pacific: Largest market in 2024

AI-powered infotainment enhances driver and passenger experiences. Electric vehicle makers, aiming to stand out, are adopting large, curved OLED and Micro-LED screens for superior visuals and futuristic designs. These innovations improve functionality, safety, and brand differentiation, making displays a central feature in next-generation vehicles.

LED display technology, using light-emitting diodes, is widely adopted in video walls, TVs, smartphones, and digital signage, holding a significant share of the display market. While innovation was limited in the past, recent advancements, such as component miniaturization, have enabled ultra-thin screens and large-scale displays for both indoor and outdoor use. Enhanced resolution, higher brightness, and greater versatility have expanded LED applications across industries. The introduction of robust surface-mounted LEDs and emerging micro-LED technology further drives adoption, offering improved durability, energy efficiency, and visual quality. These developments have strengthened LED’s role in delivering impactful visual solutions, fueling market growth and solidifying its position as a leading display technology for diverse commercial, industrial, and entertainment applications.

Consumer demand for visual excellence is driving rapid advancements in display technology. The growing popularity of high-resolution (4K/8K), high-refresh-rate, and HDR-enabled screens reflects the needs of gamers, video streamers, and creative professionals for lifelike visuals, vibrant colors, and smooth performance. These users prioritize minimal latency, superior contrast, and immersive viewing experiences. As a result, manufacturers are investing heavily in OLED, Micro-LED, and other cutting-edge display solutions to meet these expectations, enhance user satisfaction, and maintain competitiveness in an increasingly quality-driven market.

Producing advanced displays like Micro-LED and OLED is highly capital-intensive, involving complex manufacturing, specialized materials, and low production yields. These factors significantly increase costs, making large-scale manufacturing challenging and limiting affordability in price-sensitive markets. High initial investments in equipment, precision assembly, and defect reduction further add to expenses. As a result, widespread adoption is slower, with these premium technologies primarily targeting high-end applications until production efficiencies improve and costs decrease enough for broader market penetration.

Display Technology Insights

The LCD segment dominated the market and accounted for a revenue share of over 51.0% in 2024. LCD technology continues to thrive due to its cost-effectiveness compared to premium alternatives like OLED and Micro-LED. This affordability makes it the preferred choice for mid-range televisions, computer monitors, and budget smartphones, where price sensitivity is high. The technology benefits from decades of manufacturing maturity, with optimized production processes, high yields, and a vast global supply chain that ensures steady component availability. These factors collectively keep production costs low and product prices competitive, enabling widespread adoption across both developed and emerging markets. For manufacturers, LCDs offer a reliable balance of performance and affordability, ensuring they remain a staple in the global market.

The micro LED segment is anticipated to grow at the highest CAGR of 7.2% during the forecast period. Micro LED technology delivers exceptional visual performance, offering significantly higher brightness and superior contrast compared to OLED and LCD. It supports a wider color gamut and enhanced dynamic range, producing vibrant, lifelike images. These qualities make Micro LED ideal for premium applications such as high-end TVs, AR/VR headsets, advanced automotive displays, and professional-grade monitors, where visual clarity, color accuracy, and immersive viewing experiences are critical to user satisfaction and performance.

Panel Size Insights

The large panels segment dominated the market and accounted for the largest revenue share in 2024. The segment is experiencing strong growth in commercial and public display applications, driven by the increasing use of digital signage, video walls, and interactive large-format displays. Retailers leverage these solutions for dynamic product promotions, while transportation hubs use them for real-time scheduling and passenger information. In the hospitality sector, large panels enhance guest engagement through interactive services and event displays. Corporate environments are adopting them for presentations, collaboration, and brand promotion. Additionally, the rapid expansion of Digital Out-of-Home (DOOH) advertising networks is fueling demand, as advertisers seek high-visibility, impactful formats to reach wider audiences with targeted, engaging, and visually compelling content.

The microdisplays segment is expected to grow at a significant CAGR during the forecast period. The demand for microdisplays is rising with the growth of AR/VR devices across gaming, training, healthcare, and industrial sectors. These applications require high-resolution, lightweight displays for immersive and precise visuals. Enterprise AR solutions such as remote assistance, field service operations, and military simulation are further driving adoption, as organizations seek compact, energy-efficient display technologies that enhance productivity, situational awareness, and user experience in both professional and consumer environments.

Resolution Insights

The full high definition (FHD) segment dominated the market and accounted for the largest revenue share in 2024. Affordability and cost efficiency remain major growth drivers for the Full High Definition (FHD) display segment. Compared to higher-resolution options like 4K or 8K, FHD displays are significantly cheaper to manufacture due to mature production processes, established supply chains, and lower material requirements. This cost advantage makes them highly appealing to budget-conscious consumers, educational institutions, and enterprises seeking reliable display solutions without the premium price tag. In emerging markets, where price sensitivity is high, competitive retail pricing enables broader accessibility and adoption across various device categories, including televisions, laptops, monitors, and smartphones. This balance of quality and affordability ensures continued demand for FHD displays worldwide.

The 8K segment is expected to grow at a significant CAGR during the forecast period. The growing production of 8K content for streaming services, sports broadcasts, gaming, and cinematic projects is fueling demand for ultra-high-resolution displays. Consumers increasingly seek immersive, lifelike visuals, prompting TV and monitor manufacturers to integrate 8K panels into their product lines. This shift caters to premium home entertainment, professional content creation, and commercial display needs, positioning 8K technology as a key driver in the next evolution of display market innovation.

Panel Type Insights

The fixed panel segment dominated the market and accounted for the largest revenue share in 2024. The demand for digital signage is growing as retail stores, airports, train stations, and stadiums adopt fixed panel displays for advertising, wayfinding, and real-time information sharing. Permanent installations provide businesses with consistent brand visibility and enhance audience engagement through dynamic, high-quality visuals. These solutions are valued for their reliability, ability to operate continuously, and capacity to deliver targeted messages, making them a preferred choice for organizations aiming to strengthen communication and customer interaction in high-traffic environments.

The flexible panel segment is expected to grow at a significant CAGR during the forecast period. The surge in foldable smartphones, rollable TVs, and curved monitors is driving strong demand for flexible displays. Major manufacturers like Samsung, LG, and BOE are ramping up flexible OLED production to meet growing market needs. Consumers are increasingly attracted to devices that combine sleek aesthetics with portability and versatility, offering enhanced usability without compromising on screen size or quality. This trend is reshaping the consumer electronics market, positioning flexible panels as a key innovation in next-generation display technology.

Product Insights

The smartphone segment dominated the market and accounted for the largest revenue share in 2024. Rising global smartphone penetration is a major growth driver for the display market, particularly in emerging regions such as Asia, Africa, and Latin America. These areas are experiencing a significant increase in first-time smartphone buyers as mobile connectivity becomes more affordable and accessible. The expansion of 4G and the rapid rollout of 5G networks are encouraging feature phone users to upgrade to smartphones, creating strong demand for modern display technologies. Affordable mid-range models with larger, high-quality screens are becoming increasingly available, further accelerating adoption. As more consumers transition to smartphones, the need for advanced, durable, and visually appealing displays continues to grow, boosting market expansion worldwide.

The augmented reality & virtual reality segment is expected to grow at a significant CAGR over the forecast period. The growing focus on the metaverse by companies such as Meta, Roblox, and Epic Games is significantly driving demand for AR/VR headsets, as these devices serve as gateways to immersive digital environments. Beyond gaming, social media platforms like Snapchat, TikTok, and Instagram are integrating advanced AR filters and interactive VR experiences, further popularizing immersive content among users. This trend is fueling both hardware and software innovation, encouraging wider adoption of high-performance AR/VR displays that deliver richer visuals, higher interactivity, and more engaging virtual experiences across consumer and enterprise applications.

End-use Insights

The consumer electronics segment dominated the market and accounted for the largest revenue share in 2024. The rising demand for high-resolution and large-screen devices is a key growth driver for the consumer electronics segment of the display market. Consumers are increasingly opting for 4K and 8K TVs, OLED/QLED displays, and smartphones with larger screens to enhance their viewing and entertainment experiences. In the gaming sector, the popularity of monitors with higher refresh rates, 120Hz, 144Hz, and even 240Hz, is fueling demand for premium display panels that deliver smoother motion and reduced latency. These preferences are pushing manufacturers to invest in advanced display technologies, offering improved picture quality, vibrant colors, and immersive visuals to meet the growing expectations of both casual users and performance-driven consumers.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. Minimally invasive surgeries (MIS), including endoscopy, laparoscopy, and robotic-assisted procedures, increasingly depend on 4K and 8K medical-grade displays to provide surgeons with exceptional image clarity and detail. High-resolution visuals enable more precise navigation of instruments, reducing the risk of errors and improving patient safety. As hospitals prioritize advanced imaging solutions, the demand for cutting-edge surgical displays continues to grow, enhancing both procedural efficiency and clinical outcomes.

Regional Insights

The display market in Asia Pacific dominated the global market with the largest revenue share of 35.19% in 2024. Asia Pacific’s major smartphone manufacturers like Samsung, Xiaomi, and Oppo drive strong demand for OLED, AMOLED, and flexible displays. A rapidly growing middle class further boosts demand for premium consumer electronics, including 4K/8K TVs and gaming monitors, fueling significant growth in the region’s display market.

The Japan display market is expected to grow rapidly in the coming years. The growing demand for AR/VR headsets and high-performance gaming monitors is expanding the display market in Japan. Rising popularity of esports and immersive content further fuels the adoption of premium displays, as consumers seek superior visuals and smooth performance for gaming and virtual reality experiences.

China display market held a substantial share in 2024. China dominates global display manufacturing, producing vast volumes of LCD, OLED, and emerging MicroLED panels. Leading companies like BOE, TCL, and CSOT heavily invest in research, development, and expanding production capacity, fueling innovation and ensuring China remains a key supplier and technology leader in the global market.

North America Display Industry Trends

North America display industry held a significant share in the global market in 2024. The North American market is seeing strong growth in large-format and commercial displays, driven by rising demand across retail, hospitality, and corporate sectors for digital signage, interactive kiosks, and video walls. Sports arenas, airports, and public venues are increasingly adopting these solutions to deliver real-time information, enhance audience engagement, and support targeted advertising. This trend is fueled by advances in display resolution, durability, and energy efficiency, making installations more impactful and cost-effective.

The display market in the U.S. is expected to grow significantly at a CAGR of 4.2% from 2025 to 2033. The U.S., renowned for its technological innovation, leverages advanced display technologies to maintain its leadership in the sector. Adoption of cutting-edge displays enhances infotainment systems, Heads-Up Displays (HUDs), and digital instrument clusters in vehicles, improving safety and user experience. These innovations not only provide clearer, real-time information but also contribute to more enjoyable and connected driving. This continuous advancement drives growth in the display market and reinforces the U.S.’s position as a technology leader.

Europe Display Industry Trends

The display market in Europe is anticipated to register considerable growth from 2025 to 2033. Europe’s strong regulatory emphasis on energy efficiency and sustainability is boosting demand for LED, OLED, and MicroLED displays. Government incentives further encourage businesses and consumers to adopt these eco-friendly technologies, promoting reduced energy consumption and environmental impact across commercial and residential display applications.

The UK display market is expected to grow rapidly in the coming years. The UK healthcare sector is driving growth in display demand through increased use of high-resolution medical monitors for diagnostics, telemedicine, and surgeries. Additionally, the rising adoption of wearable health devices with integrated displays is boosting the need for advanced, reliable, and clear visualization technologies.

The display market in Germany held a substantial share in 2024. Germany’s dominant automotive industry fuels strong demand for digital instrument clusters, head-up displays (HUDs), and infotainment systems, particularly in electric and autonomous vehicles. Emphasizing safety, enhanced user experience, and digital transformation drives continuous innovation and adoption of advanced display technologies in the sector.

Key Display Company Insights

Key players operating in the display market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Display Companies:

The following are the leading companies in the display market. These companies collectively hold the largest market share and dictate industry trends.

- BOE Technology Group Co., Ltd.

- Samsung Electronics Co., Ltd.

- Innolux Corporation

- Panasonic Corporation

- Japan Display Inc.

- Sony Corporation

- AUO Corporation

- Sharp Corporation

- NEC Corporation

- Neyard Optoelectronic Co., Ltd.

- Visionox Company

- Tianma Microelectronics Co., Ltd.

Recent Developments

-

In August 2025, Samsung Display unveiled MONT FLEX, its new premium foldable OLED display brand, at the K-Display 2025 exhibition in Seoul. The name “MONT” is derived from the French word for “mountain,” symbolizing the pinnacle of foldable innovation.MONT FLEX displays have passed a 500,000-fold durability test, showcasing enhanced longevity and performance.

-

In May 2025, Panasonic Corporation entered into a strategic distribution agreement with Iris Global Services to increase the availability of Panasonic's LED Video Wall and Professional Display Solutions across India. Leveraging Iris Global's extensive logistics network covering over 19,000 pin codes, the partnership aims to meet the growing demand for large-format displays in sectors such as retail, education, hospitality, government, and corporate enterprises.

-

In September 2024, Sony Corporation announced the release of the ECX350F, a 0.44-inch Full HD OLED microdisplay featuring industry-leading 5.1 µm pixels and a peak brightness of up to 10,000 cd/m². Designed for augmented reality (AR) glasses, this innovation enables thinner, lighter, and more powerful devices, enhancing the AR experience.

Display Market Report Scope

Report Attribute

Details

Market size in 2025

USD 147.15 billion

Revenue forecast in 2033

USD 216.69 billion

Growth rate

CAGR of 5.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Display technology, panel size, resolution, panel type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

BOE Technology Group Co., Ltd.; Samsung Electronics Co., Ltd.; Innolux Corporation; Panasonic Corporation; Japan Display Inc.; Sony Corporation; AUO Corporation; Sharp Corporation; NEC Corporation; Neyard Optoelectronic Co., Ltd.; Visionox Company; Tianma Microelectronics Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Display Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global display market report based on display technology, panel size, resolution, panel type, product, end-use, and region.

-

Display Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

LCD

-

OLED

-

Micro-LED

-

Direct-view LED

-

Near-Eye Display

-

Others

-

-

Panel Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Microdisplays

-

Small & medium size panels

-

Large Panels

-

-

Resolution Outlook (Revenue, USD Billion, 2021 - 2033)

-

8K

-

4K

-

Full High Definition (FHD)

-

High Definition (HD)

-

Lower than HD

-

-

Panel Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Fixed Panel

-

Flexible Panel

-

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Smartphone

-

Television Sets

-

Monitors & Laptops

-

Smart Wearables

-

Augmented Reality & Virtual Reality

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Healthcare

-

Consumer Electronics

-

BFSI

-

Retail

-

Automotive

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global display market size was estimated at USD 141.36 billion in 2024 and is expected to reach USD 147.16 billion in 2025.

b. The global display market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 216.69 billion by 2033.

b. North America Display industry held a significant share in the global market in 2024. The North American display market is seeing strong growth in large-format and commercial displays, driven by rising demand across retail, hospitality, and corporate sectors for digital signage, interactive kiosks, and video walls. Sports arenas, airports, and public venues are increasingly adopting these solutions to deliver real-time information, enhance audience engagement, and support targeted advertising. This trend is fueled by advances in display resolution, durability, and energy efficiency, making installations more impactful and cost-effective.

b. Key players operating in the Display industry are BOE Technology Group Co., Ltd., Samsung Electronics Co., Ltd., Innolux Corporation, Panasonic Corporation, Japan Display Inc., Sony Corporation, AUO Corporation, Sharp Corporation, NEC Corporation, Neyard Optoelectronic Co., Ltd., Visionox Company, Tianma Microelectronics Co., Ltd.

b. The automotive sector is rapidly integrating advanced display technologies, including digital dashboards, head-up displays (HUDs), and rear-seat entertainment systems. AI-powered infotainment enhances driver and passenger experiences. Electric vehicle makers, aiming to stand out, are adopting large, curved OLED and Micro-LED screens for superior visuals and futuristic designs. These innovations improve functionality, safety, and brand differentiation, making displays a central feature in next-generation vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.